Industrial Wireless Sensor Network Market Size, Share & Trends Analysis Report By Component (Hardware, Software, Services), By Sensor Network, By Technology, By Application, By End Use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-2-68038-325-6

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

Market Size & Trends

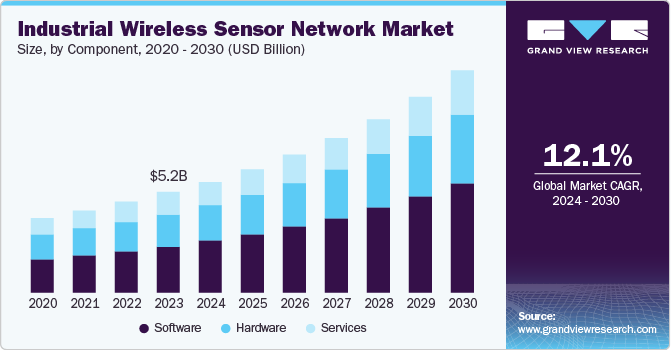

The global industrial wireless sensor network market size was valued at USD 5.19 billion in 2023 and is projected to grow at a CAGR of 12.1% from 2024 to 2030. The market is expanding significantly owing to the demand for predictive maintenance, advancements in wireless technology, and the rising adoption of modern technologies such as IoT, AI, and cloud networking. The increasing popularity of industrial wireless sensor networks among various industries such as healthcare, automation, manufacturing, and oil & gas is fueling market growth.

The expansion of industrial IoT (IIoT) and a push towards industry 4.0 and smart manufacturing are major growth drivers. Increasing regulatory requirements for safety and environmental standards and supportive government initiatives for smart manufacturing and industrial automation drive market growth. The increasing adoption of the industrial Internet of Things (IIoT) is a significant factor driving the growth of this market. IIoT leverages a network of interconnected sensors and devices to collect and analyze data across industrial environments. This trend is driven by the need for real-time monitoring, automation, and data-driven decision-making in industries such as manufacturing, oil and gas, and smart cities, transforming the industrial processes and fueling market growth. For instance, in April 2024, eInfochips announced the launch of the Aikri-64X-90XX series, specifically designed for industrial and commercial IoT applications to meet the evolving needs of industrial network solutions.

Advancements in wireless technologies are another factor fueling the growth of this industry. Introducing the latest wireless technology solutions, such as Wi-Fi 6, 5G networks, and other wireless solutions, has improved the reliability, performance, and security of ISWN solutions. For example, the rollout of the 5G network provides faster data transfer rates and greater connectivity, enabling real-time monitoring and effective control of industrial processes. In addition, developing wireless network standards & protocols such as ISA 100.11a and IEEE 802.15.4 that manage data transmission and ensure efficient communication within the network, expanding the IWSN market.

Furthermore, the growing demand for industrial automation and smart manufacturing is driving the adoption of IWSN. IWSN plays a critical role in enabling smart manufacturing by providing real-time data and insights, allowing industries to optimize their processes and improve productivity. Moreover, increasing government regulations and initiatives further drive the adoption of IWSN solutions. Governments worldwide are launching initiatives to promote industrial automation, smart manufacturing, and digitalization. For example, in April 2024, the National Science Foundation announced an additional investment of USD 7 million to expand advanced wireless testing capabilities and advance the Open Radio Access Network (O-RAN) ecosystem. The funding is expected to play a crucial role in developing and deploying next-generation wireless technologies in the region, addressing challenges, and supporting the development of a competitive market.

Component Insights

The software segment dominated the global industry and accounted for a revenue share of 46.9% in 2023. Software solutions include platforms and components that play a crucial core in data management and integration with industrial systems. Industrial wireless sensor networks generate vast amounts of data from various sensors deployed across industrial environments, driving demand for robust solutions for processing, interpreting, and leveraging data effectively. Furthermore, software solutions play a crucial role in enabling real-time monitoring, predictive maintenance, and automation in industrial settings, driving its adoption. In addition, advancements in technology such as AI, machine learning, and data analytics have fueled the demand for software solutions in IWSN, leading to growing adoption of the software segment.

The hardware segment is expected to hold a significant CAGR over the forecast period. The segment growth is driven by the increasing adoption of wireless sensors and devices across various industries. Rising innovation and rapid advancements in sensor technologies, becoming increasingly sophisticated and accurate, are essential to meeting the growing demand for precise and reliable monitoring in industrial environments. Furthermore, the expansion of IIoT and industrial automation necessitates demand for a wide range of advanced hardware components such as sensor nodes, gateways, and routers. Moreover, developing and integrating advanced technologies, including low-power sensors and 5G networks, further fuel the segment growth by enhancing data transmission capabilities and operation efficiency.

Sensor Network Insights

The flow sensor network segment dominated the market in 2023. Flow sensor networks measure the flow rate of liquids and gaseous media, which is critical in industrial processes. The rapidly widespread adoption of flow sensors in various industries, such as oil and gas, water and wastewater, and chemical processing, is driving the segment's growth. As industries increasingly adopt automation and seek real-time data for process control, there is a growing need for flow sensor networks to ensure accurate and reliable flow measurement. Furthermore, advancements in flow sensor technology, such as enhanced accuracy, improved data availability and integrity, and integration with wireless communication, have expanded the applications of flow sensor networks, fueling segment growth.

The gas sensor networks segment is anticipated to witness the fastest CAGR during the forecast period. The segment can be attributed to increasing concerns for workplace safety and environmental monitoring. These sensors help detect the concentrations of harmful gases released into environments during manufacturing processing. As industries face heightened scrutiny on environmental impact and workplace safety, the demand for reliable and accurate gas detection solutions is surging. Furthermore, stringent government regulations and standards for industrial safety and environmental protection are driving segment growth. For example, in December 2023, the Altivia chemical gas leakage in Texas, the U.S., and North Carolina gas leakage at a cosmetic factory led to a state of emergency.

Technology Insights

The WirelessHART segment accounted for the largest revenue in 2023. The segment growth is driven by its robust and reliable communication capabilities. WirelessHART is primarily used in process industries such as oil & gas, chemical and power generation, and others owing to its low power use, security feature, and highly reliable wireless communication solution designed to meet rigorous industrial demand. WirelessHART allows for simple planning, quick installation, and ease of deployment into plant infrastructure, making it an attractive choice for industrial applications. Moreover, its adherence to international standards and proven track record in improving operational efficiency and safety further translate into its leading position in the IWSN market. For example, in January 2023, the International Society of Automation announced it had approved the ANSI/ISA-100.11a-2011, "Wireless Systems for Industrial Automation: Process Control and Related Applications."

The cellular network segment is expected to emerge as the fastest-growing segment over the forecast period. The segment is mainly driven by the growing adoption of cellular technologies and the increasing use of gateway technology. Cellular networks offer significant advantages for industrial applications, including extensive coverage, low latency, and high bandwidth, making them ideal for IWSN applications where real-time data transmission is necessary. Furthermore, the rollout of 5G technology and the increasing adoption of Industry 4.0 are further fueling the growth of cellular networks. In addition, the growing use of IoT devices in IWSN further fuels the segment growth, as IoT devices require cellular connectivity to receive and transmit data.

Application Insights

The process monitoring segment dominated the market in 2023. The segment dominated the market owing to its several advantages, such as ensuring operational efficiency, safety, and quality across various industrial sectors. Process monitoring involves continuously observing and controlling industrial processes by deploying sensors that collect real-time data on variables such as temperature, pressure, flow, and chemical concentrations. Furthermore, its real-time monitoring of processes enables industries to quickly respond to changes, optimize operations, and improve productivity. Moreover, the increasing adoption of process monitoring in industries such as oil & gas and chemical processes, where safety and efficiency are paramount, has driven the segment's dominance.

The asset tracking segment is expected to experience the fastest CAGR over the forecast period. The segment growth is driven by its enhanced operational efficiency and reduced cost owing to advanced asset management. Industries are increasingly seeking ways to optimize their operations, real-time visibility, and utilization of assets. Wireless sensor networks such as asset tracking use technologies such as RFID, GPS, and IoT sensors, which provide up-to-date information on asset movement and status that help companies minimize losses and improve inventory management, fulfilling this demand. Furthermore, advancements in smart logistics and IoT integration further accelerate demand for asset-tracking solutions by providing seamless data collection and preventing unplanned downtime.

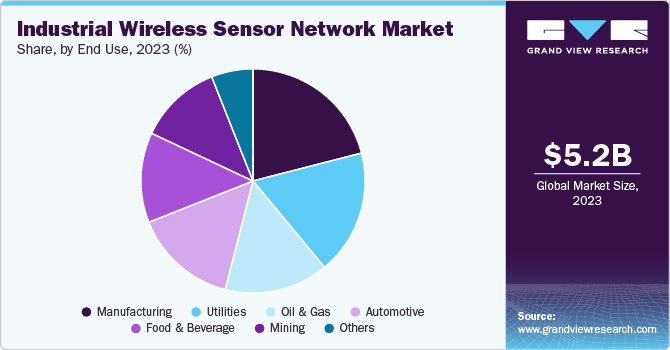

End Use Insights

The manufacturing segment dominated the industrial wireless sensor network market in 2023. The increasing adoption of automation and IoT technologies in production processes is a significant factor driving the growth of the segment. Manufacturers are increasingly leveraging IWSN’s solutions to optimize operations, improve productivity and reduce costs. Wireless sensors provide crucial data on variables such as temperature, pressure, and equipment performance, enabling precise adjustments and immediate responses to deviations. Furthermore, the integration of IWSNs supports predictive maintenance by continuously tracking equipment health and predicting failures before they occur, thereby minimizing costly disruptions.

The manufacturing segment dominated the industrial wireless sensor network market in 2023. The increasing adoption of automation and IoT technologies in production processes is a significant factor driving the segment's growth. Manufacturers increasingly leverage IWSN's solutions to optimize operations, improve productivity and reduce costs. Wireless sensors provide crucial data on variables such as temperature, pressure, and equipment performance, enabling precise adjustments and immediate responses to deviations. Furthermore, integrating IWSNs supports predictive maintenance by continuously tracking equipment health and predicting failures before they occur, thereby minimizing costly disruptions.

The utilities segment is anticipated to experience a significant CAGR during the forecast period. The growth of this segment is primarily driven by the increasing adoption of smart grid technologies and the need for efficient management of resources. The growing demand for efficient, reliable, and scalable solutions for managing essential infrastructure such as water, electricity, and gas drives the segment's growth. Wireless sensors play a crucial role in monitoring and optimizing utility operations by providing real-time insights on various parameters, including flow rates, pressure, energy consumption, and environmental conditions. This capability enhances the ability to detect issues early, manage resources more effectively, and reduce operational costs. Furthermore, the growing focus on renewable energy sources, energy efficiency, and reducing carbon emissions is expected to drive the segment's growth.

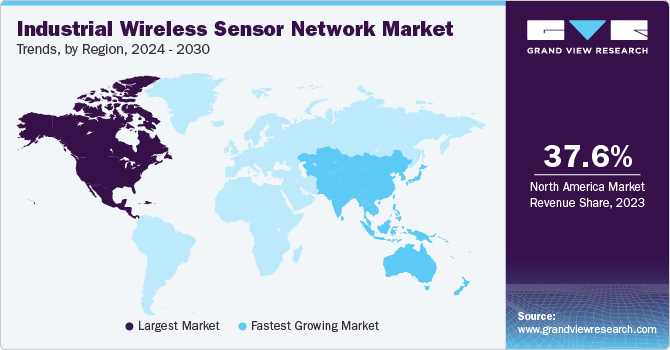

Regional Insights

North America dominated the global industrial wireless sensor network market and accounted for a revenue share of 37.6% in 2023. This market is significantly influenced by the increasing adoption of IIoT and the presence of major industrial automation organizations in the area. One of the key factors is the presence of numerous offshore oil and gas platforms in the Gulf of Mexico and the Arctic region, which heavily rely on wireless sensors for monitoring and automation. The region's advanced infrastructure, skilled workforce, and favorable business environment further support the growth of the IWSN market. In addition, the increasing adoption of 5G networks and the development of new wireless standards, such as Wi-Fi 6, further drive the growth of this market while enabling faster data transfer rates and greater connectivity.

U.S. Industrial Wireless Sensor Network Market Trends

The U.S. industrial wireless sensor network market dominated the market in 2023. Advanced infrastructure, a favorable business environment, and a robust presence of industrial automation companies are some of the key factors driving the region's dominance. Furthermore, the growing demand for predictive maintenance and asset monitoring in industries such as aerospace and defense is also fueling the region's growth in the IWSN market. Moreover, the U.S. government's support for digitalization initiatives such as the "Industry 4.0" and "Smart City Project" also promotes adopting the IWSN solution, further driving the region's growth.

Europe Industrial Wireless Sensor Network Market Trends

Europe industrial wireless sensor market held a significant share in 2023. Robust infrastructure, an increasing manufacturing sector, and the presence of industrial automation companies drive the region's growth. The increasing adoption of Industry 4.0 and IIoT technologies in European industries, such as manufacturing, oil and gas, and power generation, is fueling the region's growth. Furthermore, the strong presence of port systems in Europe, which rely heavily on wireless sensors for monitoring and automation, further accelerates the region's growth. For example, the Port of Rotterdam, one of Europe's largest and busiest ports, uses wireless sensors to monitor and optimize its operations, increasing efficiency and reducing costs.

The industrial wireless sensor network market in Germany is dominated the global industry in 2023. The projected growth of the market is expected to be driven by its strong automotive and manufacturing sector. Germany boasts a robust presence to some of the largest key players, such as Robert Bosch and Siemens, driving innovation in IWSN technology. Furthermore, the need for predictive maintenance and asset monitoring in the automotive sector further drives the industrial wireless sensor network market growth in Germany. In addition, companies like Volkswagen and BMW use wireless sensors to improve efficiency and productivity in their automotive and production lines.

Asia Pacific Industrial Wireless Sensor Network Market Trends

Asia Pacific industrial wireless sensor network market is anticipated to witness the fastest CAGR of 13.6% during the forecast period. Increasing industrialization, urbanization, growing investment in smart cities, and favorable government initiatives are some of the primary factors fueling the region's growth. The region's large manufacturing base, particularly in China and India, fuels the growth of this market as companies seek to improve efficiency and productivity. The increasing industrialization is a significant growth factor driving the region's growth as countries such as Singapore, South Korea, and Japan invest in Smart City Infrastructure, including industrial wireless sensor network solutions for energy management, transportation, and public safety. For Instance, government initiatives such as Japan's Society 5.0 aimed to transform Japan's way of life and address social challenges. In addition, the growing infrastructure development, increasing investment in smart grids, and favorable business environment support this market.

The industrial wireless sensor network market in China is dominated the global industry in 2023. Increasing industrialization, a robust manufacturing sector, and a growing adoption of Industry 4.0 and IIoT are key factors for the region's growth. Wireless sensors in smart manufacturing applications are becoming increasingly popular in China's electronics industry, with companies like Huawei and Xiaomi implementing IWSN solutions to improve efficiency and productivity. Furthermore, the robust presence of the oil & gas industry, such as shale gas estimated at around 1,115 trillion cubic feet, constituting around 40 percent share globally, driving the adoption of industrial wireless sensor network solutions such as flow sensor networks and gas sensor networks to seek real-time data and monitoring. Moreover, rising government initiatives to boost the region's manufacturing sector, such as "Made in China 2025".

Key Industrial Wireless Sensor Network Company Insights

Some key companies involved in the industrial wireless sensor network market include Cisco Systems, Inc., Huawei Technologies Co., Ltd., Advantech Co., Ltd., Honeywell International Inc., Analog Devices, Inc. and others. To address the growth in competition the major market participants are adopting strategies such as innovation, portfolio enhancements, collaborations & partnerships and more.

-

Advantech Co., Ltd., one of the prominent organizations in the industry that specializes in enabling businesses to adopt intelligent technologies seamlessly, offers a range of solutions, products, and services. The company provides wireless I/O devices, smart IoT sensing solutions, and other products.

-

Sensirion AG is an emerging key player in the sensors and sensor solutions industry that specializes in extraordinary designs and reliable offerings. The company's extensive product portfolio offers sensors associated with multiple elements, such as humidity, temperature, gas flow, mass flow, differential pressure, liquid flow, mass flow control, and more.

Key Industrial Wireless Sensor Network Companies:

The following are the leading companies in the industrial wireless sensor network market. These companies collectively hold the largest market share and dictate industry trends.

- Cisco Systems, Inc.

- Huawei Technologies Co., Ltd.

- Advantech Co., Ltd.

- Honeywell International Inc.

- Analog Devices, Inc.

- Texas Instruments Incorporated

- Intel Corporation

- ABB

- NXP Semiconductors

- Sensirion AG

Recent Developments

-

In April 2024, Advantech established a strategic collaboration with Qualcomm Technologies to revolutionize the edge computing landscape. The newly established collaboration focuses on developing an open and diverse edge AI ecosystem tailored to support Artificial Internet of Things (AIoT) applications. The partnership aims to address the challenges of deploying AI at the edge and is expected to benefit and be crucial for various industries, including industrial automation, transportation, robotics, and others.

-

In April 2024, NXP Semiconductors announced the expansion of its Edge portfolio by introducing the new Advanced Connected MCX W Wireless MCU series. Built on an FRDM development platform, the MCX W Wireless MCU series represents a significant advancement in microcontroller technology, addressing the growing demands for smarter, more connected, and more efficient solutions in industrial and IoT environments.

-

In February 2024, Advantech introduced the EVA-2000 series, a new line of smart wireless sensors incorporating LoRaWAN (Long Range Wide Area Network) technology for precision environmental monitoring. These sensors are designed to provide precise and reliable data for various environmental parameters, such as temperature, humidity, and air quality, where devices need to transmit small amounts of data over long distances with minimal power consumption.

Industrial Wireless Sensor Network Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 5.74 billion |

|

Revenue Forecast in 2030 |

USD 11.37 billion |

|

Growth rate |

CAGR of 12.1% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion, and CAGR from 2024 to 2030 |

|

Report Coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments Covered |

Component, sensor network, technology, application, end use, and region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, MEA |

|

Country scope |

U.S., Canada, Mexico, UK, Germany, France, Japan, China, India, Australia, South Korea, Brazil, South Africa, Saudi Arabia, UAE |

|

Key companies profiled |

Cisco Systems, Inc.; Huawei Technologies Co., Ltd.; Advantech Co., Ltd.; Honeywell International Inc.; Analog Devices, Inc.; Texas Instruments Incorporated; Intel Corporation; ABB; NXP Semiconductors; Sensirion AG |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Industrial Wireless Sensor Network Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global industrial wireless sensor network market report based on component, sensor network, technology, application, end use, and region:

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Hardware

-

Software

-

Services

-

-

Sensor Network Outlook (Revenue, USD Million, 2018 - 2030)

-

Temperature Sensor Networks

-

Pressure Sensor Networks

-

Level Sensor Networks

-

Flow Sensor Networks

-

Humidity Sensor Networks

-

Motion & Position Sensor Networks

-

Gas Sensor Networks

-

Light Sensor Networks

-

Chemical Sensor Networks

-

Others

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Bluetooth

-

ZigBee

-

Wi-Fi

-

Near Field Communication (NFC)

-

Cellular Network

-

WirelessHART

-

ISA 100.11a

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Machine Monitoring

-

Process Monitoring

-

Asset Tracking

-

Safety & Surveillance

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Automotive

-

Oil & Gas

-

Utilities

-

Mining

-

Food & Beverage

-

Manufacturing

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."