Inhalation And Nasal Spray Generic Drugs Market Size, Share & Trends Analysis Report By Drug Class (Bronchodilators, Corticosteroids), By Indication, By Patient Demographics, By End-use, By Distribution Channel, By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68039-965-9

- Number of Report Pages: 160

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

Market Size & Trends

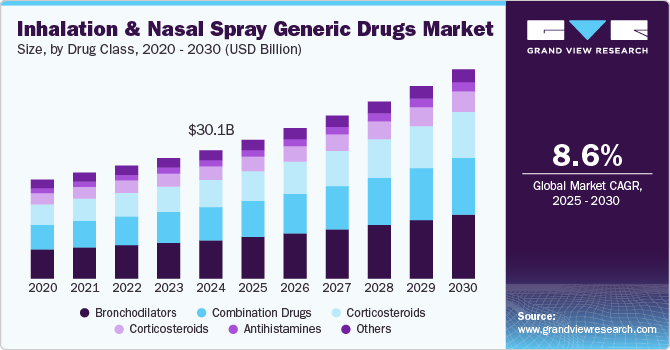

The global inhalation and nasal spray generic drugs market size was estimated at USD 30.08 billion in 2024 and is projected to grow at a CAGR of 8.56% from 2025 to 2030. Chronic diseases like asthma, chronic obstructive pulmonary disease (COPD), and allergic rhinitis are growing globally. These conditions are often treated using inhalers and nasal sprays, creating a demand for generic alternatives to branded drugs. Furthermore, air pollution and increasing smoking rates contribute to the rising incidence of respiratory conditions, further fueling market growth.

The global initiative for asthma (GINA) 2024 estimates, that asthma, a prevalent chronic non-communicable disease affecting over 260 million people globally and causing more than 450,000 preventable deaths annually, is driving significant market growth. The increasing burden of asthma, coupled with the need for affordable, effective treatments, is fueling demand for generic inhalers and nasal sprays, particularly in low- and middle-income countries where healthcare costs are a major concern. As these generics offer cost-effective alternatives to branded medications, they are playing a crucial role in reducing asthma-related mortality and improving patient outcomes, positioning the market for continued expansion.

The rising number of respiratory disease conditions in developed countries like U.S. and region like Europe is anticipated to drive market growth during the forecast period. according to the center for disease control and prevention (CDC), in 2020 , there were approximately 986,453 asthma-related emergency department (ED) visits across the U.S., with children under 18 years accounting for 270,330 ED visits, while adults (18 years and older) contributed 716,117 ED visits. The significant volume of asthma-related medical encounters underscores the growing need for effective and affordable treatment options, driving demand in the global market. As these treatments help manage chronic respiratory conditions, the market is likely to expand, especially as healthcare systems seek cost-effective solutions for large populations.

The market is expected to experience robust growth, driven by several key factors. First, the increasing demand for nasal sprays is notable in both developed and emerging markets such as China, Brazil, and India. These products are widely used to treat common respiratory conditions, but ongoing research and development efforts are expanding their potential applications for broader medical treatments. In addition, innovations in the manufacturing of nasal sprays are enhancing product effectiveness and accessibility. The rise of e-commerce platforms further supports this growth by making these products more readily available to consumers. With their fast and efficient drug delivery method, nasal sprays are set to play a crucial role in the future of medical treatments.

Drug Class Insights

Based on drug class, the bronchodilators segment led the market with the largest revenue share of 29.84% in 2024. The growth of the bronchodilator drug segment in the global market is expected to be driven by the increasing demand for quick-relief treatments for asthma and other respiratory conditions. For instance, short-acting bronchodilators, such as albuterol (Proair Hfa, Proventil Hfa, Ventolin Hfa, Accuneb), levalbuterol (xopenex hfa), Metaproterenol, And Pirbuterol (Maxair), are widely used for managing acute asthma symptoms and preventing exercise-induced bronchospasm. Their rapid action, typically within minutes, and availability in both inhaler and nebulizer forms make them essential for immediate symptom relief. However, over-reliance on these medications indicates poor asthma control, underscoring the need for better long-term management therapies, which may further influence segment dynamics.

The combination drugs segment is expected to register at a significant CAGR during the forecast period, owing to the introduction of new combination therapies by key players such as Apotex Inc. and Teva pharmaceutical industries ltd. for instance, in march 2020, Apotex Inc. launched a generic version of Meda pharmaceuticals' Dymista, a nasal spray combining Azelastine and fluticasone for the treatment of allergic rhinitis. Such combination drugs offer enhanced therapeutic efficacy by addressing multiple symptoms simultaneously, and with ongoing innovation in this area, the segment is poised for continued expansion in the future.

Indication Insights

Based on indication, the asthma segment led the market with the largest revenue share of 42.85% in 2024. According to the CDC, in 2021, approximately 9.82 million individuals live with current asthma in the U.S., experienced asthma attacks. This included 1.81 million children and 8.01 million adults. These highlights the ongoing burden of asthma across all age groups, underscoring a significant demand for effective treatments like inhalation and nasal spray generic drugs. As asthma remains a prevalent condition, the need for accessible, affordable medications will continue to drive growth for these generic treatments, offering significant potential for future expansion.

The chronic obstructive pulmonary disease (COPD) segment is projected to experience at the fastest CAGR during the forecast period. Chronic obstructive pulmonary disease (COPD) is a prevalent, preventable, and treatable condition, affecting approximately 10.1% of individuals aged 40 and older globally, as reported by the national center for biotechnology information (NCBI) in 2022. The rising prevalence of COPD underscores the growing demand for effective therapeutic solutions, particularly inhalation and nasal spray generic drugs. As the awareness of COPD management increases, coupled with an aging population and the need for affordable medication options, the market for these generic drugs is poised for significant growth in the coming years.

Patient Demographics Insights

Based on patient demographics, the adult patient segment led the market with the largest revenue share of 43.50% in 2024. According to the CDC, 4.6% of U.S. adults were diagnosed with chronic obstructive pulmonary disease (COPD), emphysema, or chronic bronchitis in 2022. This significant portion of the population indicates a growing demand for respiratory treatments, making it a key driver for the future market growth. As more adults require long-term management of respiratory conditions, generic inhalers and nasal sprays will likely see increased adoption due to their cost-effectiveness and accessibility, positioning them as essential treatment options in the expanding respiratory care segment.

The pediatric patient segment is projected to experience at the fastest CAGR during the forecast period. A 2023 study published in the journal of infectious diseases reported that, on average, 245,244 annual hospital admissions in the EU related to respiratory infections in children under 5 were linked to respiratory syncytial virus (RSV), with 75% of cases affecting those under 1 year old. Infants under 2 months were particularly vulnerable, with an incidence rate of 71.6 per 1,000 children. This high burden of RSV in young children, especially infants, highlights the growing demand for effective respiratory treatments, positioning the pediatric segment as a key driver for the future market growth.

End-use Insights

Based on end-use, the homecare segment led the market with the largest revenue share of 55.86% in 2024. The growing awareness of healthcare and advancements in product design have made it easier for patients to manage respiratory disorders at home using inhalers and nasal sprays without needing assistance from healthcare professionals. This trend, coupled with the rising geriatric population, is driving the expansion of the home care segment. According to who estimates, the global population aged 60 and older, which was 1 billion in 2020, is expected to reach 1.4 billion by 2030 and 2.1 billion by 2050. This aging demographic further boosts the demand for home-based respiratory treatments, supporting the market growth.

The hospital segment is projected to witness at a lucrative CAGR during the forecast period. According to the CDC, in 2020, there were a total of 94,560 hospital inpatient stays due to asthma, with 27,055 of these involving children under 18 and 67,505 involving adults aged 18 and older. This high number of hospitalizations highlights the ongoing prevalence of asthma, emphasizing the need for effective treatment options. The significant demand for management of asthma, particularly through affordable and accessible treatment forms like inhalers and nasal sprays, suggests a growing opportunity for the market growth.

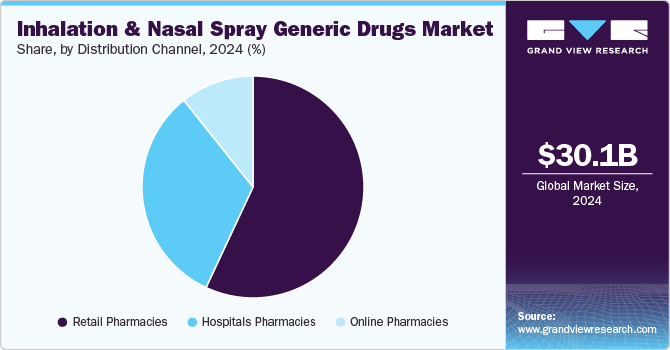

Distribution Channel Insights

Based on distribution channel, the retail pharmacies segment led the market with the largest revenue share of 56.96% in 2024. According to the commonwealth fund's 2021 report, generic drugs make up about 90% of all prescription drugs dispensed in the U.S., and they are chosen 97% of the time when available. Reimbursement to pharmacies for these generics is determined by maximum allowable cost (MAC) schedules, which cap the price payers will reimburse for specific off-patent drugs. Each state creates its own mac schedule for Medicaid reimbursement. In the future, these reimbursement mechanisms, combined with the high dispensing rate of generics, will likely drive growth in the retail pharmacy segment of the global market, particularly as cost containment and accessibility become more critical in healthcare.

The online pharmacies segment is projected to witness at a significant CAGR over the forecast period.The growing accessibility and convenience of online pharmacies, fueled by rising internet penetration, has significantly boosted consumer adoption. For instance, according to the pharmaceutical journal, in 2020, England saw a 45% increase in online pharmacy product dispensation compared to the previous year. This trend is likely to drive market growth, as more patients seek convenient, remote access to essential medications, particularly for chronic respiratory conditions.

Regional Insights

North America inhalation and nasal spray generic drugs market dominated the inhalation and nasal spray generic drugs market with the revenue share of 38.54% in 2024. This dominance is primarily attributed to the growing prevalence of respiratory conditions such as asthma and COPD, supported by a well-established healthcare infrastructure. The region benefits from advanced therapeutic innovations, including combination drugs and corticosteroids, which cater to the diverse needs of adult, pediatric, and geriatric patients. However, rising healthcare costs and disparities in insurance coverage may hinder broader regional growth.

U.S. Inhalation And Nasal Spray Generic Drugs Market Trends

The U.S. inhalation and nasal spray generic drugs market is anticipated to dominate North America in 2024, fueled by the increasing cases of respiratory diseases like asthma and allergic rhinitis. Telemedicine and online consultations are enhancing patient accessibility, while hospitals and retail pharmacies remain key distribution channels. Although this growing demand supports market expansion, barriers such as varying provider knowledge about the latest treatments and the challenges of high out-of-pocket costs for uninsured patients persist.

Europe Inhalation And Nasal Spray Generic Drugs Market Trends

The inhalation and nasal spray generic drugs market in Europe is emerging as a promising area, benefiting from a growing awareness of respiratory conditions and increased access to healthcare services. This is further boosted by advancements in drug delivery systems, such as decongestant sprays and bronchodilators, which are gaining popularity among patients suffering from conditions like COPD and allergic rhinitis. Regulatory frameworks in the region support the introduction of new and effective treatments, and combination therapies are becoming more common, particularly in hospitals and homecare settings.

The UK inhalation and nasal spray generic drugs market holds a significant share of global market, driven by the increasing incidence of allergic rhinitis and asthma. The integration of digital health solutions with physical care, such as online pharmacies and homecare applications, is making it easier for patients to manage chronic conditions. Educational initiatives aimed at improving treatment adherence and patient outcomes are playing a key role in boosting market growth.

The inhalation and nasal spray generic drugs market in Germany is anticipated to exhibit strong growth within Europe in 2024, fueled by a rising geriatric population that frequently suffers from chronic respiratory conditions. The market is seeing strong demand for corticosteroids and bronchodilators to treat asthma and COPD. In addition, the growing preference for generic alternatives over branded drugs, combined with improved hospital and retail pharmacy access, is expected to support growth.

The France inhalation and nasal spray generic drugs market is poised for expansion, supported by government-led initiatives aimed at improving awareness of respiratory diseases like asthma and COPD. The increased focus on patient-centered care and advancements in drug formulation are supporting the adoption of generic drugs, particularly in hospitals and homecare settings.

Asia Pacific Inhalation And Nasal Spray Generic Drugs Market Trends

The Asia Pacific inhalation and nasal spray generic drugs market is projected to experience at the fastest CAGR from 2025 to 2030. Rapid urbanization, rising pollution levels, and increased awareness of respiratory health are driving demand for effective treatments such as antihistamines and combination drugs. A surge in online pharmacies, coupled with greater access to healthcare resources, is further boosting market penetration. In addition, the rising middle class with growing disposable incomes is fueling demand for both prescription and OTC medications.

The China inhalation and nasal spray generic drugs market is anticipated to grow at a significant CAGR during the forecast period, owing to an increased focus on managing asthma and allergic rhinitis. Government initiatives that aim to enhance healthcare accessibility, especially in rural areas, and rising investments in respiratory research are expected to stimulate market growth. Retail and hospital pharmacies are pivotal in ensuring broad patient access to these therapies.

The japan inhalation and nasal spray generic drugs market remains is driven by advancements in personalized respiratory treatments, including sophisticated inhalation devices for bronchodilators and corticosteroids. The country’s aging population and the government's focus on homecare services are further enhancing the adoption of these generic drugs. In addition, online pharmacies are increasingly becoming a popular choice for medication access, contributing to overall market growth.

Latin America Inhalation And Nasal Spray Generic Drugs Market Trends

The inhalation and nasal spray generic drugs market in Latin America is expanding, propelled by rising healthcare investments and increased patient awareness of respiratory conditions. The market is seeing growing adoption of affordable generic alternatives for conditions like COPD and asthma, with hospitals and retail pharmacies playing key roles in distribution. The region’s focus on improving healthcare infrastructure, particularly in Brazil, is also fostering greater demand for these therapies.

The Brazil inhalation and nasal spray generic drugs market is driven by increasing healthcare expenditure and expanding access to advanced respiratory treatments. The rising prevalence of respiratory diseases among both pediatric and adult patients is pushing demand for bronchodilators and corticosteroids, particularly in hospital and retail pharmacy settings.

Middle East & Africa Inhalation And Nasal Spray Generic Drugs Market Trends

The inhalation and nasal spray generic drugs market in Middle East & Africa is expected to witness at a notable CAGR during the forecast period, as government initiatives focused on improving healthcare access and managing chronic respiratory conditions. Increased patient awareness of diseases such as asthma and allergic rhinitis is fueling demand for effective therapies, with hospitals and homecare becoming increasingly important settings for treatment.

The Saudi Arabia inhalation and nasal spray generic drugs market is set to be a fast-growing market within the mea region, driven by a growing population and increased healthcare investments. The focus on managing chronic respiratory conditions like asthma through innovative treatments such as decongestant sprays and bronchodilators is boosting demand. The development of online and hospital pharmacy networks is further improving patient access to these generic therapies, supporting market expansion.

Key Inhalation And Nasal Spray Generic Drugs Company Insights

Some of the key players in the market include teva pharmaceuticals industries ltd, Viatris Inc., Akorn Operating Company Llc, Cipla, Sandoz Group Ag, and others are prominent players in the global pharmaceutical industry. These companies specialize in manufacturing a wide range of pharmaceutical products, including generic medicines for specialized treatments across various therapeutic areas. Their global reach and extensive product portfolios contribute significantly to healthcare markets worldwide, addressing diverse medical needs and improving patient outcomes.

Key Inhalation And Nasal Spray Generic Drugs Companies:

The following are the leading companies in the inhalation and nasal spray generic drugs market. These companies collectively hold the largest market share and dictate industry trends.

- Teva Pharmaceuticals Industries Ltd

- Viatris Inc.

- Akorn Operating Company Llc

- Cipla

- Sandoz Group Ag

- Apotex Inc.

- Hikma Pharmaceuticals Plc

- Beximco Pharmaceuticals Ltd

- Sun Pharmaceutical Industries Ltd

- Nephron Pharmaceuticals Corporation

Recent Developments

-

In May 2024, Amphastar Pharmaceuticals, Inc. received approval from the U.S. food and drug administration (FDA) for its abbreviated new drug application (ANDA) for albuterol sulfate inhalation aerosol, previously designated as amp-008. This medication is indicated for treating and preventing bronchospasm in patients aged four and older with reversible obstructive airway disease, as well as for preventing exercise-induced bronchospasm in the same age group.

-

In July 2023, VIATRIS, in collaboration with Kindeva, launched Breyna (Budesonide and Formoterol Fumarate Dihydrate) inhalation aerosol, the first fda-approved generic alternative to Symbicort. Breyna is designed for individuals managing asthma and chronic obstructive pulmonary disease (COPD). This launch is anticipated to enhance accessibility and treatment options for these conditions.

-

In August 2023, Lupin limited announced the launch of Tiotropium Bromide Inhalation Powder, delivering 18 mcg per capsule, for the treatment of chronic obstructive pulmonary disease (COPD) in the United States. This launch is likely to have a significant impact on the market.

Inhalation And Nasal Spray Generic Drugs Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 32.55 billion |

|

Revenue forecast in 2030 |

USD 49.09 billion |

|

Growth Rate |

CAGR of 8.56% from 2025 to 2030 |

|

Base year for estimation |

2024 |

|

Historical data |

2018 - 2023 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Drug class, indication, patient demographics, end-use, distribution channel, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

U.S.; Canada; Mexico; Uk; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Brazil; Argentina; South Africa; Uae; Saudi Arabia; And Kuwait |

|

Key companies profiled |

Teva Pharmaceuticals Industries Ltd; Viatris Inc.; Akorn Operating Company Llc; Cipla; Sandoz Group Ag; Apotex Inc.; Hikma Pharmaceuticals Plc; Beximco Pharmaceuticals Ltd; Sun Pharmaceutical Industries Ltd; Nephron Pharmaceuticals Corporation |

|

Customization scope |

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country; regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Inhalation And Nasal Spray Generic Drugs Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global inhalation and nasal spray generic drugs market report based on drug class, indication, patient demographics, end-use, distribution channel, and region.

-

Drug Class Outlook (Revenue, USD Million, 2018 - 2030)

-

Bronchodilators

-

Combination Drugs

-

Corticosteroids

-

Decongestant Sprays

-

Antihistamines

-

Others

-

-

Indication Outlook (Revenue, USD Million, 2018 - 2030)

-

Asthma

-

Chronic Obstructive Pulmonary Disease (COPD)

-

Allergic Rhinitis

-

Others

-

-

Patient Demographics Outlook (Revenue, USD Million, 2018 - 2030)

-

Adult Patient

-

Pediatric Patient

-

Geriatric Patient

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Homecare

-

Hospitals

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Retail Pharmacies

-

Hospital Pharmacies

-

Online Pharmacies

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East And Africa (Mea)

-

South Africa

-

Saudi Arabia

-

Kuwait

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global inhalation and nasal spray generic drugs market size was estimated at USD 30.08 billion in 2024 and is expected to reach USD 32.55 billion in 2025.

b. The global inhalation and nasal spray generic drugs market is expected to witness a compound annual growth rate of 8.56% from 2025 to 2030 to reach USD 49.09 billion in 2030.

b. Based on drug class, the bronchodilators segment held the largest share of 29.84% in 2024, owing to its high adoption for the treatment of respiratory diseases including asthma and COPD worldwide.

b. Some key players operating in the inhalation and nasal spray generic drugs market include Teva Pharmaceuticals Industries Ltd.; Mylan N.V.; Akorn Operating Company LLC; Cipla Inc.; Sandoz International GmBH (Novartis AG); Apotex Inc.; Hikma Pharmaceuticals PLC; Sun Pharmaceuticals Industries Ltd.; Beximco Pharmaceuticals Ltd.; and Nephron Pharmaceuticals Corporation amongst others.

b. Key factors driving the inhalation & nasal spray generic drugs market growth are the rising incidence of chronic respiratory diseases, the increasing geriatric population, the rising number of drug approvals, and the growing demand for generic drugs.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."