- Home

- »

- Communications Infrastructure

- »

-

Industrial Wireline Networking Market Size Report, 2030GVR Report cover

![Industrial Wireline Networking Market Size, Share & Trends Report]()

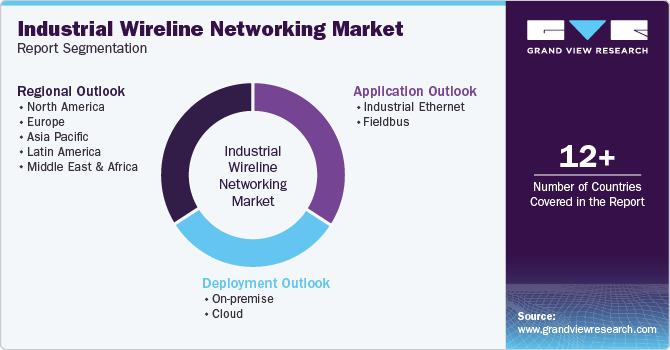

Industrial Wireline Networking Market Size, Share & Trends Analysis Report By Application (Industrial Ethernet, Fieldbus), By Deployment (On-premise, Cloud), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-419-0

- Number of Report Pages: 130

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

Industrial Wireline Networking Market Trends

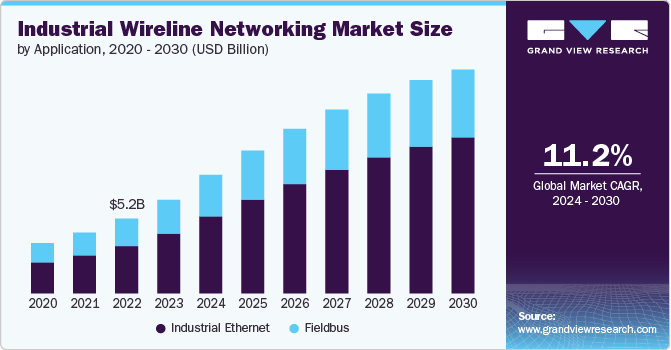

The global industrial wireline networking market size was estimated at USD 6.56 billion in 2023 and is projected to grow at a CAGR of 11.2% from 2024 to 2030. Industrial wireline networking refers to the use of wired communication technologies in industrial environments to facilitate the transfer of data and communication between various machines, devices, and control systems. The reliability, security, speeds, and low latency offered by industrial wireline networks are contributing to the market’s growth.

Industrial wireline networking offers reliability, speed, and security, which are crucial in industrial environments. Unlike wireless networks, wireline networks are less susceptible to interference, providing consistent and stable connectivity essential for real-time data transmission and process control. This reliability is particularly important in industries such as manufacturing, energy, utilities, and transportation, where downtime can lead to significant losses and safety risks. These benefits provided by industrial wireline networking are contributing to the market's growth.

The industrial wireline networking's ability to support high data rates and low latency makes it ideal for applications that demand precision and quick response times, such as robotics, automation, and machine-to-machine communication. The robust security features of wireline networking, including reduced risk of unauthorized access and easier implementation of physical security measures, also play a significant role in its adoption. As industries seek to protect sensitive operational data from cyber threats, the demand for industrial wireline networking is anticipated to grow.

Technological advancements are driving the market growth, with innovations such as Industrial Ethernet and advanced fieldbus systems leading the way. Industrial Ethernet protocols like EtherNet/IP and PROFINET are increasingly favored for their ability to support high-speed communication and integrate seamlessly with existing IT infrastructures. Furthermore, the integration of wireline networking with emerging technologies like the Industrial Internet of Things (IIoT) and edge computing further enhances its capabilities, enabling more efficient data collection, analysis, and decision-making at the network's edge.

However, despite the positive growth factors, the issue of network scalability and flexibility act as a restraint to the market's growth. Industrial wireline networks, while robust and reliable, often require extensive physical infrastructure that can be difficult to scale up and costly to deploy as industrial needs change. Unlike wireless networks, which can be easily adjusted and expanded, wireline networks necessitate substantial time, effort, and cost to modify, limiting their adaptability in dynamic industrial environments and posing a challenge to the market's growth.

Application Insights

Based on application, the industrial ethernet segment led the market with the largest revenue share of 64.1% in 2023. The segment’s growth is driven by its superior speed, reliability, and integration capabilities with modern automation systems. Industrial Ethernet’s adoption is propelled by the need for real-time data processing and seamless connectivity in complex industrial environments, supporting advanced applications such as smart manufacturing and IoT.

The fieldbus segment is expected to register at a significant CAGR from 2024 to 2030. The fieldbus segment maintains steady growth, primarily supported by its established use in legacy systems and specific applications requiring deterministic communication. While not as fast-growing as Industrial Ethernet, Fieldbus remains vital in industries that prioritize stability and established protocols over modernization.

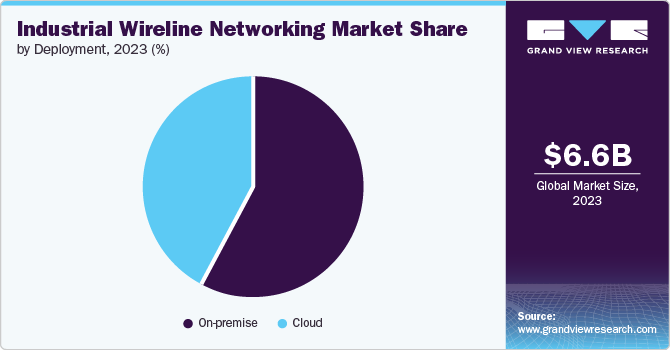

Deployment Insights

Based on deployment, the on-premise segment led the market with the largest revenue share of 57.7% in 2023. On-premise deployment continues to hold a significant share of the market, driven by industries requiring stringent data security and control over their networking infrastructure. While growth is slower compared to cloud solutions, on-premise remains crucial for operations that prioritize security and regulatory constraints.

The cloud segment is expected to register at the fastest CAGR from 2024 to 2030. The cloud deployment segment is growing rapidly due to its scalability, cost-efficiency, and ease of remote access. Industries are increasingly adopting cloud solutions to leverage real-time data analytics and improve operational efficiency, making it a key growth area within industrial wireline networking.

Regional Insights

The industrial wireline networking market in North Americais expected to grow at the fastest CAGR from 2024 to 2030. The North American market is experiencing strong growth, fueled by advanced industrial automation and significant investments in infrastructure upgrades. The region's focus on integrating cutting-edge technologies like IoT and AI in manufacturing processes is further driving the demand for reliable wireline Ethernet solutions.

U.S. Industrial Wireline Networking Market Trends

The industrial wireline networking market in U.S. is anticipated to register at a significant CAGR from 2024 to 2030. The market growth can be attributed to the robust adoption of industrial Ethernet driven by extensive R&D activities and a high concentration of technology-driven industries in the country. Furthermore, the push towards smart factories and digitalization across various sectors is harnessing the U.S. market's expansion.

Asia Pacific Industrial Wireline Networking Market Trends

Asia Pacific dominated the industrial wireline networking market with the revenue share of 30.2% in 2023. The market growth is driven by rapid industrialization and increasing investments in manufacturing and infrastructure. The adoption of advanced automation technologies and the region's focus on improving its manufacturing capabilities are some of the key growth drivers for the market.

Europe Industrial Wireline Networking Market Trends

The industrial wireline networking market in Europe is anticipated to grow at a significant CAGR from 2024 to 2030. Europe's market growth is propelled by the widespread adoption of Industry 4.0 initiatives and a strong emphasis on smart manufacturing. The region's commitment to enhancing production efficiency and sustainability through advanced networking solutions contributes significantly to market expansion.

Key Industrial Wireline Networking Company Insights

Key players operating in the global market include BCE Inc, Industrial Networking Solutions (INS), Hitachi Energy Ltd., Huawei Technologies Co., Ltd., L&T Technology Services Limited, VIAVI Solutions Inc., Amphenol Network Solutions, Intel Corporation, Siemens AG, and Broadcom. The market is highly competitive, with companies continually striving to achieve a competitive advantage through cutting-edge technological innovations and distinctive service offerings. Firms are focusing on the development of advanced, high-speed, and reliable networking solutions that cater to the unique demands of various industrial sectors.

Key Industrial Wireline Networking Companies:

The following are the leading companies in the industrial wireline networking market. These companies collectively hold the largest market share and dictate industry trends.

- BCE Inc.

- Industrial Networking Solutions (INS)

- Hitachi Energy Ltd.

- Huawei Technologies Co., Ltd.

- L&T Technology Services Limited

- VIAVI Solutions Inc.

- Amphenol Network Solutions

- Intel Corporation

- Siemens AG

- Broadcom

Recent Developments

-

In July 2023, Allied Telesis, a networking tools and connectivity solutions provider, announced the launch of its IE220 Series of industrial Ethernet switches with PoE++ for power intensive devices. These switches can withstand challenging environmental conditions such as wide ranging temperatures, electromagnetic noise, high humidity, and vibrations. Such innovations in the industrial Ethernet field are indirectly harnessing the industrial wireline networking market’s growth

Industrial Wireline Networking Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 8.33 billion

Revenue forecast in 2030

USD 15.73 billion

Growth rate

CAGR of 11.2% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 – 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments covered

Application, deployment, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; U.K.; France; China; India; Japan; South Korea; Australia; Brazil; Kingdom of Saudi Arabia (KSA); UAE; South Africa

Key companies profiled

BCE Inc; Industrial Networking Solutions (INS); Hitachi Energy Ltd.; Huawei Technologies Co., Ltd.; L&T Technology Services Limited; VIAVI Solutions Inc.; Amphenol Network Solutions; Intel Corporation; Siemens AG; Broadcom

Customization scope

Free report customization (equivalent to up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Industrial Wireline Networking Market Report Segmentation

The report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global industrial wireline networking market based on application, deployment, and region.

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Industrial Ethernet

-

Fieldbus

-

-

Deployment Outlook (Revenue, USD Million, 2018 - 2030)

-

On-premise

-

Cloud

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa (MEA)

-

UAE

-

Kingdom of Saudi Arabia (KSA)

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global industrial wireline networking market size was estimated at USD 6.56 billion in 2023 and is expected to reach USD 8.33 billion in 2024.

b. The global industrial wireline networking market is expected to grow at a compound annual growth rate of 11.2% from 2024 to 2030 to reach USD 15.73 billion by 2030.

b. Asia Pacific dominated the industrial wireline networking market with a share of 30.2% in 2023. The growth of the Asia Pacific industrial wireline market is driven by rapid industrialization and increasing investments in manufacturing and infrastructure.

b. Some key players operating in the industrial wireline networking market include BCE Inc., Industrial Networking Solutions (INS), Hitachi Energy Ltd., Huawei Technologies Co., Ltd., L&T Technology Services Limited, VIAVI Solutions Inc., Amphenol Network Solutions, Intel Corporation, Siemens AG, and Broadcom.

b. Key factors that are driving the market growth include proliferation of wireless technologies in industry operations and the rise in the growth of industrial IoT.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."