- Home

- »

- Water & Sludge Treatment

- »

-

Industrial Water Treatment Chemicals Market Size Report, 2030GVR Report cover

![Industrial Water Treatment Chemicals Market Size, Share & Trends Report]()

Industrial Water Treatment Chemicals Market Size, Share & Trends Analysis Report By Application (Cooling & Boilers, Water Desalination, Raw Water Treatment) By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-2-68038-684-4

- Number of Report Pages: 160

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Bulk Chemicals

Report Overview

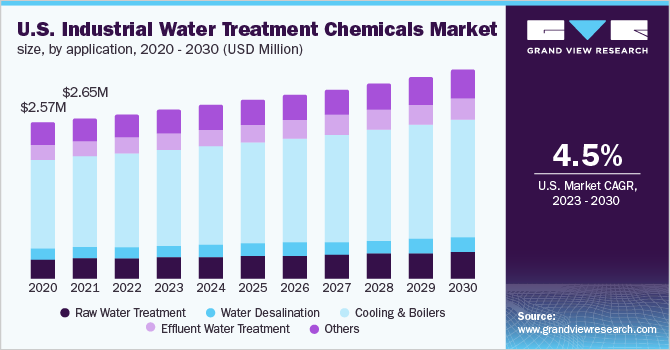

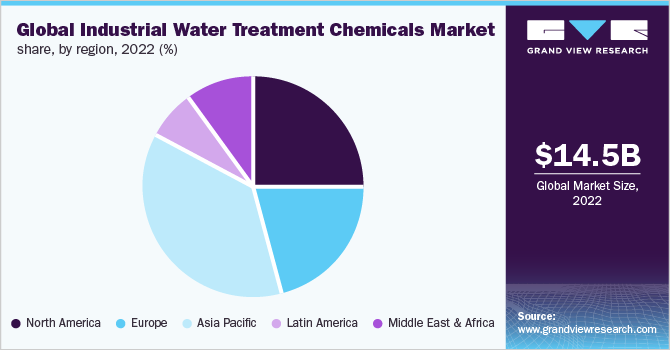

The global industrial water treatment chemicals market size was valued at USD 14.48 billion in 2022 and is anticipated to expand at a compound annual growth rate (CAGR) of 4.9% from 2023 to 2030. This is attributable due to the presence of a large number of water treatment industrial units and favorable regulatory support across key economies.

Rapid urbanization, rising economic development, and expanding industrial activity are the factors contributing to an ongoing increase in demand for water. To meet the constantly expanding demand and ensure customer safety, a variety of goods are used. Boiler treatment, wastewater effluent treatment, cooling treatment, and purification are the four fundamental procedures involved.

Due to the changing climate, shifting patterns of energy production, land use, and expanding population, there will likely be an increase in the need for the freshwater. Most of the freshwater usage in the nation is for irrigation, and cooling, along with industrial and municipal purposes, as well as for aquaculture and cattle.

As a result of the erratic rainfall and precipitation, Asia Pacific, Central & South America, and Africa have a low per capita supply of freshwater for human consumption. These areas represent developing markets for the biocides employed in the control of industrial effluent to preserve hygienic conditions and offer drinkable resources for the populations.

Another treatment technology rapidly gaining attention is desalination aimed at producing water that can be used for drinking as well as industrial use. A wide range of chemicals is being used in the desalination process which includes flocculants, coagulants, PH adjusters, deposit control agents, reducing chemicals, and biocides.

Water desalination techniques are attaining a strong significance due to the scarcity of freshwater. In desalination facilities, excess salts as well as other minerals are eradicated from the solution through membrane-based or thermal-based techniques, thus rendering it fit for industrial consumption. RO (reverse osmosis) and distillation are used for seawater desalination, while electrodialysis and RO are used to desalt brackish water.

Application Insights

Cooling & boilers applications dominated the market with the highest revenue share of 56.4% in 2022. This is attributed to their utilization in various industries including power plants, steel and metal, sugar and paper mills, and petrochemicals. Growth of the industrial, power, and manufacturing sectors is anticipated to augment the demand for boiler chemicals and systems in various emerging countries such as Brazil, China, Malaysia, India, and Indonesia during the forecast period.

The need for pretreated solutions is projected to rise because of the presence of heavy metals and suspended particles, particularly in important nations like the U.S., China, India, the UK, Germany, and Brazil. Future product consumption is anticipated to have more advantageous opportunities because of this.

A procedure called effluent treatment is used to securely dispose of or reuse industrial wastewater. During this procedure, deoiling polyelectrolytes, also known as DOPE, organic coagulants, flocculants, filtration aids, and dewatering aids are used to separate industrial wastewater in an effluent treatment facility. The requirement to limit freshwater use by industry is expected to significantly increase demand for wastewater treatment. In addition to reducing procurement costs, the procedure protects the environment from pollution and advances sustainable development.

Regional Insights

Asia Pacific dominated the market with the highest revenue share of 36.9% in 2022. This is attributed to the large industrial base presence and rising demand for water reuse. Due to legislative support from the government for private sector engagement in wastewater management and urban infrastructure in economies such as Thailand, Vietnam, the Philippines, and Indonesia, are leading water PPP development.

Europe has also anticipated strict laws intended to reduce residential water pollution, which is projected to surge demand for the treatment in the municipal and industrial sectors. Additionally, the rising domestic use of municipal facilities for water and wastewater treatment is likely to have a significant impact on the market in the near future.

Germany emerged as one of the largest consumers of these chemicals in the European region. In Germany, 90.0% of the process water is treated after use in line with the linked requirements and finally discharged into surface waters. For optimal water utilization, process wastewater recycling must be combined with water treatment. The amount of water used in industrial processes is six times greater than that used for domestic purposes in Germany.

The chemical industry together with industrial biotechnology is considered the leading industry for water use. The chemical industry is continuously offering innovative solutions for wastewater treatment used for both industrial and municipal processes through the development of new materials, process techniques, and chemicals. The industrial utilization in Germany during the next coming years will mainly focus on compliance with the requirements of the European Water Framework Directive.

Key Companies & Market Share Insights

The competition in the global industrial water treatment chemicals market is highly reliant on the quality of the product, the number of manufacturers & distributors, and their regional presence. In addition, the source of the products also plays an important role in the growth of the industry. As the current trends are more inclined towards bio-based alternatives over traditional synthetically produced water treatment, the manufacturers are increasingly focusing on various R&D activities regarding the production and application of such bio-based products across a variety of end-uses. This creates lucrative growth opportunities for the manufacturing companies operating in the market.

Forward integration is displayed by Suez S.A., Cortec Corporation, and Snf wherein the business activities of the companies are extended to include control of the direct supply as well as manufacturing, distribution, and application of the product in the market. Presence across different stages of the value chain has contributed to the profits of companies by decreasing the distribution cost and providing them with better control over the pricing of their products. New product launches in line with the current industry trends are also expected to have a positive impact on the market. For instance, in October 2021, Ecolab obtained Purolite, a separation and purification life science solution provider. Some of the prominent players in the global industrial water treatment chemicals market include:

-

BWA Water Additives.

-

The Dow Chemical Company

-

Cortec Corporation

-

Buck man Laboratories International Inc.

-

AkzoNobel N.V.

-

Solvay S.A.

-

Solenis LLC

-

Kemira Oyj

-

Snf Floerger

-

Suez S.A

-

Ecolab Incorporated

-

BASF SE

-

Clariant

Industrial Water Treatment Chemicals Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 15.04 billion

Revenue forecast in 2030

USD 21.23 billion

Growth Rate

CAGR of 4.9% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million, volume in Kilotons, CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; U.K.; Germany; France; Italy; Spain;, Belgium; Sweden; Austria; Finland; Poland; Turkey; China; India; Japan; South Korea; Singapore; Indonesia; Thailand; Vietnam; Australia; New Zealand; CIS; Rest of Asia Pacific; Brazil; Argentina; Chile; South Africa

Key companies profiled

BWA Water Additives; The Dow Chemical Company; Cortec Corporation; Buck man Laboratories International Inc.; AkzoNobel N.V.; Solvay S.A.; Solenis LLC; Kemira Oyj; Snf Floerger; Suez S.A.; Ecolab Incorporated; BASF SE

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Industrial Water Treatment Chemicals Market Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis on the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global industrial water treatment chemicals market report based on the application and region:

-

Application Outlook (Revenue, USD Million; Volume, Kilotons; 2018 - 2030)

-

Raw Water Treatment

-

Deoiling Polyelectrolytes (DOPE)

-

Organic Coagulants

-

Flocculants

-

Filtration Aids

-

Dewatering Aids

-

Others

-

-

Water Desalination

-

Biocides

-

Cleaning Agents

-

Carbonates

-

Sulfates

-

Metal Oxides

-

Silica

-

Chelating Agents incl. NaOH

-

Biofilms

-

Others

-

-

Antiscalants

-

Flocculants

-

Defoaming Agents

-

Others

-

-

Cooling & Boilers

-

Sludge Controllers

-

Antifoams

-

Antiscalants

-

Oxygen Scavengers

-

Others

-

-

Effluent Water Treatment

-

Deoiling Polyelectrolytes (DOPE)

-

Organic Coagulants

-

Flocculants

-

Filtration Aids

-

Dewatering Aids

-

Others

-

-

Others

-

-

Regional Outlook (Revenue, USD Million; Volume, Kilotons; 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Belgium

-

Sweden

-

Austria

-

Finland

-

Poland

-

Turkey

-

-

Asia Pacific

-

China

-

Japan

-

South Korea

-

India

-

Singapore

-

Indonesia

-

Thailand

-

Vietnam

-

Australia

-

New Zealand

-

CIS

-

Indonesia

-

Rest of Asia Pacific

-

-

Latin America

-

Brazil

-

Argentina

-

Chile

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global industrial water treatment chemicals market size was estimated at USD 14.48 billion in 2022 and is expected to reach USD 15.04 billion in 2023.

b. The global industrial water treatment chemicals market is expected to grow at a compound annual growth rate of 4.9% from 2023 to 2030 to reach USD 21.23 billion by 2030.

b. Asia Pacific dominated the industrial water treatment chemicals market with a share of 36.9% in 2022. This is attributed to large industrial base presence and rising demand for water reuse. Due to legislative support from government for private sector engagement in wastewater management and urban infrastructure in economies such as Thailand, Vietnam, the Philippines, and Indonesia, are leading water PPP development.

b. Some key players operating in the industrial water treatment chemicals market include BWA Water Additives, The Dow Chemical Company, Cortec Corporation, Buckman Laboratories International Inc., AkzoNobel N.V., Solvay S.A., Solenis LLC, Kemira Oyj, Snf Floerger, Suez S.A., Ecolab Incorporated, and BASF SE.

b. Key factors that are driving the market growth include presence of large number of water treatment industrial units, favorable regulatory support across key economies, rapid urbanization, rising economic development, and expanding industrial activity.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."