- Home

- »

- Advanced Interior Materials

- »

-

Industrial Part Feeders Market Size And Share Report, 2030GVR Report cover

![Industrial Part Feeders Market Size, Share & Trends Report]()

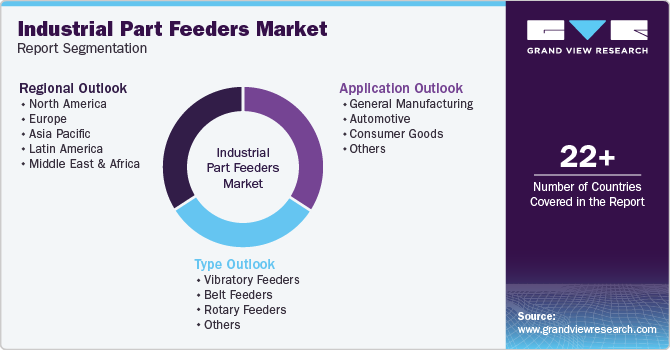

Industrial Part Feeders Market Size, Share & Trends Analysis Report By Type (Vibratory Feeders, Belt Feeders), By Application (General Manufacturing, Automotive), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-455-5

- Number of Report Pages: 152

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

Industrial Part Feeders Market Size & Trends

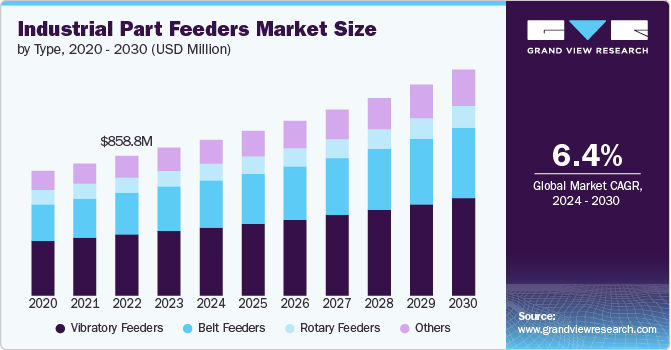

The global industrial part feeders market size was estimated at USD 908.5 million in 2023 and is projected to grow at a CAGR of 6.4% from 2024 to 2030. The demand for industrial part feeders has seen a notable increase across various industries such as general manufacturing, food & beverage, and pharmaceutical as these machines are essential for automating the feeding process. For instance, in the general manufacturing industry, precision and efficiency are paramount. Vibratory feeders are extensively used to ensure that pill capsules are sorted, oriented, and fed into packaging lines with remarkable accuracy and speed. This not only enhances production rates but also minimizes manual handling, thereby reducing the risk of contamination.

The demand for industrial part feeders in sectors such as general manufacturing and mining is experiencing significant growth. In the food & beverage industry, the need for efficient, hygienic, and high-speed feeders to handle various ingredients and products is driving demand. These feeders play a crucial role in maintaining continuous, controlled flow in production lines, ensuring consistency and quality in food products. In mining, the demand is fueled by the necessity for durable, robust feeders capable of handling rough materials and operating in harsh environments. These feeders are essential for the consistent feeding of ores and aggregates to crushing and processing equipment, contributing to operational efficiency and productivity. As these industries continue to expand and emphasize automation, the demand for industrial part feeders is expected to rise further.

Drivers, Opportunities & Restraints

The industrial part feeders market is primarily propelled by the ongoing advancements in automation and control technologies within various industries. As sectors such as food & beverage, pharmaceutical, and manufacturing continuously seek efficiency and precision in their operations, the demand for industrial part feeders has surged. These devices offer unparalleled accuracy in material handling, contributing to optimized production processes and minimized waste. Moreover, the rising focus on customization and scalability in production lines further accentuates the necessity for adaptable and reliable feeding solutions, thus fueling the growth of the market.

Moreover, the opportunities within the industrial part feeders market are vast, especially in the field of integrating smart technologies, such as IoT and AI, to revolutionize how these systems operate. With the incorporation of these technologies, industrial part feeders can become more intelligent, offering predictive maintenance, real-time monitoring, and operation adjustments based on analytical feedback. This not only enhances operational efficiency but also extends the lifespan of the feeders, leading to cost savings over time. Emerging markets, with their rapid industrialization, also present lucrative prospects for the expansion of the industrial part feeders market, catering to the increasing demand for automation solutions.

Restraints in the industrial part feeders market arise from the initial high costs of installation and maintenance of advanced feeding systems. Smaller enterprises might find it challenging to justify the upfront investment, despite the long-term efficiencies these systems introduce. Furthermore, the lack of skilled personnel to operate and maintain these sophisticated devices can be a significant hindrance, particularly in regions where technical education and training are not adequately emphasized. Environmental concerns and regulatory standards also pose challenges, compelling companies to invest in eco-friendly and compliant materials and technologies, potentially inflating costs and complicating operations..

Type Insights

“The demand for belt feeders type segment is expected to grow at a significant CAGR of 6.2% from 2024 to 2030 in terms of revenue”

The vibratory feeders type segment led the market and accounted for 43.5% of the global market revenue share in 2023. Vibratory feeders are experiencing a robust demand across various industries due to their precise control and efficiency in material handling. Particularly popular in sectors such as pharmaceuticals, electronics, and food processing, these feeders are prized for their gentle handling of delicate materials, contributing to minimal product damage during processing. Their adaptability to different materials and capacity to handle a wide range of product sizes and shapes further enhance their appeal. In addition, advancements in technology have led to smarter, more energy-efficient vibratory feeders that can integrate seamlessly with automated systems, making them even more indispensable in modern manufacturing setups.

Belt feeders, on the other hand, are witnessing a surge in demand within heavy-duty applications, notably in mining and bulk material handling industries. Their capability to handle large volumes of materials, combined with their durability and reliability, makes them a critical component in the efficient operation of these sectors. Belt feeders offer the advantage of a controlled and continuous feed to processing plants, improving the overall operational flow. Moreover, with the focus on environmental sustainability and safety, innovations in belt feeder designs are geared towards reducing energy consumption, lowering dust emissions, and enhancing worker safety, further driving their demand in the market.

Application Insights

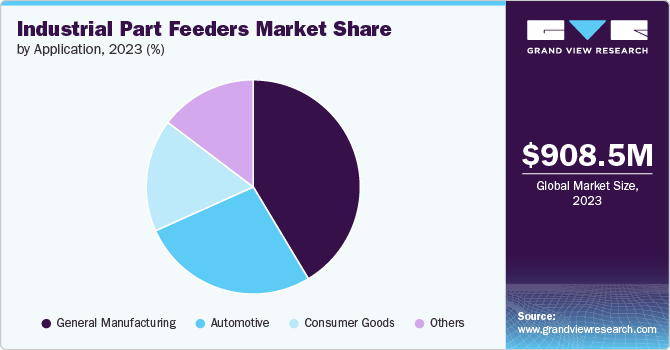

“The demand for consumer goods application segment is expected to grow at a significant CAGR of 6.9% from 2024 to 2030 in terms of revenue”

The general manufacturing application segment led the market and accounted for 41.4% of the global market revenue share in 2023. The demand for industrial part feeders in general manufacturing has seen a notable increase driven by the growing emphasis on automation and efficiency within the manufacturing sector. These devices are essential for efficiently orienting and feeding various parts into assembly and processing lines, thereby enhancing productivity and minimizing manual labor costs. The surge in demand is also fueled by the diverse applications of part feeders across various industries such as automotive, electronics, pharmaceuticals, and consumer goods.

In the field of consumer goods manufacturing, the demand for industrial part feeders has been experiencing a marked increase, a trend that can be attributed to the sector's relentless pursuit of operational efficiency and scalability. These specialized devices play a pivotal role in automating the assembly process, ensuring precise and consistent feeding of components such as electronics, packaging materials, and other small parts crucial for the production of consumer products. As the industry faces growing pressures to boost productivity, reduce waste, and accommodate a wider variety of products due to changing consumer preferences, the versatility and efficiency offered by part feeders become increasingly valuable. Moreover, the advent of smart manufacturing practices and the integration of IoT technology into production lines have further elevated the importance of these devices, making them essential for firms looking to stay competitive in the fast-paced consumer goods market.

Regional Insights

“India to witness fastest market growth at 7.3% CAGR”

In India, industrial part feeders play a crucial role in the diverse industries, ranging from food & beverage, pharmaceuticals, mining among others. The burgeoning growth of the pharmaceutical industry is a key driver behind the soaring demand in the industrial part feeders market. This growth can be attributed to the escalating need for precision and efficiency in the manufacturing processes of pharmaceutical products. Industrial feeders, which are crucial for the accurate feeding of materials into production lines, play an instrumental role in ensuring the consistency and quality of these products. As the pharmaceutical sector continues its expansion, fueled by increasing investments in R&D and an uptick in the prevalence of chronic diseases, the reliance on these feeders to maintain high standards of production is more significant than ever. This trend is expected to propel further advancements in feeder technology, catering to the specific needs of pharmaceutical manufacturing and reinforcing the symbiotic relationship between these industries.

Asia Pacific Industrial Part Feeders Market Trends

In the Asia Pacific region, the demand for industrial part feeders is driven by rapid industrialization and the expansion of manufacturing hubs in countries like China, Japan, and South Korea. These feeders are integral to consumer goods, pharmaceuticals, and food processing industries, providing precise material handling solutions that ensure efficiency and productivity. The region’s focus on automation and smart manufacturing practices is further boosting the adoption of sophisticated feeding systems, marking a shift towards more reliable and efficient production processes.

Europe Industrial Part Feeders Market Trends

Europe's approach to industrial part feeders emphasizes sustainability and innovation, with a strong focus on reducing environmental impact and enhancing energy efficiency. European manufacturers are integrating smart and automated feeding systems that can adapt to different materials and recycling processes, important in industries such as general manufacturing, automotive, and consumer goods. This technological advancement supports the continent’s commitment to the circular economy and sustainable industrial practices, maintaining its position at the forefront of industrial innovation.

North America Industrial Part Feeders Market Trends

In North America, the industrial feeder market is characterized by a strong demand for high-tech, adaptable solutions, catering to a wide range of industries including aerospace, food and beverage, and chemicals. The push for digitization and the Industrial Internet of Things (IIoT) integration in manufacturing processes has led to the development of more sophisticated, data-driven feeding systems. These systems not only improve operational efficiency but also offer enhanced safety and monitoring capabilities, aligning with the region’s focus on safe, efficient, and innovative manufacturing environments.

Key Industrial Part Feeders Company Insights

Some of the key players operating in the market include Meyer Industries, Inc., Syntron Material Handling, AViTEQ, Acrison, Inc., Merrick Industries, Inc., among others.

-

Meyer Industries, Inc. is a premier name in the manufacturing of bulk material handling and food processing equipment. Meyer Industries, known for its innovative solutions, specializes in a wide range of products from vibratory conveyors and bucket elevators to mix-blend systems and more. The company prides itself on delivering high-quality, custom-engineered systems that cater to the specific needs of its clients across various industries, including food processing, pharmaceuticals, and chemicals. Meyer Industries combines state-of-the-art technology with practical design to provide systems that enhance efficiency and productivity for its customers.

-

Syntron Material Handling stands out as a global leader in material handling solutions and manufacturing of conveying and vibratory equipment. The company's rich history and extensive experience have established it as a trusted provider of high-quality feeders, screens, and conveyors. Syntron Material Handling is dedicated to improving the productivity and efficiency of its customers’ operations through innovative designs and technology. The company serves a diverse range of industries, including mining, aggregates, and food processing, offering solutions that are tailored to meet the unique requirements of each sector.

Acrison, Inc., and Merrick Industries, Inc.are some of the emerging market participants in the industrial part feeders market.

-

Merrick Industries, Inc. has been a key player in the design and manufacture of material handling equipment and systems for over 100 years. Specializing in weighing, feeding, and conveying solutions, Merrick Industries brings a wealth of experience and expertise to its work. The company is known for its high-quality gravimetric and volumetric feeders, belt scales, flow meters, and related control systems, tailored to the specific needs of industries like power generation, cement manufacturing, and pet food production. Merrick's dedication to innovation and customer service has solidified its position as a provider of dependable, performance-driven solutions.

-

Acrison, Inc. has established itself as a pioneering figure in the development and manufacturing of dry solids metering and handling technologies. With a focus on precision feeding systems, Acrison has garnered an international reputation for its innovative, high-quality equipment designed to meet the specific requirements of its customers. The company's product range includes volumetric and gravimetric feeders, continuous blenders, and bin dischargers, among others. Acrison is committed to excellence, offering solutions that enhance accuracy, reliability, and operational efficiency in industries such as water and wastewater treatment, chemical processing, and food manufacturing.

Key Industrial Part Feeders Companies:

The following are the leading companies in the industrial part feeders market. These companies collectively hold the largest market share and dictate industry trends.

- Meyer Industries, Inc.

- Syntron Material Handling

- AViTEQ

- Acrison, Inc.

- Merrick Industries, Inc.

- JÖST GmbH + Co. KG

- Coperion K-Tron

- Thayer Scale

- Schenck Process

- FMC Technologies

- Carrier Vibrating Equipment, Inc.

- Eriez Manufacturing Co.

- Graco

- Weber Schraubautomaten GmbH

- Fortville Feeders

Recent Developments

-

In January 2024, Thayer Scale is introducing the Model MSV feeder. This innovative, compact device is a mass-counterbalanced gravimetric feeder designed for high precision. It ensures responsive and accurate control of feed rates, specifically tailored for free-flowing pellets and granules, all within a smaller-sized package.

-

In March 2022, The Cleveland Vibrator Co. acquired Fastfeed Corporation. The company specializes in creating automation solutions for the alignment, feeding, and handling of parts. The company addresses specific customer challenges through its offerings, which range from vibratory feeders to comprehensive turnkey solutions such as pick-and-place, dial assembly, robotic, and vision systems.

Industrial Part Feeders Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 958.7 million

Revenue forecast in 2030

USD 1.39 billion

Growth rate

CAGR of 6.4% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD /billion/million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company market position analysis, competitive landscape, growth factors, and trends

Segments covered

Type, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country Scope

U.S.; Canada; Mexico; Germany; France; Italy; UK; Spain; China; Japan; India; South Korea; Australia; Brazil; Argentina; South Africa; Saudi Arabia; UAE

Key companies profiled

Meyer Industries, Inc.; Syntron Material Handling; AViTEQ; Acrison, Inc.; Merrick Industries, Inc.; JÖST GmbH + Co. KG; Coperion K-Tron; Thayer Scale; Schenck Process; FMC Technologies; Carrier Vibrating Equipment, Inc.; Eriez Manufacturing Co.; Graco; Weber Schraubautomaten GmbH; Fortville Feeders

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Industrial Part Feeders Market Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis on the industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the industrial part feeders market on the basis of type, application, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Vibratory Feeders

-

Belt Feeders

-

Rotary Feeders

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

General Manufacturing

-

Automotive

-

Consumer Goods

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global industrial part feeders market size was estimated at USD 908.5 million in 2023 and is expected to reach USD 958.7 million in 2024.

b. The global industrial part feeders market, in terms of revenue, is expected to grow at a compound annual growth rate of 6.4% from 2024 to 2030 to reach USD 1.39 billion by 2030.

b. The vibratory feeders type segment led the market and accounted for 43.5% of the global market revenue share in 2023. Vibratory feeders are experiencing a robust demand across various industries due to their precise control and efficiency in material handling.

b. Some of the key players operating in the industrial part feeders market include Meyer Industries, Inc., Syntron Material Handling, AViTEQ, Acrison, Inc., Merrick Industries, Inc., JÖST GmbH + Co. KG, Coperion K-Tron, Thayer Scale, Schenck Process, FMC Technologies, Carrier Vibrating Equipment, Inc., Eriez Manufacturing Co., Graco, Weber Schraubautomaten GmbH, Fortville Feeders.

b. The demand for industrial part feeders has seen a notable increase across various industries such as food & beverage, and pharmaceutical as these machines are essential for automating the feeding process.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."