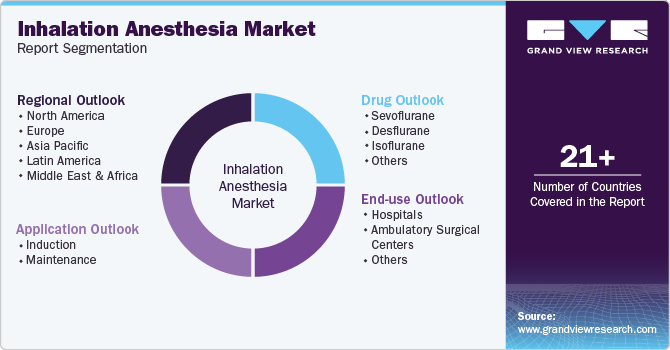

Inhalation Anesthesia Market Size, Share & Trends Analysis Report By Drug (Sevoflurane, Desflurane), By Application (Induction, Maintenance), By End-use, By Region, And Segment Forecasts, 2025 - 2030

- Report ID: 978-1-68038-509-0

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

Inhalation Anesthesia Market Size & Trends

The global inhalation anesthesia market size was estimated at USD 1.51 billion in 2024 and is projected to grow at a CAGR of 6.65% from 2025 to 2030. The growth of the market can be attributed to the increasing number of surgical procedures and the rising demand for shorter hospital stays. Inhalation anesthesia offers higher patient outcomes compared to intravenous anesthesia, as administering anesthetic agents through the respiratory tract allows for more controllable, effective sedation that is both cost-effective and safe.

The distinct advantages of inhalation anesthesia, such as precise dosing and ease of monitoring, particularly for patients on ventilation for over 24 hours, are driving its adoption. Inhalation anesthesia is seen as a superior alternative to intravenous routes in many cases, especially in surgeries requiring longer sedation.

A comprehensive study utilizing Danish national registries, published in April 2022, compared the effects of inhalation anesthesia and total intravenous anesthesia (TIVA) on postoperative outcomes in 22,179 colorectal cancer surgery patients. After adjusting for confounding factors through propensity score methods, the study revealed that inhalation anesthesia was linked to significantly fewer postoperative complications than TIVA. This evidence further underscores the patient benefits of inhalation anesthesia, supporting its increasing use and driving market growth over the forecast period.

Inhalation anesthesia was associated with a lower rate of complications within 30 days post-surgery, with 22.2% of patients experiencing issues compared to 25.2% in the TIVA group. Specifically, surgical complications such as wound dehiscence, anastomotic leaks, and abscesses occurred in 15.7% of patients using inhalation anesthesia, versus 19.6% in the TIVA group. These findings emphasize the advantages of inhalation anesthesia in reducing surgical infections and enhancing wound healing. Consequently, superior outcomes in minimizing surgical complications and infections are expected to drive its growing adoption in colorectal and other high-risk surgeries.

Technological advancements are playing a crucial role in shaping the future of the market for inhalation anesthesia. In recent years, the development of more efficient, safer, and patient-centric delivery systems has greatly improved both surgical outcomes and patient care. Modern anesthesia, equipped with advanced monitoring tools, now offers enhanced precision in administering anesthesia, reducing adverse effects and promoting faster recovery times for patients.

The introduction of smart inhalation devices with real-time monitoring capabilities has further optimized dosing accuracy, minimized waste, and improved patient safety. For example, in February 2023, the U.S. FDA approved VERO Biotech Inc.'s second-generation GENOSYL iNO delivery system, specifically designed for use in operating rooms with rebreathing anesthesia. This groundbreaking device is the first to be authorized for delivering inhaled nitric oxide (iNO) through both non-rebreathing and rebreathing methods, improving patient care, reducing hospital costs, and minimizing environmental impact. These technological innovations are driving the evolution of the market, making procedures safer and more efficient.

The high volume of patients undergoing orthopedic, cardiovascular, and general surgeries, which require anesthesia, underscores the growing demand for effective anesthetic methods. According to the National Biotechnology Information Center (NCBI), approximately 310 million major surgeries are performed globally each year, with 40 to 50 million in the U.S. alone and about 20 million in Europe. Inhalation anesthesia plays a critical role, particularly in orthopedic surgeries, where it serves as a primary method to ensure patient safety and comfort while optimizing surgical conditions.

Anesthetic agents like sevoflurane and desflurane are commonly used in these procedures due to their rapid induction properties, allowing quick access to the surgical site, which is especially beneficial for orthopedic operations. Moreover, these agents are easily metabolized and eliminated from the body, leading to faster patient recovery and making them ideal for outpatient procedures. As a result, the increasing number of orthopedic surgeries is expected to drive the demand in the coming years.

Drug Insights

The sevoflurane segment dominated the market with the largest market share and is expected to grow at a significant CAGR of 7.47% over the forecast period. Sevoflurane is a widely used inhalational anesthetic, favored for its rapid onset and quick recovery, making it ideal for both pediatric and adult patients. Its pleasant odor and minimal airway irritation contribute to a smooth induction and emergence from anesthesia, while its ability to maintain stable hemodynamics enhances its versatility across various surgical settings. These favorable pharmacokinetic properties make sevoflurane a preferred choice in many clinical environments. The inhalation anesthesia market is increasingly shifting toward agents that emphasize both effective sedation and patient safety. Sevoflurane is witnessing an increase in demand due to several key factors. The global rise in surgical procedures, particularly in outpatient and same-day discharge contexts, underscores the need for anesthetics that promote faster recovery times. Sevoflurane’s swift elimination from the body makes it well-suited for these situations, allowing patients to resume their normal activities sooner, further boosting its popularity in modern anesthetic practices.

The desflurane segment is growing significantly in the forecast year. Desflurane is a volatile inhalation anesthetic known for its rapid induction and recovery times, making it a preferred choice in both adult and pediatric surgeries. Its precise control over the depth of anesthesia, combined with fast onset, makes it especially useful in outpatient settings and surgeries that demand quick patient recovery. These characteristics have significantly contributed to its growing adoption across a variety of surgical procedures. The increasing demand for desflurane is largely driven by its low blood/gas solubility, allowing for swift adjustments in anesthesia depth. This feature proves highly advantageous in longer surgeries or cases requiring careful monitoring, such as in elderly or obese patients. In addition, desflurane’s ability to maintain stable hemodynamics during procedures further strengthens its appeal, particularly in complex surgeries where patient stability is critical. These combined factors are fueling the growth of desflurane, making it a key player in modern surgical practices.

Application Insights

In terms of application, the maintenance segment dominated the market with the largest share in 2024 and is the fastest-growing segment, and is expected to grow at a CAGR of 6.73% over the forecast period. The maintenance segment is crucial for sustaining sedation during surgery following the initial induction phase. This phase ensures patient stability throughout the procedure, particularly in complex or prolonged surgeries. Anesthetic agents such as sevoflurane, isoflurane, and desflurane are frequently used during maintenance due to their reliable pharmacokinetic properties and the ease with which anesthesia depth can be adjusted. In recent years, the use of maintenance inhalation anesthetics has significantly increased. This growth is driven by rising surgical volumes, advancements in anesthetic delivery systems, and a growing preference for inhaled anesthetics over intravenous alternatives for extended sedation. Inhalation anesthetics offer better control over anesthesia levels and facilitate faster patient recovery, making them increasingly favored in modern surgical practices.

The induction segment is experiencing significant growth. The demand for inhalation anesthesia during the induction phase is growing in tandem with the rising number of surgical procedures performed globally. The World Health Organization (WHO) reports that over 310 million major surgeries take place each year, which amplifies the need for effective anesthetic agents. The global market is expected to expand, driven by the increasing prevalence of chronic illnesses like cardiovascular diseases and cancer that necessitate surgical intervention. In particular, sevoflurane and desflurane are favored in outpatient environments for their quick recovery profiles and beneficial pharmacokinetic properties, making them well-suited for shorter procedures.

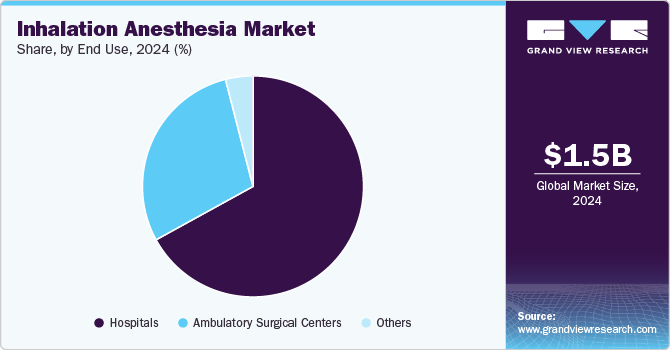

End-use Insights

The hospital segment dominated the market in 2024 with a share of 68.52% due to various factors such as technological advancements, increasing surgical procedures, and a strong emphasis on patient safety and recovery. The rising prevalence of elective surgeries, minimally invasive procedures, and complex operations—fueled by an aging population and a higher incidence of chronic diseases—has heightened the demand for inhalation anesthesia in hospitals. As surgical volumes continue to grow, the need for effective and safe anesthetic solutions will increase, encouraging hospitals to implement advanced inhalation anesthetic agents. According to the German Society for Anesthesiology and Intensive Care Medicine, roughly 17 million anesthesia procedures are performed annually in German hospitals, in addition to thousands more in outpatient facilities. Notably, each anesthetic procedure can emit up to 118 kilograms of CO2 equivalents. Traditionally, exhaled gases from these machines have been released into the atmosphere, significantly contributing to the greenhouse effect and environmental degradation.

The Ambulatory surgical centers (ASCs) segment is expected to grow at a rapid CAGR over the forecast period. ASCs are recognized for their cost-effectiveness compared to traditional hospital environments. Their lower operational costs often result in reduced out-of-pocket expenses for patients and improved reimbursement rates for healthcare providers. This financial benefit makes ASCs an appealing choice for both patients and insurers, driving the increased use of inhalation anesthesia in these facilities. Numerous studies have shown that ambulatory surgery is not only safe but also effective, often leading to fewer hospital-acquired complications than traditional inpatient procedures. The Michigan Value Collaborative (MVC) reports that in 2022, the surgical landscape in the U.S. is undergoing a significant shift, with around 70% of surgical procedures now being performed in outpatient settings. Over the past decade, ASCs have experienced remarkable growth, solidifying their role as essential components of the healthcare ecosystem. This trend further underscores the rising demand for efficient anesthetic solutions, particularly inhalation anesthesia, in these innovative surgical environments.

Regional Insights

The North America inhalation anesthesia market dominated the global market and accounted for 52.77% of revenue share in 2024, largely driven by an increasing number of surgical procedures, advancements in technology, and a rising elderly population. Consequently, there is a significant demand for effective general anesthesia medications. A February 2024 article from Discovery ABA noted that 26.2 million surgical procedures were performed in the U.S. in 2022. In addition, data from the National Library of Medicine indicated that in 2021, nearly nine major surgeries were performed for every 100 older adults, with over one in seven Medicare beneficiaries undergoing major surgery within a five-year period. This underscores a substantial and growing demand for dependable general anesthesia solutions.

U.S. Inhalation Anesthesia Market Trends

The U.S. inhalation anesthesia market held a significant share in the North America region in 2024, primarily fueled by the increasing prevalence of chronic diseases and a higher volume of surgical procedures. According to the CDC, nearly 60% of adults in the U.S. have at least one chronic condition, such as heart disease or diabetes, which often require surgical intervention. The American Heart Association estimates that around 805,000 Americans experience a heart attack each year, underscoring the pressing demand for effective solutions in surgical environments. In addition, the rise in surgical procedures further supports market expansion; for instance, data from Hoag Review, updated in February 2022, revealed that more than 190 Ambulatory Surgery Centers (ASCs) in the U.S. are now performing minimally invasive spine surgeries, reflecting a significant growth trend over the past decade.

Europe Inhalation Anesthesia Market Trends

The Europe inhalation anesthesia market is experiencing significant growth driven by several factors. Increasing surgical volumes, fueled by a rising prevalence of chronic diseases and an aging population, are major contributors to this expansion. According to the European Society of Cardiology, approximately 45% of individuals over the age of 65 are affected by cardiovascular diseases (CVDs), highlighting the significant health challenges faced by this demographic. In 2022, nearly 4 million people in Europe died from CVDs. In addition, the incidence of surgeries among adults in Europe in 2022 was notably influenced by the growing prevalence of chronic conditions, particularly cardiovascular disorders and cancer.

The UK inhalation anesthesia market is expected to show significant growth driven by several factors, including an increase in elective surgeries and a rising number of surgical procedures, which are contributing to a demand for shorter hospital stays. Inhalation anesthesia is favored for its ability to provide better patient outcomes compared to intravenous methods, particularly in terms of recovery speed and comfort during and after surgery.

The Germany inhalation anesthesia market is experiencing significant growth driven by a growing number of surgical procedures and increasing adoption of inhalation anesthesia as it enables enhanced patient outcomes compared to intravenous anesthesia. The German Society for Anesthesiology and Intensive Care Medicine estimates that approximately 17 million anesthesia procedures are conducted annually in German hospitals.

Asia Pacific Inhalation Anesthesia Market Trends

The Asia Pacific inhalation anesthesia market is expected to grow at the fastest CAGR over the forecast period, driven by demographic changes, particularly the aging population and increased life expectancy, leading to a higher incidence of chronic diseases that necessitate surgical interventions. Furthermore, lifestyle factors, such as sedentary behavior and poor dietary choices, contribute to the prevalence of conditions like obesity, diabetes, and cardiovascular diseases, which frequently require surgical treatment. In addition, advancements in medical technology have broadened the range of surgical procedures available, including minimally invasive and robotic-assisted surgeries, thereby enhancing the demand for anesthesia.

The China inhalation anesthesia market is growing at a lucrative rate. The combination of a high volume of surgeries and this extensive demographic is projected to drive market growth during the forecast period. In 2022, there were approximately 4.8 million new cancer cases globally, leading to about 2.57 million deaths. Lung cancer was the most common, accounting for 1.06 million new cases (22% of total cases) and 733,291 deaths. In addition, there has been an increase in road accidents and severe injuries requiring surgical intervention. In 2023, China recorded a 12% decrease in the number of major road accidents that resulted in three or more fatalities compared to 2019.

Latin America Inhalation Anesthesia Market Trends

The Latin America inhalation anesthesia market exhibits high growth potential in the region. As desflurane is phased out in Europe, manufacturers may prioritize the production and distribution of other anesthetic agents, such as sevoflurane and isoflurane, which could lead to increased availability of these alternatives in Latin American markets. This shift may encourage healthcare providers in Latin America to adopt these safer, lower-emission anesthetics, aligning with global trends toward more sustainable medical practices.

Middle East and Africa Inhalation Anesthesia Market Trends

The MEA inhalation anesthesia market growth is driven by several factors, including increasing healthcare spending, a rise in surgical procedures, and the adoption of advanced anesthetic technologies. This analysis provides a comprehensive overview of the competitive landscape, market drivers, adoption trends, and growth opportunities within this region. Increased government and private sector investments in healthcare infrastructure have significantly boosted the availability of surgical services.

The Saudi Arabia inhalation anesthesia market growth is anticipated to grow over the forecast period. Increasing healthcare investments and a growing number of surgical procedures are driving the demand for inhalation anesthetics, particularly sevoflurane and desflurane, which are known for their rapid onset & recovery profiles. This trend is bolstered by advancements in anesthesia technology, which enhances patient safety and procedural efficiency, allowing for more complex surgeries to be performed with greater confidence.

Key Inhalation Anesthesia Company Insights

The market is highly competitive due to several strategic initiatives, such as new product launches, mergers and acquisitions, and regional expansion, undertaken by key market players to increase their global footprints. Companies are diversifying their product portfolios to address a broader range of applications.

Key Inhalation Anesthesia Companies:

The following are the leading companies in the inhalation anesthesia market. These companies collectively hold the largest market share and dictate industry trends.

- Halocarbon, LLC

- Baxter

- AbbVie Inc.

- Lunan Pharmaceutical Group

- Piramal Enterprises Ltd.

- Sandoz Group AG

- Fresenius Kabi AG

Recent Developments

-

In June 2023, Lunan Pharmaceutical Group obtained marketing authorization for sevoflurane for inhalation from the Netherlands Committee for Drug Evaluation. This anesthetic, intended for general anesthesia in both adults and pediatric patients, is anticipated to receive approvals in Germany and Spain shortly after that. This marks Lunan's second product to gain approval in the Netherlands.

-

In August 2023, Mindray introduced A Series Anesthesia Systems, enhancing patient safety and operational efficiency. AnaeSight™, Mindray’s groundbreaking solution for combined intravenous-inhalational anesthesia (CIVIA), integrates anesthesia machines, patient monitors, and pumps, allowing centralized control of both intravenous and inhalational anesthetics.

-

In January 2022, Dechra announced the acquisition of Isoflurane Anesthetic and Sevoflurane Inhalant Anesthetic from Halocarbon Life Sciences. These inhalation anesthesia products are utilized in both human and veterinary medicine. Dechra intends to introduce branded Isoflurane and Sevoflurane products specifically for veterinary use.

-

In October 2022, Blue-Zone Technologies, Ltd. secured USD 8 million in institutional funding from Crédit Mutuel Equity and Round Pond Ventures to scale its operations and expand globally. Blue-Zone's technology reduces hazardous environmental waste in hospitals while offering a cost-efficient source of inhalation anesthetics.

Inhalation Anesthesia Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 1.61 billion |

|

Revenue forecast for 2030 |

USD 2.22 billion |

|

Growth rate |

CAGR of 6.65% from 2025 to 2030 |

|

Actual data |

2018 - 2023 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD billion/million and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Drug, application, end-use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; Germany; France; UK; Italy; Spain; Denmark, Sweden, Norway, Japan; China; India; Australia; South Korea; Thailand, Brazil; Argentina; South Africa; Saudi Arabia; UAE, Kuwait |

|

Key companies profiled |

Halocarbon, LLC; Baxter; AbbVie Inc.; Lunan Pharmaceutical Group; Piramal Enterprises Ltd.; Sandoz Group AG; Fresenius Kabhi AG. |

|

Customization scope |

Free report customization (equivalent to up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Inhalation Anesthesia Market Report Segmentation

This report forecasts revenue growth and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the global inhalation anesthesia market report based on drug, application, end-use, and region.

-

Drug Outlook (Revenue, USD Million, 2018 - 2030)

-

Sevoflurane

-

Desflurane

-

Isoflurane

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Induction

-

Maintenance

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Ambulatory Surgical Centers

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global inhalation anesthesia market size was estimated at USD 1.51 billion in 2024 and is expected to reach USD 1.61 billion in 2025.

b. The global inhalation anesthesia market is expected to grow at a compound annual growth rate of 6.65% from 2025 to 2030 to reach USD 2.22 billion by 2030.

b. Sevoflurane dominated the inhalation anesthesia market in 2022 with 62.45% because it is potent, rapidly acting, and has faster emergence and recovery as compared to the other drugs available in the market.

b. Some key players operating in the inhalation anesthesia market include Baxter, Abbvie Inc, Halocarbon Product COrporation, Sandoz International GmbH, and Piramal Enterprises Ltd..

b. Key factors that are driving the inhalation anesthesia market growth include a growing number of surgical procedures, higher patient benefits associated with the use of inhalation anesthesia as compared to intravenous anesthesia, and rise in hospital care cost.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."