- Home

- »

- Automotive & Transportation

- »

-

Inland Water Passenger Transport Market Size Report, 2030GVR Report cover

![Inland Water Passenger Transport Market Size, Share & Trends Report]()

Inland Water Passenger Transport Market Size, Share & Trends Analysis By Vessel (Water Taxis, Cruise Ships), By Propulsion (Conventional, Electric), By Transportation Mode, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-143-9

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

Market Size & Trends

The global inland water passenger transport market size was estimated at USD 1.5 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 5.6% from 2023 to 2030. The interest in the inland water passenger transport industry is due to growing environmental concerns, government-backed efforts, and the rising desire for efficient, sustainable transportation solutions. Owing to its potential to minimize carbon emissions and enhance connectivity between urban and rural regions, this method of transportation is coming under more and more scrutiny. As a result of its ability to lower carbon footprints and improve regional accessibility, it has attracted considerable interest from both investors and governments. Inland water passenger transport is poised for a bright future as it develops and seamlessly integrates into contemporary transportation networks, providing passengers with a cleaner, more efficient travel option. This is true despite obstacles like upfront capital investments and competition from alternative transport modes.

With a focus on green and sustainable transportation options, inland water passenger transportation has emerged as a viable option that not only reduces carbon emissions but also relieves traffic congestion. This mode of transportation serves both urban and rural areas, making it an essential component of multi-modal transportation networks. It is essential for the provision of efficient and ecologically friendly transit options, especially in locations with access to waterways.

COVID-19 Impact

The COVID-19 pandemic has significantly disrupted the market for inland water passenger transport, changing its dynamics forever. Governments implemented travel restrictions and lockdowns to stop the global spread of the virus. The market, which caters to both metropolitan commuters and tourists and is heavily dependent on passenger interactions, was immediately and severely impacted by this. Initially in the epidemic, passenger demand fell precipitously, forcing several carriers to halt operations. The industry encountered previously unheard-of difficulties due to worries about virus transmission in small places.

The financial repercussions were significant. Operators needed help paying operating expenditures, such as crew salaries and vessel maintenance, while revenue streams had dried up. The future of the industry appeared dubious as uncertainty grew. Operators had to follow strict health and safety procedures because safety precautions had to take precedence. These mandated social seclusion, mask usage, and more stringent cleaning practices increased operational complexity and expenses.

The sector witnessed a sluggish and uneven recovery over time. Passengers continued to be wary even as certain areas started to relax the rules, and international travel restrictions kept tourism-related services from growing. Governments in several nations offered the industry lifelines in the form of grants, subsidies, and loans to help operators get through this difficult time. Some business owners investigated new revenue sources to adapt. One tactic they used to make up for the downturn in passenger transit was diversification into cargo transport. It has become more obvious that the market's long-term recovery and sustainability depend on its capacity to negotiate these mutating market conditions as well as the changing public health situation. Success in this industry now depends heavily on a person's ability to adapt to changing health protocols and show flexibility and resilience.

Vessel Insights

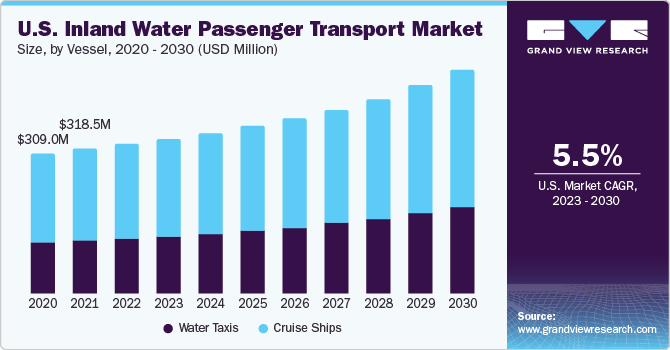

Based on vessels, the market is bifurcated into water taxis and cruise ships segments. The cruise ships segment dominated the overall market with a market share of 62.2% in 2022, and it is anticipated to witness a CAGR of 5.2% during the forecast period. Cruise ships play a distinctive and major position in the industry, providing passengers with a relaxing and scenic form of transportation along rivers, canals, and other inland waterways. These boats offer an abundant and all-encompassing experience on the lake and cater to both domestic and foreign guests. Cruise ships are popular choices for individuals looking for an unforgettable trip because of their amenities, which include good cuisine, entertainment, and comfortable rooms. Cruise ships are employed more frequently for themed and event-based trips in addition to their tourist appeal, significantly broadening their market position. Cruise ships are an important and interesting part of the market because of the allure of leisure travel, the rise in interest in environmentally friendly and sustainable modes of transportation, and constant innovation in onboard services and amenities.

The water taxi segment is anticipated to grow at the fastest CAGR of 6.1% throughout the forecast period. In urban and waterfront areas, water taxis are efficient and speedy vehicles that offer a convenient and on-demand mode of transportation. These boats are ideal for commuters, tourists, and anybody trying to navigate crowded cities because they are designed for short-distance, point-to-point transport. With the ability to customize their routes, water taxis give customers a speedy and frequently beautiful alternative to congested highways. Due to their small size and agility, they can access locations where larger vessels cannot. The utilization of better energy sources, such as electric or hybrid propulsion systems, adds to their appeal as ecologically friendly products. Water taxis are becoming a vital component of modern urban transportation networks to address the demand for effective, sustainable, and emission-free transit.

Propulsion Insights

In terms of propulsion, the market is segmented into conventional, electric, hydrogen, and hybrid. The conventional propulsion segment dominated the market in 2022 with a market share of 47.0%, and it is anticipated to witness a CAGR of 4.6% during the forecast period. Conventional propulsion systems primarily require the use of internal combustion engines, which are frequently fueled by diesel or gasoline. With their dependability and ample power, these conventional propulsion systems have long been the backbone of the industry, supplying ferries, cruise ships, and freight barges, among other types of boats. However, due to their negative effects on the environment, including greater emissions and a potential for air and water contamination, conventional propulsion techniques have come under closer examination. As a result of these concerns, there is a growing trend toward exploring more sustainable alternatives, such as electric or hybrid propulsion systems, which have a lower environmental footprint and higher efficiency, aligning with the industry's shifting focus toward eco-friendly and responsible transportation solutions.

The electric propulsion segment is anticipated to observe the fastest CAGR of 6.7% throughout the forecast period. As a cleaner, more environmentally friendly substitute for conventional internal combustion engines, electric propulsion is revolutionizing inland water passenger transportation. Electric propulsion systems are used to move several vessels, including small ferries and cruise ships, as well as bigger ferries and water taxis. Due to their eco-friendliness, which results in zero emissions at the point of use and considerably lessens the environmental impact of inland water transportation, these systems are gaining popularity. Electric propulsion offers financial advantages due to lower running costs and higher energy efficiency as the focus on lowering carbon footprints grows. Electric propulsion is becoming more widely recognized as a potential and responsible alternative for navigating the future of inland water passenger transport as governments and operators look for methods to lessen the sector's environmental effects.

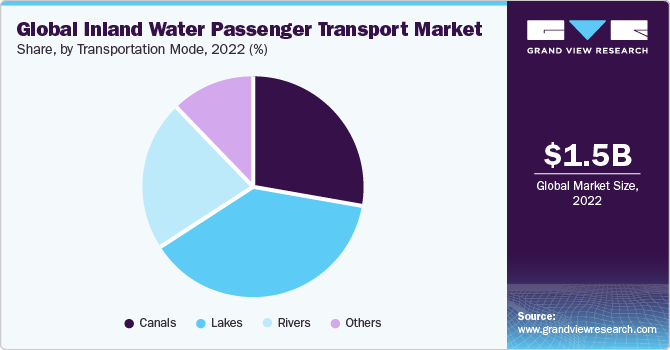

Transportation Mode Insights

In terms of transportation mode, the market is segmented into canals, lakes, rivers, and others. The rivers segment dominated the market in 2022 with a revenue share of 38.7%, and it is anticipated to witness a CAGR of 5.2% over the forecast period. Rivers have long been used as natural commerce routes, and many areas have a strong tradition of using passenger boats on these rivers. From quick commuter trips in urban areas to longer, leisurely river cruises, this market offers a wide choice of services that combine practicality and tourism prospects. With increasing focus on lowering emissions and supporting eco-friendly transportation options, these watery routes are not only economical but environmentally sustainable as well. The industry is constantly changing, with modernization programs, cutting-edge technologies, and safety precautions improving passenger experiences and ensuring smooth connectivity between urban and rural areas, making it an essential and rising-in-demand form of transportation.

The canals segment is anticipated to register the fastest CAGR of 6.3% over the forecast period. Canals have historically been important for trade and transportation. They also link urban and rural areas with waterways that frequently meander through beautiful scenery. The canal passenger transport services are flexible and enticing options for both citizens and tourists, ranging from quick intra-city commutes to beautiful journeys. In keeping with the increased emphasis on more ecologically friendly transportation options, these routes are not only effective but also environmentally sound. Inland water passenger transit through canals is a crucial and environmentally benign means of transportation, and operators are continuing to update their infrastructure, vessels, and novel technologies while maintaining safety standards.

Regional Insights

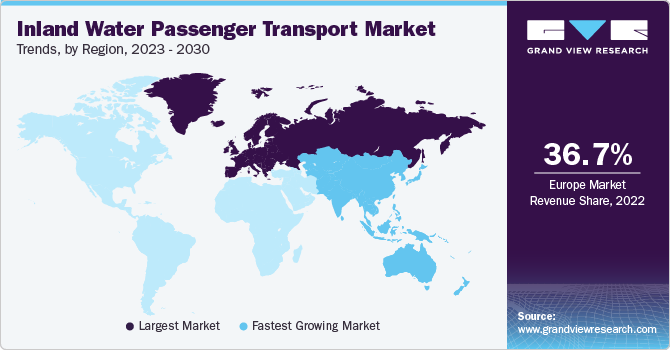

Europe led the overall market in 2022 with a market share of 36.7%. Europe has a vast network of lakes, canals, and rivers that have historically been essential for the movement of people and goods around the continent. The transportation industry in Europe is characterized by a wide variety of passenger ships that serve urban, suburban, and rural areas alike, including ferries, water taxis, and opulent river cruises. As a low-carbon alternative to land and air transport, this industry perfectly reflects Europe's concern for environmental sustainability. Government initiatives, cutting-edge technology, and effective scheduling have supported this sector's growth.In addition, Europe is a prime location for inland water passenger transportation due to its rich cultural legacy, varied landscapes, and historic waterways, drawing both visitors and locals. The inland water passenger transport industry in the region is positioned for continued expansion, providing both scenic travel and a responsible approach to mobility as Europe continues to promote sustainable and efficient transportation solutions.

Asia Pacific is anticipated to observe significant growth, growing at the fastest CAGR of 6.5% throughout the forecast period. A distinctive feature of Asia Pacific is its extensive and intricate network of rivers, lakes, and canals, which are used for everything from recreational excursions to daily transportation. This industry presents a promising alternative to lessen transportation congestion and cut carbon emissions considering the region's increasing urban centers and quickly expanding populations. The potential of inland water transport has been recognized by governments throughout the Asia Pacific, and they have put laws and investments in place to support its expansion, including updating infrastructure and strengthening safety precautions.Water taxis have grown in popularity as effective urban transportation solutions in the Southeast Asian region. The Asia Pacific market is on the rise, offering both practical and sustainable transportation solutions for a region with a vast and diverse geographical landscape.

Key Companies & Market Share Insights

The market is fragmented and is anticipated to witness competition due to several players' presence. Key factors influencing the competition within this sector include market demand, regional geographical coverage, the diversity of services offered, and a focus on sustainability and modernization. The major players in the market often cater to tourists seeking luxurious and immersive experiences along major waterways. Local and regional carriers, on the other hand, cater to specific markets and shorter itineraries. These include businesses that serve tourist sites or provide water taxi or ferry services in urban areas. The competitive environment is significantly shaped by government policies, including incentives, subsidies, and restrictions. Operators who benefit from government policies that are advantageous to them may have an edge, while those who are subject to strict regulatory requirements may need to adapt and innovate to stay competitive.

Key Inland Water Passenger Transport Companies:

- Damen Shipyards Group

- HOLLAND SHIPYARDS GROUP

- SES-X Marine Technologies

- Kooiman Marine Group

- CARTUBI S.r.l.

- Incat Crowther

- Baumüller

- ABB

- Siemens

- Groupe Beneteau

Inland Water Passenger Transport Market Report Scope

Attribute

Details

Market size value in 2023

USD 1.55 billion

Revenue forecast in 2030

USD 2.26 billion

Growth Rate

CAGR of 5.6% from 2023 to 2030

Historic year

2017 - 2021

Base year for estimation

2022

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Vessel, propulsion, transportation mode, region

Regional scope

North America; Europe; Asia-Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; UK; Germany; France; China; India; Japan; Brazil; Mexico

Key companies profiled

Damen Shipyards Group; HOLLAND SHIPYARDS GROUP; SES-X Marine Technologies; Kooiman Marine Group; CARTUBI S.r.l.; Incat Crowther; Baumüller; ABB; Siemens; Groupe Beneteau

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

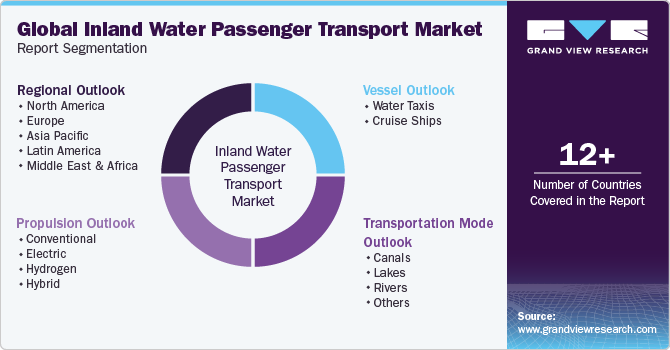

Global Inland Water Passenger Transport Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global inland water passenger transport market report based on vessel, propulsion, transportation mode, and region:

-

Vessel Outlook (Revenue, USD Million, 2017 - 2030)

-

Water Taxis

-

Cruise Ships

-

-

Propulsion Outlook (Revenue, USD Million, 2017 - 2030)

-

Conventional

-

Electric

-

Hydrogen

-

Hybrid

-

-

Transportation Mode Outlook (Revenue, USD Million, 2017 - 2030)

-

Canals

-

Lakes

-

Rivers

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia-pacific

-

China

-

India

-

Japan

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global inland water passenger transport market size was estimated at USD 1.49 billion in 2022 and is expected to reach USD 1.55 billion in 2023.

b. The global inland water passenger transport market is expected to grow at a compound annual growth rate of 5.6% from 2023 to 2030 to reach USD 2.26 billion by 2030.

b. Europe accounted for the highest revenue share of 36.7% in 2022. Europe has a vast network of lakes, canals, and rivers that have historically been essential for the movement of people and goods around the continent. The transportation industry in Europe is characterized by a wide variety of passenger ships that serve urban, suburban, and rural areas alike, including ferries, water taxis, and opulent river cruises.

b. Some key players in this market include Damen Shipyards Group, HOLLAND SHIPYARDS GROUP, SES-X Marine Technologies, Kooiman Marine Group, CARTUBI S.r.l., Incat Crowther, Baumüller, ABB, Siemens, and Groupe Beneteau.

b. The market is expected to be driven by the growing environmental concerns, government-backed efforts, and the rising desire for efficient, sustainable transportation solutions. With a focus on green and sustainable transportation options, inland water passenger transportation has emerged as a viable option that not only reduces carbon emissions but also relieves traffic congestion.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."