- Home

- »

- Pharmaceuticals

- »

-

Inpatient Services Market Size, Share & Growth Report, 2030GVR Report cover

![Inpatient Services Market Size, Share & Trends Report]()

Inpatient Services Market (2024 - 2030) Size, Share & Trends Analysis Report By Treatment (Cardiovascular Disorders, Cancer), By Ownership (Publicly/Government-Owned, For-Profit Privately Owned), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-316-0

- Number of Report Pages: 175

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Inpatient Services Market Summary

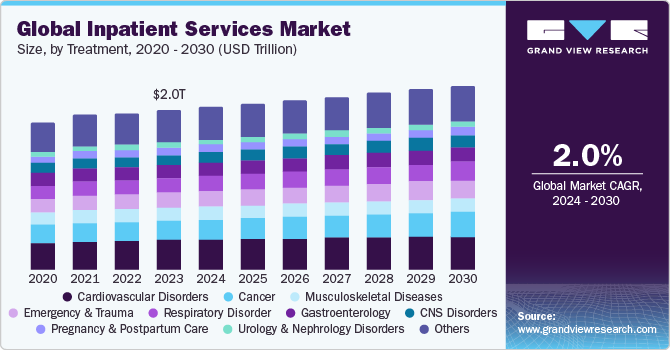

The global inpatient services market size was estimated at USD 2.05 trillion in 2023 and is projected to reach USD 2.37 trillion by 2030, growing at a CAGR of 2.05% from 2024 to 2030. The increasing prevalence of chronic diseases such as diabetes, cardiovascular diseases, neurological disorders, and cancer, which often require prolonged hospital stays and specialized inpatient care, and improvements in medical tools and technologies, such as diagnostic imaging and laboratory testing are expected to contribute to the growing demand for the market.

Key Market Trends & Insights

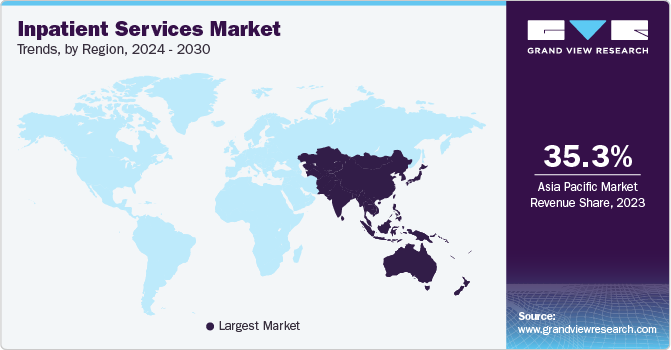

- The inpatient services market in Asia Pacific dominated the global market with a share of 35.30% in 2023.

- The China inpatient services market held the largest share of the Asia Pacific market.

- By treatment, the cardiovascular disorders segment dominated the market with largest revenue share of 18.38% in 2023.

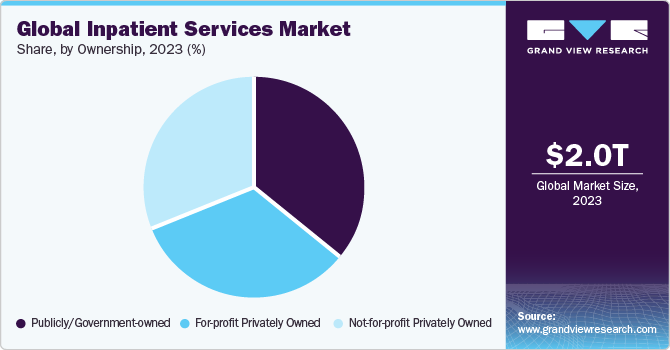

- By ownership, the publicly/government-owned segment held the largest revenue share of 36.0% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 2.05 Trillion

- 2030 Projected Market Size: USD 2.37 Trillion

- CAGR (2024-2030): 2.05%

- Asia Pacific: Largest market in 2023

The COVID-19 pandemic disrupted the industry with economic uncertainty, staffing shortages, increased operating expenses, unpredictable patient volumes, and volatility in medication and medical devices supply.

Moreover, the growth of the industry is attributed to the increasing focus on patient-centric care. Hospitals are shifting their focus towards providing high-quality, personalized care to patients, which often requires extended hospital stays and specialized inpatient care. This shift towards patient-centric care is driven by the growing awareness of the importance of patient satisfaction and outcomes in delivery. According to the study conducted by the researchers of UNC School of Medicine, in the U.S., the annual pediatric inpatient discharges in 4,000 hospitals studied decreased by 26.5% in 2020 from 2019. However, the discharges from pediatric hospitals increased to 81.8% in 2020 from 58.9% in 2019.

Furthermore, rising insurance coverage for inpatient services, majorly in developing countries, is expected to drive the growth of the market over the forecast period. Many countries are focusing on healthcare financing and majorly on costlier inpatient procedures. Moreover, the trend toward personalization of care is significantly driving the growth of the market. This shift is majorly driven by increased patient expectations. Patients are now more informed and demanding of personalized experiences, which include tailored services, real-time access to health records, and seamless communication with providers. This emphasis on personalized care is transforming the way inpatient care is delivered, with providers adapting to meet the evolving needs of patients.

Market Concentration & Characteristics

The market is highly fragmented, with major and emerging hospitals operating in different countries and regions. Furthermore, the degree of innovation is high, and the level of M&A activities is moderate. Regulations have a high impact on the industry, while regional expansion is moderate. However, service expansion is high.

The degree of innovation in the market is high. Many hospitals focus on digital transformations in the departments and inpatient care to create and modify business processes and improve patient experiences. They focus on improving patient flow, adopting digital scheduling, staffing, and supply chain management. Moreover, organizations are adopting digital transformation to improve clinical decision-making, employing AI & ML for personalized medicine. Many examples of digitalization in inpatient care include m-health, telemedicine, digital pathology, EHR/EMR, health wearables, and many others.

The level of mergers and acquisitions (M&A) in the market is significant, impacted by the need for scale, financial pressures, and the shift towards value-based care in developed countries. For instance, in November 2023, Saint Luke’s Health System and BJC HealthCare entered into a definite agreement on the merger of two hospital systems in the U.S. The combined organization is expected to operate 28 hospitals.

Shifting regulatory landscapes significantly impact the competitiveness of inpatient care, presenting both challenges and opportunities for providers. Regulatory changes can directly impact the services healthcare providers can offer or create new service needs. This can lead to the addition of new services, equipment upgrades, and facility modifications.

The impact of service expansion on the global market is high, driven by various factors such as the need for specialized care, advancements in medical technology, and the growing demand for high-quality care. Improvements in medical technology, such as minimally invasive surgical techniques and telemedicine, enhance the quality and efficiency of inpatient care, leading to increased demand.

Regional growth, particularly in the Asia Pacific and Latin America region, is moderate. This is due to the increasing prevalence of chronic diseases, the growing demand for high-quality care, and the growth of healthcare infrastructure. For instance, in May 2022, Cleveland Clinic expanded its footprint with the opening of a new private hospital in Europe. The health system opened a new hospital in London, UK, near the Buckingham Palace Garden.

Treatment Insights

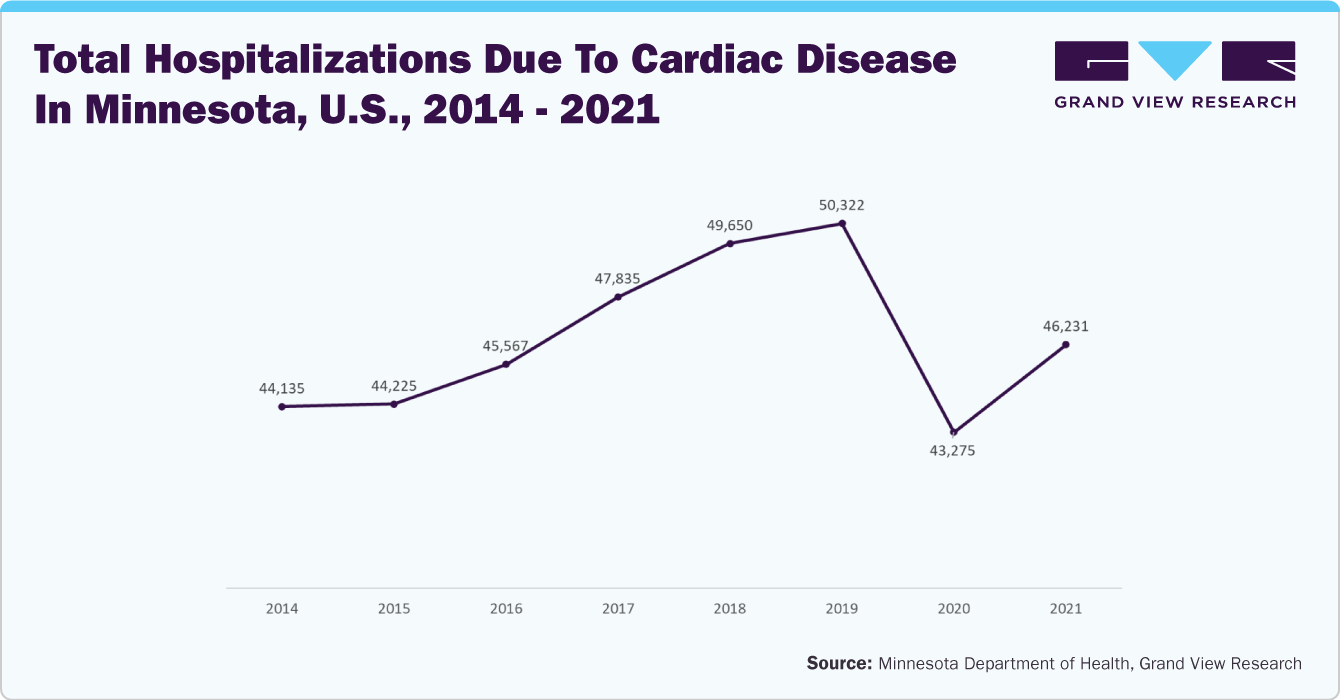

The cardiovascular disorders segment dominated the market with largest revenue share of 18.38% in 2023. This is attributed to the increased incidence of cardiovascular diseases due to an aging population, obesity, reduced physical activity, and smoking. Advances in diagnostic techniques, such as vessel wall MRI, enhance diagnosis and treatment strategies for cardiovascular diseases such as atherosclerosis. Growing awareness and public health initiatives that encourage healthy lifestyles and frequent screenings also contribute to the market growth. According to the Minnesota Department of Health, in 2021, more than 46,000 individuals in Minnesota, U.S., were hospitalized for cardiac disorder, an increase from 2020.

However, the respiratory disorder segment is expected to grow at the fastest CAGR from 2024 to 2030. This growth is due to the increasing incidence of respiratory disorders such as asthma, Chronic Obstructive Pulmonary Disease (COPD), and lung cancer. As the prevalence of these conditions continues to rise, the demand for treatment is increasing. Moreover, advancements in treatment options are contributing to the segment’s growth. The development of new and innovative treatment options, including targeted therapies and immunotherapies, is expanding the treatment options available for respiratory disorders. This has increased demand for the industry as patients require more complex and specialized care.

Ownership Insights

The publicly/government-owned segment held the largest revenue share of 36.0% in 2023. This is attributed to providing specialized medical procedures at relatively minimal expense and the availability of many patient beds catering to various medical conditions. Community hospitals are observed to have the largest number of patient beds and cater to numerous service areas/medical conditions via their specialized departments. Moreover, with the launch of new public hospitals majorly in developing countries, the market is expected to witness significant growth over the forecast period. For instance, in April 2022, the Health Ministry of Turkey opened a new hospital in Hatay, Southern Turkey, with financial aid from the EU. The hospital is expected to ease the existing pressure on the province's health infrastructure and increase its capacity to cater to the growing demand.

However, the for-profit privately owned segment is expected to witness the fastest CAGR from 2024 to 2030. This is primarily due to the increasing focus on specialized services and critical care, such as cancer and cardiovascular, which are typically provided by private hospitals. These hospitals are expanding their capabilities to cater to patients with urgent medical needs, increasing inpatient services demand. For instance, in January 2024, Ramsay Health Care announced the opening new hospital in New Epping, Australia. The hospital will open in two stages, the first in 2024, and the second is anticipated to open in 2027. The first stage is 70 inpatient beds in private hospitals, including six critical care units and four for high-dependency patients.

Regional Insights

TheNorth America inpatient services marketis dominated by private hospitals, with a significant market share held by major players such as HCA Healthcare, Cleveland Clinic, and John Hopkins. These players have a strong presence across the region, with a focus on providing high-quality care.

U.S. Inpatient Services Market Trends

TheU.S. inpatient services marketheld the largest share of the North America market. This is due to the presence of comprehensive medical care for patients requiring extended hospital stays. In addition, the increasing demand for specialized care, particularly in areas such as cardiovascular, pediatrics, and neurology, is expected to drive the market's growth.

Asia Pacific Inpatient Services Market

The inpatient services market in Asia Pacific dominated the global market with a share of 35.30% in 2023. This is attributed to the rising prevalence of chronic diseases with the increase in population, growing investment in healthcare infrastructure in the region, and increasing focus on curative care. The governments of many countries in the region are investing in new health systems and hospitals to address the growing demand for healthcare services.

The China inpatient services market held the largest share of the Asia Pacific market, majorly driven by the 2009 healthcare reform and the rapid growth of private hospitals. The government is actively promoting reforms to improve the quality, efficiency, and accessibility of services, including inpatient care. These reforms include encouraging private investment in the healthcare sector, implementing health insurance schemes, and introducing policies to regulate and standardize medical services.

The inpatient services market in India has experienced significant growth and expansion in recent years due to increasing healthcare expenditure, rising prevalence of chronic diseases, and advancements in medical technology and healthcare infrastructure development. The private healthcare system is prominent in the country offering advanced healthcare delivery.

Europe Inpatient Services Market Trends

The Europe inpatient services marketis expected to witness significant growth over the forecast period. This is due to the increasing demand for healthcare services and advancements in medical technology. The market is expected to be boosted due to the presence of key players, government policies supporting healthcare development, and the growing awareness of the importance of patient engagement in healthcare.

The inpatient services market in the UK is characterized by a mix of public and private sector providers. The National Health Service (NHS) is the largest player, offering free treatment at the point of use for residents. Private healthcare providers complement these services, providing patients with private health insurance or self-pay options. Patients often bypass waiting times or access care not readily available on the NHS.

The Germany inpatient services market is expected to witness significant growth over the forecast period. The combination of a dual system consisting of statutory health insurance (Gesetzliche Krankenversicherung, GKV) covering the majority of the population and private health insurance (Private Krankenversicherung, PKV) for higher-income earners and self-employed individuals influences the market, where hospitals are reimbursed through a Diagnosis-Related Groups (DRG) system, encouraging efficiency and high standards of care.

Latin America Inpatient Services Market

Theinpatient services market in Latin Americais diverse, catering to various healthcare needs across various countries, each with its challenges and opportunities. The market is witnessing growth due to demand for addressing its population's acute and chronic healthcare needs, comprising a significant portion of the healthcare expenditure.

The Brazil inpatient services market is driven by the growing coverage for these services in the country. Brazil operates a unique healthcare system, the Unified Health System (Sistema Único de Saúde - SUS), which guarantees health as a citizen's right and highlights universal access to healthcare services, including inpatient care. This public system coexists with the private sector, creating a dynamic market that caters to various population segments.

Middle East & Africa Inpatient Services Market Trends

The inpatient services market in the Middle East & Africareflects diverse economic, cultural, and political environments across the region. The market is impacted by disparities in healthcare access, quality, and infrastructure, with some countries investing in state-of-the-art facilities and others struggling to meet basic healthcare needs. Despite these challenges, the region is witnessing considerable growth and transformation in the healthcare sector, driven by increasing healthcare investment, demographic changes, and a rising burden of diseases.

The Saudi Arabia inpatient services market has witnessed substantial growth and transformation in recent times, attributed to significant government investment, regulatory reforms, and an increasing focus on healthcare quality and accessibility. These efforts are in line with Saudi Arabia's Vision 2030, which aims to enhance the overall healthcare infrastructure and improve health outcomes across the nation.

Key Inpatient Services Company Insights

The market is highly competitive, and major players face competition from established and emerging outpatient providers such as Ambulatory Surgery Centers (ASCs). Providers are adopting various strategies to stay competitive, including strategic investments in expanding their services and geographic presence to gain a competitive advantage. Providers are also investing in technology to transform their services and improve the efficiency of their operations. This includes the adoption of Electronic Health Records (EHRs), telemedicine, and other digital technologies to enhance patient care and support remote monitoring.

Key Inpatient Services Companies:

The following are the leading companies in the inpatient services market. These companies collectively hold the largest market share and dictate industry trends.

- Apollo Hospitals Enterprise Ltd.

- Max Healthcare

- West Suffolk NHS Foundation Trust

- Royal Papworth Hospital NHS Foundation Trust

- Cedars-Sinai

- UCLA Medical Centers

- The Johns Hopkins Hospital

- Mayo Clinic

- Keio University (Medical Services)

- THE ROYAL MELBOURNE HOSPITAL

- Burjeel Holdings

Recent Developments

-

In April 2024, UCSF Health opened a new USD 4.3 billion hospital in San Francisco, U.S. The hospital is a 15-story state-of-the-art facility with advanced technologies in robotics, surgical procedures, and diagnostics.

-

In February 2024, pediatric consultants at King’s College Hospital (KCH) and Evelina London Children’s Hospital (the Evelina) entered into a partnership with clinicians at the Edward Francis Small Teaching Hospital (EFSTH) in The Gambia. The partnership is expected to improve the quality of care for pediatric patients at EFSTH through mentoring, outreach visits, online training, and other support services.

-

In October 2023, Aster DM Healthcare opened the new Aster Whitefield Hospital, a multi-super-specialty hospital in Whitefield, Bangalore. The 506-bed state-of-the-art facility will provide comprehensive medical care.

Inpatient Services Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 2.10 Trillion

Revenue forecast in 2030

USD 2.37 Trillion

Growth rate

CAGR of 2.05% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion/ trillion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Treatment, ownership, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Norway; Denmark; Sweden; China; Japan; India; South Korea; Australia; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Apollo Hospitals Enterprise Ltd.; Max Healthcare; West Suffolk NHS Foundation Trust; Royal Papworth Hospital NHS Foundation Trust; Cedars-Sinai; UCLA Medical Centers; The Johns Hopkins Hospital; Mayo Clinic; Keio University (Medical Services); THE ROYAL MELBOURNE HOSPITAL; Burjeel Holdings

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Inpatient Services Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global inpatient services market report based on treatment, ownership, and region.

-

Treatment Outlook (Revenue, USD Billion, 2018 - 2030)

-

Cardiovascular Disorders

-

Cancer

-

Musculoskeletal Diseases

-

Emergency & Trauma

-

Respiratory Disorder

-

Gastroenterology

-

CNS Disorders

-

Pregnancy and Postpartum Care

-

Urology & Nephrology Disorders

-

Others

-

-

Ownership Outlook (Revenue, USD Billion, 2018 - 2030)

-

Publicly/Government-owned

-

Not-for-profit privately owned

-

For-profit privately owned

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Sweden

-

Denmark

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global inpatient services market size was estimated at USD 2.05 trillion in 2023 and is expected to reach USD 2.10 billion in 2024.

b. The global inpatient services market is expected to grow at a compound annual growth rate of 2.05% from 2024 to 2030 to reach USD 2.37 trillion by 2030.

b. Cardiovascular disorders segment dominated the inpatient services market with a share of 18.38% in 2023 owing to the increased incidence of cardiovascular diseases due to an aging population, obesity, reduced physical activity, and smoking.

b. Some key players operating in the inpatient services market include Apollo Hospitals Enterprise Ltd., Max Healthcare, West Suffolk NHS Foundation Trust, Royal Papworth Hospital NHS Foundation Trust, Cedars-Sinai, UCLA Medical Centers, The Johns Hopkins Hospital, Mayo Clinic, Keio University (Medical Services), THE ROYAL MELBOURNE HOSPITAL, Burjeel Holdings.

b. Key factors that are driving the inpatient services market growth include increasing prevalence of diagnosed chronic diseases, rise in geriatric population, and growing public investment in new medical technologies.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.