Industrial Oil Water Separators Market Size, Share & Trends Analysis Report By Type (Above Ground OWS, Below Ground OWS), By End-use (Oil & Gas, Chemical), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-376-3

- Number of Report Pages: 152

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

Market Size & Trends

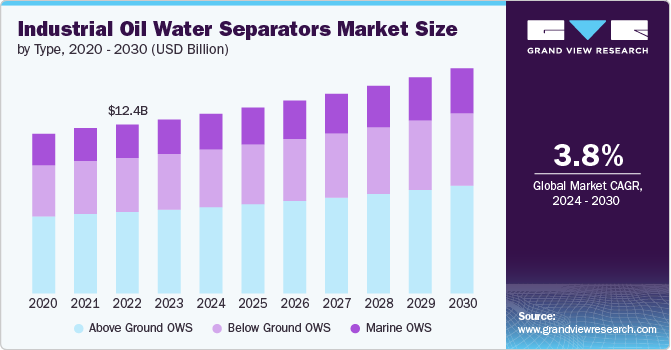

The global industrial oil water separators market size was estimated at USD 12.81 billion in 2023 and is projected to grow at a CAGR of 3.8% from 2024 to 2030. The market is witnessing substantial growth due to increasing environmental regulations and the rising demand for wastewater treatment in industries such as oil & gas, marine, and manufacturing. Moreover, innovations such as the development of compact, high-capacity units that can handle larger volumes of fluid while occupying less space are gaining traction. In addition, the adoption of automated systems for real-time monitoring and control of the separation process is on the rise, enhancing operational efficiency and compliance with environmental standards.

Market trends indicate a shift towards more sustainable and energy-efficient oil-water separation solutions. As industries worldwide strive to minimize their environmental impact, the demand for separators that can effectively treat and recycle wastewater is increasing. This is particularly evident in regions with stringent environmental regulations and those facing water scarcity challenges. The trend towards sustainability is also driving the adoption of materials and processes that contribute to the circular economy, with companies investing in research and development to explore innovative oil-water separation technologies that offer lower energy consumption and reduced carbon footprint.

Drivers, Opportunities & Restraints

The market is driven by the increasing need to treat wastewater and meet environmental regulations. Industries such as oil & gas, marine, and manufacturing generate significant quantities of oily wastewater, which must be treated before discharge or reuse. In addition, the growing focus on water recycling and reuse in industrial sectors to ensure sustainable practices also propels the demand for efficient oil-water separators.

One of the main challenges facing the global market is the high cost associated with the purchase and maintenance of these systems. This can be particularly prohibitive for small and medium enterprises that operate on tight budgets. Moreover, the technical complexity of oil-water separators and the need for skilled personnel to operate and maintain these systems pose additional barriers to adoption. For example, in regions with a lack of skilled labor or where the technology is not readily accessible, companies might hesitate to invest in these systems.

Innovations aimed at improving efficiency, reducing costs, and minimizing the environmental footprint of these systems can increase their attractiveness to potential users. For instance, the development of compact, energy-efficient oil-water separators that can be easily integrated into existing industrial processes can significantly expand the market reach. Furthermore, the rising industrialization in emerging economies, coupled with tightening environmental regulations worldwide, is expected to open new avenues for growth. For instance, countries such as China and India are rapidly industrializing and implementing stringent water pollution control norms, which could drive demand for advanced oil-water separation solutions.

Type Insights

“The demand for marine OWS type segment is expected to grow at a significant CAGR of 4.0% from 2024 to 2030 in terms of revenue”

Based on type, the above ground OWS segment led the market with the revenue share of 48.2% in 2023. Industries, including oil and gas, power generation, and manufacturing, have seen a steady demand for effective water treatment solutions to comply with local and international wastewater discharge standards. The necessity to prevent oil-contaminated runoff from reaching natural water bodies has propelled the development and implementation of sophisticated above-ground OWS technologies. These systems are designed to remove oil and grease from water before discharge or recycling, helping industries in water-scarce regions to reuse water and thereby promoting sustainability.

The demand for marine OWS has been on the rise, driven by stringent environmental regulations and the increasing awareness of marine pollution's dire consequences. Shipping companies and operators of marine vessels are now more than ever invested in ensuring that their operations meet the International Maritime Organization (IMO) guidelines, especially the MARPOL Annex I regulations. These regulations strictly limit the oil content in the water discharged into the sea. With the global maritime sector growing, especially in regions such as Asia-Pacific and the Middle East, the demand for efficient and reliable marine OWS systems is witnessing a significant uptick.

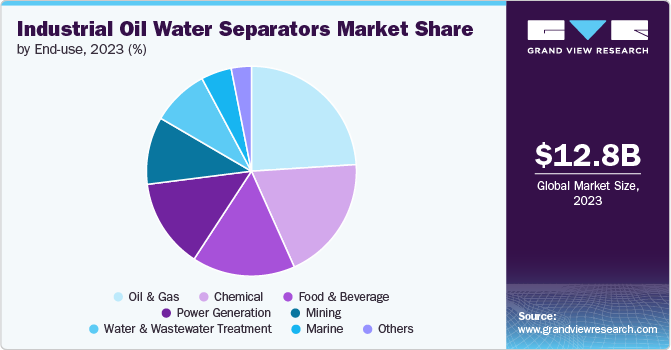

End-use Insights

“The demand for marine end segment is expected to grow at a significant CAGR of 5.7% from 2024 to 2030 in terms of revenue”

Based on end-use, the oil & gas segment led the market with the revenue share of 31.6% in 2023. Industrial oil water separators are crucial components in the oil & gas and marine industries, serving to mitigate environmental impacts while adhering to regulatory standards. For the oil & gas industry, these separators are essential in treating wastewater that contains oil and suspended solids, ensuring that the water can be safely discharged or reused within operations. An example of their application in this industry includes the treatment of produced water, a byproduct of oil extraction, where separators efficiently remove oil droplets to meet environmental discharge criteria or prepare the water for reuse in injection processes.

Similarly, in the marine industry, oil water separators play a vital role in preventing oil pollution at sea. Ships and vessels are equipped with these systems to treat bilge water—the water that accumulates in the lowest part of the ship, which often contains oil, grease, and other contaminants—before it is discharged. For instance, large cargo ships use sophisticated separators that can handle high volumes of bilge water, ensuring compliance with international regulations such as the International Convention for the Prevention of Pollution from Ships (MARPOL), which mandates that oil content in discharged water must be below a certain limit to prevent marine pollution. Through these applications, industrial oil water separators demonstrate their essential role in promoting sustainable practices in both the oil & gas and marine end use industries.

Regional Insights

“U.S. to witness fastest market growth at 3.7% CAGR”

North America dominated the industrial oil water separators market with the revenue share of 32.36% in 2023. North America market is driven by the stringent environmental regulations imposed by governmental agencies such as the EPA. Companies such as Mercer International and Parkson Corporation are at the forefront, offering innovative solutions that cater to these needs, emphasizing the reduction of hydrocarbon levels in discharged water.

U.S. Industrial Oil Water Separators Market Trends

The industrial oil water separators market in U.S. is estimated to grow at a significant CAGR of 3.7% over the forecast period. The U.S., a significant player in the North American market, has seen a burgeoning demand attributed to both the stringent environmental regulations enforced by the Environmental Protection Agency (EPA) and the booming shale oil and gas sector. The Clean Water Act, in particular, necessitates industries to deploy mechanisms like oil water separators to prevent oil discharge into navigable waters. Additionally, sectors such as chemical manufacturing, oil refining, and metalworking all contribute to the rising demand within the country.

Europe Industrial Oil Water Separators Market Trends

The industrial oil water separators market inEurope focus is on sustainability and energy efficiency, with a strong push for systems that not only separate oil from water but also recover usable oil, reducing waste and potentially lowering operational costs. The market here is seeing a rise in the adoption of coalescing plate separator technology, which is known for its high efficiency in oil recovery. Companies such as Sulzer Ltd, and Freytech are leading this trend, providing systems that are tailored to meet the stringent environmental standards set by the European Union.

Asia Pacific Industrial Oil Water Separators Market Trends

The industrial oil water separators market inAsia Pacific is experiencing rapid industrial growth, leading to an increased demand for cost-effective and reliable oil water separators. In this region, the trend is towards adopting systems that are easy to maintain and operate, which offer durability and resistance to corrosion. Market players like Kanagawa Kiki Kogyo and Megator are capitalizing on this trend, offering solutions that cater to the robust industrial expansion, particularly in countries like China and India.

Key Industrial Oil Water Separators Company Insights

Some of the key players operating in the market include Donaldson Company, Inc., GEA, Siemens AG among others.

-

Donaldson Company, Inc. operates through two business segments - Industrial Products and Engine Products. The company offers on-road, off-road, aerospace, and aftermarket services through its Engine Products segment. It further caters to gas turbine systems, industrial filtration solutions, and special applications through its Industrial Products segment. As of 2022, the company’s segmental revenue share for the Industrial Products segment and Engine Products segment stood at 30% and 70% respectively. It caters to a wide range of industries namely, aerospace, automotive, agriculture, biotechnology, construction, defense, energy, food & beverage, forestry, industrial process, manufacturing, and marine, among others

-

GEA Group AG is globally recognized for its excellence in the engineering and manufacturing of machinery and plants for the food, beverage, and pharmaceutical sectors. Founded in 1881 and headquartered in Düsseldorf, Germany, GEA has established itself as an innovation leader, dedicated to providing sustainable and efficient process technology solutions. Their expansive product portfolio includes separators, heat exchangers, pumps, valves, and processing lines designed to enhance performance and optimize production processes. With a strong emphasis on research and development, GEA continues to pioneer technologies aimed at reducing energy consumption and minimizing environmental impact, thereby supporting clients in achieving their sustainability goals

Compass Water Solutions and Recovered Energy are some of the emerging market participants in the global market.

-

Compass Water Solutions is a leading company in the water treatment industry, specializing in the design and manufacture of innovative water purification and oil removal technologies. With a global presence, Compass Water Solutions provides a range of products and services to meet the needs of various sectors, including marine, industrial, and offshore. The company is committed to sustainability and environmental protection, offering solutions that aim to reduce water consumption and waste, enhance efficiency, and minimize environmental impact

-

Recovered Energy is a dynamic company focused on providing energy recovery solutions and services. They are dedicated to the development and implementation of technologies that capture and repurpose wasted energy from various industrial processes. Recovered Energy aims to improve energy efficiency, reduce greenhouse gas emissions, and offer cost-effective solutions to its clients. By harnessing the potential of unused energy, the company plays a pivotal role in promoting sustainable practices and supporting the transition towards cleaner and more sustainable energy systems

Key Industrial Oil Water Separators Companies:

The following are the leading companies in the industrial oil water separators market. These companies collectively hold the largest market share and dictate industry trends.

- Alfa Laval

- Donaldson

- Clarcor

- Andritz

- WesTech Engineering

- Wartsila

- Compass Water Solutions

- Filtration

- Parker-Hannifin

- Recovered Energy

- Containment Solutions

- ZCL

- GEA

- Wilbur Eagle

- Siemens AG

Recent Developments

- In April 2024, The International Association of Plumbing and Mechanical Officials (IAPMO) recently released a new standard, IGC 325: High-Efficiency Oil/Water Separators, introducing a performance-based criterion for the industry. This standard defines High-Efficiency Oil/Water Separators as devices that can remove at least 90% of hydrocarbons from wastewater in drainage systems. For a separator to be deemed 90% efficient, it must undergo testing and obtain certification according to IAPMO IGC 325

Industrial Oil Water Separators Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 13.21 billion |

|

Revenue forecast in 2030 |

USD 16.48 billion |

|

Growth rate |

CAGR of 3.8% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company market position analysis, competitive landscape, growth factors, and trends |

|

Segments covered |

Type, end-use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country Scope |

U.S.; Canada; Mexico; Germany; Russia; UK; France; Italy; Japan; China; India; Australia; South Korea; Brazil; Argentina; Saudi Arabia; South Africa; UAE; Iran |

|

Key companies profiled |

Alfa Laval; Donaldson; Clarcor; Andritz; WesTech Engineering; Wartsila; Compass Water Solutions; Filtration; Parker-Hannifin; Recovered Energy; Containment Solutions; ZCL; GEA; Wilbur Eagle; Siemens AG |

|

Customization scope |

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Industrial Oil Water Separators Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis on the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global industrial oil water separators market report based on type, end-use, and region:

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Above Ground OWS

-

Below Ground OWS

-

Marine OWS

-

-

End-use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Oil & Gas

-

Chemical

-

Food & Beverage

-

Power Generation

-

Water & Wastewater Treatment

-

Marine

-

Mining

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

Russia

-

UK

-

France

-

Italy

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Iran

-

-

Frequently Asked Questions About This Report

b. The global industrial oil water separators market size was estimated at USD 12.81 billion in 2023 and is expected to reach USD 13.21 billion in 2024.

b. The global industrial oil water separators market, in terms of revenue, is expected to grow at a compound annual growth rate of 3.8% from 2024 to 2030 to reach USD 16.48 billion by 2030.

b. The oil & gas end-use segment led the market and accounted for 31.6% of the global revenue share in 2023. Industrial oil water separators are crucial components in the oil & gas and marine industries, serving to mitigate environmental impacts while adhering to regulatory standards. For the oil & gas industry, these separators are essential in treating wastewater that contains oil and suspended solids, ensuring that the water can be safely discharged or reused within operations.

b. Some of the key players operating in the industrial oil water separators market include Alfa Laval, Donaldson, Clarcor, Andritz, WesTech Engineering, Wartsila, Compass Water Solutions, Filtration, Parker-Hannifin, Recovered Energy, Containment Solutions, ZCL, GEA, Wilbur Eagle, Siemens AG.

b. The industrial oil-water separator market is witnessing substantial growth due to increasing environmental regulations and the rising demand for wastewater treatment in industries such as oil & gas, marine, and manufacturing. Moreover, innovations such as the development of compact, high-capacity units that can handle larger volumes of fluid while occupying less space are gaining traction.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."