Infectious Respiratory Disease Diagnostics Market Size, Share & Trends Analysis By Product (Instruments, Services, Consumables), By Sample (Blood, NPS), By Application, By Technology, By End-use, By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68039-976-4

- Number of Report Pages: 120

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

Market Size & Trends

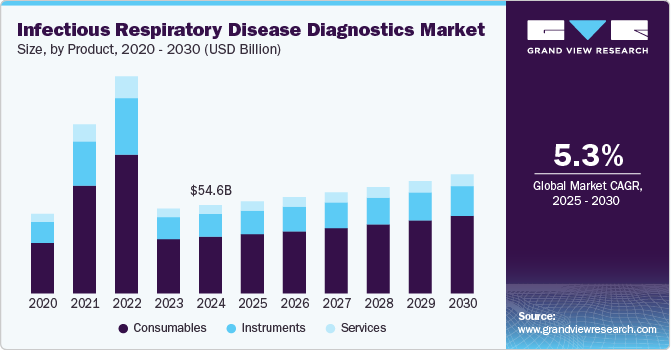

The global infectious respiratory disease diagnostics market size was estimated at USD 54.58 billion in 2024 and is expected to grow at a CAGR of 5.3% from 2025 to 2030. The market is driven by several key factors, including the growing prevalence of diseases like tuberculosis and pneumonia, advancements in diagnostic technologies, and increased partnerships and collaborations between major players. For instance, in February 2023, Thermo Fisher Scientific and Mylab Discovery Solutions announced a partnership to develop and distribute diagnostic test kits for infectious diseases such as multi-drug-resistant tuberculosis, hepatitis B virus, hepatitis C virus, HIV, and genetic analysis (HLA B27) in India. The collaboration combines Thermo Fisher’s global expertise with Mylab’s local manufacturing capabilities to expand access to high-quality testing solutions.

Advancements in diagnostic techniques, including molecular diagnostics and point-of-care testing, have further accelerated market expansion by improving accuracy and reducing turnaround times. Governments, healthcare organizations, and key players are increasing investments in research and development to enhance diagnostic capabilities, contributing to market growth. The COVID-19 pandemic was crucial in increasing the demand for diagnostic tools, consumables, and assays and spurring innovation and product launches. Moreover, growing awareness about the importance of early detection and diagnosis in managing infectious diseases drives consumer demand and healthcare providers’ adoption of advanced diagnostics, further fueling market expansion.

As of August 2022, the U.S. FDA had approved 439 diagnostic tests for COVID-19 under Emergency Use Authorization (EUAs). The market is becoming increasingly competitive with the introduction of new molecular diagnostic tests for detecting SARS-CoV-2. Rapid technological advancements offer greater accuracy, portability, and cost-efficiency and are expected to drive market growth significantly. In April 2020, Canon Medical Systems introduced the Aquilion Prime SP CT system, designed to diagnose viral infectious diseases quickly. This system features an integrated decontamination tool that uses automated UV-C technology to sanitize the equipment after each use.

The growing adoption of self-testing and point-of-care products is expected to further drive market expansion. In May 2024, Wondfo Biotech was granted Emergency Use Authorization (EUA) for Wondfo Biotech’s point-of-care assay that simultaneously tests for WELLlife COVID-19 and influenza A and B. This dual testing capability allows for rapid diagnosis in a single test, which is particularly beneficial during flu season when symptoms can overlap with those of COVID-19. Furthermore, in May 2024, BioPerfectus received approval from Brazil’s ANVISA for its dengue and malaria diagnostic kits. In collaboration with the China CDC, the company developed the Malaria Pf/Pan (HRP2/pLDH) Antigen Rapid Test Kit, supplied to Papua New Guinea, to support local efforts in managing infectious diseases. Such product approvals are likely to fuel overall market growth in the coming years.

Product Insights

The consumables segment dominated the market and accounted for the largest revenue share of 64.3% in 2024. Technological advancements in diagnostic devices have resulted in more sophisticated testing methods, necessitating specialized consumables. Innovations in point-of-care testing and home testing kits require consumables that are not only reliable but also easy to use, driving their demand among both healthcare professionals and patients. Moreover, the COVID-19 pandemic has accelerated the production and use of consumables, with a notable increase in the development of rapid tests and related materials. This trend has prompted manufacturers to invest in research and development, introducing new and improved consumables.

In September 2021, the U.S. FDA authorized approximately 261 molecular diagnostic products, 88 serological tests, and 34 antigen tests for COVID-19 diagnosis. The instrument segment emerged as the second-largest revenue contributor in 2024, driven by the launch of innovative products designed to assist healthcare professionals in diagnosing COVID-19. For example, in March 2021, Vyaire Medical, Inc. launched AioCare, a mobile spirometry system for diagnosing respiratory diseases in Europe, the Middle East, and Australia. This product delivers hospital-grade accuracy and allows physicians to monitor patients remotely through advanced digital connectivity, making it easier to manage care at home.

Sample Insights

In 2024, the nasopharyngeal swabs segment accounted for the largest market share of 34.8%. Nasopharyngeal swabs are the gold standard for collecting samples to diagnose respiratory infections, including COVID-19, influenza, and other viral and bacterial pathogens. Their effectiveness in obtaining samples from the upper respiratory tract ensures high sensitivity and specificity in testing, making them a preferred choice for healthcare providers. The widespread adoption of molecular testing techniques, such as polymerase chain reaction (PCR), has increased the demand for nasopharyngeal swabs. These tests require high-quality samples to accurately detect the presence of pathogens, and nasopharyngeal swabs are well-suited for this purpose. In addition, the COVID-19 pandemic significantly accelerated the use of nasopharyngeal swabs, leading to a surge in their production and utilization. Governments and healthcare organizations emphasized the importance of accurate testing, which further drove demand.

The saliva segment is likely to grow with a lucrative CAGR of 6.2% over the forecast period. This growth can be attributed to the rising demand for noninvasive testing methods and the increasing use of various sample types in diagnostics. A study published in May 2020 demonstrated that saliva tests had a sensitivity of approximately 84.2% and a specificity of 98.9%. These promising results prompted companies to focus on developing and marketing saliva-based tests that do not require swabs. For example, in March 2021, BATM Advanced Communications Ltd. launched an RT-PCR kit that employs Salivette technology, allowing individuals to collect samples for COVID-19 testing without needing traditional swabs.

Technology Insights

In 2024, the molecular diagnostics segment accounted for 66.6% of the market share. The significant market share for molecular tests is largely due to the growing demand for accurate diagnosis of COVID-19, RSV, influenza, and other respiratory infections. PCR remains the gold standard technology for amplifying DNA, making it a trusted choice for molecular diagnostics. In response to this demand, companies are developing multiplex tests that enable the simultaneous diagnosis of multiple infectious respiratory diseases using a single swab. For example, in December 2020, GENETWORx, LLC introduced an innovative test capable of detecting three respiratory viruses—SARS-CoV-2, RSV, and Influenza A & B—from a single sample.

The immunoassays segment is likely to grow steadily, driven by technological advancements and the introduction of new products. In April 2021, Bio-Rad Laboratories, Inc. launched a blood-based immunoassay kit designed to detect IgM, IgA, and IgG antibodies to diagnose COVID-19. This launch is anticipated to enhance COVID-19 diagnostics, contributing to the industry's overall growth.

Application Insights

The COVID-19 segment dominated the global market in 2024, accounting for 43.8% of the revenue. Increased COVID-19 variants, product approvals, and heightened research and development efforts drove this dominance. However, with rising vaccination rates expected to lessen the severity of the disease, testing rates are likely to decline in the coming years. In response to changing market dynamics, key players are launching direct-to-consumer testing kits that allow individuals to collect samples without needing trained personnel, thereby reducing turnaround times.

Meanwhile, influenza is projected to experience a significant growth of 6.3% during the forecast period. This anticipated growth can be attributed to heightened government focus and increased funding for research and development to advance influenza diagnostic technologies. As public health initiatives prioritize the early detection and treatment of this infectious disease, the market for influenza diagnostics is expected to expand substantially.

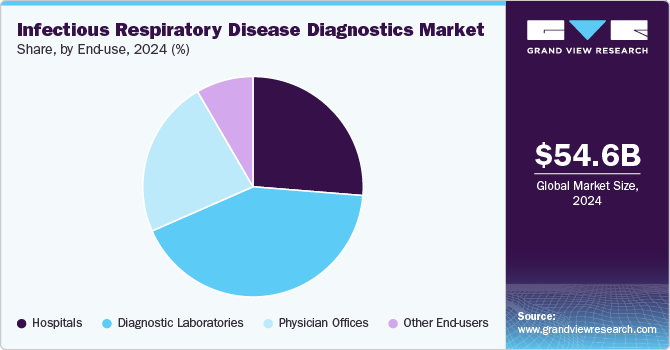

End-use Insights

In 2024, the diagnostic laboratories segment led the market, accounting for 42.2% of the revenue share. They are equipped with advanced technology and staffed by skilled professionals, enabling them to perform a wide array of diagnostic tests with high accuracy and reliability. This capability is essential for detecting infectious diseases and chronic conditions that require precise diagnosis. Furthermore, these laboratories offer comprehensive testing services, address routine and specialized needs, and can efficiently handle large volumes of samples. The rising prevalence of diseases and an increasing focus on early diagnosis have led healthcare providers to increasingly depend on laboratory services for improved patient management. Moreover, advancements in laboratory automation and artificial intelligence have enhanced the efficiency and speed of test results, further solidifying the reliance on diagnostic laboratories.

The physician offices segment is projected to experience substantial growth during the forecast period, driven by a growing preference among patients. The segment is likely to grow at a CAGR of 4.9% over the forecast period. Launching innovative assays that deliver rapid PoC results is expected to enhance this segment's growth further. For example, in April 2021, Chembio Diagnostics, Inc. introduced a rapid PoC test for COVID-19 and Influenza A&B, designed to differentiate between patients with influenza or COVID-19 more quickly than traditional methods. This advancement allows for faster decision-making in conventional and decentralized healthcare settings, contributing to the increasing adoption of PoC diagnostics in physician offices.

Regional Insights

North America infectious respiratory disease diagnostics market dominated the overall global market and accounted for 41.85% of revenue share in 2024. The region benefits from advanced healthcare infrastructure and high healthcare expenditure, enabling the rapid adoption of innovative diagnostic technologies. The presence of leading biotechnology and pharmaceutical companies in the United States fosters continuous research and development, resulting in the introduction of cutting-edge diagnostic solutions.

U.S. Infectious Respiratory Disease Diagnostics Market Trends

Theinfectious respiratory disease diagnostics market in the U.S. held a significant share of the North American market in 2024, fueled by the presence of key players and a large end user base. The increasing prevalence of chronic and infectious diseases and increasing public awareness about early diagnosis and preventive healthcare drive demand for diagnostic tests.

Europe Infectious Respiratory Disease Diagnostics Market Trends

The infectious respiratory disease diagnostics market in Europe is experiencing significant growth. Europe holds a significant share of the overall market, driven by advanced healthcare systems, strong regulatory frameworks, and increasing demand for early disease detection. The region benefits from extensive research and development initiatives, leading to innovative diagnostic solutions. Furthermore, rising awareness of preventive healthcare further fuels market growth.

The UK infectious respiratory disease diagnostics market will likely show significant growth due to healthcare improvements and technological developments. The National Health Service (NHS) drives demand for accurate and efficient diagnostic solutions, particularly in response to rising chronic diseases. In addition, advancements in point-of-care testing and increased investment in medical technologies contribute to the market's growth, ensuring that the UK remains at the forefront of diagnostic advancements.

The infectious respiratory disease diagnostics market in Germany is experiencing significant growth. The country benefits from a well-established network of diagnostic laboratories and medical device manufacturers, driving the development of cutting-edge diagnostic technologies. Germany’s commitment to research and development, supported by significant government funding, fosters advancements in areas such as molecular diagnostics and point-of-care testing.

Asia Pacific Infectious Respiratory Disease Diagnostics Market Trends

The infectious respiratory disease diagnostics market in Asia Pacificis experiencing the fastest growth,driven by significant advancements in terms of technology. Countries like China, India, and Japan are leading this expansion due to their large populations and growing demand for advanced diagnostic solutions. The region is witnessing significant technological advancements, particularly in molecular diagnostics and point-of-care testing, which enhance the speed and accuracy of disease detection.

China infectious respiratory disease diagnostics market is growing, driven by the rapid expansion of its biotechnology and pharmaceutical industries. China is a prominent player in the diagnostic market, characterized by rapid growth fueled by increasing healthcare investments and a vast population. The country has made significant strides in advancing its healthcare infrastructure, leading to a rising demand for innovative diagnostic solutions.

Latin America Infectious Respiratory Disease Diagnostics Market Trends

The infectious respiratory disease diagnostics market in Latin Americais experiencing significant growth,driven by an increasing demand for healthcare services and improvements in medical infrastructure. The rising prevalence of chronic and infectious diseases, such as diabetes and COVID-19, is boosting the need for accurate and efficient diagnostic solutions.

Middle East and Africa Infectious Respiratory Disease Diagnostics Market Trends

The infectious respiratory disease diagnostics market in MEAis expanding, driven by an increasing emphasis on healthcare improvement and disease prevention. Rapid urbanization, rising disposable incomes, and a growing burden of chronic and infectious diseases are key factors fueling demand for diagnostic solutions.

Saudi Arabia infectious respiratory disease diagnostics market growth is driven by substantial investments in healthcare infrastructure and a commitment to improving public health. The country's Vision 2030 initiative aims to enhance healthcare services, increase the availability of advanced diagnostic solutions, and promote preventive care.

Key Infectious Respiratory Disease Diagnostics Company Insights

The competitive scenario in the market is high, with key players such as Abbott, Thermo Fisher Scientific, Inc., Koninklijke Philips N.V., F. Hoffmann-La Roche Ltd., BD, bioMérieux SA, Bio-Rad Laboratories, Inc., Quidel Corporation, Siemens Healthcare GmbH, Danaher, and Qiagen holding significant positions. Prominent market participants focus on increasing the customer base by launching new products. For instance, in May 2024, F. Hoffman-La Roche Ltd. received FDA approval for its HPV self-testing kit, which can help identify women at risk of developing cervical cancer at an earlier stage. Furthermore, in March, SEKISUI Diagnostics obtained EUA clearance for the OSOM Flu SARS-CoV-2 Combo Test. It was approved for use in professional and home testing settings.

Key Infectious Respiratory Disease Diagnostics Companies:

The following are the leading companies in the infectious respiratory disease diagnostics market. These companies collectively hold the largest market share and dictate industry trends.

- Abbott

- Thermo Fisher Scientific, Inc.

- Koninklijke Philips N.V.

- F. Hoffmann-La Roche Ltd.

- BD

- bioMérieux SA

- Bio-Rad Laboratories, Inc.

- Quidel Corporation

- Siemens Healthcare GmbH

- Danaher

- Qiagen

Recent Developments

-

In May 2024, Wondfo Biotech was granted Emergency Use Authorization (EUA) for Wondfo Biotech’s point-of-care assay that simultaneously tests for WELLlife COVID-19 and influenza A and B. This dual testing capability allows for rapid diagnosis in a single test, which is particularly beneficial during flu season when symptoms can overlap with those of COVID-19.

-

In May 2024, BioPerfectus received approval from Brazil’s ANVISA for its dengue and malaria diagnostic kits. In collaboration with the China CDC, the company developed the Malaria Pf/Pan (HRP2/pLDH) Antigen Rapid Test Kit, supplied to Papua New Guinea, to support local efforts in managing infectious diseases.

-

In May 2024, F. Hoffman-La Roche Ltd. received FDA approval for its HPV self-testing kit, which can help identify women at risk of developing cervical cancer at an earlier stage.

-

In April 2024, Cepheid announced that its Xpert HIV-1 Qual XC received prequalification from WHO, confirming its high standards of performance, quality, safety, and reliability. This in vitro nucleic acid amplification test detects HIV-1 total nucleic acids from dried blood spots and whole blood specimens, offering extended strain coverage and results up to seven to ten days before seroconversion. It was approved for early diagnosis in infants, adolescents, & adults in both POC and laboratory settings.

Infectious Respiratory Disease Diagnostics Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 56.92 billion |

|

Revenue forecast in 2030 |

USD 73.56 billion |

|

Growth rate |

CAGR of 5.3% from 2025 to 2030 |

|

Actual data |

2018 - 2023 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, sample, technology, application, end-use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Norway; Denmark; Sweden; China; Japan; India; Australia; Thailand; South Korea; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait |

|

Key companies profiled |

Abbott; Thermo Fisher Scientific Inc.; Koninklijke Philips N.V.; F. Hoffmann-La Roche Ltd.; bioMérieux SA; BD; Quidel Corporation; QIAGEN; Danaher; Siemens Healthcare GmbH |

|

Customization scope |

Free report customization (equivalent up to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Infectious Respiratory Disease Diagnostics Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis on the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the infectious respiratory disease diagnostics market report based on product, sample, technology, application, end-use and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Instruments

-

Imaging Tests

-

Respiratory Measurement Devices

-

Other Instruments

-

-

Consumables

-

Services

-

-

Sample Outlook (Revenue, USD Million, 2018 - 2030)

-

Saliva

-

Nasopharyngeal Swabs (NPS)

-

Anterior Nasal Region

-

Blood

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

COVID-19

-

Influenza

-

Respiratory Syncytial Virus (RSV)

-

Tuberculosis

-

Streptococcus Testing

-

Other Respiratory Disease Testing

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Immunoassay

-

Molecular Diagnostics

-

Microbiology

-

Other Technologies

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Diagnostic Laboratories

-

Physician Offices

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Norway

-

Denmark

-

Sweden

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global infectious respiratory disease diagnostics market size was estimated at USD 54.58 billion in 2024 and is expected to reach USD 56.92 billion in 2025.

b. The global infectious respiratory disease diagnostics market is expected to witness a compound annual growth rate of 5.3% from 2025 to 2030 to reach USD 73.56 billion in 2030.

b. Based on product, the consumables segment dominated the market and accounted for the largest revenue share of 64.3% in 2024

b. Some key players operating in the infectious respiratory disease diagnostics market include Abbott; Thermo Fisher Scientific Inc.; Koninklijke Philips N.V.; F. Hoffmann-La Roche Ltd.; bioMérieux SA; BD; Quidel Corporation; QIAGEN; Danaher; Siemens Healthcare GmbH.

b. The major factors driving market growth are the rising incidence of infectious respiratory diseases, the rising number of product approvals, and increasing initiatives by government and non-profit organizations to improve diagnostic tests.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."