Infectious Disease Molecular Diagnostics Market Size, Share & Trends Analysis Report By Product (Instruments, Reagents), By Technology (Mass Spectrometry, PCR, In Situ Hybridization), By Application, By End-use, By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68039-529-7

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

Market Size & Trends

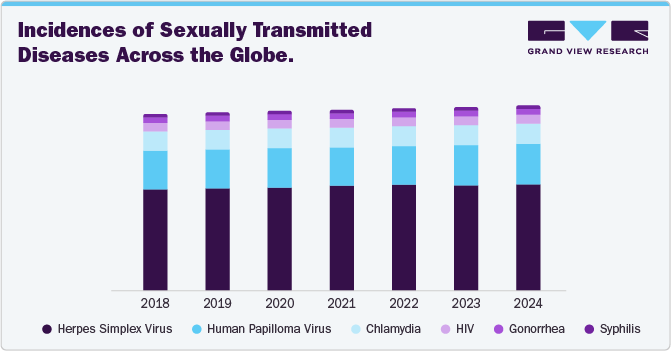

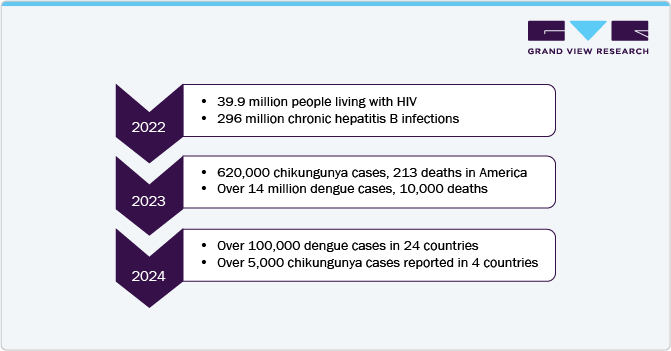

The global infectious disease molecular diagnostics market size was estimated at USD 16.24 billion in 2024 and is expected to grow at a CAGR of 3.37% from 2025 to 2030a. The market surge is attributable to the increasing prevalence of infectious diseases worldwide. According to a World Health Organization report, As of January 22, 2025, over 5,000 chikungunya virus disease (CHIKVD) cases and two deaths have been reported globally across four countries. In 2024, 620,000 cases and 213 deaths were detected, primarily in the Americas, with Brazil, Paraguay, and Argentina reporting the highest burdens.

Asia saw significant cases, particularly in India and Pakistan, while Senegal was the only affected African country. Europe recorded one locally acquired case in France and 118 cases in La Réunion. Diseases such as HIV/AIDS, hepatitis, tuberculosis, and respiratory infections continue to pose significant public health challenges, necessitating advanced diagnostic solutions. In addition, the aging global population contributed to market growth, as older individuals are more susceptible to infections and require frequent diagnostic testing.

Advancements in molecular diagnostics have transformed the field, making tests more accurate, rapid, and widely accessible. For instance, in January 2025, the French startup AlterDiag partnered with the Institut Pasteur to develop rapid infectious disease diagnostics using single-domain antibodies and immunochromatography. This collaboration aims to enhance or introduce point-of-care tests for WHO-priority pathogens. Cutting-edge techniques such as Polymerase Chain Reaction (PCR), nucleic acid amplification, and next-generation sequencing have significantly improved pathogen detection with high precision. These innovations have not only increased diagnostic accuracy but also shortened result turnaround times, which is critical for timely treatment and effective disease containment.

Government initiatives and public health campaigns aimed at controlling the spread of infectious diseases considerably propelled market growth. Governments and health organizations worldwide have heavily invested in screening programs, awareness campaigns, and early detection initiatives. These efforts emphasize the importance of early diagnosis and treatment, driving the adoption of molecular diagnostic technologies. In addition, regulatory support and funding for research and development have fostered significant innovation in the field.

The growing availability of external funding for clinical research in infectious disease molecular diagnostics is expected to drive market expansion, as financial support plays a key role in advancing product innovation. For instance, in January 2025, Rhode Island Hospital secured a USD 1 million grant from CARB-X to aid in developing a direct-from-blood PCR test for pneumonia-causing bacteria. This initiative aims to enhance the diagnosis of lower respiratory tract infections (LRTIs) by providing rapid and precise detection, ultimately addressing the urgent need for improved diagnostic tools to combat antibiotic resistance and optimize patient care.

Similarly, in January 2025, Kryptos Biotechnologies was awarded a USD 1.2 million grant from the RIGHT Foundation to develop a 30-minute multiplex molecular test for sexually transmitted infections. Leveraging its ultrafast photonic PCR technology, the company aims to advance the Kuick system, offering faster, more cost-effective, and more accurate point-of-care diagnostics. These investments highlight the increasing emphasis on innovation and accessibility in infectious disease diagnostics.

In addition, healthcare infrastructure improvements in emerging economies have expanded access to molecular diagnostics. Countries in Asia Pacific, Africa, and Latin America have invested heavily in healthcare facilities and diagnostic laboratories, increasing the availability of advanced diagnostic tests. Patients have increasingly favored molecular diagnostics that enable the identification of specific genetic markers and pathogens, allowing for tailored treatment plans. This personalized approach enhances treatment efficacy and reduces the risk of adverse effects.

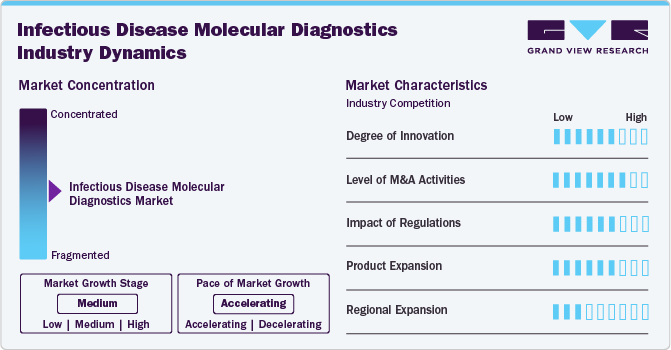

Market Concentration & Characteristics

The infectious disease molecular diagnostics industry is experiencing rapid innovation, driven by advancements in PCR, CRISPR-based diagnostics, and AI-powered analysis. For instance, in September 2024, The company announced the launch of TAGS - Temperature-Activated Generation of Signal, a novel technology to greatly enhance the detection of pathogens. Emerging technologies such as nanopore sequencing and single-molecule detection are enhancing accuracy and speed. Additionally, miniaturized point-of-care (POC) devices are making diagnostics more accessible, particularly in resource-limited settings, improving early disease detection and patient outcomes.

Mergers and acquisitions (M&A) are intensifying in the infectious disease molecular diagnostics industry, as key players seek technological integration, geographic expansion, and portfolio diversification. In June 2024, The company, OLM Diagnostics, which manufactures a variety of diagnostics tests, was acquired by the distributor and manufacturers of diagnostic test kits, IMMY. Companies are acquiring startups with novel diagnostic platforms and forming strategic alliances to enhance capabilities. For instance, major acquisitions in PCR and rapid testing technologies are strengthening market competition and accelerating innovation-driven growth.

Regulatory policies significantly influence the infectious disease molecular diagnostics industry, ensuring test accuracy, safety, and reliability. Agencies like the FDA, EMA, and WHO enforce stringent guidelines for approval. Fast-track approvals for pandemic-related diagnostics and the emergence of IVD Regulation (IVDR) in Europe are reshaping compliance standards, impacting product development timelines and market entry strategies.

Market players are expanding their portfolios with multiplex molecular panels, rapid POC assays, and AI-integrated diagnostic solutions. Innovations in self-testing kits and portable devices are improving accessibility. Additionally, the rise of next-generation sequencing (NGS) in infectious disease detection is enabling more comprehensive pathogen identification, enhancing personalized treatment and antimicrobial resistance monitoring.

The market is growing across North America, Europe, Asia-Pacific, and Latin America, driven by rising disease prevalence, government initiatives, and improved healthcare infrastructure. In Asia-Pacific, investments in low-cost molecular diagnostics are expanding access, while Latin America is witnessing increased adoption of PCR-based testing. Emerging economies are fostering partnerships to localize production and reduce dependence on imports.

Product Insights

Reagents led the market with a 25.86% revenue share in 2024 and are projected to experience the fastest CAGR over the forecast period due to their widespread use in infectious disease diagnostics. As critical components in PCR, nucleic acid amplification, and sequencing, reagents play a vital role in ensuring high-accuracy pathogen detection. The COVID-19 pandemic significantly fueled demand for reagents, as global testing programs required large-scale screening for SARS-CoV-2. This surge has driven increased production and commercialization of innovative reagent formulations, further propelling market growth. Additionally, technological advancements have enhanced reagent efficiency and reliability, supporting the development of point-of-care (PoC) testing, which depends on high-quality reagents for fast and accurate results.

However, diagnostic services are expected to witness substantial growth due to rising demand for specialized testing solutions for various infectious diseases. These services encompass laboratory testing, data analysis, and interpretation, crucial for precise diagnosis and effective treatment planning. Innovations such as Next-Generation Sequencing (NGS), digital PCR, and automated diagnostic platforms have strengthened service capabilities, enabling more accurate and efficient pathogen detection. These advancements have expanded the scope of diagnostic services, including tests for emerging and rare infectious diseases, enhancing accessibility and clinical decision-making.

Technology Insights

Polymerase Chain Reaction (PCR) technology secured the dominant revenue share in 2024 owing to its widespread application in detecting a broad range of infectious diseases, including COVID-19, HIV, hepatitis, and tuberculosis. PCR’s ability to amplify small amounts of DNA or RNA to detectable levels makes it an invaluable tool for accurate and early diagnosis. Furthermore, technological advancements such as real-time PCR (qPCR) and digital PCR (dPCR) improved the sensitivity and specificity of tests, enabling the detection of low-abundance pathogens and genetic mutations.

The PCR market includes various techniques, such as quantitative PCR, reverse transcription PCR, inverse PCR, and multiplex PCR, with multiplex PCR gaining traction for its ability to detect multiple targets simultaneously. Recent years have seen an increase in product approvals, signaling market expansion. For example, in January 2025, Bosch Healthcare Solutions received CE-IVDR certification for its Vivalytic PCR test, designed for bacterial meningitis diagnosis. Similarly, in December 2024, Altona Diagnostics secured EU IVDR certification for its PCR-based test kits, with plans to launch over 14 molecular diagnostic test kits in 2025.

In Situ Hybridization (ISH) technology is projected to expand at a CAGR of 8.75% over the forecast period, driven by its ability to precisely localize specific nucleic acid sequences within cells and tissues. This capability makes ISH an essential tool for highly accurate disease diagnosis. Innovations such as fluorescence in situ hybridization (FISH) and chromogenic in situ hybridization (CISH) have significantly enhanced the sensitivity and specificity of diagnostic tests. These advancements facilitate the visualization and quantification of viral loads, gene expression, and chromosomal abnormalities, aiding in accurate diagnosis and treatment planning.

Governments and healthcare organizations are heavily investing in advanced diagnostic technologies to strengthen early disease detection and management. For example, in July 2022, Bio-Techne launched the RNAscope ISH Probe High-Risk HPV in Europe to improve the detection of HPV mRNA in oropharyngeal squamous cell carcinoma (OPSCC). Unlike the commonly used p16 IHC test, which has a 5-20% misdiagnosis rate, this probe directly detects HPV E6/E7 mRNA, ensuring greater diagnostic precision and improved treatment selection. The probe is designed for use with the Leica Biosystems BOND-III stainer and can identify high-risk HPV types 16, 18, 26, 31, and others in FFPE tissue samples.

Application Insights

Respiratory diseases held the largest market share of 71.96% in 2024, driven primarily by the rising prevalence of respiratory infectious diseases such as Respiratory Syncytial Virus (RSV), influenza, COVID-19, etc. These viruses pose substantial health risks, particularly to vulnerable populations, including infants and older adults, leading to increased hospitalizations and outpatient visits. The seasonal nature of these infections and their high hospitalization rates call for the urgent need for rapid and accurate diagnostic tools. The introduction of innovative diagnostic tests and strategic partnerships among key industry players is further expected to support the expansion of this segment in the market. For instance, BioGX B.V. has developed an automated multiplex real-time RT-PCR assay that detects RSV A and B, enhancing the efficiency of respiratory virus detection.

Meanwhile, Human Papillomavirus (HPV) diagnostics are expected to be the fastest-growing segment over the forecast period. This growth is attributed to the high global prevalence of HPV infections, a major cause of cervical and other anogenital cancers. The rising incidence of HPV-related cancers has driven the demand for early detection and intervention tools. Additionally, the expansion of widespread HPV vaccination programs has influenced the market, increasing the need for robust diagnostic solutions to monitor vaccine effectiveness and identify breakthrough infections. This combination of prevention and diagnostic monitoring is crucial for comprehensive HPV management.

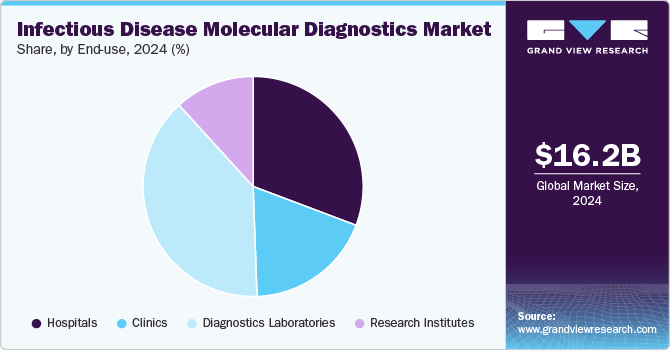

End-use Insights

Diagnostic laboratories held the dominant revenue share in 2024, driven by the rising prevalence of infectious diseases such as HIV, hepatitis, tuberculosis, and respiratory infections, which require accurate and timely diagnosis. These laboratories are well-equipped with advanced infrastructure and expertise, enabling them to handle high test volumes efficiently. Additionally, the growing shift toward personalized medicine has significantly increased the demand for molecular diagnostic services. By identifying specific genetic markers and pathogens, molecular diagnostics facilitate tailored treatment plans, enhancing treatment efficacy while minimizing adverse effects.

Diagnostic laboratories play a crucial role in healthcare, performing a wide range of molecular tests for various diseases. They are often affiliated with hospitals, academic institutions, and reference laboratories, serving diverse healthcare needs. With cutting-edge technology, these labs process large sample volumes, ensuring rapid and precise molecular diagnostic services.

This segment is expected to retain its dominance due to strong market penetration and consistently high test volumes. Additionally, government initiatives—such as reimbursement policies for diagnostic tests—are anticipated to further propel market growth. Many healthcare institutions are increasingly collaborating with diagnostic labs to integrate a broad spectrum of tests, including microbiology diagnostics, driving expansion. Furthermore, the growing presence of diagnostic laboratories in emerging and underdeveloped markets is expected to capture a significant market share, reinforcing their global influence in infectious disease diagnostics.

Research institutes are projected to grow at a CAGR of 5.61% during the forecast period, playing a pivotal role in advancing molecular diagnostics. As key end users of diagnostic products, these institutes drive scientific innovation, contributing to the development of cutting-edge diagnostic tools. Their research focuses on pathogen behavior, resistance patterns, and disease transmission, shaping public health strategies and clinical practices. The increasing volume of R&D activities in novel diagnostic technologies is a major growth driver, fueling advancements in precision, speed, and accuracy in disease detection.

These institutions enhance market innovation by engaging in standalone research projects, collaborations with startups and established companies, and commercialization of research products. Their contributions accelerate the evolution of diagnostics, ensuring continuous improvements in timely and effective disease detection.

For instance, in December 2024, the Liverpool School of Tropical Medicine's Infection Innovation Consortium (ii) partnered with the Translational Development Fund (TDF) and LifeArc, a leading medical research charity, to advance rapid testing, drug trials, and novel infectious disease solutions. The initiative secured over GBP 2.7 million (USD 3.4 million) in funding, aimed at developing new diagnostic tools and treatments for low- and middle-income countries. By fostering collaborations among researchers, healthcare professionals, and industry partners, this initiative seeks to accelerate diagnostic research and drive impactful healthcare solutions.

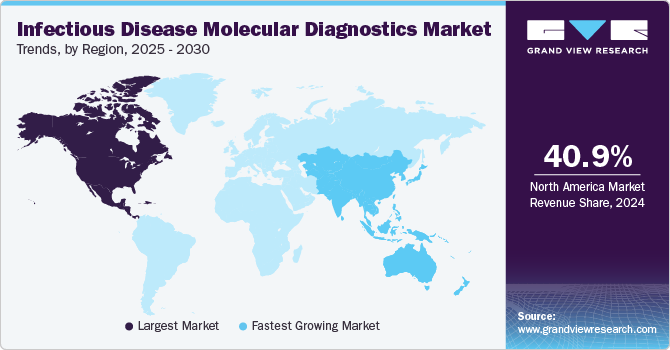

Regional Insights

North America infectious disease molecular diagnosis market accounted for 40.95% of the revenue share in 2024, driven by the high prevalence of infectious diseases such as COVID-19, influenza, HIV, and hepatitis. The need for accurate and timely diagnosis has fueled demand for molecular diagnostic tools. Additionally, the rising adoption of point-of-care (PoC) testing has significantly influenced market growth, as it enables rapid bedside or community-based diagnosis, ensuring timely treatment and effective disease containment.

U.S. Infectious Disease Molecular Diagnostics Market Trends

The infectious disease molecular diagnosis market in the U.S. is poised for substantial growth during the forecast period, propelled by technological advancements in real-time PCR, next-generation sequencing (NGS), and digital PCR. These innovations have enhanced diagnostic accuracy, speed, and efficiency, enabling healthcare providers to quickly identify pathogens and determine optimal treatment strategies. This progress is crucial for improving patient outcomes and strengthening infection control measures.

Europe Infectious Disease Molecular Diagnostics Market Trends

In 2024, Europe infectious disease molecular diagnosis market held a significant revenue share, bolstered by strong investments in diagnostic infrastructure and technology. Regional governments have prioritized healthcare system improvements, with substantial funding directed toward advanced diagnostic technologies. These efforts aim to strengthen early detection capabilities, enhance disease management, and improve overall public health outcomes.

The presence of sophisticated healthcare infrastructure, high disposable income, and growing awareness about the benefits of early diagnosis are key drivers expected to propel the infectious disease molecular diagnostics market in the UK. In December 2024, The UK Health Security Agency (UKHSA) launched the Diagnostic Accelerator to enhance the country’s pandemic preparedness by improving the speed and scalability of diagnostic tests for emerging infectious diseases. The team will focus on advancing molecular and point-of-care tests, collaborating with industry and academic partners to address diagnostic gaps and ensure rapid test availability for pathogens with epidemic and pandemic potential. This initiative aims to ensure effective disease surveillance and response in future health crises.

Germany infectious disease molecular diagnostics market is experiencing significant growth, driven by the increasing demand for faster, more accurate diagnostic solutions across various therapeutic areas, particularly infectious diseases. Germany is a key player in the European infectious disease molecular diagnostics landscape, owing to its advanced healthcare infrastructure, strong healthcare regulations, and a growing demand for precise diagnostics.

Asia Pacific Infectious Disease Molecular Diagnostics Market Trends

The infectious disease molecular diagnosis market in Asia Pacific is projected to grow significantly during the forecast period, driven by the rising prevalence of infectious diseases such as COVID-19, tuberculosis, HIV, and hepatitis. The high disease burden in the region underscores the critical need for advanced diagnostic solutions to enable early and accurate detection for effective disease management. Additionally, the growing geriatric population has increased the demand for molecular diagnostics. The expansion of biotechnology and biopharmaceutical companies in the region has further contributed to market growth by driving innovation and enhancing access to advanced diagnostic tools.

Increasing prevalence of infectious diseases, advancements in diagnostic technologies, and a growing emphasis on early disease detection and personalized medicine is expected to drive Japan infectious disease molecular diagnostics market. Earthquakes in Japan significantly impact public health, often triggering outbreaks of respiratory and gastrointestinal infections due to overcrowding and poor sanitation in evacuation shelters. The Noto Peninsula earthquake on January 1, 2024, exacerbated infectious disease transmission, particularly COVID-19 and influenza, highlighting the urgent need for improved disaster preparedness and infection control measures. The study analyzed emergency cases at Kanazawa Medical University Himi Municipal Hospital, showing a spike in infections post-earthquake, with COVID-19 peaking later than influenza due to differences in incubation periods.

Latin America Infectious Disease Molecular Diagnostics Market Trends

The Latin America infectious disease molecular diagnosis market includes countries such as Brazil, and Argentina. Technological advancements in the Latin America industry are expected to contribute to market growth. Increasing government expenditure on Research & Development (R&D), the rising focus of multinational medical device companies in the infectious disease molecular diagnostics sector, and growing patient awareness about infectious diseases are expected to drive market growth during the forecast period.

Middle East & Africa Infectious Disease Molecular Diagnostics Market Trends

The infectious disease molecular diagnostics market in the Middle East and Africa is growing significantly. The African region faces a significant dengue burden, with 13 countries reporting active transmission in early 2024, totaling 32,925 cases and 57 deaths. Burkina Faso (52% of cases, 67% of deaths), Mauritius (7177 cases, 15 deaths), and Mali (3231 cases, 3 deaths) are the most affected. Circulating serotypes include DENV-1, DENV-2, and DENV-3. Key challenges include limited funding, shortages of rapid diagnostics, and a lack of skilled lab technicians and entomologists, underscoring the growing need for advanced molecular diagnostics in the MEA region to enhance surveillance and outbreak response.

Key Infectious Disease Molecular Diagnostics Company Insights

The global infectious disease molecular diagnostics market is highly competitive, with key players such as Danaher Corporation, Bio-Rad Laboratories, bioMérieux SA, and F. Hoffmann-La Roche Ltd focusing on enhancing speed, accuracy, specialty, and precision in their products. These companies prioritize new product development, research & development (R&D) investments, and strategic mergers and acquisitions to strengthen their market position.

-

Danaher Corporation is a multinational conglomerate with operations in life sciences, diagnostics, and environmental solutions. Recognized for its Kaizen-driven continuous improvement approach, the company designs manufactures and markets a diverse range of medical, industrial, and commercial products and services.

-

Bio-Rad Laboratories, Inc., a U.S.-based company, specializes in life science research and clinical diagnostics. It offers an extensive portfolio of instruments, software, reagents, consumables, and scientific solutions for applications such as cell biology, gene expression, protein purification, and drug discovery.

Key Infectious Disease Molecular Diagnostics Companies:

The following are the leading companies in the infectious disease molecular diagnostics market. These companies collectively hold the largest market share and dictate industry trends.

- Abbott

- Danaher Corporation

- Bio-Rad Laboratories, Inc.

- bioMérieux SA

- F. Hoffmann-La Roche Ltd

- Agilent Technologies, Inc.

- Becton, Dickinson and Company

- Hologic, Inc. (Gen-Probe)

- Illumina, Inc.

- Grifols S.A.

- Qiagen

- Siemens Healthineers AG

- Sysmex Corporation

Recent Developments

-

In February 2025, Advanced Biological Laboratories (ABL) announced the transfer and licensing agreement of know-how and IP rights of Fastrack Diagnostics Luxembourg (FTD Ltd.) with Siemens Healthineers.

-

In June 2024, OLM Diagnostics, OLM diagnostics, which manufactures a variety of diagnostics tests, was acquired by the distributor and manufacturers of diagnostic test kits, IMMY.

-

In January 2024, bioMérieux announced the acquisition of LUMED, a software company known for developing a clinical decision support system. This system aids hospitals in optimizing antimicrobial prescriptions and monitoring healthcare-associated infections.

Infectious Disease Molecular Diagnostics Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 17.08 billion |

|

Revenue forecast in 2030 |

USD 20.15 billion |

|

Growth rate |

CAGR of 3.37% from 2025 to 2030 |

|

Actual data |

2018 - 2024 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, technology, application, end-use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait |

|

Key companies profiled |

Abbott; Danaher Corporation; bioMérieux SA; F. Hoffmann-La Roche Ltd; Bio-Rad Laboratories, Inc.; Agilent Technologies, Inc.; Becton, Dickinson and Company; Hologic, Inc. (Gen-Probe); Illumina, Inc., Grifols S.A.; Qiagen; Siemens Healthineers AG; Sysmex Corporation |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Infectious Disease Molecular Diagnostics Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global infectious disease molecular diagnostics market report based on product, technology, application, end-use, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Instruments

-

Reagents

-

Services

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Polymerase Chain Reaction (PCR)

-

Multiplex PCR

-

Instruments

-

Reagents

-

Others

-

-

Other PCR

-

-

In Situ Hybridization

-

Instruments

-

Reagents

-

Services

-

-

Isothermal Nucleic Acid Amplification Technology (INAAT)

-

Instruments

-

Reagents

-

Services

-

-

Chips and Microarrays

-

Instruments

-

Reagents

-

Services

-

-

Mass Spectrometry

-

Instruments

-

Reagents

-

Services

-

-

Transcription Mediated Amplification

-

Instruments

-

Reagents

-

Services

-

-

Others

-

Instruments

-

Reagents

-

Services

-

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Respiratory Diseases

-

Tuberculosis

-

Meningitis

-

Gastrointestinal Tract Infections

-

HPV

-

Sexually Transmitted Infections

-

Sepsis

-

Drug Resistance Diseases

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Clinics

-

Diagnostics Laboratories

-

Research Institutes

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global infectious disease molecular diagnostics market size was estimated at USD 16.24 billion in 2024 and is expected to reach USD 17.08 billion in 2025.

b. The global infectious disease molecular diagnostics market is expected to grow at a compound annual growth rate of 3.37% from 2025 to 2030 to reach USD 20.15 billion by 2030.

b. North America dominated the infectious disease molecular diagnostics market with a share of 40.95% in 2024. This is attributable to growing regulatory support and increasing investment in diagnostics.

b. Some key players operating in the infectious disease molecular diagnostics market include Abbott; Danaher Corporation; bioMérieux SA; F. Hoffmann-La Roche Ltd; Bio-Rad Laboratories, Inc.; Agilent Technologies, Inc.; Becton, Dickinson and Company; Hologic, Inc. (Gen-Probe); Illumina, Inc., Grifols S.A.; Qiagen; Siemens Healthineers AG; Sysmex Corporation

b. Key factors that are driving the market growth include the growing use of molecular diagnostics in infection detection, the rising geriatric population, and the increasing demand for point-of-care molecular diagnostics for the management of a growing number of infections.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."