Inkjet Coders Market Size, Share & Trends Analysis Report By Type (CIJ Coder, DOD Inkjet Coder, Thermal Inkjet (TIJ), Others), By Application (Food Industry, Pipes, Wire & Cables, Other), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68038-088-0

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Semiconductors & Electronics

Inkjet Coders Market Size & Trends

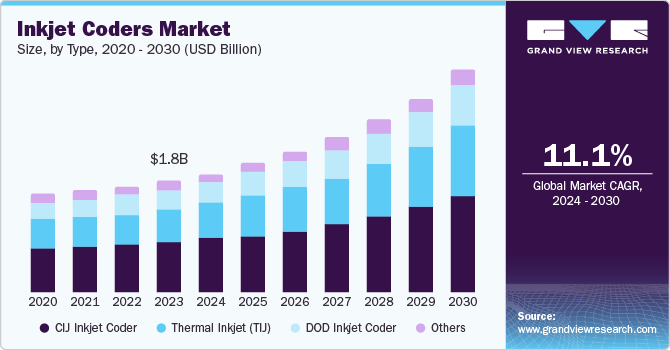

The global inkjet coders market was valued at USD 1.81 billion in 2023 and is projected to grow at a CAGR of 11.1% from 2024 to 2030. The market is anticipated to experience a gradual development of demand due to the growing focus on adherence to strict labeling regulations, anti-counterfeiting measures, and traceability requirements. The continuously growing industries, such as personal care, consumer electronics, food and beverages, automotive, pharmaceuticals, and others, have accelerated the demand for inkjet coders for various purposes. In addition, technological advancements adopted by manufacturers and innovation are projected to lead to greater growth in this industry during the forecast period.

The market is anticipated to experience significant growth opportunities during the forecast period due to technological improvements and automation in coder software for controlling automatic ink viscosity and flush systems. This is expected to save time by eliminating the process of cleaning and stopping the print head at regular intervals.

Additionally, the market is expected to be influenced by reduced risks and the increasing demand for minimizing solvent evaporation (fast drying time). In addition, the growing retail industry and increasing demand for fast-moving consumer goods are expected to generate an upsurge in effective printing solutions and services while ensuring compliance with determined regulations in each market and industry.

Furthermore, growing trade and increasing demand for packaged goods and other products, such as pharmaceuticals, have contributed to the growth of this industry. These aspects have developed unending requirements for printed labels, codes, and tags. In the pharmaceutical industry, these printers are utilized to label boxes, packages, and blister packs for medications and pharmacy products, allowing for the necessary traceability according to legal requirements and safeguarding against fake drugs.

Inkjet printers have numerous benefits compared to laser printers in coding, including cost-effectiveness and easy integration, which are anticipated to drive the demand for inkjet coders during the forecast period. Numerous manufacturers are currently looking for high-quality coding and printing devices, leading to substantial growth and investment prospects for participants in the inkjet coders market.

The increasing inclination of customers towards online shopping and the unceasing willingness of businesses to enhance their digital footprint through online distribution has also been generating greater demand for inkjet coders in multiple regions. These coders are frequently involved in routine operations such as daily doorstep deliveries, package dispatches, returns, and more.

Type Insights

The Continuous Inkjet (CIJ) coder segment dominated the global industry and accounted for a revenue share of 44.9% in 2023. Numerous industries are growing in preference for CIJ coders, attributed to their efficiency, versatility, and cost-effectiveness compared to other coding technologies. CIJ coders have ability to print on various surfaces, including plastic, metal, glass, and cardboard. These coders can print diverse information, including logos, alphanumeric characters, expiration dates, and barcodes with high resolution, driving the demand for various purposes. The rising demand for fast, uninterrupted printing and minimized downtime contributes to the expansion of the CIJ coder market.

The Thermal Inkjet (TIJ) segment is expected to experience the fastest CAGR during the forecast period. The advantages of TIJ coders, such as minimal Volatile Organic Compounds (VOC) emissions, low maintenance costs, high print quality, and resolution, drive the market growth. In addition, these coders provide ink delivery systems with sealed cartridges, making refills easy and preventing spills. Therefore, the demand from users for these coders is anticipated to grow rapidly in approaching years.

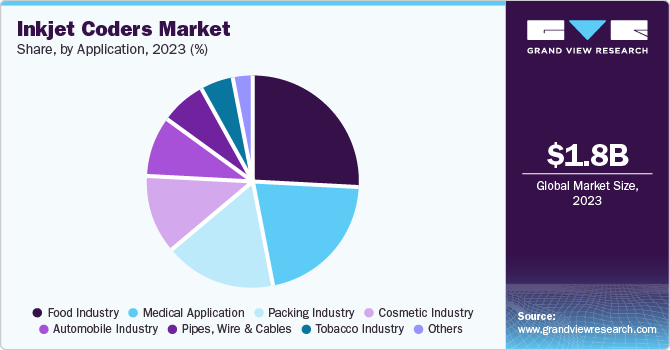

Application Insights

Based on the application, the food industry segment held the largest revenue share of the global industry in 2023. With the rising consumption and demand for packaged food and beverages, the industry is expected to provide favorable growth prospects for all the participants in the supply chain. Coding and marking in the food industry enable customers to access and understand the products' nutrition details, possible allergens, and alcohol levels while purchasing. Additionally, strict guidelines regarding displaying information such as product manufacturing date, expiration date, batch number, and rules regarding labeling the products are expected to contribute significantly to the growing demand for inkjet coders.

The packaging industry segment is anticipated to experience a significant CAGR over the forecast period. The rising penetration of automation in coding and marking solutions drives market growth. These coders are necessary for most packaging facilities to print and mark variable information on various materials such as plastic, paper, glass, and metal, including product codes, expiration dates, batch numbers, and bar codes. Growing investments in the packaging industry are anticipated to drive the market during the forecast period. For instance, SIG, a packaging company from Switzerland, established the first aseptic carton packs in Ahmedabad in 2023 and aims to invest more between 2023 and 2025.

Regional Insights & Trends

Europe inkjet coders market dominated the global market with a revenue share of 30.5% in 2023. European Union and member countries have made significant investments in research and development, resulting in major advances in inkjet technology. For instance, the European Union (EU) IS planning to allocate nearly USD 200 million towards advanced digital technologies and research[HD1]. Increasing growth experienced by industries such as e-commerce, packaging, food and beverages, cosmetics, and pharmaceuticals in the region is expected to fuel growth for the inkjet coders market during the forecast period.

UK Inkjet Coders Market Trends

The UK inkjet coders market held a significant revenue share of the regional industry in 2023. This is attributed to stringent regulations regarding product food safety, labeling, traceability, and environmental impact, driving the demand for reliable and compliant inkjet coding solutions. In addition, the availability of a skilled workforce with expertise in precision engineering supports the growth of the inkjet coder industry in the country. Increasing inclination towards consuming packaged food and beverages, growing response to e-commerce websites, and growth experienced by the pharmaceutical industry are projected to increase demand for inkjet coders in the approaching years.

North America Inkjet Coders Market Trends

North America market was identified as a lucrative region in 2023. The growth is attributed to the rising use of inkjet coding technologies in the food and beverages industry in the region. The U.S. and Canada packaging, food, and pharmaceutical industry widely use these coders on a large scale. Moreover, the region's prominent coding manufacturers and solution providers are driving the market expansion. The presence of multiple e-commerce industry participants that operate on a global scale has influenced this industry in recent years.

The U.S. inkjet coders market is expected to grow rapidly during the forecast period. This market is mainly driven by continuous innovation in inkjet technology, which includes enhanced speed, improved print quality, and eco-friendly inks. The rising utilization of inkjet coders in different industries, such as pharmaceuticals, food and beverage, cosmetics, and automotive, contributes to the development of the market. The booming e-commerce industry has increased the demand for efficient and accurate product labeling, driving the adoption of inkjet coders. Also, growing consumer awareness of product information and traceability is anticipated to influence the demand for inkjet coding.

Asia Pacific Inkjet Coders Market Trends

Asia Pacific inkjet coders market is anticipated to witness significant growth during the forecast period. Countries such as China, India, and Japan are experiencing rapid industrialization, leading to increased demand for efficient packaging and labeling solutions. Moreover, the cost-effectiveness offered by the inkjet coders makes them attractive to businesses in the region and an alternative to traditional labeling methods. The stringent product labeling and traceability regulations push enterprises to adopt inkjet coding technology, driving market growth.

China inkjet coders market held a substantial market share in 2023. The prominent companies in the industry are located in the region due to the growing advancements in technology, affordable capital costs, and changing preferences and needs of market participants. The increasing emphasis on sustainable packaging solutions presents opportunities for inkjet coders to use eco-friendly inks and materials. Additionally, integrating inkjet coders with smart manufacturing systems and Internet of Things (IoT) technologies will drive market growth.

Key Inkjet Coders Company Insight

Some of the key companies in the inkjet coders market include ANSER CODING INC., Hitachi Industrial Equipment Systems Co., Ltd., ITW Diagraph, KGK Jet India., Kiwi Coders Corporation., and others. Inkjet manufacturers are prioritizing the development of innovative products to enhance market penetration and revenue share. Developing new prototypes with unique attributes such as energy efficiency, outstanding electrical characteristics, accuracy, and adaptability has become the focus of multiple large enterprises in the industry.

-

ANSER, a marking and product coding equipment provider, employs Thermal Ink Jet (TIJ) technology. The company offerings include a smart Printhead, the A Series, including the A1 Inkjet Printer; the X Series, including the X1 Controller and X1 Printhead; the U Series, including the U2 Inkjet Printer, and ink solutions such as Water-based, Solvent-based, and Specialty ink.

-

ITW Diagraph, a global company, offers product identification solutions that help manufacturers consistently create high-quality marks with technology integration and ongoing service support. The company portfolio includes small-character continuous inkjet printers, large-character inkjet printers, thermal industrial inkjet printers, laser coding, and more.

Key Inkjet Coders Companies:

The following are the leading companies in the inkjet coders market. These companies collectively hold the largest market share and dictate industry trends.

- ANSER CODING INC.

- Hitachi Industrial Equipment Systems Co., Ltd.

- ITW Diagraph

- KGK Jet India

- Kiwi Coders Corporation.

- Linx Printing Technologies. (Danaher.)

- Markem-Imaje

- Shanghai Rottweil Handyware Printing Technology Co., Ltd

- Videojet Technologies Inc.

- Xaar plc.

Recent Developments

-

In June 2024, Videojet Technologies Inc. introduced new 1880 HR CIJ printers, Videojet 1880 +, and 1880 UHS. The company aims for advancement in the Videojet 1880 platform, these solutions integrate state-of-the-art features and digital connectivity to print dates, codes, and other variable data on packaging and products.

-

In June 2023, Markem-Imaje released the new 9750 Expert Series continuous inkjet (CIJ) coders, introducing three novel products to provide significant enhancements for FMCG manufacturers. With this launch, the company aims to expand as a prominent CIJ supplier, contributing to the environment by designing the inkjet coder that utilizes Methyl Ethyl Ketone (MEK)-free ink and reduces volatile organic compound (VOCs) emission up to 60% in consumable-saving mode.

Inkjet Coders Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 1.93 billion |

|

Revenue forecast in 2030 |

USD 3.61 billion |

|

Growth Rate |

CAGR of 11.1% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Type, application, region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, MEA |

|

Country scope |

U.S., Canada, Mexico, Germany, UK, France, China, Japan, India, and Brazil |

|

Key companies profiled |

ANSER CODING INC.; Hitachi Industrial Equipment Systems Co., Ltd.; ITW Diagraph; KGK Jet India; Kiwi Coders Corporation; Linx Printing Technologies. (Danaher.); Markem-Imaje; Shanghai Rottweil Handyware Printing Technology Co., Ltd; Videojet Technologies Inc.; Xaar plc. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Inkjet Coders Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the inkjet coders market report based on type, application, and region.

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

CIJ Inkjet Coder

-

DOD Inkjet Coder

-

Thermal Inkjet (TIJ)

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Food Industry

-

Medical Application

-

Cosmetic Industry

-

Automobile Industry

-

Pipes, Wire & Cables

-

Tobacco Industry

-

Packing Industry

-

Other

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."