- Home

- »

- Nutraceuticals & Functional Foods

- »

-

Industrial Starch Market Size, Share & Growth Report, 2030GVR Report cover

![Industrial Starch Market Size, Share & Trends Report]()

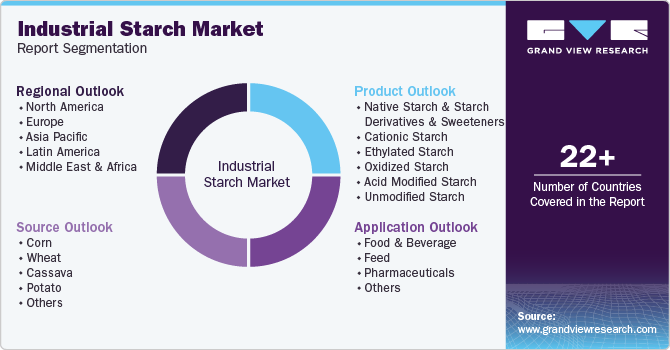

Industrial Starch Market (2025 - 2030) Size, Share & Trends Analysis Report By Application (Food & Beverage, Feed, Pharmaceuticals), By Source (Corn, Wheat, Cassava, Potato), By Product, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-511-1

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Industrial Starch Market Summary

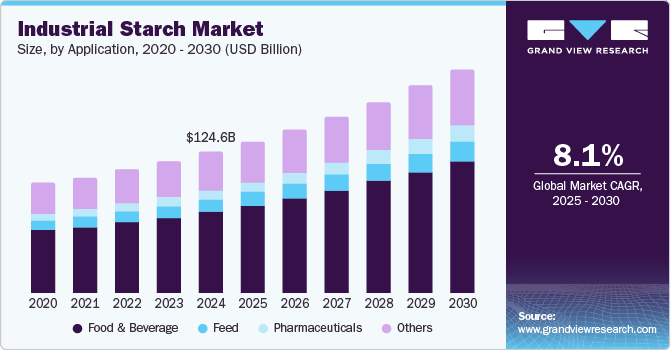

The global industrial starch market size was estimated at USD 124.6 billion in 2024 and is projected to reach USD 197.4 billion by 2030, growing at a CAGR of 8.1% from 2025 to 2030. The rising demand for convenience foods drives this growth and has significantly increased the need for starch as a gelling, stabilizing, and thickening agent in various processed food products.

Key Market Trends & Insights

- North America dominated the global industrial starch market with a revenue share of 48.6% in 2024.

- The U.S. held the largest revenue share of the North American industrial starch market in 2024.

- By application, the food & beverage segment accounted for the largest share of 57.7% in 2024.

- By source, the corn segment held the largest market share of the global industrial starch market in 2024.

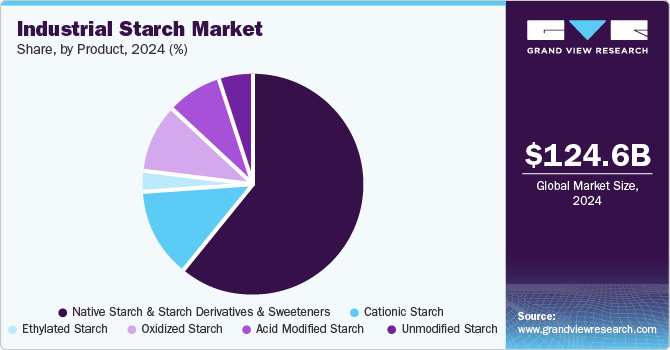

- By product, the native starch and starch derivatives & sweeteners segment dominated the global industrial starch market in 2024.

Market Size & Forecast

- 2024 Market Size: USD 124.6 Billion

- 2030 Projected Market Size: USD 197.4 Billion

- CAGR (2025-2030): 8.1%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

In addition, the expansion of the food industry, especially in developing countries, is contributing to the surge in starch demand. The growing awareness of sustainability and the shift towards eco-friendly packaging solutions, such as starch-based bioplastics, are also crucial.

Advancements in starch processing technologies are enhancing starch's efficiency and functionality, enabling its use in a broader range of applications. This technological progress is complemented by the diversification of starch's applications in industries such as paper, where it improves the strength and quality of paper products, textiles, where it is used in fabric finishing and sizing; and pharmaceuticals, where it serves as a binder and disintegrant in tablet formulations.

Application Insights

The food & beverage segment accounted for the largest share of 57.7% in 2024 due to the extensive use of starch as a thickening, stabilizing, and gelling agent in various processed food products. Starches are integral in the production of bakery items, snacks, beverages, and confectionery, where they enhance texture, mouthfeel, and shelf stability. The rising demand for convenience foods and the growing preference for clean-label products have further propelled the use of natural and recognizable ingredients such as starch. In addition, the development of gluten-free products has increased the demand for starch-based alternatives, making it a vital component in the food industry.

The pharmaceuticals segment is expected to grow at a CAGR of 9.1% from 2025 to 2030. Starch derivatives, such as dextrins and starch-based excipients, play a crucial role in drug formulation. These ingredients are used as binders, fillers, and disintegrants in the production of tablets and capsules. The increasing demand for pharmaceutical products, coupled with the need for cost-effective and efficient manufacturing processes, is driving the growth of the starch market in this segment. The versatility and functionality of starches make them valuable components in developing various medications.

Source Insights

The corn segment held the largest market share of the global industrial starch market in 2024 due to corn's high yield, versatile applications, and well-established supply chains. Corn starch is widely utilized in food products, pharmaceuticals, and industrial applications, making it a staple ingredient in many sectors. The increasing demand for processed foods and a rising preference for natural and plant-based ingredients has bolstered the corn segment's growth. Moreover, innovations in corn starch processing have improved its functionality and efficiency in various applications, further enhancing its market appeal.

The wheat segment is projected to grow steadily over the forecast period, fueled by the expanding use of wheat starch in the food industry, particularly in baking and confectionery applications, where it serves as a thickening agent and texture enhancer. Moreover, due to its biodegradable properties and performance characteristics, wheat starch is gaining traction in non-food sectors, such as paper and textiles. The increasing awareness of sustainability and the shift towards eco-friendly products could drive demand for wheat starch as manufacturers seek alternative materials that align with environmental goals.

Product Insights

The native starch and starch derivatives & sweeteners segment dominated the global industrial starch market in 2024. Native starch, extracted from sources such as corn, potato, and tapioca, is widely used in food processing, textile manufacturing, and paper production due to its natural thickening and stabilizing properties. Starch derivatives, such as maltodextrin, glucose syrups, and modified starches, expand the range of applications by offering enhanced functionality such as improved solubility and stability under various conditions.

These derivatives are crucial in producing sweeteners, which are extensively used in the food and beverage industry for their taste-modifying properties and in non-food sectors for fermentation processes and pharmaceuticals. The broad applicability and versatile nature of native starch and its derivatives ensure their significant share in the market.

The cationic starch segment is projected to grow at a CAGR of 8.0% over the forecast period. Cationic starches are primarily used in the paper industry to improve paper strength, retention, and drainage during the papermaking process. The positive charge of cationic starches allows them to bond more effectively with the negatively charged fibers, fillers, and other additives in paper pulp, enhancing the overall quality of the paper. In addition, the growing demand for high-quality packaging materials and the need for sustainable and recyclable packaging solutions are driving the adoption of cationic starches. The segment is also seeing increased use in the textile industry for warp sizing and in wastewater treatment as flocculants.

Regional Insights

North America dominated the global industrial starch market with a revenue share of 48.6% in 2024 due to the high demand for starch in various industries, such as food and beverages, paper, and pharmaceuticals. The robust agricultural sector in North America, particularly the extensive cultivation of corn and wheat, provides a steady supply of raw materials for starch production. In addition, advancements in starch processing technologies and the presence of major market players have further strengthened North America's position in the global market. The emphasis on sustainability and the development of bio-based products are also driving the demand for industrial starch in the region.

U.S. Industrial Starch Market Trends

The U.S. held the largest revenue share of the North American industrial starch market in 2024, driven by the extensive use of starch in various applications, including food processing, paper manufacturing, and textiles. The U.S. market benefits from a well-established infrastructure, strong agricultural output, and significant investments in research and development. The increasing demand for convenience foods and the growing awareness of eco-friendly packaging solutions are key factors contributing to the market's growth. In addition, the presence of major starch manufacturers and continuous innovation in starch products enhance the market's expansion in the U.S.

Europe Industrial Starch Market Trends

Europe accounted for a significant market share in the global industrial starch market in 2024 driven by the well-established food and beverage industry, which is one of the largest consumers of industrial starch. The region's stringent regulations on food quality and safety also drive the demand for high-quality, functional ingredients such as starches. Moreover, the presence of major starch manufacturers in countries such as Germany, France, and the Netherlands supports the robust market growth.

Asia Pacific Industrial Starch Market Trends

The industrial starch market in Asia Pacific is anticipated to grow the fastest over the forecast period. This rapid growth is attributed to the burgeoning food and beverage industry in countries such as China and India, where rising incomes and changing dietary habits are increasing the demand for processed foods. Furthermore, the expanding paper and packaging industries in the region are driving the need for starch as a key raw material. The presence of a large agricultural base also ensures a steady supply of raw materials for starch production.

Key Industrial Starch Company Insights

Some of the key companies in the Industrial Starch market include Cargill, Incorporated, Archer Daniels Midland Company, Ingredion Incorporated, Tate & Lyle PLC, AGRANA Beteiligungs-AG, and others.

-

Cargill Incorporated provides a wide range of starch products derived from corn, wheat, and tapioca, catering to various industries such as food and beverage, pharmaceuticals, and paper.

-

Tate & Lyle PLC offers a diverse range of starches and sweeteners. Its products are used in the food, beverage, pharmaceutical, and personal care industries.

Key Industrial Starch Companies:

The following are the leading companies in the industrial starch market. These companies collectively hold the largest market share and dictate industry trends.

- Cargill, Incorporated

- Archer Daniels Midland Company

- Ingredion Incorporated

- Tate & Lyle PLC

- AGRANA Beteiligungs-AG

- Grain Processing Corporation

- Roquette Frères

- Tereos Group

- Royal Cosun

- Altia Industrial

- Global Bio-chem Technology Group Company Limited

- General Starch Limited

- Eiamheng

- Coöperatie Koninklijke Avebe U.A.

- Galam Group

Recent Developments

-

In July 2024, Cryopak invested in its Atlanta facility, adding a high-volume, low-cost starch manufacturing department. This expansion enables Cryopak to offer starch as a new, sustainable insulation substrate alongside its existing PUR, paper, cotton, fiber, and EPS options. This innovative starch technology is the first to rival traditional materials such as EPS in terms of cost, performance, and scalability, while significantly improving sustainability.

-

In August 2024, Al Ghurair Foods initiated the construction of an advanced corn starch manufacturing plant within the Khalifa Economic Zones Abu Dhabi. This state-of-the-art facility marks a regional milestone and plays a crucial role in enhancing local food production capacities. It aligns strategically with the UAE's National Strategy for Food Security, emphasizing the importance of self-sufficiency in the agricultural sector and the development of sustainable food supply chains.

Industrial Starch Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 133.7 billion

Revenue forecast in 2030

USD 197.4 billion

Growth rate

CAGR of 8.1% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, volume in metric tons and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, source, product, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; Japan; India; Australia; Brazil; Argentina; Saudi Arabia

Key companies profiled

Cargill, Incorporated; Archer Daniels Midland Company; Ingredion Incorporated; Tate & Lyle PLC; AGRANA Beteiligungs-AG; Grain Processing Corporation; Roquette Frères; Tereos Group; Royal Cosun; Altia Industrial; Global Bio-chem Technology Group Company Limited; General Starch Limited; Eiamheng; Coöperatie Koninklijke Avebe U.A.; Galam Group

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Industrial Starch Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global industrial starch market report based on application, source, product, and region:

-

Application Outlook (Volume, Metric Tonnes; Revenue, USD Million, 2018 - 2030)

-

Food & Beverage

-

Feed

-

Bakery & Confectionery

-

Dairy & Frozen Desserts

-

Beverages

-

Convenience Foods

-

Others

-

-

Pharmaceuticals

-

Others

-

-

Source Outlook (Volume, Metric Tonnes; Revenue, USD Million, 2018 - 2030)

-

Corn

-

Wheat

-

Cassava

-

Potato

-

Others

-

-

Product Outlook (Volume, Metric Tonnes; Revenue, USD Million, 2018 - 2030)

-

Native Starch and Starch Derivatives & Sweeteners

-

Cationic Starch

-

Ethylated Starch

-

Oxidized Starch

-

Acid Modified Starch

-

Unmodified Starch

-

-

Regional Outlook (Volume, Metric Tonnes; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Denmark

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

Saudi Arabia

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.