Infrared Sensor Market Size, Share & Trends Analysis Report By Type (Near Infrared (NIR), Infrared, Far Infrared (FIR)), By Working Mechanism (Active, Passive), By Application, End-use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-360-1

- Number of Report Pages: 250

- Format: PDF

- Historical Range: 2017 - 2023

- Forecast Period: 2024 - 2030

- Industry: Semiconductors & Electronics

Infrared Sensor Market Size & Trends

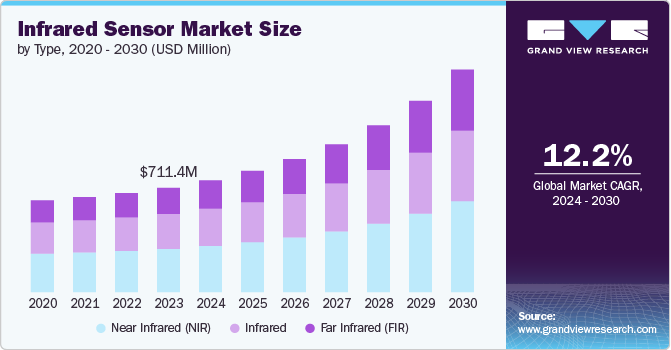

The global infrared sensor market size was estimated at USD 711.4 million in 2023 and is expected to grow at a CAGR of 12.2% from 2024 to 2030. An infrared sensor is a device that detects infrared radiation emitted or reflected by objects. It is used in various applications such as temperature measurement, proximity sensing, night vision, and remote controls, leveraging the heat signatures emitted by objects to provide data or enable control functions. The market growth is driven by factors such as the increasing demand for consumer electronics, growth in the automotive industry, and rising adoption in healthcare applications.

Infrared sensors are witnessing rising demand within the consumer electronics sector, driven by the proliferation of smart devices and technological advancements. These sensors are fundamental to tablets, smartphones, and smart home devices, enabling features such as proximity sensing, gesture recognition, and ambient light adjustment. The demand is further fueled by the growing adoption of augmented reality (AR) and virtual reality (VR) applications, where infrared sensors contribute to enhanced user interactions and immersive experiences. Additionally, infrared sensors play a crucial role in energy-efficient device design by optimizing power consumption based on user proximity and environmental conditions. As consumer preferences shift towards interconnected and intelligent devices, the integration of infrared sensors is becoming ubiquitous across various consumer electronics categories.

The automotive industry is a key driver for the market growth, primarily due to the advancements in vehicle safety and automation technologies. Infrared sensors are essential components in advanced driver assistance systems (ADAS), enabling functionalities such as night vision, pedestrian detection, and adaptive cruise control. These sensors enhance driver visibility in low-light conditions and improve vehicle safety by detecting obstacles and potential collisions. Moreover, infrared sensors are utilized for occupant monitoring systems, ensuring passenger safety and comfort. With the increasing adoption of electric vehicles (EVs) and autonomous driving technologies, the demand for infrared sensors is expected to surge as automakers prioritize safety features and regulatory compliance.

Furthermore, infrared sensors are gaining traction in healthcare applications due to their non-invasive nature and ability to provide accurate and real-time health data. These sensors are widely used for non-contact temperature measurement, vital sign monitoring, and medical imaging, facilitating remote patient monitoring and telehealth services. Infrared sensors play a crucial role in fever screening systems, enabling early detection of infectious diseases and ensuring public health safety in high-traffic areas such as airports and healthcare facilities.

Additionally, infrared thermal imaging aids medical professionals in diagnosing conditions like inflammation, circulatory problems, and musculoskeletal disorders. The integration of infrared sensor technology into wearable health devices is revolutionizing personalized healthcare solutions, supporting preventive care and chronic disease management. As the healthcare industry continues to prioritize efficiency, accuracy, and patient-centric care, the demand for infrared sensors is poised to grow, driving innovation in medical diagnostics and monitoring technologies.

Type Insights

The Near Infrared (NIR) segment held the largest share of 41.6% in 2023, due to its widespread applications in sectors such as telecommunications, medical diagnostics, and environmental monitoring. NIR sensors are widely used in the healthcare sector for non-invasive medical imaging techniques, such as pulse oximetry and spectroscopy. Their use in fiber optic communications and quality control processes in manufacturing has further strengthened their market dominance. The versatility and cost-effectiveness of NIR Working Mechanism have made it a preferred choice for various industrial and commercial applications, contributing to its substantial market share.

The Far Infrared (FIR) segment is expected to grow at the fastest CAGR of 13.6% during the forecast period, due to its superior capabilities in temperature measurement and thermal imaging, which are essential for a wide range of applications. FIR sensors are increasingly utilized in sectors such as healthcare, automotive, and consumer electronics for applications such as night vision, non-contact temperature sensing, and thermal cameras. The growing emphasis on safety and security, along with advancements in FIR technology making sensors more accurate and affordable, has driven their adoption. In addition, the rise in demand for Advanced Driver-Assistance Systems (ADAS) in vehicles has significantly contributed to the rapid growth of the FIR segment.

Working Mechanism Insights

The active segment held the largest market share of 57.8% in 2023, which can be attributed to its ability to provide more precise and reliable measurements compared to passive mechanisms. Active infrared sensors emit their own infrared light and measure the reflection, allowing for accurate detection and measurement even in low-light conditions. This technology is widely used in applications such as security systems, industrial automation, and gesture recognition in consumer electronics, where high accuracy and reliability are crucial. The growing demand for advanced security and automation solutions has significantly boosted the adoption of active infrared sensors, solidifying their market leadership.

The passive segment is expected to register the fastest CAGR of 12.5% in the forthcoming years, due to its energy efficiency and cost-effectiveness, which are highly attractive for a broad range of applications. Passive Infrared (PIR) sensors do not emit their own light but detect infrared radiation from objects, which makes them ideal for motion detection in security systems, home automation, and lighting control. The increasing demand for smart home technologies and energy-saving solutions has significantly driven the adoption of PIR sensors. In addition, advancements in sensor technology have improved the reliability and sensitivity of PIR sensors, further fueling their demand.

Application Insights

The motion sensing segment held the largest market share of 28.5% in 2023, due to its extensive use in security systems, home automation, and consumer electronics. Motion sensors are essential for detecting movement and triggering responses such as lighting, alarms, and automated home controls, making them essential for both commercial and residential security. The proliferation of smart home devices and the increasing focus on safety and energy efficiency have significantly driven the demand for motion-sensing infrared sensors. Moreover, the integration of these sensors in a wide range of devices, from gaming consoles to smartphones, has further bolstered their market dominance.

The gas and fire detection segment is expected to register the fastest CAGR of 12.6% from 2024 to 2030, due to the rising emphasis on safety and regulatory compliance in industrial and residential settings. Infrared sensors are highly effective in detecting gas leaks and fires by identifying specific infrared signatures, offering rapid and reliable responses crucial for preventing accidents. The increasing installation of these sensors in factories, refineries, and homes to enhance safety measures has driven significant demand. Furthermore, advancements in infrared sensor technology have improved their sensitivity and accuracy, making them more attractive for gas and fire detection applications.

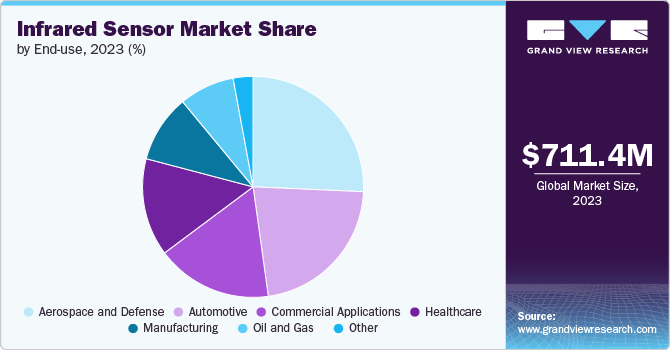

End-use Insights

The aerospace and defense segment held the largest share of 25.7% in 2023, due to the crucial role these sensors play in surveillance, targeting, and navigation systems. Infrared sensors are essential for night vision equipment, missile guidance, and thermal imaging, providing superior situational awareness and operational effectiveness in various defense applications. Significant investments by governments and defense organizations in upgrading and maintaining advanced sensor technologies have resulted in substantial demand. In addition, the integration of infrared sensors in unmanned aerial vehicles (UAVs) and other advanced aerospace technologies has further strengthened their dominance in this sector.

The healthcare segment is anticipated to grow at the fastest CAGR of 12.8% during the forecast period, due to the growing adoption of non-invasive diagnostic and monitoring devices. Infrared sensors are widely used in medical applications such as thermography, pulse oximetry, and blood glucose monitoring, driven by the demand for advanced, patient-friendly healthcare solutions. The COVID-19 pandemic accelerated the need for infrared-based temperature screening and remote health monitoring, further driving segment growth. Moreover, continuous technological advancements in infrared sensor accuracy and miniaturization have expanded their applications in portable and wearable medical devices, contributing to rapid growth in the healthcare segment.

Regional Insights

North America secured the largest market share of 37.1% in 2023, driven primarily by robust technological advancements and high adoption rates across diverse industries. The region benefits from strong R&D capabilities, extensive investment in defense and aerospace sectors, and a mature industrial base. Additionally, stringent regulatory standards and increasing applications in automotive safety systems, smart devices, and healthcare contribute to North America's dominant position in the global market.

U.S. Infrared Sensor Market Trends

The U.S. held the largest market share in the North America market in 2023, due to its significant investments in defense, aerospace, and consumer electronics industries, which are key users of infrared sensor technologies. Additionally, the country's advanced healthcare sector and stringent regulatory environment further drive the adoption of infrared sensors for medical applications and safety systems. The U.S. market dominance is also supported by its robust infrastructure for research and development, fostering continuous innovation and technological advancements in infrared sensor capabilities.

Asia Pacific Infrared Sensor Market Trends

In the infrared sensor market, Asia Pacific is expected to record the fastest CAGR of 13.1% over the forecast period, propelled by several key factors. These include rapid industrialization across emerging economies such as China and India, which drive demand for infrared sensors in manufacturing automation and process control applications. The region's burgeoning automotive sector also contributes significantly, with increasing integration of infrared sensors in vehicles for ADAS and safety systems. Moreover, rising investments in smart infrastructure and consumer electronics further bolster the demand for infrared sensors in Asia Pacific, supporting the region's robust market growth trajectory.

Europe Infrared Sensor Market Trends

Europe held a significant market share in 2023 due to its strong presence in industries such as automotive manufacturing, aerospace, and healthcare. These sectors drive substantial demand for infrared sensors in applications ranging from automotive safety systems to medical diagnostics and thermal imaging. Additionally, Europe's emphasis on environmental regulations and energy efficiency standards further boosts the adoption of infrared sensors in building automation and climate monitoring applications, contributing to the region's market prominence.

Key Infrared Sensor Company Insights

Some of the key companies operating in the Infrared Sensor Market include Omron Corporation and FLIR Systems, Inc.

-

Omron Automation is an industrial automation company that develops, sells, and services fully integrated automation solutions, including control, sensing, safety, motion, vision, and robotics, among others. Its pioneering technological contributions span a variety of fields, such as healthcare, industrial automation, automotive electronics, environmental solutions, social systems, and mechanical components. The company leverages its comprehensive portfolio to build integrated solutions that optimize manufacturing and enhance safety.

Teledyne Technologies Incorporated and Excelitas Technologies Corp. are some of the emerging companies in the target market.

-

Teledyne Technologies Incorporated offers enabling technologies for industrial growth markets that demand advanced technology and high reliability. Its product offerings include aircraft information management systems; digital imaging sensors; monitoring and control instrumentation for marine and environmental applications; systems and cameras within the visible, infrared and X-ray spectra; electronic test and measurement equipment; harsh environment interconnects; and defense electronics and satellite communication subsystems. The company’s operations are primarily located in the U.S., Canada, U.K., and Western and Northern Europe.

Key Infrared Sensor Companies:

The following are the leading companies in the infrared sensor market. These companies collectively hold the largest market share and dictate industry trends.

- FLIR Systems, Inc.

- Hamamatsu Photonics K.K.

- Murata Manufacturing Co., Ltd.

- Texas Instruments Incorporated

- Raytheon Technologies Corporation

- Honeywell International Inc.

- NXP Semiconductors N.V.

- Teledyne Technologies Incorporated

- Excelitas Technologies Corp.

- Lynred

- Omron Automation

- Vishay Intertechnology, Inc.

Recent Developments

-

In April 2024, Teledyne DALSA, a Teledyne Technologies Incorporated firm specializing in machine vision technology, launched the radiometric version of its long wave infrared compact camera platform called MicroCalibir. The platform offers precise temperature measurements of +/-2°C or +/-2%, which makes it ideal for a range of applications in security and surveillance, industrial process monitoring and maintenance, and search and rescue.

-

In October 2023, Omron Automation, an industry automation solutions provider, announced the launch of its SWIR camera series that leverages unique short wave infrared technology to address common manufacturing challenges. Using this technology, the company offers unparalleled performance in capturing data and images surpassing the capabilities of traditional cameras.

Infrared Sensor Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 762.1 million |

|

Revenue forecast in 2030 |

USD 1,516.4 million |

|

Growth rate |

CAGR of 12.2% from 2024 to 2030 |

|

Actual data |

2017 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Type, working mechanism, application, end use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; China; Japan; India; South Korea; Australia; Brazil; KSA; UAE; South Africa |

|

Key companies profiled |

FLIR Systems, Inc.; Hamamatsu Photonics K.K.; Murata Manufacturing Co., Ltd.; Texas Instruments Incorporated; Raytheon Technologies Corporation; Honeywell International Inc.; NXP Semiconductors N.V.; Teledyne Technologies Incorporated; Excelitas Technologies Corp.; Lynred; Omron Automation; Vishay Intertechnology, Inc. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Infrared Sensor Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global infrared sensor market report based on type, working mechanism, application, end use, and region:

-

Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Near Infrared (NIR)

-

Infrared

-

Far Infrared (FIR)

-

-

Working Mechanism Outlook (Revenue, USD Million, 2017 - 2030)

-

Active

-

Passive

-

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Motion Sensing

-

Temperature Measurement

-

Security & Surveillance

-

Gas & Fire Detection

-

Spectroscopy

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2017 - 2030)

-

Healthcare

-

Aerospace & Defense

-

Automotive

-

Commercial Applications

-

Manufacturing

-

Oil & Gas

-

Other

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global infrared sensor market size was valued at USD 711.4 million in 2023 and is expected to reach USD 762.1 million in 2024.

b. The global infrared sensor market is expected to witness a compound annual growth rate of 12.2% from 2024 to 2030 to reach USD 1,516.4 million by 2030.

b. The motion sensing segment held the largest share of 28.5% in the infrared sensor market due to its extensive use in security systems, home automation, and consumer electronics.

b. Key players in the infrared sensor market include FLIR Systems, Inc., Hamamatsu Photonics K.K., Murata Manufacturing Co., Ltd., Texas Instruments Incorporated, Raytheon Technologies Corporation, Honeywell International Inc., NXP Semiconductors N.V., Teledyne Technologies Incorporated, Excelitas Technologies Corp., Lynred, Omron Automation, and Vishay Intertechnology, Inc.

b. The infrared sensor market is driven by factors such as the increasing demand for consumer electronics, growth in the automotive industry, and rising adoption in healthcare applications.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."