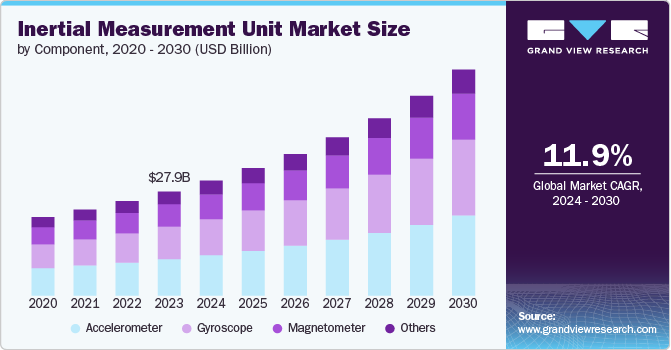

Inertial Measurement Unit Market Size, Share & Trends Analysis Report By Component (Accelerometer, Gyroscope), By Technology, By Application (Space Launch Vehicles, Missiles, Marine Vessels), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-404-6

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2017 - 2023

- Forecast Period: 2024 - 2030

- Industry: Semiconductors & Electronics

Inertial Measurement Unit Market Trends

The global inertial measurement unit market size was estimated at USD 27.99 billion in 2023 and is expected to grow at a CAGR of 11.9% from 2024 to 2030. An inertial measurement unit (IMU) is a device comprising multiple sensors that measure acceleration, angular velocity, and orientation. It finds applications across various industries, including aerospace, automotive, consumer electronics, and robotics. The IMU market is driven by the escalating demand for precise navigation, motion tracking, and stabilization systems.

Advancements in sensor technology, miniaturization, and reduced power consumption are propelling market growth. However, factors such as high costs associated with high-precision IMUs and potential inaccuracies due to external disturbances pose challenges. The increasing adoption of autonomous vehicles, drones, and wearable devices is driving demand for compact and low-cost IMUs. Moreover, stringent safety regulations in sectors like aviation and automotive necessitate the use of highly reliable IMUs. To capitalize on these trends, market players are focusing on developing advanced inertial measurement unit solutions with enhanced accuracy, reliability, and power efficiency.

The IMU market is subject to a complex regulatory landscape, varying across different industries and geographical regions. Aviation and defense sectors impose stringent quality, safety, and performance standards on IMUs. Automotive and consumer electronics industries have their own set of regulations related to data privacy, cybersecurity, and electromagnetic compatibility. Adherence to these regulations is crucial for market entry and product approval. Non-compliance can result in significant financial penalties and reputational damage.

The inertial measurement unit (IMU) market is primarily driven by the growing demand for precise navigation, motion tracking, and stabilization systems across various applications. The increasing adoption of autonomous vehicles, drones, and robotics is fueling market growth. Additionally, advancements in sensor technology and the development of low-cost IMUs are expanding the market potential. However, challenges such as the high cost of high-precision IMUs, potential inaccuracies due to external disturbances, and the need for robust data fusion algorithms hinder market growth.

The inertial measurement unit market presents significant opportunities for growth and innovation. The integration of IMUs with other sensors, such as GPS and cameras, can create new applications and enhance system performance. The development of low-power and compact IMUs will open up new market segments, particularly in the consumer electronics and wearable devices sectors. Moreover, the increasing focus on augmented reality and virtual reality technologies offers promising prospects for IMU adoption. By addressing the existing challenges and capitalizing on emerging trends, market players can achieve substantial growth in the inertial measurement unit market.

Component Insights

The accelerometer segment dominated the market in 2023 and accounted for a more than 35% share of global revenue. Accelerometers are essential for measuring linear acceleration in three-dimensional space, making them indispensable in smartphones, gaming consoles, automotive systems, and industrial equipment. Their widespread use in consumer electronics, where they enhance functionalities such as screen orientation, motion sensing, and fitness tracking, significantly contributes to their market dominance. Additionally, the integration of accelerometers in advanced driver-assistance systems (ADAS) and autonomous vehicles further boosts their demand.

The gyroscope segment is projected to expand at a faster CAGR during the forecast period 2024 to 2030. This growth is driven by the increasing adoption of gyroscopes in applications requiring precise rotational motion sensing, such as virtual reality headsets, drones, and robotics. The rise in demand for high-performance and reliable navigation and stabilization systems in aerospace and defense sectors also fuels the rapid expansion of the gyroscope segment. As technology advances and the need for accurate motion tracking continues to escalate, the gyroscope segment is poised to sustain its impressive growth trajectory.

Technology Insights

The mechanical gyro segment dominated the market in 2023 and is anticipated to register the fastest growth during the forecast period 2024 to 2030. Mechanical gyroscopes dominate the inertial measurement unit market due to their established reliability, durability, and extensive use in traditional navigation systems. These gyroscopes are critical components in aircraft, marine, and military applications where precise orientation and stabilization are paramount. Their robustness in harsh environments and long operational life make them the preferred choice for many high-stakes applications, ensuring their leading position in the market. Furthermore, mechanical gyroscopes are also the fastest-growing segment in the inertial measurement unit market, spurred by continuous advancements in miniaturization and performance enhancement.

The fiber optics gyro segment (FOG) is projected to witness significant growth from 2024 to 2030. The segment is experiencing significant growth due to its superior accuracy, reduced size, and immunity to electromagnetic interference. These attributes make FOGs particularly attractive for high-precision applications in aerospace, defense, and autonomous vehicles. The growth of the fiber optics gyro segment is bolstered by the increasing demand for advanced navigation systems that require higher performance and reliability. As technological innovations continue to evolve, the adoption of fiber optics gyros is expected to rise, highlighting their crucial role in the future landscape of the inertial measurement unit market.

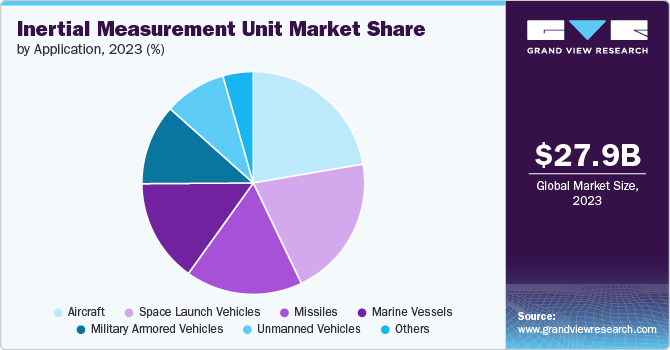

Application Insights

The aircraft segment dominated the market in 2023. The aircraft segment remains the dominant end-use sector in the inertial measurement unit (IMU) market, driven by the critical need for precise navigation, stabilization, and control systems in both commercial and military aviation. inertial measurement units are integral to flight control systems, autopilot functions, and navigation instruments, ensuring safe and efficient aircraft operations. The increasing production of commercial aircraft, alongside the rising investments in advanced fighter jets and unmanned aerial vehicles (UAVs), reinforces the dominant position of the aircraft segment.

The marine vessels segment is projected to grow at a faster CAGR during the forecast period 2024 to 2030. This surge is fueled by the growing demand for accurate navigation and stabilization systems in commercial shipping, naval defense, and recreational boating. The advent of autonomous marine vessels and the increasing focus on maritime safety and efficiency drive the adoption of advanced IMUs in this segment. Additionally, the expansion of offshore oil and gas exploration activities necessitates robust and reliable navigation solutions, further propelling the growth of inertial measurement units in marine applications. As maritime industries continue to evolve, the marine vessels segment is expected to witness sustained growth, cementing its status as a rapidly expanding sector in the inertial measurement unit market.

Regional Insights

North America inertial measurement unit market dominated the market in 2023 and accounted for a 35.0% share of the global revenue. The region's leadership is driven by the U.S. and Canada, which have robust aerospace, defense, and automotive sectors. The extensive use of IMUs in aircraft, spacecraft, and military applications, supported by substantial defense budgets, underscores this dominance. North America's focus on innovation and development in autonomous vehicles and advanced driver-assistance systems (ADAS) further propels the demand for IMUs. Additionally, the presence of major IMU manufacturers and extensive research and development activities contribute to the region's leading position. The growing adoption of IMUs in consumer electronics and industrial automation across North America highlights the diverse application range of these devices, reinforcing the region's dominance in the global market.

U.S. Inertial Measurement Unit Market Trends

The inertial measurement unit market in the U.S.is expected to grow at a significant CAGR from 2024 to 2030. The U.S. aerospace industry, with key players like Boeing, Lockheed Martin, and Northrop Grumman, demands advanced inertial measurement units for navigation and control in aircraft, satellites, and spacecraft. The country's large defense budget supports the development and procurement of high-precision IMUs for various military applications, including missile guidance and drones. Additionally, the U.S. automotive industry's focus on autonomous vehicles and ADAS boosts the demand for reliable IMUs. The presence of leading technology companies and strong emphasis on research and development contribute to the innovation and growth of the IMU market. The increasing use of IMUs in consumer electronics, healthcare devices, and industrial automation further enhances market expansion, positioning the U.S. as a key growth driver in the global IMU market.

Europe Inertial Measurement Unit Market Trends

Europe inertial measurement unit marketis expected to grow at a significant CAGR from 2024 to 2030. Countries like Germany, France, and the UK lead in these sectors, heavily investing in technologies that require precise navigation and stabilization solutions provided by IMUs. The European Union's emphasis on transportation safety, the development of autonomous vehicles, and the modernization of military capabilities fuels the demand for IMUs. Additionally, Europe's strong industrial automation sector, increasingly relying on advanced sensors, contributes to market growth. The presence of key IMU manufacturers and ongoing research and development activities further bolster the market. Europe’s commitment to space exploration, through initiatives by the European Space Agency (ESA), also drives demand for high-performance IMUs. As technological advancements continue and industries seek more precise navigation solutions, Europe is expected to maintain its significant growth trajectory in the IMU market.

The inertial measurement unit market in Germany is expected to grow at a significant CAGR from 2024 to 2030. Germany dominates the European IMU market due to its robust automotive, aerospace, and industrial sectors. The country is home to major automotive manufacturers like BMW, Daimler, and Volkswagen, which are at the forefront of developing autonomous driving technologies requiring advanced IMUs. Germany’s aerospace industry, supported by companies like Airbus, also heavily relies on IMUs for precise navigation and control in aircraft. Additionally, Germany’s strong focus on industrial automation and the use of advanced sensors in manufacturing processes contribute to its leadership in the IMU market. The country's commitment to innovation and technological advancements, along with substantial investments in research and development, further solidifies its dominant position in Europe. As Germany continues to lead in high-tech industries, its dominance in the European IMU market is expected to persist.

Asia Pacific Inertial Measurement Unit Market Trends

Asia Pacific inertial measurement unit marketis expected to grow with the fastest CAGR during the forecast period 2024 to 2030. The Asia Pacific region is the fastest-growing market for IMUs, driven by rapid industrialization and technological advancements in countries like China, Japan, and South Korea. These nations are leaders in consumer electronics manufacturing, automotive production, and aerospace development, all of which extensively utilize IMUs. The increasing adoption of autonomous vehicles, drones, and robotics in these countries significantly boosts the demand for high-precision IMUs. Additionally, rising defense budgets and the focus on modernizing military capabilities in the region further propel market growth. China, in particular, invests heavily in its aerospace and defense sectors, leading to substantial growth in the inertial measurement unit market. The presence of numerous IMU manufacturers and continuous investments in research and development contribute to the region’s rapid expansion. As these trends continue, Asia Pacific is set to maintain its position as the fastest-growing region in the global inertial measurement unit market.

The inertial measurement unit market in India is expected to grow at a significant CAGR from 2024 to 2030. The Indian government has been significantly increasing defense spending to enhance military capabilities and boost domestic production of defense equipment, including advanced navigation systems where IMUs are crucial. India’s ambitious space programs and the rise of indigenous satellite launches also drive the demand for IMUs. Additionally, the country's automotive industry, one of the largest globally, contributes significantly to the IMU market’s growth. The push towards electric vehicles and autonomous driving technologies requires advanced IMUs for navigation and stability. The increasing penetration of smartphones and other consumer electronics, which rely on IMUs, further fuels market growth. With continued investments in technology and infrastructure, India is set to lead the fastest growth trajectory in the Asia Pacific region's IMU market.

Key Inertial Measurement Unit Company Insights

The market is characterized by a dynamic interplay of established industry giants and emerging technology-driven companies. Key players in this market have been instrumental in driving technological advancements and expanding the application domains of IMUs. These companies possess strong research and development capabilities, coupled with extensive manufacturing and distribution networks.

However, the market is witnessing increased competition from new entrants, particularly those specializing in miniaturization and low-cost IMU solutions. This intensified rivalry is fostering innovation and driving prices downward, making IMU technology accessible to a broader range of applications. The overall competitive landscape is expected to evolve rapidly with the integration of advanced technologies such as artificial intelligence and machine learning, further reshaping the market dynamics.

Key Inertial Measurement Unit Companies:

The following are the leading companies in the inertial measurement unit market. These companies collectively hold the largest market share and dictate industry trends.

- Analog Devices, Inc.

- Bosch Sensortec GmbH

- Collins Aerospace

- Continental AG

- GEM elettronica

- Honeywell International Inc.

- Pepperl+Fuchs SE

- Safran Group

- SBG Systems

- STMicroelectronics NV

- TDK Corporation

- VectorNav

- Würth Elektronik eiSos GmbH & Co. KG.

Recent Developments

-

In May 2024, STMicroelectronics launched a new automotive-grade IMU, the ASM330LHBG1, designed for advanced driver assistance systems and navigation. This 6-axis sensor combines accelerometer and gyroscope data, offering high accuracy and reliability for safety-critical applications. The IMU includes on-chip processing capabilities and is compatible with ST's existing IMU products.

-

In November 2023, Honeywell unveiled the HGuide i400, a compact and rugged MEMS-based IMU designed for aerospace and defense applications. This high-precision device measures rotational and lateral motion, offering exceptional performance in a small package. With its wide compatibility and ease of integration, the HGuide i400 is poised to enhance navigation and guidance capabilities across various platforms.

Inertial Measurement Unit Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 30.92 billion |

|

Revenue forecast in 2030 |

USD 60.83 billion |

|

Growth rate |

CAGR of 11.9% from 2024 to 2030 |

|

Actual data |

2017 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in usd million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company market share, competitive landscape, growth factors, and trends |

|

Segments covered |

Component, technology, application, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; Japan; India; South Korea; Australia; Brazil; United Arab Emirates (UAE); Kingdom of Saudi Arabia (KSA); South Africa |

|

Key companies profiled |

Analog Devices, Inc.; Bosch Sensortec GmbH; Collins Aerospace; Continental AG; GEM elettronica; Honeywell International Inc.; Pepperl+Fuchs SE; Safran Group; SBG Systems; STMicroelectronics NV; TDK Corporation; VectorNav; Würth Elektronik eiSos GmbH & Co. KG |

|

Customization scope |

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional, and segment scope |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Inertial Measurement Unit Market Report Segmentation

The report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the inertial measurement unit market based on component, technology, application, and region.

-

Component Outlook (Revenue, USD Million, 2017 - 2030)

-

Accelerometer

-

Gyroscope

-

Magnetometer

-

Others

-

-

Technology Outlook (Revenue, USD Million, 2017 - 2030)

-

Mechanical Gyro

-

Ring Laser Gyro

-

Fiber Optics Gyro

-

Microelectromechanical Systems (MEMs)

-

Others

-

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Aircraft

-

Space Launch Vehicles

-

Missiles

-

Marine Vessels

-

Military Armored Vehicles

-

Unmanned Vehicles

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa (MEA)

-

United Arab Emirates (UAE)

-

Kingdom of Saudi Arabia (KSA)

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global inertial measurement unit market size was estimated at USD 27.99 billion in 2023 and is expected to reach USD 30.92 billion in 2024.

b. The global inertial measurement unit market is expected to grow at a compound annual growth rate of 11.9% from 2024 to 2030, reaching USD 60.83 billion by 2030.

b. North America dominated the inertial measurement unit market in 2023, accounting for a 35.0% share of global revenue. The region's leadership is driven by the U.S. and Canada, which have robust aerospace, defense, and automotive sectors. The extensive use of IMUs in aircraft, spacecraft, and military applications, supported by substantial defense budgets, underscores this dominance.

b. Some key players operating in the inertial measurement unit market include Analog Devices, Inc., Bosch Sensortec GmbH, Collins Aerospace, Continental AG, GEM elettronica, Honeywell International Inc., Pepperl+Fuchs SE, Safran Group, SBG Systems, STMicroelectronics NV, TDK Corporation, VectorNav, and Würth Elektronik eiSos GmbH & Co. KG.

b. The inertial measurement unit market is primarily driven by the growing demand for precise navigation, motion tracking, and stabilization systems across various applications. The increasing adoption of autonomous vehicles, drones, and robotics is fueling market growth. Additionally, advancements in sensor technology and the development of low-cost IMUs are expanding the market potential.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."