- Home

- »

- Medical Devices

- »

-

Infection Control Market Size & Share, Industry Report, 2030GVR Report cover

![Infection Control Market Size, Share & Trends Report]()

Infection Control Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (Equipment, Services, Consumables), By End Use (Hospitals, Medical Device Companies, Clinical Laboratories, Pharmaceutical Companies, Others), By Region, And Segment Forecasts

- Report ID: GVR-1-68038-822-0

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Infection Control Market Summary

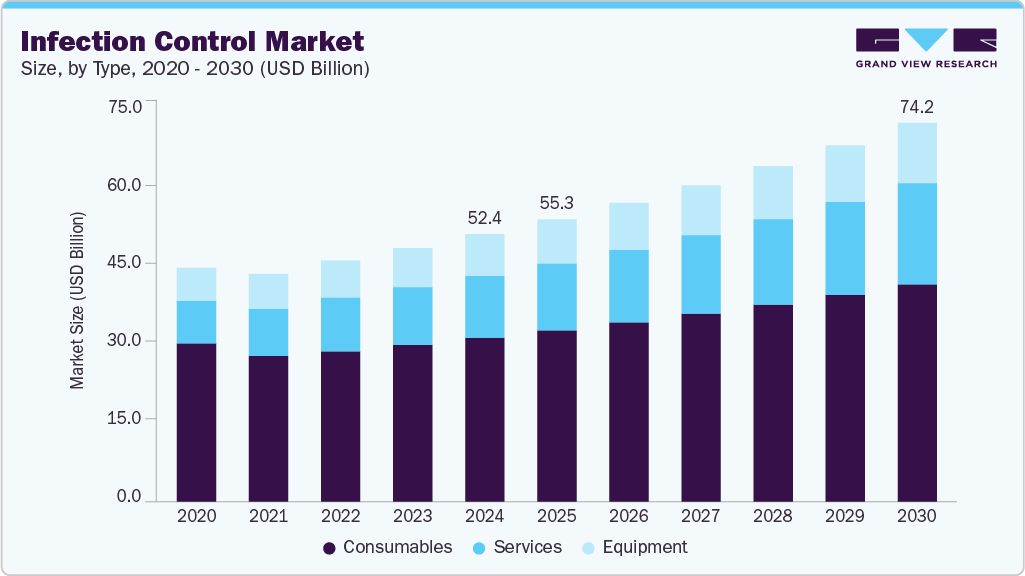

The global infection control market size was estimated at USD 52.38 billion in 2024, and is projected to reach USD 74.21 billion by 2030, growing at a CAGR of 6.1% from 2025 to 2030. The market is primarily driven by an increasing number of surgical & clinical procedures that require infection prevention.

Key Market Trends & Insights

- North America dominated the infection control market and accounted for the largest revenue share of 48.3% in 2024.

- The infection control market in the U.S. accounted for the major revenue share of the regional market in 2024.

- By type, the consumables segment dominated the market for infection control and accounted for the largest revenue share in 2024.

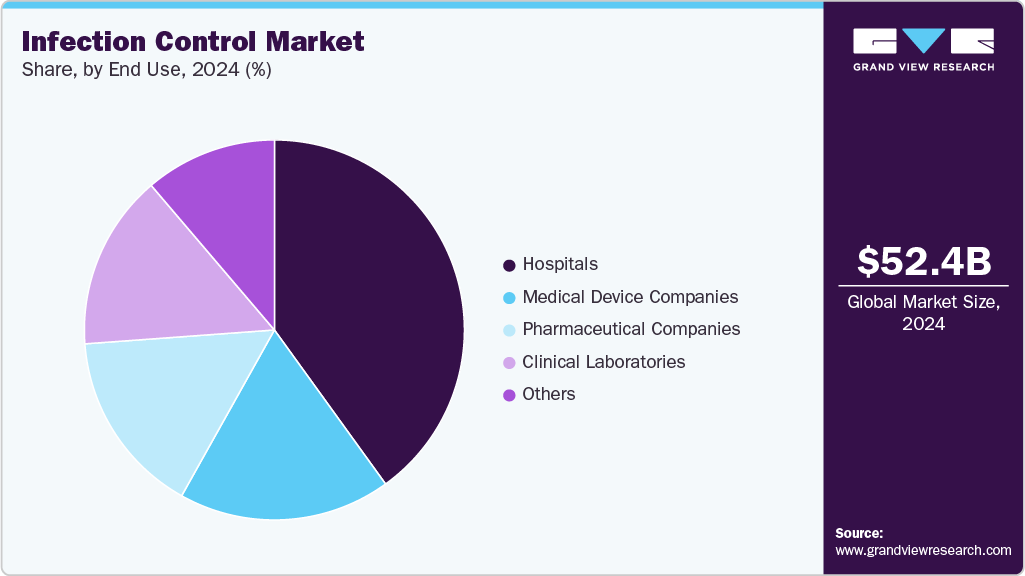

- By end use, the hospital segment is accounted for the largest revenue share in 2024 and is also expected to grow at the fastest CAGR over the forecast period from 2025 to 2030.

Market Size & Forecast

- 2024 Market Size: USD 52.38 Billion

- 2030 Projected Market Size: USD 74.21 Billion

- CAGR (2025-2030): 6.1%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Technological advancements in infection control have significantly enhanced the ability of healthcare providers to prevent and manage infections. Innovations such as automated disinfection systems, UV light technology, antimicrobial surface coatings, and advanced air filtration systems have demonstrated efficacy in reducing HAIs by up to 30% and is expected to contribute to the market growth. An increase in outsourcing sterilization services and the introduction of advanced sterilizing solutions are further contributing to the growth of the market for infection control. One of the important growth drivers is the increasing number of government initiatives to ensure highly intensive infection prevention. Government organizations are increasingly involved in issuing guidelines to promote awareness and efficient prevention measures globally, which is expected to contribute to market growth throughout the forecast period. For instance, the World Health Organization (WHO) has issued guidelines for preventing and controlling pandemic- and epidemic-prone acute respiratory diseases in healthcare. The guidelines range from standard precautions such as hand hygiene and usage of personal protective equipment to guidelines for disinfection and sterilization.

According to the article published by the National Library of Medicine in May 2024, Acute respiratory infections (ARIs) are a major global health burden, leading to around 4.25 million deaths annually. These infections lead to millions of outpatient visits each year, particularly affecting high-risk groups such as the elderly, young children, and individuals with chronic conditions such as asthma or heart disease.

Diseases such as pneumonia and infections such as bloodstream, urinary tract, surgical site, and MRSA constitute most hospital-acquired infections. Other major healthcare-associated infections (HAIs) include catheter-associated urinary tract infections, ventilator-associated pneumonia, and catheter-related bloodstream. One of the utmost concerns for the market is HAIs, which affect patient recovery; thereby, mortality rates are being significantly impacted globally. According to an article by NIH in April 2023, HAIs are the most common adverse effects in hospitals, leading to serious health risks, increased morbidity and mortality, and higher costs for patients, families, and healthcare systems. HAIs affect about 3.2% of hospitalized patients in the U.S. and 6.5% in the EU, with global prevalence expected to be even higher. This facilitates the need for effective infection prevention and control solutions.

According to a practical guide published by the WHO on preventing hospital-acquired infections, the increase in hospitalization duration with surgical infections was approximately eight days. These prolonged stays are predicted to significantly contribute to the overall costs incurred during the hospitalization period, thus, raising the clinical urgency for adopting infection prevention measures. It is presumed that prolonged hospital stay is also not economical for the hospitals and healthcare payers due to excessive usage of resources to treat the acquired infection. These additional costs are majorly generated through increased usage of drugs, additional diagnostic studies, and laboratory equipment, creating a resource allocation imbalance.

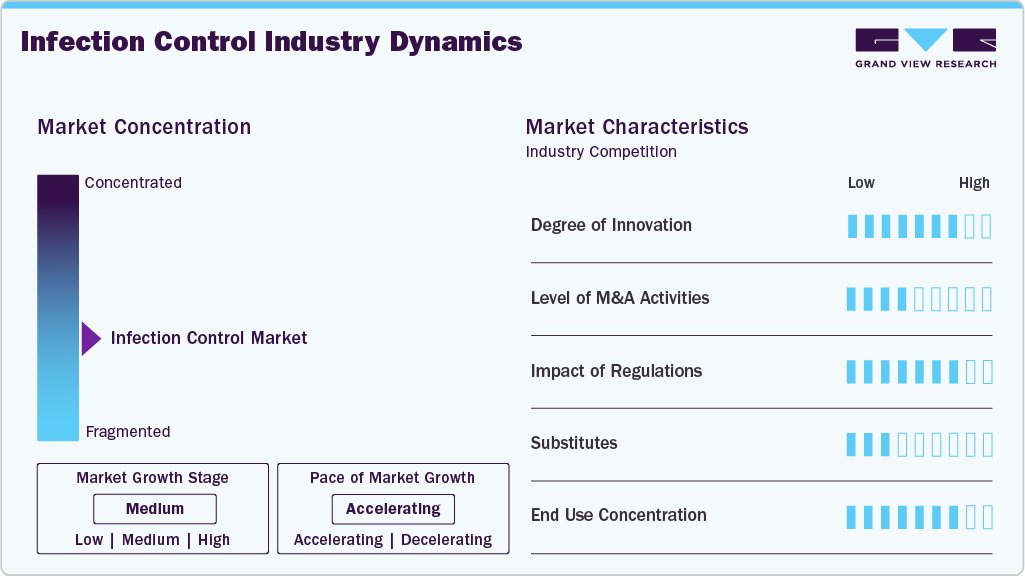

Market Concentration & Characteristics

The market growth stage is high, and the market growth is accelerating. The industry is experiencing high innovation as the market players develop advanced innovations in infection control equipment essential for addressing growing challenges in healthcare environments. For instance, automated disinfection robots thoroughly clean high-touch areas within healthcare facilities. For instance, in March 2024, Seal Shield, a healthcare technology company, showcased Shyld AI at the HIMSS 2024 conference in Orlando, Florida.

The market is characterized by a moderate level of mergers and acquisitions (M&A). M&A is driven by factors such as expanding product portfolios and gaining market share. For instance, in August 2023, STERIS plc. acquired BD’s laparoscopic instrumentation, surgical instrumentation, and sterilization container assets. This acquisition is expected to strengthen, expand, and complement STERIS’s product offerings within the healthcare segment.

The impact of regulations is high on industry. Organizations such as the CDC, WHO, and local health authorities often develop these regulations. Each organization has different requirements, leading to inconsistencies in practice. For instance, the CDC outlines specific precautions for different types of infections, which may not always align with local regulations or practices, complicating adherence in healthcare facilities.

Type Insights

The consumables segment dominated the market for infection control and accounted for the largest revenue share in 2024. The dominant share captured by consumables is predicted to be a consequence of consistent usage and the short life cycle of these products. Consumables are being extensively incorporated in disinfection, sterilization, and other control procedures and are indispensable parts of the procedures mentioned above, accounting for a larger share.

Increasing hospital admission rate is expected to boost the demand for infection control as these patients contribute to the increasing medical waste, boosting the market growth over the forecast period. For instance, in August 2024, CloroxPro launched new plant-based Clorox EcoClean disinfecting wipes. Such innovations foster the development of environment-friendly products and solutions for waste disposal, fueling market growth.

The services segment is expected to grow at the fastest CAGR of 8.6% during the forecast period. This rapid growth is attributed to the high inclination of market players to reduce overall healthcare expenditure and the utilization of benefits involved. It primarily includes cost advantages, increased efficiency of services, enhanced productivity, and a significantly higher focus on the core areas of development, which are critical to a company’s overall profit and growth. The organizations also strive to promote the adoption through issuing guidelines and recommendations for selection, risk assessment, rational usage, removal, and considerations to reduce the risk of transmission of respiratory pathogens to healthcare workers and other medical staff within a healthcare facility. Furthermore, services are segmented into contract sterilization and infectious waste disposal. The contract sterilization segment is again classified into ethylene oxide sterilization, e-beam sterilization, gamma sterilization, and others.

End Use Insights

The hospital segment dominated the market for infection control. It accounted for the largest revenue share in 2024 and is also expected to grow at the fastest CAGR over the forecast period from 2025 to 2030. The considerable share is mainly a result of the high probability of getting infected on hospital premises by transmitting blood-borne or respiratory pathogens. Hospital-acquired infections require rigorous control as it is one of the major challenges faced by the market. This has urged public health organizations and hospitals to adopt highly effective control systems. Also, as per research published in NCBI, 40% to 60% of hospital infections were estimated to be at surgical sites.

One of the major concerns is the high probability of infection from pathogens such as drug-resistance, blood-borne, and others in the operating room, because of which the need of the market is growing. For instance, frequent usage of urinary catheters poses a high probability of UTIs and may result in catheter-associated (CA)-UTIs. According to data published by the National Center for Biotechnology Information (NCBI), Urinary tract infections (UTIs) are among the most common bacterial infections in women, making up about 25% of all infections. More than half of all women around 50-60% are likely to experience a UTI in their lives. This high prevalence highlights a strong demand for effective treatments and prevention solutions for such infections. These factors are expected to widen the future growth prospects of the market.

The medical devices companies’ segment is expected to witness significant growth over the forecast period. Companies such as Medtronic, manufacture a range of single-use medical devices designed to reduce the risk of cross-contamination between patients. These products are typically packaged with sterile barriers and undergo terminal sterilization before being delivered to healthcare facilities.

Regional Insights

North America dominated the infection control market and accounted for the largest revenue share of 48.3% in 2024. This is owing to the increasing incidence of hospital-and laboratory-acquired infections. In addition, technological advancements and the local presence of prominent players adopting expansion strategies, such as investment and R&D in infection control equipment, acquisitions, expansions, and new product launches, are expected to fuel the market. Moreover, increasing government support through initiatives and policies encourages end users to adopt advanced and compliant infection control equipment and services.

U.S. Infection Control Market Trends

The infection control market in the U.S. accounted for the major revenue share of the regional market in 2024. The U.S. infection control industry is growing due to the high costs and health risks of infections acquired in healthcare settings, known as HAIs, and the rising problem of antibiotic-resistant germs. The government supports infection prevention through strong policies, guidelines, and funding to encourage the use of proven infection control products and practices. The U.S. market is also expected to grow due to increasing incidence of laboratory-acquired infections and the growing availability of technologically advanced control devices. Elsevier Ltd.’s study, “Laboratory-acquired infections and pathogen escapes worldwide between 2000 and 2021: a scoping review,” published in December 2023, highlighted that 309 individuals were affected by laboratory-acquired infections from 2000 to 2021. Of the total infections, around 78.6% of individuals were from North America

Europe Infection Control Market Trends

Europe infection control market held a substantial share in 2024. According to a report by the European Centre for Disease Prevention and Control (ECDC) in May 2024, each year, approximately 4.3 million patients in hospitals across the EU/EEA acquire at least one healthcare-associated infection (HAI), highlighting a significant challenge to patient safety.

Germany infection control market dominated the Europe market with the largest revenue share in 2024, due to the growing incidence of HAIs owing to the rising number of surgeries & hospital admissions in Germany. According to an article published by the Robert Koch Institute (RKI) in February 2024, an estimated 400,000 to 600,000 patients experience HAI annually, resulting in approximately 10,000 to 20,000 fatalities. Furthermore, increasing government support through programs and initiatives encourages healthcare end users to adopt infection control equipment and services.

Asia Pacific Infection Control Market Trends

Asia Pacific is expected to expand at the fastest CAGR of 7.4% over the forecast period from 2025 to 2030, owing to the growing number of outsourcing organizations, growing expenditure on healthcare, and evolving healthcare standards and infrastructure unprecedentedly across this region. Government organizations are focusing more on improving infection control standards, as it is also one of the important factors contributing to the growth of the Asia Pacific region.

China's infection control market held the largest share in 2024, owing to the increasing number of laboratory-acquired infections in the country, which is expected to improve the demand for technologically advanced infection control devices. Some of the notable players operating in the market are Shinva Medical Instrument Co., Ltd.; Galbino Technology Inc.; and Belimed. These players are investing in clinical trials and partnerships to develop technologically advanced products.

The India infection control market is expected to witness significant growth over the forecast period. This is attributed to factors such as inadequate hygiene standards and hospitals witnessing substantially increased patient volumes.

Key Infection Control Company Insights

The competition is marked by the extensive implementation of collaborative strategies by major companies such as Advanced Sterilization Products, STERIS, and 3M, which accounts for their dominant market share. These players are highly focused on adopting competitive strategies such as mergers and acquisitions, new product development initiatives, and geographical expansion.

-

STERIS Life Sciences offers a comprehensive range of infection control solutions, including sterilization equipment, disinfectants, and cleanroom products, designed to help pharmaceutical and biotechnology companies maintain sterile environments and comply with global regulatory standards.

-

Belimed provides a comprehensive range of infection control solutions, including washer-disinfectors, steam sterilizers, and ultrasonic washers, designed to ensure the safe and efficient reprocessing of medical instruments in healthcare facilities.

Key Infection Control Companies:

The following are the leading companies in the infection control market. These companies collectively hold the largest market share and dictate industry trends.

- 3M

- Belimed AG

- O&M Halyard or its affiliates.

- GETINGE AB (publ) Corporate

- ASP

- MATACHANA

- Sterigenics U.S., LLC - A Sotera Health company

- MMM Group

- Medivators Inc.

- STERIS.

- Midmark Corporation.

- W&H

Recent Developments

-

In July 2024, Midmark Corporation launched its next-generation M11 and M9 steam sterilizers, designed for enhanced durability and ease of use. These sterilizers feature integrated capabilities to improve instrument processing and compliance documentation efficiencies.

-

In January 2023, W&H Dentalwerk launched the Lexa Plus sterilizer, a pre-vacuum, Class B sterilizer designed for the North American market.

-

In March 2023, Getinge, a Swedish medical technology company, acquired Ultra Clean Systems Inc. to expand its ultrasonic cleaning technology portfolio for surgical instruments, especially for complex and robotic surgery tools.

Infection Control Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 55.32 billion

Revenue forecast in 2030

USD 74.21 billion

Growth rate

CAGR of 6.1% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Type, end use, region

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Thailand; Brazil; Argentina; South Africa; Saudi Arabia, UAE; Kuwait

Key companies profiled

3M; Belimed AG; O&M Halyard or its affiliates.; Getinge Group; ASP; MATACHANA; Sterigenics U.S., LLC - A Sotera Health company; MMM Group; Cantel Medical Corp.; STERIS Corporation; Midmark Corporation.; Medivators Inc.; W&H

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

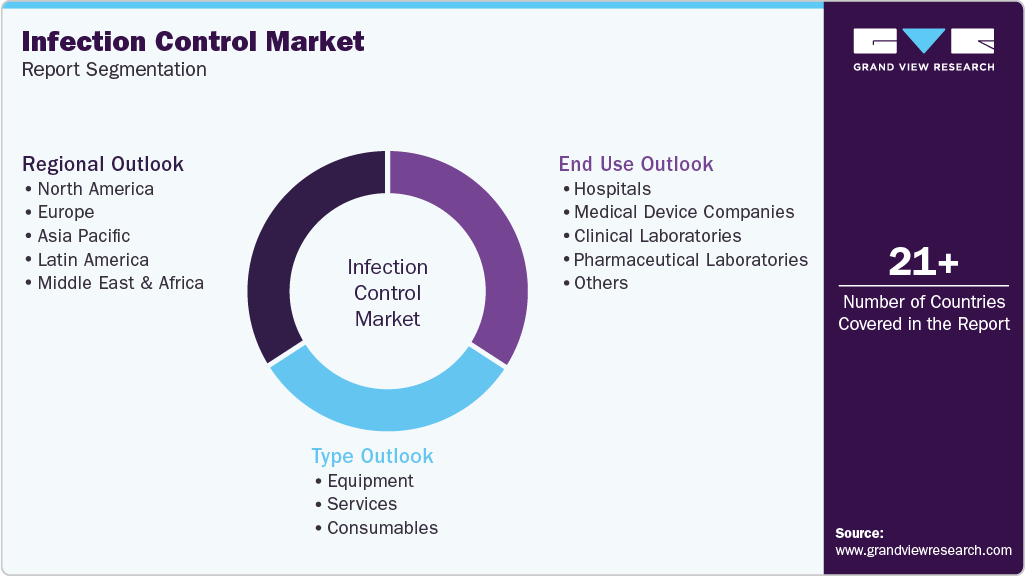

Global Infection Control Market Report Segmentation

This report forecasts revenue growth and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For the purpose of this report, Grand View Research has segmented the global infection control market on the basis of type, end use, and region:

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Equipment

-

Disinfectors

-

Washers

-

Flushes

-

Endoscope Reprocessors

-

-

Sterilization Equipment

-

Heat Sterilization Equipment

-

Low Temperature Sterilization Equipment

-

Radiation Sterilization Equipment

-

Filtration Sterilization Equipment

-

Liquid Sterilization Equipment

-

-

Others

-

-

Services

-

Contract Sterilization

-

Ethylene Oxide Sterilization

-

E-beam Sterilization

-

Gamma Sterilization

-

Others

-

-

Infectious Waste Disposal

-

-

Consumables

-

Infectious Waste Disposal

-

Disinfectants

-

Sterilization Consumables

-

Safety enhanced medical devices

-

Personal Protective Equipment

-

Others

-

-

-

End Use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Hospitals

-

Medical Device Companies

-

Clinical Laboratories

-

Pharmaceutical Laboratories

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.