Industrial Protective Footwear Market Size, Share & Trends Analysis Report By Product (Leather, Rubber), By End-use (Construction, Manufacturing), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: 978-1-68038-899-2

- Number of Report Pages: 152

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

Industrial Protective Footwear Market Trends

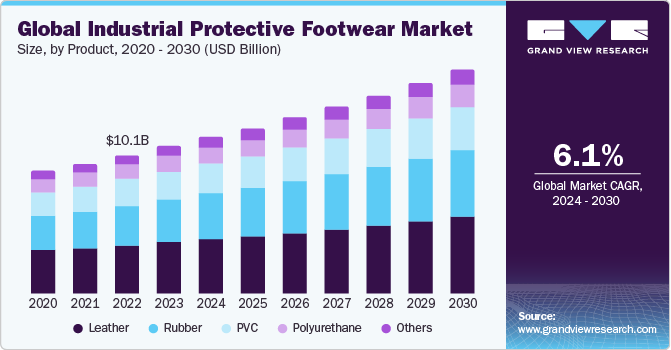

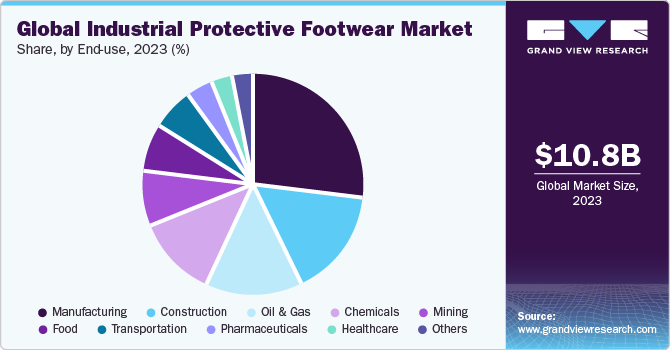

The global industrial protective footwear market size was estimated at USD 10.76 billion in 2023 and is projected to grow at a CAGR of 6.1% from 2024 to 2030. Rising demand for foot protection in industries such as chemicals, construction, oil and gas, pharmaceuticals, and others is projected to drive the market growth over the forecast period.

The industrial safety footwear market will be significantly impacted by occupational safety regulations. Regulations requiring corporations to guarantee worker safety in sectors are likely to boost demand for industrial protective footwear. These laws specify the sort of industrial protective footwear that must be worn throughout certain industrial or commercial procedures.

Increasing onshore and offshore drilling operations, as well as expanding shale gas production in the U.S., are expected to boost demand for protective footwear to safeguard people from dangers. Large-scale investments in oil and gas production levels and overall production efficiency are expected to contribute to the expansion of the oil and gas sector in U.S. throughout the projection period.

Another major factor is the increasing awareness about workplace safety among employees and employers. As the workforce becomes more informed about the potential hazards in industrial environments, the demand for protective footwear that can prevent injuries from slips, falls, and exposure to harmful substances is rising. This heightened awareness is fostering a safety-first culture, prompting industries to prioritize investments in protective gear, including footwear.

The technological advancements in footwear materials and manufacturing processes are also propelling market growth. Innovations such as lightweight composites, improved sole designs for better grip, and enhanced comfort features are making protective footwear more appealing to workers. These advancements not only enhance safety but also improve the overall wearing experience, encouraging more widespread adoption.

Market Concentration & Characteristics

The market growth stage is medium, and the pace is accelerating. The market is characterized by a high degree of innovation, which is attributable to the rapid technological advancements. Moreover, market players are adopting organic and inorganic growth strategies, such as product launches, geographical expansions, mergers & acquisitions, and collaborations, to strengthen their position in the global market.

Regulatory frameworks established by governments and international bodies, such as the Occupational Safety and Health Administration (OSHA) in the U.S., the European Union’s PPE Directive, and various national standards, mandate the use of protective footwear in industrial and hazardous work environments. These regulations are designed to ensure the safety and well-being of workers by minimizing the risk of injuries related to falls, slips, heavy objects, electrical hazards, and chemical exposures.

The degree of innovation in the global market is substantial, driven by advancements in materials science, manufacturing processes, and design technologies. One of the key areas of innovation is the development of advanced materials. Traditional protective footwear relied heavily on leather and steel for durability and protection. However, modern advancements have introduced materials such as thermoplastic polyurethane (TPU), composite materials, and carbon fiber. These materials offer improved impact resistance, lighter weight, and better flexibility without compromising on protection. For instance, composite toe caps provide similar protection to steel toes but are significantly lighter, reducing fatigue for the wearer.

The concentration of end-users in the global market is diverse, spanning across multiple industries with varying levels of demand intensity. The distribution of these end-users significantly influences market dynamics, with certain sectors driving a larger share of the demand due to the inherent risks and regulatory requirements associated with their operations. The manufacturing industry also represents a significant portion of the end-user base. Within this sector, workers are exposed to a variety of risks such as heavy machinery, electrical hazards, and chemical spills. The diverse nature of manufacturing, encompassing automotive, electronics, machinery, and consumer goods, among others, means that protective footwear must cater to a wide range of safety requirements and operational conditions.

In the context of industrial protective footwear, the primary substitutes include other forms of personal protective equipment (PPE) and various safety practices. While these alternatives can provide some level of protection, they are generally not as effective as dedicated protective footwear for safeguarding feet in hazardous work environments. For instance, anti-fatigue mats and slip-resistant flooring can reduce the risk of slips, trips, and falls in industrial settings. These solutions can improve overall workplace safety by providing better traction and cushioning, but they do not offer direct protection to the feet from impacts or punctures.

Product Insights

The leather segment led the market with the largest revenue share of 35.4% in 2023. Leather is renowned for its durability and strength, providing superior protection against various industrial hazards such as heavy objects, sharp materials, and harsh environmental conditions. This makes leather footwear particularly suitable for demanding industries like construction, manufacturing, and mining. Moreover, leather's natural properties allow it to conform to the shape of the wearer’s foot over time, providing a custom fit that further enhances comfort and reduces fatigue.

The rubber segment is expected to grow at a significant CAGR during the forecast period. Rubber's inherent properties make it an excellent material for protective footwear, offering exceptional resistance to water, chemicals, and oils, which is crucial in environments like chemical plants, food processing units, and oil and gas industries. This resistance ensures that rubber footwear can withstand exposure to hazardous substances, providing a high level of protection for workers.

End-use Insights

Based on end-use, the manufacturing segment led the market with the largest revenue share of 27.4% in 2023. The nature of manufacturing work often involves handling heavy objects, operating forklifts and other machinery, and working in environments with potential electrical hazards. This diverse range of risks necessitates a variety of protective features in footwear, such as steel or composite toe caps, slip-resistant soles, and electrical hazard protection, making protective footwear indispensable in these settings.

The construction segment is projected to grow at a significant CAGR over the forecast period. The rapid growth of the construction industry, fueled by urbanization, infrastructure development, and residential and commercial building projects, further amplifies the demand for protective footwear. As new construction projects are initiated and existing ones expanded, the workforce increases, leading to a higher consumption of safety footwear. This continuous growth sustains a robust market for industrial protective footwear tailored to the specific needs of construction workers.

Regional Insights

The industrial protective footwear market in North America is anticipated to witness at a significant CAGR from 2024 to 2030. With the rapid expansion of the oil & gas, chemicals, and manufacturing sectors in North America, there is an increased need for industrial protective footwear to ensure the safety of workers. Thus, thereby positively impacting the North America market.

U.S. Industrial Protective Footwear Market Trends

The industrial protective footwear market in the U.S. is anticipated to grow at the fastest CAGR of 6.7% from 2024 to 2030. The surged oil & gas production in the U.S. and the increased adoption of industrial protective footwear like leather footwear in the oil & gas industry are expected to contribute to the market growth over the forecast period.

The Canada industrial protective footwear market accounted for the revenue share of over 13.9% in the North America market. Canada has robust health and safety regulations enforced by agencies such as the Canadian Centre for Occupational Health and Safety (CCOHS) and provincial bodies like Ontario's Ministry of Labour. These regulations mandate the use of protective footwear in various industrial settings to prevent workplace injuries. Compliance with these stringent standards drives consistent demand for high-quality protective footwear across industries.

Europe Industrial Protective Footwear Market Trends

Europe dominated the industrial protective footwear market with the revenue share of 32.8% in 2023. The rise in infrastructure development projects across Europe can be attributed to heighten spending in this sector and an increased emphasis on sustainability and technological advancements. One notable example is the Baltic Power Offshore Wind Farm project, which broke ground in the third quarter of 2023. This initiative, slated for completion by 2025. These mega projects often involve construction activities conducted at elevated heights with a corresponding need for robust market.

The industrial protective footwear market in Germany is expected to grow at a significant CAGR of 6% during the forecast period. Germany's economy is heavily industrialized, with significant contributions from automotive manufacturing, machinery, chemical production, and construction industries. These sectors inherently involve high-risk activities that require robust safety measures, including the use of industrial protective footwear.

The UK industrial protective footwear market held the significant share in the European market owing to the rising end-use industries. The UK has comprehensive health and safety regulations enforced by the Health and Safety Executive (HSE). These regulations require employers to provide appropriate protective footwear to mitigate workplace hazards, ensuring that safety standards are met across various industries.

Asia Pacific Industrial Protective Footwear Market Trends

The industrial protective footwear market in Asia Pacific is expected to register at the fastest CAGR of 7.3% over the forecast period. Countries in the Asia Pacific region, particularly China and India, are implementing stricter legal and policy measures to enhance worker safety, particularly regarding accidental related to handling machinery in industries like construction, oil &gas, manufacturing, and mining.

The China industrial protective footwear market is estimated to grow at a significant CAGR over the forecast period. Rapid urbanization in the country is one of the primary factors boosting the growth of the construction sector. In addition, China is likely to emerge as one of the promising markets for industrial buildings due to the presence of favorable government policies promoting investments in the manufacturing sector.

The industrial protective footwear market in India accounted for the revenue share of over 8% in the Asia Pacific market. Favorable government initiatives such as “Make in India” are expected to drive investments in the aircraft, electronics, and automotive manufacturing industries. Stringent product testing and compliance with regulatory standards in the electronics and electrical industries are expected to drive the demand for market growth over the forecast period.

Central & South America Industrial Protective Footwear Market Trends

The industrial protective footwear market in Central & South America is estimated to grow at a rapid CAGR over the forecast period. Economic growth and foreign direct investment in various sectors, particularly infrastructure projects, mining, and energy, are driving demand for protective footwear. Large-scale projects often involve multinational companies that adhere to international safety standards, further propelling the market growth for protective footwear.

The Brazil industrial protective footwear market held over significant share in the Central & South American market, owing to the rising end-use industries. There is a growing emphasis on workplace safety and health in Brazil. Companies are increasingly focusing on reducing workplace injuries to enhance productivity and avoid legal and financial repercussions.

Middle East & Africa Industrial Protective Footwear Market Trends

The industrial protective footwear market in the Middle East & Africa is experiencing rapid development due to ongoing industrialization and urbanization. The Middle East is known for its ambitious construction and infrastructure projects, including skyscrapers, residential complexes, airports, and transportation networks. Countries like the UAE, Saudi Arabia, and Qatar are heavily investing in these sectors, creating significant demand for protective footwear to ensure worker safety on construction sites.

The UAE industrial protective footwear market held over significant share in the European market owing to the rising end-use industries. The UAE is known for its ambitious construction and infrastructure projects, including skyscrapers, residential complexes, airports, and transportation networks.

Key Industrial Protective Footwear Company Insights

Some of the key players operating in the global market include JAL Group, COFRA S.r.l, Honeywell International Inc, Dunlop Boots, Hewats Edinburgh.

-

COFRA S.r.l. has been designing and manufacturing a diverse range of protective equipment including workwear, gloves, footwear, eye and airway protectors, and shop equipment. It also offers airway protectors and fall arrest systems. Its shoe and boot collection caters to multiple applications like hiking, running, leisure activities, outdoor activities, and city works

-

Honeywell International Inc., operates through four reportable business segments, namely aerospace, building technologies, performance materials & technologies, and safety & productivity solutions. The personal protective equipment business comes under the safety & productivity solutions segment. Sales of this segment observed a decline of USD 907.0 million in 2022 due to lower organic sales in sensing and safety technologies driven by lower demand for personal protective equipment and unfavorable impact of foreign currency translation

Rock Fall Ltd, VF Corporation, Wolverine are some of the emerging market participants in the global market.

-

VF Corporation is a leader in the global workwear and protective footwear market. Its brands are known for their quality, durability, and innovation in safety technologies. The company serves a wide range of industries and has a strong presence in North America, Europe, and other global markets

-

Rock Fall Ltd specializes in manufacturing safety footwear that meets stringent safety standards and provides protection against various workplace hazards. Rock Fall integrates innovative technologies into its footwear, including protective toe caps (steel toe, composite toe, aluminum toe), penetration-resistant midsoles, anti-static properties, slip-resistant outsoles, and waterproof membranes

Key Industrial Protective Footwear Companies:

The following are the leading companies in the industrial protective footwear market. These companies collectively hold the largest market share and dictate industry trends.

- Honeywell International Inc.

- Wolverine World Wide Inc

- VF Corporation

- Bata Corporation

- Dunlop Protective Footwear

- Rock Fall (UK) LTD

- Hilson Footwear Pvt. Ltd

- U-power Group Spa

- Cofra SRL

- Uvex Group

- elten gmbh

- Saina Corporation Co. Ltd

- Oftenrich Holdings Co. Ltd.

- Rahman Group

- JAL Group

Recent Developments

-

In September 2023, Cat Footwear launched the Invader Mid Vent, which highlights a variety of advanced features. These include a ReViveTech Engineered Comfort footbed, a lining made entirely from post-industrial recycled materials with an NXT footbed cover, a resilient EVA midsole, a sturdy nylon shank, a composite toe cap for enhanced protection, and a rugged industrial-grade rubber outsole

-

In October 2022, Xena Workwear introduced the Valence SD shoe, a Chelsea boot designed for static dissipative purposes. This shoe features elastic side panels on both sides for easy wearing. It is available in two variants: one made from LWG Certified leather in a rich chestnut color, and the other crafted from vegan leather in a sleek onyx hue

Industrial Protective Footwear Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 11.38 billion |

|

Revenue forecast in 2030 |

USD 16.24 billion |

|

Growth rate |

CAGR of 6.1% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, end-use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa |

|

Country scope |

U.S.; Canada; Mexico; France; Germany; Italy; Russia; Scandinavia; Spain; UK; China; India; Japan; South Korea; Indonesia; Australia; Thailand; Malaysia; Argentina; Brazil; Saudi Arabia; UAE; South Africa |

|

Key companies profiled |

JAL Group; COFRA S.r.l; Dunlop Boots; Hewats Edinburgh; Honeywell International Inc; RAHMAN Group; Rock Fall Ltd; Uvex Safety Group; VF Corporation; Wolverine |

|

Customization scope |

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Industrial Protective Footwear Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis on the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global industrial protective footwear market report based on product, end-use, and region:

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Leather

-

Rubber

-

PVC

-

Polyurethane

-

Others

-

-

End-use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Construction

-

Manufacturing

-

Oil & Gas

-

Chemicals

-

Food

-

Pharmaceuticals

-

Healthcare

-

Transportation

-

Mining

-

Others

-

-

Region Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

France

-

Germany

-

Italy

-

Russia

-

Scandinavia

-

Spain

-

UK

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Indonesia

-

Australia

-

Thailand

-

Malaysia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global industrial protective footwear size was estimated at USD 10.76 billion in 2023 and is expected to reach USD 11.38 billion in 2024

b. The global industrial protective footwear, in terms of revenue, is expected to grow at a compound annual growth rate of 6.1% from 2024 to 2030 to reach USD 16.24 billion by 2030

b. Europe dominated the global industrial protective footwear and accounted for a 32.8% share, in terms of revenue, in 2023. The market is growing due to several factors including increasing occupational injuries coupled with requirement for highly effective wear & tear resistant and high-utility protective equipment in most of the core industries such as metal manufacturing, oil & gas, automotive and refining is expected to augment penetration of the industrial protective footwear in the region over the forecast period

b. Some of the key players operating in the industrial protective footwear market include JAL Group, COFRA S.r.l, Dunlop Boots, Hewats Edinburgh, Honeywell International Inc, and among others

b. The key factors that are driving the industrial protective footwear market include rapid infrastructural development, rising construction, oil and gas, mining, pharmaceuticals, medical and health care industries

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."