Industrial Robotics Market Size, Share & Trends Analysis Report By Application (Handling, Welding & Soldering, Assembling & Disassembling, Processing), By End-use, By Region, And Segment Forecasts, 2025 - 2030

- Report ID: 978-1-68038-160-3

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

Industrial Robotics Market Size & Trends

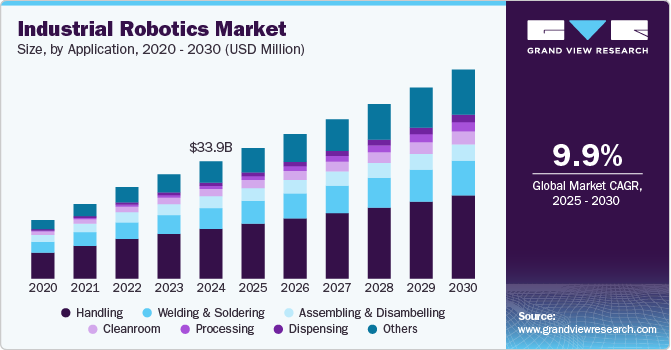

The global industrial robotics market size was estimated at USD 33,956.1 million in 2024 and is projected to grow at a CAGR of 9.9% from 2025 to 2030. The surge in e-commerce has accelerated the demand for industrial robotics, warehousing, and logistics. Robots are streamlining operations by automating processes such as sorting, picking, packing, and delivery. This trend is fueled by the need for efficiency and reduced lead times to meet consumer expectations for faster deliveries. Companies are also leveraging robotics to manage seasonal spikes in demand, particularly during holidays.

The integration of artificial intelligence (AI) further enhances robotic systems, optimizing supply chain operations through predictive analytics.

The RaaS model is gaining traction as businesses seek cost-effective automation solutions. This subscription-based approach allows companies to deploy robots without high upfront investments, making robotics accessible to a broader market. RaaS providers offer services such as installation, maintenance, and upgrades, ensuring operational efficiency. This model is particularly beneficial for industries with fluctuating demands, enabling scalability and flexibility. As more businesses embrace RaaS, the market is witnessing a shift towards operational expenditure (OPEX)-focused solutions.

The industrial robotics industry is playing a critical role in advancing sustainability objectives. Modern robotic systems are engineered for energy efficiency, significantly reducing the carbon footprint of manufacturing processes. By enabling precision-driven production, robotics minimize material waste and optimize resource usage. Furthermore, industries are increasingly integrating renewable energy solutions into power robotic systems, reinforcing their commitment to eco-friendly operations. Government policies and global regulatory frameworks are actively promoting sustainable automation practices, accelerating this shift. These efforts not only align with sustainability goals but also enhance brand image and address the evolving expectations of environmentally conscious consumers.

The industrial robotics industry is also undergoing a transformation through the integration of AI and machine learning. These technologies empower robots to execute complex functions such as visual inspections, predictive maintenance, and dynamic decision-making. AI-powered systems can process vast datasets in real-time, ensuring optimal functionality and reducing operational downtime. Machine learning further enhances the performance of industrial robots by enabling continuous improvement through experience, driving efficiency and effectiveness over time. This technological evolution is paving the way for tailored robotic solutions across sectors such as manufacturing, healthcare, and pharmaceuticals.

Collaborative robots (cobots) are reshaping the landscape of the industrial robotics industry. Designed to operate alongside human workers, cobots enhance productivity while prioritizing workplace safety. Their affordability and adaptability make them particularly appealing to small and medium-sized enterprises (SMEs), fostering wider adoption across diverse applications. Key industries such as automotive, electronics, and healthcare are leveraging cobots for high-precision tasks. Moreover, advancements in sensors and machine learning are enabling cobots to navigate complex environments and manage intricate workflows, further driving their integration within the industrial robotics industry.

Application Insights

The handling segment accounted for the largest market revenue share of over 42% in 2024. The demand for high-payload robots is rising as industries require automation for handling heavy materials and goods. These robots are particularly useful in sectors such as automotive, aerospace, and construction, where precision and safety are critical for heavy-duty tasks. High-payload robots improve efficiency by reducing the time and labor required to handle large or bulky items. They also enhance workplace safety by minimizing human involvement in potentially hazardous lifting and transportation operations. With advancements in robotics, these machines are becoming more versatile and capable of handling delicate tasks alongside heavy lifting.

The processing segment is predicted to foresee significant growth in the coming years. Industrial robots are increasingly adopted in the food and beverage sector to enhance processing efficiency and meet hygiene standards. Robots perform tasks such as slicing, mixing, and decorating with precision, ensuring consistency and quality. Automation reduces contamination risks by minimizing human contact and addressing stringent regulatory requirements. In addition, robots enable high-speed production lines, meeting the growing demand for ready-to-eat and packaged foods. This trend is driven by the need for agility and innovation in response to changing consumer preferences and global market expansion.

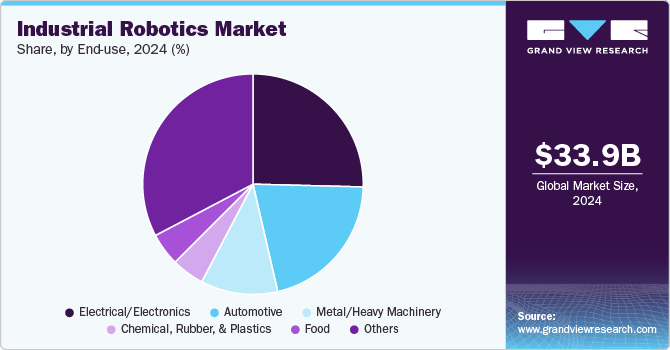

End-use Insights

The electrical/electronics segment held a significant share of the market in 2024. The electrical/electronics industry increasingly relies on industrial robots for precision-driven tasks such as soldering, assembly, and component handling. Robots are essential in manufacturing micro-sized components, where human intervention may lead to errors or inefficiencies. With the miniaturization of devices like smartphones, wearables, and IoT gadgets, the need for precise and consistent robotic assembly is paramount. Advanced robotics solutions equipped with vision systems ensure high-quality outcomes, reducing defects and rework. This trend is driven by manufacturers’ need to meet stringent quality standards while accelerating production timelines.

The headsets segment is predicted to foresee the highest growth in the coming years. The chemical, rubber, and plastics industries are leveraging industrial robots to handle hazardous materials and operate in high-risk environments. Robots are deployed for tasks such as mixing chemicals, handling toxic substances, and operating in extreme temperatures. This trend minimizes human exposure to dangerous conditions, improving workplace safety and compliance with stringent health regulations. Robotic systems ensure precision and consistency in processes, reducing the risk of accidents and product defects. By automating hazardous operations, companies are optimizing efficiency while prioritizing employee well-being.

Regional Insights

North America industrial robotics market has a significant revenue share of over 8% in 2024. North America is witnessing robust adoption of industrial robots, driven by the demand for advanced manufacturing solutions across industries such as automotive, aerospace, and logistics. Companies are leveraging robotics to enhance productivity, ensure precision, and address labor shortages in high-skill roles. Government initiatives supporting automation and Industry 4.0 technologies are further accelerating the deployment of robots in this region.

U.S. Industrial Robotics Market Trends

The U.S. Industrial Robotics market is expected to grow at a CAGR from 2025 to 2030. The U.S. is leading in the adoption of customizable robotics solutions integrated with artificial intelligence (AI) to meet diverse industry requirements. The growing demand for automation in logistics, healthcare, and e-commerce sectors is a key driver of this trend. In addition, the focus on reshoring manufacturing operations has amplified investments in robotics to enhance domestic production capabilities.

Europe Industrial Robotics Market Trends

The industrial robotics market in Europe is expected to witness significant growth over the forecast period. In Europe, the industrial robotics industry is witnessing significant growth due to the region’s emphasis on sustainability and green manufacturing. Collaborative robots (cobots) are widely adopted to improve efficiency while maintaining safety and flexibility in operations. In addition, stringent environmental regulations are pushing industries to utilize robotics for energy-efficient production and waste reduction.

Asia Pacific Industrial Robotics Market Trends

The industrial robotics market in the Asia Pacific region is anticipated to register the fastest CAGR over the forecast period. Asia Pacific dominates the industrial robotics industry due to rapid industrialization and significant investments in automation technologies, particularly in countries such as China, Japan, and South Korea. The region's strong manufacturing base, coupled with government programs promoting robotics, is fueling the market’s growth. Increasing demand for consumer electronics and automotive products is further driving the adoption of robotics in assembly and material handling.

Key Industrial Robotics Company Insights

Several leading companies in the market for industrial robotics, including ABB Ltd., Fanuc Corporation, Yaskawa Electric Corporation, KUKA AG, Mitsubishi Electric Corporation, and Denso Corporation, are actively pursuing strategies to expand their customer base and strengthen their competitive positioning. These strategies encompass partnerships, mergers and acquisitions, collaborations, and the development of innovative products and technologies. By adopting these initiatives, these companies aim to bolster their market presence and stay attuned to shifting consumer demands. These efforts emphasize fostering innovation and catering to the dynamic requirements of industries reliant on industrial robotics.

-

ABB Ltd. specializes in providing advanced automation and robotic solutions tailored to diverse industries such as automotive, electronics, and logistics. The company is recognized for its innovations in manufacturing robotics, including systems for assembly, welding, and material handling. ABB’s robots are integrated with cutting-edge AI and IoT technologies, enabling smarter, interconnected factory environments. Their focus on energy-efficient and sustainable robotics aligns with global manufacturing trends toward eco-friendly operations. ABB’s broad product portfolio and focus on digital solutions position it as a leader in industrial automation.

-

Logitech Fanuc Corporation is renowned for its expertise in CNC control systems and robotic automation, catering primarily to industries requiring precision. Its robotic solutions are widely used in machining, assembly, and high-speed pick-and-place operations. The company’s emphasis on reliability and long-lasting performance has made its robots a trusted choice in industrial settings. Fanuc also invests heavily in developing systems that combine robotics with AI for enhanced productivity. Its global presence and customer-focused approach ensure that it remains a preferred partner in industrial robotics.

Key Industrial Robotics Companies:

The following are the leading companies in the industrial robotics market. These companies collectively hold the largest market share and dictate industry trends.

- ABB Ltd.

- Yaskawa Electric Corporation

- Mitsubishi Electric Corporation

- Nachi-Fujikoshi Corp.

- Comau SpA

- KUKA AG

- Fanuc Corporation

- Denso Corporation

- Kawasaki Heavy Industries, Ltd.

- Omron Corporation

Recent Developments

-

In May 2024, Neura Robotics announced a strategic partnership with OMRON aimed at integrating AI-enhanced cognitive robots into manufacturing processes. This collaboration seeks to leverage advanced artificial intelligence to boost operational efficiency and enhance safety measures within factory environments. By combining their respective technologies, both companies aim to create smarter, more responsive robotic systems that can adapt to various production challenges. This initiative represents a significant step forward in the evolution of industrial automation.

-

In February 2024, Olis Robotics formed a partnership with Kawasaki Robotics to deliver integrated solutions that enhance production speed and minimize downtime costs for customers. This collaboration enables the deployment of Olis' remote error recovery technology on Kawasaki's robotic systems, allowing for faster troubleshooting and recovery from operational disruptions. The partnership is designed to significantly reduce downtime costs by up to 90%, providing users with rapid access to expert support. Together, they aim to streamline operations and improve overall productivity in industrial settings.

-

In June 2024, RoboDK entered into a partnership with KEBA Industrial Automation to merge the capabilities of their respective platforms, Kemro X and RoboDK. This collaboration is focused on providing users with the ability to test various real-world configurations of industrial robots, facilitating informed decision-making in automation processes. By integrating these platforms, customers will benefit from enhanced simulation and testing capabilities, ultimately leading to improved efficiency in robot deployment. This partnership underscores a commitment to advancing industrial automation through innovative technological solutions.

Industrial Robotics Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 37,821.3 million |

|

Revenue forecast in 2030 |

USD 60,562.0 million |

|

Growth rate |

CAGR of 9.9% from 2025 to 2030 |

|

Actual data |

2018 - 2023 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD billion/million and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Application, end-use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; Germany; UK; France; China; India; Japan; Australia; South Korea; Brazil; UAE; South Africa; KSA |

|

Key companies profiled |

ABB Ltd., Yaskawa Electric Corporation, Mitsubishi Electric Corporation, Nachi-Fujikoshi Corp., Comau SpA, KUKA AG, Fanuc Corporation, Denso Corporation, Kawasaki Heavy Industries, Ltd., and Omron Corporation. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts' working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Industrial Robotics Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global industrial robotics market report based on application, end use, and region.

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Handling

-

Assembling & Disassembling

-

Welding & Soldering

-

Cleanroom

-

Dispensing

-

Processing

-

Others

-

-

End Use Outlook (Volume, Thousand Units; Revenue, USD Million, 2018 - 2030)

-

Automotive

-

Electrical/Electronics

-

Metal/Heavy Machinery

-

Chemical, Rubber, & Plastics

-

Food

-

Others

-

-

Regional Outlook (Volume, Thousand Units; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

MEA

-

UAE

-

South Africa

-

KSA

-

-

Frequently Asked Questions About This Report

b. The global industrial robotics market size was estimated at USD 33,956.1 million in 2024 and is expected to reach USD 37,821.3 million in 2025.

b. The global industrial robotics market is expected to grow at a compound annual growth rate of 9.9% from 2025 to 2030 to reach USD 60,562.0 million by 2030.

b. The electrical application segment dominated the global industrial robotics market with a share of over 25% in 2024. This is attributed to the growing need to integrate advanced electronics in new cars.

b. Some of the key players in the global industrial robotics market include Adept Technology Inc.; Fanuc Robotics Company; Kuka AG; Mitsubishi Electric Corporation; Yamaha Motor Company; and Yaskawa Electric Corporation.

b. Key factors that are driving the market growth include increasing use for non-automotive applications, demand from emerging countries, and improved productivity and cost reduction benefits.

Table of Contents

Chapter 1. Methodology and Scope

1.1. Market Segmentation and Scope

1.2. Market Definitions

1.3. Research Methodology

1.3.1. Information Procurement

1.3.2. Information or Data Analysis

1.3.3. Market Formulation & Data Visualization

1.3.4. Data Validation & Publishing

1.4. Research Scope and Assumptions

1.4.1. List of Data Sources

Chapter 2. Executive Summary

2.1. Market Outlook

2.2. Segment Outlook

2.3. Competitive Insights

Chapter 3. Industrial Robotics Market Variables, Trends, & Scope

3.1. Market Introduction/Lineage Outlook

3.2. Industry Value Chain Analysis

3.3. Market Dynamics

3.3.1. Market Drivers Analysis

3.3.2. Market Restraints Analysis

3.3.3. Industry Opportunities

3.3.4. Industry Challenges

3.4. Industrial Robotics Market Analysis Tools

3.4.1. Porter’s Analysis

3.4.1.1. Bargaining power of the suppliers

3.4.1.2. Bargaining power of the buyers

3.4.1.3. Threats of substitution

3.4.1.4. Threats from new entrants

3.4.1.5. Competitive rivalry

3.4.2. PESTEL Analysis

3.4.2.1. Political landscape

3.4.2.2. Economic and Social landscape

3.4.2.3. Technological landscape

3.4.2.4. Environmental landscape

3.4.2.5. Legal landscape

Chapter 4. Industrial Robotics Market: Application Estimates & Trend Analysis

4.1. Segment Dashboard

4.2. Industrial Robotics Market: Application Movement Analysis, 2024 & 2030 (USD Million)

4.3. Handling

4.3.1. Handling Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million, Volume, Thousand Units; Revenue, USD Million, 2018 - 2030)

4.4. Welding & Soldering

4.4.1. Welding & Soldering Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

4.5. Cleanroom

4.5.1. Cleanroom Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

4.6. Dispensing

4.6.1. Dispensing Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

4.7. Processing

4.7.1. Processing Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

4.8. Others

4.8.1. Others Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

Chapter 5. Industrial Robotics Market: End Use Estimates & Trend Analysis

5.1. Segment Dashboard

5.2. Industrial Robotics Market: End Use Movement Analysis, USD Million, Volume, Thousand Units; Revenue, 2024 & 2030

5.3. Automotive

5.3.1. Automotive Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million, Volume, Thousand Units; Revenue)

5.4. Electrical/Electronics

5.4.1. Electrical/Electronics Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million, Volume, Thousand Units; Revenue)

5.5. Metal/Heavy Machinery

5.5.1. Metal/Heavy Machinery Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million, Volume, Thousand Units; Revenue)

5.6. Chemical, Rubber, & Plastics

5.6.1. Chemical, Rubber, & Plastics Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million, Volume, Thousand Units; Revenue)

5.7. Food

5.7.1. Food Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million, Volume, Thousand Units; Revenue)

5.8. Others

5.8.1. Others Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million, Volume, Thousand Units; Revenue)

Chapter 6. Industrial Robotics Market: Regional Estimates & Trend Analysis

6.1. Industrial Robotics Market Share, By Region, 2024 & 2030 (USD Million)

6.2. North America

6.2.1. North America Industrial Robotics Market Estimates and Forecasts, 2018 - 2030 (USD Million)

6.2.2. North America Industrial Robotics Market Estimates and Forecasts, by Application, 2018 - 2030 (USD Million)

6.2.3. North America Industrial Robotics Market Estimates and Forecasts, by End Use, 2018 - 2030 (USD Million, Volume, Thousand Units; Revenue)

6.2.4. U.S.

6.2.4.1. U.S. Industrial Robotics Market Estimates and Forecasts, 2018 - 2030 (USD Million)

6.2.4.2. U.S. Industrial Robotics Market Estimates and Forecasts, by Application, 2018 - 2030 (USD Million)

6.2.4.3. U.S. Industrial Robotics Market Estimates and Forecasts, by End Use, 2018 - 2030 (USD Million, Volume, Thousand Units; Revenue)

6.2.5. Canada

6.2.5.1. Canada Industrial Robotics Market Estimates and Forecasts, 2018 - 2030 (USD Million)

6.2.5.2. Canada Industrial Robotics Market Estimates and Forecasts, by Application, 2018 - 2030 (USD Million)

6.2.5.3. Canada Industrial Robotics Market Estimates and Forecasts, by End Use, 2018 - 2030 (USD Million, Volume, Thousand Units; Revenue)

6.2.6. Mexico

6.2.6.1. Mexico Industrial Robotics Market Estimates and Forecasts, 2018 - 2030 (USD Million)

6.2.6.2. Mexico Industrial Robotics Market Estimates and Forecasts, by Application, 2018 - 2030 (USD Million)

6.2.6.3. Mexico Industrial Robotics Market Estimates and Forecasts, by End Use, 2018 - 2030 (USD Million, Volume, Thousand Units; Revenue)

6.3. Europe

6.3.1. Europe Industrial Robotics Market Estimates and Forecasts, 2018 - 2030 (USD Million)

6.3.2. Europe Industrial Robotics Market Estimates and Forecasts, by Application, 2018 - 2030 (USD Million)

6.3.3. Europe Industrial Robotics Market Estimates and Forecasts, by End Use, 2018 - 2030 (USD Million, Volume, Thousand Units; Revenue)

6.3.4. UK

6.3.4.1. UK Industrial Robotics Market Estimates and Forecasts, 2018 - 2030 (USD Million)

6.3.4.2. UK Industrial Robotics Market Estimates and Forecasts, by Application, 2018 - 2030 (USD Million)

6.3.4.3. UK Industrial Robotics Market Estimates and Forecasts, by End Use, 2018 - 2030 (USD Million, Volume, Thousand Units; Revenue)

6.3.5. Germany

6.3.5.1. Germany Industrial Robotics Market Estimates and Forecasts, 2018 - 2030 (USD Million)

6.3.5.2. Germany Industrial Robotics Market Estimates and Forecasts, by Application, 2018 - 2030 (USD Million)

6.3.5.3. Germany Industrial Robotics Market Estimates and Forecasts, by End Use, 2018 - 2030 (USD Million, Volume, Thousand Units; Revenue)

6.3.6. France

6.3.6.1. France Industrial Robotics Market Estimates and Forecasts, 2018 - 2030 (USD Million)

6.3.6.2. France Industrial Robotics Market Estimates and Forecasts, by Application, 2018 - 2030 (USD Million)

6.3.6.3. France Industrial Robotics Market Estimates and Forecasts, by End Use, 2018 - 2030 (USD Million, Volume, Thousand Units; Revenue)

6.4. Asia Pacific

6.4.1. Asia Pacific Industrial Robotics Market Estimates and Forecasts, 2018 - 2030 (USD Million)

6.4.2. Asia Pacific Industrial Robotics Market Estimates and Forecasts, by Application, 2018 - 2030 (USD Million)

6.4.3. Asia Pacific Industrial Robotics Market Estimates and Forecasts, by End Use, 2018 - 2030 (USD Million, Volume, Thousand Units; Revenue)

6.4.4. China

6.4.4.1. China Industrial Robotics Market Estimates and Forecasts, 2018 - 2030 (USD Million)

6.4.4.2. China Industrial Robotics Market Estimates and Forecasts, by Application, 2018 - 2030 (USD Million)

6.4.4.3. China Industrial Robotics Market Estimates and Forecasts, by End Use, 2018 - 2030 (USD Million, Volume, Thousand Units; Revenue)

6.4.5. Japan

6.4.5.1. Japan Industrial Robotics Market Estimates and Forecasts, 2018 - 2030 (USD Million)

6.4.5.2. Japan Industrial Robotics Market Estimates and Forecasts, by Application, 2018 - 2030 (USD Million)

6.4.5.3. Japan Industrial Robotics Market Estimates and Forecasts, by End Use, 2018 - 2030 (USD Million, Volume, Thousand Units; Revenue)

6.4.6. India

6.4.6.1. India Industrial Robotics Market Estimates and Forecasts, 2018 - 2030 (USD Million)

6.4.6.2. India Industrial Robotics Market Estimates and Forecasts, by Application, 2018 - 2030 (USD Million)

6.4.6.3. India Industrial Robotics Market Estimates and Forecasts, by End Use, 2018 - 2030 (USD Million, Volume, Thousand Units; Revenue)

6.4.7. South Korea

6.4.7.1. South Korea Industrial Robotics Market Estimates and Forecasts, 2018 - 2030 (USD Million)

6.4.7.2. South Korea Industrial Robotics Market Estimates and Forecasts, by Application, 2018 - 2030 (USD Million)

6.4.7.3. South Korea Industrial Robotics Market Estimates and Forecasts, by End Use, 2018 - 2030 (USD Million, Volume, Thousand Units; Revenue)

6.4.8. Australia

6.4.8.1. Australia Industrial Robotics Market Estimates and Forecasts, 2018 - 2030 (USD Million)

6.4.8.2. Australia Industrial Robotics Market Estimates and Forecasts, by Application, 2018 - 2030 (USD Million)

6.4.8.3. Australia Industrial Robotics Market Estimates and Forecasts, by End Use, 2018 - 2030 (USD Million, Volume, Thousand Units; Revenue)

6.5. Latin America

6.5.1. Latin America Industrial Robotics Market Estimates and Forecasts, 2018 - 2030 (USD Million)

6.5.2. Latin America Industrial Robotics Market Estimates and Forecasts, by Application, 2018 - 2030 (USD Million)

6.5.3. Latin America Industrial Robotics Market Estimates and Forecasts, by End Use, 2018 - 2030 (USD Million, Volume, Thousand Units; Revenue)

6.5.4. Brazil

6.5.4.1. Brazil Industrial Robotics Market Estimates and Forecasts, 2018 - 2030 (USD Million)

6.5.4.2. Brazil Industrial Robotics Market Estimates and Forecasts, by Application, 2018 - 2030 (USD Million)

6.5.4.3. Brazil Industrial Robotics Market Estimates and Forecasts, by End Use, 2018 - 2030 (USD Million, Volume, Thousand Units; Revenue)

6.6. Middle East and Africa

6.6.1. Middle East and Africa Industrial Robotics Market Estimates and Forecasts, 2018 - 2030 (USD Million)

6.6.2. Middle East and Africa Industrial Robotics Market Estimates and Forecasts, by Application, 2018 - 2030 (USD Million)

6.6.3. Middle East and Africa Industrial Robotics Market Estimates and Forecasts, by End Use, 2018 - 2030 (USD Million, Volume, Thousand Units; Revenue)

6.6.4. KSA

6.6.4.1. KSA Industrial Robotics Market Estimates and Forecasts, 2018 - 2030 (USD Million)

6.6.4.2. KSA Industrial Robotics Market Estimates and Forecasts, by Application, 2018 - 2030 (USD Million)

6.6.4.3. KSA Industrial Robotics Market Estimates and Forecasts, by End Use, 2018 - 2030 (USD Million, Volume, Thousand Units; Revenue)

6.6.5. UAE

6.6.5.1. UAE Industrial Robotics Market Estimates and Forecasts, 2018 - 2030 (USD Million)

6.6.5.2. UAE Industrial Robotics Market Estimates and Forecasts, by Application, 2018 - 2030 (USD Million)

6.6.5.3. UAE Industrial Robotics Market Estimates and Forecasts, by End Use, 2018 - 2030 (USD Million, Volume, Thousand Units; Revenue)

6.6.6. South Africa

6.6.6.1. South Africa Industrial Robotics Market Estimates and Forecasts, 2018 - 2030 (USD Million)

6.6.6.2. South Africa Industrial Robotics Market Estimates and Forecasts, by Application, 2018 - 2030 (USD Million)

6.6.6.3. South Africa Industrial Robotics Market Estimates and Forecasts, by End Use, 2018 - 2030 (USD Million, Volume, Thousand Units; Revenue)

Chapter 7. Competitive Landscape

7.1. Recent Developments & Impact Analysis by Key Market Participants

7.2. Company Categorization

7.3. Company Market Positioning

7.4. Company Heat Map Analysis

7.5. Strategy Mapping

7.6. Company Profiles

7.6.1. ABB Ltd.

7.6.1.1. Participant’s Overview

7.6.1.2. Financial Performance

7.6.1.3. Product Benchmarking

7.6.1.4. Recent Developments

7.6.2. Yaskawa Electric Corporation

7.6.2.1. Participant’s Overview

7.6.2.2. Financial Performance

7.6.2.3. Product Benchmarking

7.6.2.4. Recent Developments

7.6.3. Mitsubishi Electric Corporation

7.6.3.1. Participant’s Overview

7.6.3.2. Financial Performance

7.6.3.3. Product Benchmarking

7.6.3.4. Recent Developments

7.6.4. Nachi-Fujikoshi Corp.

7.6.4.1. Participant’s Overview

7.6.4.2. Financial Performance

7.6.4.3. Product Benchmarking

7.6.4.4. Recent Developments

7.6.5. Comau SpA

7.6.5.1. Participant’s Overview

7.6.5.2. Financial Performance

7.6.5.3. Product Benchmarking

7.6.5.4. Recent Developments

7.6.6. KUKA AG

7.6.6.1. Participant’s Overview

7.6.6.2. Financial Performance

7.6.6.3. Product Benchmarking

7.6.6.4. Recent Developments

7.6.7. Fanuc Corporation

7.6.7.1. Participant’s Overview

7.6.7.2. Financial Performance

7.6.7.3. Product Benchmarking

7.6.7.4. Recent Developments

7.6.8. Denso Corporation

7.6.8.1. Participant’s Overview

7.6.8.2. Financial Performance

7.6.8.3. Product Benchmarking

7.6.8.4. Recent Developments

7.6.9. Kawasaki Heavy Industries, Ltd.

7.6.9.1. Participant’s Overview

7.6.9.2. Financial Performance

7.6.9.3. Product Benchmarking

7.6.9.4. Recent Developments

7.6.10. Omron Corporation

7.6.10.1. Participant’s Overview

7.6.10.2. Financial Performance

7.6.10.3. Product Benchmarking

7.6.10.4. Recent Developments

List of Tables

Table 1 Global Industrial Robotics market, 2018 - 2030 (USD Million)

Table 2 Global Industrial Robotics market estimates and forecasts by region, 2018 - 2030 (USD Million)

Table 3 Global Industrial Robotics market estimates and forecast by Application, 2018 - 2030 (USD Million)

Table 4 Global Industrial Robotics market estimates and forecast by End Use, 2018 - 2030 (Volume, Thousand Units; Revenue, USD Million, 2018 - 2030)

Table 5 Industrial Robotics market estimates and forecast by Handling, 2018 - 2030 (USD Million)

Table 6 Industrial Robotics market estimates and forecast by Assembling & Disambelling, 2018 - 2030 (USD Million)

Table 7 Industrial Robotics market estimates and forecast by Welding & Soldering, 2018 - 2030 (USD Million)

Table 8 Industrial Robotics market estimates and forecast by Cleanroom, 2018 - 2030 (USD Million)

Table 9 Industrial Robotics market estimates and forecast by Dispensing, 2018 - 2030 (USD Million)

Table 10 Industrial Robotics market estimates and forecast by Processing, 2018 - 2030 (USD Million)

Table 11 Industrial Robotics market estimates and forecast by Others, 2018 - 2030 (USD Million)

Table 12 Industrial Robotics market estimates and forecast by Automotive, 2018 - 2030 (USD Million)

Table 13 Industrial Robotics market estimates and forecast by Electrical/Electronics, 2018 - 2030 (USD Million)

Table 14 Industrial Robotics market estimates and forecast by Metal/Heavy Machinery, 2018 - 2030 (USD Million)

Table 15 Industrial Robotics market estimates and forecast by Chemical, Rubber, & Plastics, 2018 - 2030 (USD Million)

Table 16 Industrial Robotics market estimates and forecast by Food, 2018 - 2030 (USD Million)

Table 17 Industrial Robotics market estimates and forecast by Others, 2018 - 2030 (USD Million)

Table 18 North America Industrial Robotics Market Estimates and Forecast, 2018 - 2030 (USD Million)

Table 19 North America Industrial Robotics market estimates and forecast, by Application, 2018 - 2030 (USD Million)

Table 20 North America Industrial Robotics market estimates and forecast, by End Use, 2018 - 2030 (Volume, Thousand Units; Revenue, USD Million, 2018 - 2030)

Table 21 U.S. Industrial Robotics Market Estimates and Forecast, 2018 - 2030 (USD Million)

Table 22 U.S. Industrial Robotics market estimates and forecast, by Application, 2018 - 2030 (USD Million)

Table 23 U.S. Industrial Robotics market estimates and forecast, by End Use, 2018 - 2030 (Revenue, USD Million, Volume, Thousand Units)

Table 24 Canada Industrial Robotics Market Estimates and Forecast, 2018 - 2030 (USD Million)

Table 25 Canada Industrial Robotics market estimates and forecast, by Application, 2018 - 2030 (USD Million)

Table 26 Canada Industrial Robotics market estimates and forecast, by End Use, 2018 - 2030 (Revenue, USD Million, Volume, Thousand Units)

Table 27 Mexico Industrial Robotics Market Estimates and Forecast, 2018 - 2030 (USD Million)

Table 28 Mexico Industrial Robotics market estimates and forecast, by Application, 2018 - 2030 (USD Million)

Table 29 Mexico Industrial Robotics market estimates and forecast, by End Use, 2018 - 2030 (Revenue, USD Million, Volume, Thousand Units)

Table 30 Europe Industrial Robotics Market Estimates and Forecast, 2018 - 2030 (USD Million)

Table 31 Europe Industrial Robotics market estimates and forecast, by Application, 2018 - 2030 (USD Million)

Table 32 Europe Industrial Robotics market estimates and forecast, by End Use, 2018 - 2030 (Revenue, USD Million, Volume, Thousand Units)

Table 33 UK Industrial Robotics Market Estimates and Forecast, 2018 - 2030 (USD Million)

Table 34 UK Industrial Robotics market estimates and forecast, by Application, 2018 - 2030 (USD Million)

Table 35 UK Industrial Robotics market estimates and forecast, by End Use, 2018 - 2030 (Revenue, USD Million, Volume, Thousand Units)

Table 36 Germany Industrial Robotics Market Estimates and Forecast, 2018 - 2030 (USD Million)

Table 37 Germany Industrial Robotics market estimates and forecast, by Application, 2018 - 2030 (USD Million)

Table 38 Germany Industrial Robotics market estimates and forecast, by End Use, 2018 - 2030 (Revenue, USD Million, Volume, Thousand Units)

Table 39 France Industrial Robotics Market Estimates and Forecast, 2018 - 2030 (USD Million)

Table 40 France Industrial Robotics market estimates and forecast, by Application, 2018 - 2030 (USD Million)

Table 41 France Industrial Robotics market estimates and forecast, by End Use, 2018 - 2030 (Revenue, USD Million, Volume, Thousand Units)

Table 42 Asia Pacific Industrial Robotics Market Estimates and Forecast, 2018 - 2030 (USD Million)

Table 43 Asia Pacific Industrial Robotics market estimates and forecast, by Application, 2018 - 2030 (USD Million)

Table 44 Asia Pacific Industrial Robotics market estimates and forecast, by End Use, 2018 - 2030 (Revenue, USD Million, Volume, Thousand Units)

Table 45 China Industrial Robotics Market Estimates and Forecast, 2018 - 2030 (USD Million)

Table 46 China Industrial Robotics market estimates and forecast, by Application, 2018 - 2030 (USD Million)

Table 47 China Industrial Robotics market estimates and forecast, by End Use, 2018 - 2030 (Revenue, USD Million, Volume, Thousand Units)

Table 48 Japan Industrial Robotics Market Estimates and Forecast, 2018 - 2030 (USD Million)

Table 49 Japan Industrial Robotics market estimates and forecast, by Application, 2018 - 2030 (USD Million)

Table 50 Japan Industrial Robotics market estimates and forecast, by End Use, 2018 - 2030 (Revenue, USD Million, Volume, Thousand Units)

Table 51 India Industrial Robotics Market Estimates and Forecast, 2018 - 2030 (USD Million)

Table 52 India Industrial Robotics market estimates and forecast, by Application, 2018 - 2030 (USD Million)

Table 53 India Industrial Robotics market estimates and forecast, by End Use, 2018 - 2030 (Revenue, USD Million, Volume, Thousand Units)

Table 54 South Korea Industrial Robotics Market Estimates and Forecast, 2018 - 2030 (USD Million)

Table 55 South Korea Industrial Robotics market estimates and forecast, by Application, 2018 - 2030 (USD Million)

Table 56 South Korea Industrial Robotics market estimates and forecast, by End Use, 2018 - 2030 (Revenue, USD Million, Volume, Thousand Units)

Table 57 Australia Industrial Robotics Market Estimates and Forecast, 2018 - 2030 (USD Million)

Table 58 Australia Industrial Robotics market estimates and forecast, by Application, 2018 - 2030 (USD Million)

Table 59 Australia Industrial Robotics market estimates and forecast, by End Use, 2018 - 2030 (Revenue, USD Million, Volume, Thousand Units)

Table 60 Latin America Industrial Robotics Market Estimates and Forecast, 2018 - 2030 (USD Million)

Table 61 Latin America Industrial Robotics market estimates and forecast, by Application, 2018 - 2030 (USD Million)

Table 62 Latin America Industrial Robotics market estimates and forecast, by End Use, 2018 - 2030 (Revenue, USD Million, Volume, Thousand Units)

Table 63 Brazil Industrial Robotics Market Estimates and Forecast, 2018 - 2030 (USD Million)

Table 64 Brazil Industrial Robotics market estimates and forecast, by Application, 2018 - 2030 (USD Million)

Table 65 Brazil Industrial Robotics market estimates and forecast, by End Use, 2018 - 2030 (Revenue, USD Million, Volume, Thousand Units)

Table 66 MEA Industrial Robotics Market Estimates and Forecast, 2018 - 2030 (USD Million)

Table 67 MEA Industrial Robotics market estimates and forecast, by Application, 2018 - 2030 (USD Million)

Table 68 MEA Industrial Robotics market estimates and forecast, by End Use, 2018 - 2030 (Revenue, USD Million, Volume, Thousand Units)

Table 69 KSA Industrial Robotics Market Estimates and Forecast, 2018 - 2030 (USD Million)

Table 70 KSA Industrial Robotics market estimates and forecast, by Application, 2018 - 2030 (USD Million)

Table 71 KSA Industrial Robotics market estimates and forecast, by End Use, 2018 - 2030 (Revenue, USD Million, Volume, Thousand Units)

Table 72 UAE Industrial Robotics Market Estimates and Forecast, 2018 - 2030 (USD Million)

Table 73 UAE Industrial Robotics market estimates and forecast, by Application, 2018 - 2030 (USD Million)

Table 74 UAE Industrial Robotics market estimates and forecast, by End Use, 2018 - 2030 (Revenue, USD Million, Volume, Thousand Units)

Table 75 South Africa Industrial Robotics Market Estimates and Forecast, 2018 - 2030 (USD Million)

Table 76 South Africa Industrial Robotics market estimates and forecast, by Application, 2018 - 2030 (USD Million)

Table 77 South Africa Industrial Robotics market estimates and forecast, by End Use, 2018 - 2030 (Revenue, USD Million, Volume, Thousand Units)

List of Figures

Fig. 1 Industrial Robotics Market Segmentation

Fig. 2 Market Research Process

Fig. 3 Technology Landscape

Fig. 4 Information Procurement

Fig. 5 Primary Research Pattern

Fig. 6 Market Research Approaches

Fig. 7 Parent Market Analysis

Fig. 8 Data Analysis Models

Fig. 9 Market Formulation and Validation

Fig. 10 Data Validating & Publishing

Fig. 11 Market Snapshot

Fig. 12 Competitive Landscape Snapshot

Fig. 13 Industrial Robotics Market: Industry Value Chain Analysis

Fig. 14 Market driver relevance analysis (Current & future impact)

Fig. 15 Market restraint relevance analysis (Current & future impact)

Fig. 16 Industrial Robotics Market: PORTER’s Analysis

Fig. 17 Industrial Robotics Market: PESTEL Analysis

Fig. 18 Industrial Robotics Market: Application Outlook Key Takeaways (Revenue, USD Million, 2018 - 2030)

Fig. 19 Industrial Robotics Market: Application Movement Analysis (Revenue, USD Million, 2018 - 2030), 2024 & 2030

Fig. 20 Handling Market Estimates & Forecasts, 2018 - 2030 (Revenue, USD Million, 2018 - 2030)

Fig. 21 Assembling & Disambelling Market Estimates & Forecasts, 2018 - 2030 (Revenue, USD Million, 2018 - 2030)

Fig. 22 Welding & Soldering Market Estimates & Forecasts, 2018 - 2030 (Revenue, USD Million, 2018 - 2030)

Fig. 23 Cleanroom Market Estimates & Forecasts, 2018 - 2030 (Revenue, USD Million, 2018 - 2030)

Fig. 24 Dispensing Market Estimates & Forecasts, 2018 - 2030 (Revenue, USD Million, 2018 - 2030)

Fig. 25 Processing Market Estimates & Forecasts, 2018 - 2030 (Revenue, USD Million, 2018 - 2030)

Fig. 26 Others Market Estimates & Forecasts, 2018 - 2030 (Revenue, USD Million, 2018 - 2030)

Fig. 27 Industrial Robotics Market: End Use Outlook Key Takeaways (USD Million, Volume, Thousand Units; Revenue)

Fig. 28 Industrial Robotics Market: End Use Movement Analysis (USD Million, Volume, Thousand Units; Revenue), 2024 & 2030

Fig. 29 Automotive Market Estimates & Forecasts, 2018 - 2030 (USD Million, Volume, Thousand Units; Revenue)

Fig. 30 Electrical/Electronics Market Estimates & Forecasts, 2018 - 2030 (USD Million, Volume, Thousand Units; Revenue)

Fig. 31 Metal/Heavy Machinery Market Estimates & Forecasts, 2018 - 2030 (USD Million, Volume, Thousand Units; Revenue)

Fig. 32 Chemical, Rubber, & Plastics Market Estimates & Forecasts, 2018 - 2030 (USD Million, Volume, Thousand Units; Revenue)

Fig. 33 Food Market Estimates & Forecasts, 2018 - 2030 (USD Million, Volume, Thousand Units; Revenue)

Fig. 34 Others Market Estimates & Forecasts, 2018 - 2030 (USD Million, Volume, Thousand Units; Revenue)

Fig. 35 Industrial Robotics Market Revenue, by Region, 2024 & 2030, (USD Million)

Fig. 36 Regional Marketplace: Key Takeaways

Fig. 37 Industrial Robotics market: Regional outlook, 2024 & 2030, (USD Million)

Fig. 38 North America Industrial Robotics Market Estimates and Forecasts, 2018 - 2030 (USD Million)

Fig. 39 US Industrial Robotics Market Estimates and Forecasts, 2018 - 2030 (USD Million)

Fig. 40 Canada Industrial Robotics Market Estimates and Forecasts, 2018 - 2030 (USD Million)

Fig. 41 Mexico Industrial Robotics Market Estimates and Forecasts, 2018 - 2030 (USD Million)

Fig. 42 Europe Industrial Robotics Market Estimates and Forecasts, 2018 - 2030 (USD Million)

Fig. 43 UK Industrial Robotics Market Estimates and Forecasts, 2018 - 2030 (USD Million)

Fig. 44 Germany Industrial Robotics Market Estimates and Forecasts, 2018 - 2030 (USD Million)

Fig. 45 France Industrial Robotics Market Estimates and Forecasts, 2018 - 2030 (USD Million)

Fig. 46 Asia Pacific Industrial Robotics Market Estimates and Forecast, 2018 - 2030 (USD Million)

Fig. 47 China Industrial Robotics Market Estimates and Forecasts, 2018 - 2030 (USD Million)

Fig. 48 Japan Industrial Robotics Market Estimates and Forecasts, 2018 - 2030 (USD Million)

Fig. 49 India Industrial Robotics Market Estimates and Forecasts, 2018 - 2030 (USD Million)

Fig. 50 Australia Industrial Robotics Market Estimates and Forecasts, 2018 - 2030 (USD Million)

Fig. 51 South Korea Industrial Robotics Market Estimates and Forecasts, 2018 - 2030 (USD Million)

Fig. 52 Latin America Industrial Robotics Market Estimates and Forecasts, 2018 - 2030 (USD Million)

Fig. 53 Brazil Industrial Robotics Market Estimates and Forecasts, 2018 - 2030 (USD Million)

Fig. 54 MEA Industrial Robotics Market Estimates and Forecasts, 2018 - 2030 (USD Million)

Fig. 55 UAE Industrial Robotics Market Estimates and Forecasts, 2018 - 2030 (USD Million)

Fig. 56 South Africa Industrial Robotics Market Estimates and Forecasts, 2018 - 2030 (USD Million)

Fig. 57 Saudi Arabia Industrial Robotics Market Estimates and Forecasts, 2018 - 2030 (USD Million)

Fig. 58 Key Company Categorization

Fig. 59 Strategic Framework

Market Segmentation

- Industrial Robotics Application Outlook (Revenue, USD Million, 2018 - 2030)

- Handling

- Assembling & Disambelling

- Welding & Soldering

- Cleanroom

- Dispensing

- Processing

- Others

- Industrial Robotics End Use Outlook (Volume, Thousand Units; Revenue, USD Million, 2018 - 2030)

- Automotive

- Electrical/Electronics

- Metal/Heavy Machinery

- Chemical, Rubber, & Plastics

- Food

- Others

- Industrial Robotics Regional Outlook (Volume, Thousand Units; Revenue, USD Million, 2018 - 2030)

- North America

- North America Industrial RoboticsMarket, by Application

- Handling

- Assembling & disassembling

- Welding & soldering

- Cleanroom

- Dispensing

- Processing

- Others

- North America Industrial Robotics Market, by End Use

- Automotive

- Electrical/Electronics

- Metal/Heavy Machinery

- Chemical, Rubber, & Plastics

- Food

- Others

- U.S. Industrial RoboticsMarket, by Application

- Handling

- Assembling & disassembling

- Welding & soldering

- Cleanroom

- Dispensing

- Processing

- Others

- U.S. Industrial Robotics Market, by End Use

- Automotive

- Electrical/Electronics

- Metal/Heavy Machinery

- Chemical, Rubber, & Plastics

- Food

- Others

- Canada Industrial RoboticsMarket, by Application

- Handling

- Assembling & disassembling

- Welding & soldering

- Cleanroom

- Dispensing

- Processing

- Others

- Canada Industrial Robotics Market, by End Use

- Automotive

- Electrical/Electronics

- Metal/Heavy Machinery

- Chemical, Rubber, & Plastics

- Food

- Others

- Mexico Industrial RoboticsMarket, by Application

- Handling

- Assembling & disassembling

- Welding & soldering

- Cleanroom

- Dispensing

- Processing

- Others

- Mexico Industrial Robotics Market, by End Use

- Automotive

- Electrical/Electronics

- Metal/Heavy Machinery

- Chemical, Rubber, & Plastics

- Food

- Others

- North America Industrial RoboticsMarket, by Application

- Europe

- Europe Industrial RoboticsMarket, by Application

- Handling

- Assembling & disassembling

- Welding & soldering

- Cleanroom

- Dispensing

- Processing

- Others

- Europe Industrial Robotics Market, by End Use

- Automotive

- Electrical/Electronics

- Metal/Heavy Machinery

- Chemical, Rubber, & Plastics

- Food

- Others

- UK Industrial RoboticsMarket, by Application

- Handling

- Assembling & disassembling

- Welding & soldering

- Cleanroom

- Dispensing

- Processing

- Others

- UK Industrial Robotics Market, by End Use

- Automotive

- Electrical/Electronics

- Metal/Heavy Machinery

- Chemical, Rubber, & Plastics

- Food

- Others

- Germany Industrial RoboticsMarket, by Application

- Handling

- Assembling & disassembling

- Welding & soldering

- Cleanroom

- Dispensing

- Processing

- Others

- Germany Industrial Robotics Market, by End Use

- Automotive

- Electrical/Electronics

- Metal/Heavy Machinery

- Chemical, Rubber, & Plastics

- Food

- Others

- France Industrial RoboticsMarket, by Application

- Handling

- Assembling & disassembling

- Welding & soldering

- Cleanroom

- Dispensing

- Processing

- Others

- France Industrial Robotics Market, by End Use

- Automotive

- Electrical/Electronics

- Metal/Heavy Machinery

- Chemical, Rubber, & Plastics

- Food

- Others

- Europe Industrial RoboticsMarket, by Application

- Asia Pacific

- Asia Pacific Industrial RoboticsMarket, by Application

- Handling

- Assembling & disassembling

- Welding & soldering

- Cleanroom

- Dispensing

- Processing

- Others

- Asia Pacific Industrial Robotics Market, by End Use

- Automotive

- Electrical/Electronics

- Metal/Heavy Machinery

- Chemical, Rubber, & Plastics

- Food

- Others

- China Industrial RoboticsMarket, by Application

- Handling

- Assembling & disassembling

- Welding & soldering

- Cleanroom

- Dispensing

- Processing

- Others

- China Industrial Robotics Market, by End Use

- Automotive

- Electrical/Electronics

- Metal/Heavy Machinery

- Chemical, Rubber, & Plastics

- Food

- Others

- Japan Industrial RoboticsMarket, by Application

- Handling

- Assembling & disassembling

- Welding & soldering

- Cleanroom

- Dispensing

- Processing

- Others

- Japan Industrial Robotics Market, by End Use

- Automotive

- Electrical/Electronics

- Metal/Heavy Machinery

- Chemical, Rubber, & Plastics

- Food

- Others

- South Korea Industrial RoboticsMarket, by Application

- Handling

- Assembling & disassembling

- Welding & soldering

- Cleanroom

- Dispensing

- Processing

- Others

- South Korea Industrial Robotics Market, by End Use

- Automotive

- Electrical/Electronics

- Metal/Heavy Machinery

- Chemical, Rubber, & Plastics

- Food

- Others

- India Industrial RoboticsMarket, by Application

- Handling

- Assembling & disassembling

- Welding & soldering

- Cleanroom

- Dispensing

- Processing

- Others

- India Industrial Robotics Market, by End Use

- Automotive

- Electrical/Electronics

- Metal/Heavy Machinery

- Chemical, Rubber, & Plastics

- Food

- Others

- Australia Industrial RoboticsMarket, by Application

- Handling

- Assembling & disassembling

- Welding & soldering

- Cleanroom

- Dispensing

- Processing

- Others

- Australia Industrial Robotics Market, by End Use

- Automotive

- Electrical/Electronics

- Metal/Heavy Machinery

- Chemical, Rubber, & Plastics

- Food

- Others

- Asia Pacific Industrial RoboticsMarket, by Application

- Latin America

- Latin America Industrial RoboticsMarket, by Application

- Handling

- Assembling & disassembling

- Welding & soldering

- Cleanroom

- Dispensing

- Processing

- Others

- Latin America Industrial Robotics Market, by End Use

- Automotive

- Electrical/Electronics

- Metal/Heavy Machinery

- Chemical, Rubber, & Plastics

- Food

- Others

- Brazil Industrial RoboticsMarket, by Application

- Handling

- Assembling & disassembling

- Welding & soldering

- Cleanroom

- Dispensing

- Processing

- Others

- Brazil Industrial Robotics Market, by End Use

- Automotive

- Electrical/Electronics

- Metal/Heavy Machinery

- Chemical, Rubber, & Plastics

- Food

- Others

- Latin America Industrial RoboticsMarket, by Application

- MEA

- MEA Industrial RoboticsMarket, by Application

- Handling

- Assembling & disassembling

- Welding & soldering

- Cleanroom

- Dispensing

- Processing

- Others

- MEA Industrial Robotics Market, by End Use

- Automotive

- Electrical/Electronics

- Metal/Heavy Machinery

- Chemical, Rubber, & Plastics

- Food

- Others

- Saudi Arabia Industrial RoboticsMarket, by Application

- Handling

- Assembling & disassembling

- Welding & soldering

- Cleanroom

- Dispensing

- Processing

- Others

- Saudi Arabia Industrial Robotics Market, by End Use

- Automotive

- Electrical/Electronics

- Metal/Heavy Machinery

- Chemical, Rubber, & Plastics

- Food

- Others

- South Africa Industrial RoboticsMarket, by Application

- Handling

- Assembling & disassembling

- Welding & soldering

- Cleanroom

- Dispensing

- Processing

- Others

- South Africa Industrial Robotics Market, by End Use

- Automotive

- Electrical/Electronics

- Metal/Heavy Machinery

- Chemical, Rubber, & Plastics

- Food

- Others

- UAE Industrial RoboticsMarket, by Application

- Handling

- Assembling & disassembling

- Welding & soldering

- Cleanroom

- Dispensing

- Processing

- Others

- UAE Industrial Robotics Market, by End Use

- Automotive

- Electrical/Electronics

- Metal/Heavy Machinery

- Chemical, Rubber, & Plastics

- Food

- Others

- MEA Industrial RoboticsMarket, by Application

- North America

Report content

Qualitative Analysis

- Industry overview

- Industry trends

- Market drivers and restraints

- Market size

- Growth prospects

- Porter’s analysis

- PESTEL analysis

- Key market opportunities prioritized

- Competitive landscape

- Company overview

- Financial performance

- Product benchmarking

- Latest strategic developments

Quantitative Analysis

- Market size, estimates, and forecast from 2018 to 2030

- Market estimates and forecast for product segments up to 2030

- Regional market size and forecast for product segments up to 2030

- Market estimates and forecast for application segments up to 2030

- Regional market size and forecast for application segments up to 2030

- Company financial performance

Research Methodology

Grand View Research employs comprehensive and iterative research methodology focused on minimizing deviance in order to provide the most accurate estimates and forecast possible. The company utilizes a combination of bottom-up and top-down approaches for segmenting and estimating quantitative aspects of the market. In Addition, a recurring theme prevalent across all our research reports is data triangulation that looks market from three different perspectives. Critical elements of methodology employed for all our studies include:

Preliminary data mining

Raw market data is obtained and collated on a broad front. Data is continuously filtered to ensure that only validated and authenticated sources are considered. In addition, data is also mined from a host of reports in our repository, as well as a number of reputed paid databases. For comprehensive understanding of the market, it is essential to understand the complete value chain and in order to facilitate this; we collect data from raw material suppliers, distributors as well as buyers.

Technical issues and trends are obtained from surveys, technical symposia and trade journals. Technical data is also gathered from intellectual property perspective, focusing on white space and freedom of movement. Industry dynamics with respect to drivers, restraints, pricing trends are also gathered. As a result, the material developed contains a wide range of original data that is then further cross-validated and authenticated with published sources.

Statistical model

Our market estimates and forecasts are derived through simulation models. A unique model is created customized for each study. Gathered information for market dynamics, technology landscape, application development and pricing trends is fed into the model and analyzed simultaneously. These factors are studied on a comparative basis, and their impact over the forecast period is quantified with the help of correlation, regression and time series analysis. Market forecasting is performed via a combination of economic tools, technological analysis, and industry experience and domain expertise.

Econometric models are generally used for short-term forecasting, while technological market models are used for long-term forecasting. These are based on an amalgamation of technology landscape, regulatory frameworks, economic outlook and business principles. A bottom-up approach to market estimation is preferred, with key regional markets analyzed as separate entities and integration of data to obtain global estimates. This is critical for a deep understanding of the industry as well as ensuring minimal errors. Some of the parameters considered for forecasting include:

• Market drivers and restrains, along with their current and expected impact

• Raw material scenario and supply v/s price trends

• Regulatory scenario and expected developments

• Current capacity and expected capacity additions up to 2030

We assign weights to these parameters and quantify their market impact using weighted average analysis, to derive an expected market growth rate.

Primary validation

This is the final step in estimating and forecasting for our reports. Exhaustive primary interviews are conducted, on face to face as well as over the phone to validate our findings and assumptions used to obtain them. Interviewees are approached from leading companies across the value chain including suppliers, technology providers, domain experts and buyers so as to ensure a holistic and unbiased picture of the market. These interviews are conducted across the globe, with language barriers overcome with the aid of local staff and interpreters. Primary interviews not only help in data validation, but also provide critical insights into the market, current business scenario and future expectations and enhance the quality of our reports. All our estimates and forecast are verified through exhaustive primary research with Key Industry Participants (KIPs) which typically include:

• Market leading companies

• Raw material suppliers

• Product distributors

• Buyers

The key objectives of primary research are as follows:

• To validate our data in terms of accuracy and acceptability

• To gain an insight in to the current market and future expectations

Data Collection Matrix

|

Perspective |

Primary research |

Secondary research |

|

Supply side |

|

|

|

Demand side |

|

|

Industry Analysis Matrix

|

Qualitative analysis |

Quantitative analysis |

|

|

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."