- Home

- »

- Biotechnology

- »

-

Industrial Microbiology Testing Services Market Report, 2030GVR Report cover

![Industrial Microbiology Testing Services Market Size, Share & Trends Report]()

Industrial Microbiology Testing Services Market (2024 - 2030) Size, Share & Trends Analysis Report By Test Type (Sterility Testing, Microbial Limits Testing), By End-use (Agricultural, Food & Beverages), By Region, And Segment Forecasts

- Report ID: GVR-4-86040-108-4

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

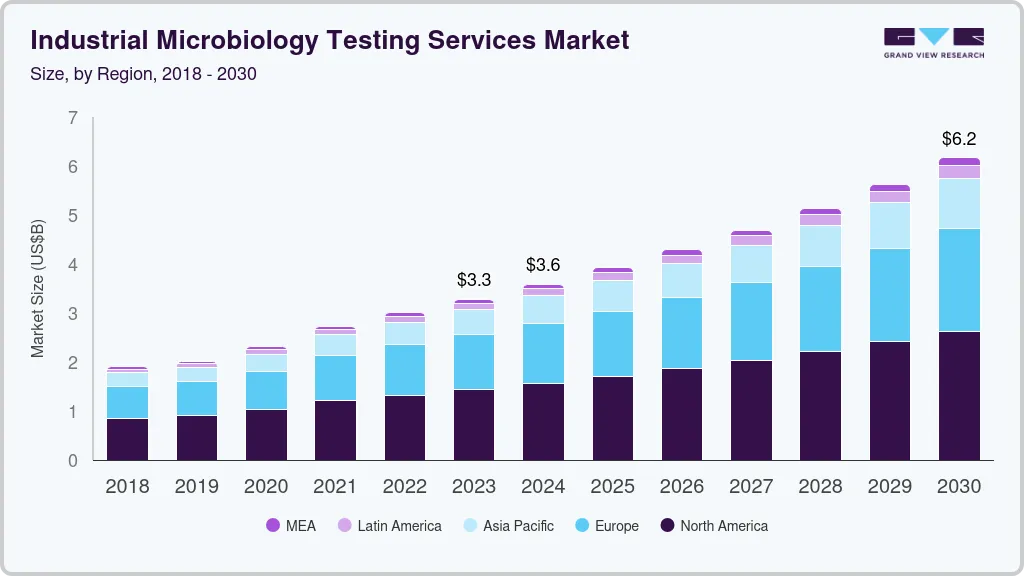

The global industrial microbiology testing services market size was estimated at USD 3.28 billion in 2023 and is expected to reach USD 6.17 billion by 2030, growing at a compound annual growth rate (CAGR) of 9.4% from 2024 to 2030. The rapid spread of infectious diseases across the globe, including the novel coronavirus disease and its emerging variants, increasing utilization of advanced industrial microbiology techniques for pharmaceutical and food & beverage manufacturing, and rising public concerns about the efficacy and safety of pharmaceutical and food & beverage products are the main drivers of the global market. The advancement of molecular biology and genetic technologies has had a significant impact on microbiological applications for the creation of novel diagnostic procedures.

The COVID-19 pandemic has also boosted business expansion. For example, in April 2021, researchers from Universitat Pompeu Fabra, Universitat de Barcelona, & Hospital Clinic presented a review of the microbiological diagnosis approach for COVID-19. Similarly, the American Society for Microbiology developed a verification process to help labs do efficient and effective verification for commercial COVID-19 molecular assays. Hence, propelling the market growth. Industries including pharmaceutical, food & beverage production enterprises in particular look to reduce the risk of product contamination due to the serious implications along with strict regulatory policies.

As a result, it is expected that the market size will increase over the coming years due to stringent test requirements by regulatory bodies to uphold the product's integrity and quality control. Moreover, the growing acceptance of these testing techniques in the food & beverage industry is projected to drive growth during the forecasted period. It is projected that demand will rise in the coming years as a result of the increased focus on industrial safety, food safety, and cleanliness. In addition, an increase in public-private funds for targeted research initiatives, rising awareness about the advantages of microbial tests, and an increase in the global geriatric population will all contribute to more lucrative prospects for market participants during the forecast period.

In the coming years, the growth of the market will be further accelerated by factors, such as the rising number of strategic alliances, expansion of hospitals & laboratories, availability of low-cost clinical microbiology testing products, and rising per capita health care spending. For instance, NIST held an online conference to introduce the Rapid Microbial Testing Methods (RMTM) Consortium on September 17, 2020. The goal of the RMTM Consortium is to deal with the demand for measures and regulations to boost faith in the application of quick tests for microbial contamination in products for advanced therapy and regenerative medicine.

Test Type Insights

On the basis of test types, the global industry has been further categorized into sterility testing, microbial limits testing, bio-burden testing, water testing, air monitoring tests, and others. The sterility testing segment led the market in 2022 and accounted for the largest share of 31.33% of the overall revenue. Factors, such as increased research & development in life sciences and a rise in the number of medicine launches, are driving the market expansion. Furthermore, the rising global demand for sterilized products, as well as a few potential safety issues associated with the products, which usually arise from manufacturing processes that involve complicated biological and structural characteristics, are expected to drive market growth over the forecast period.

On the other hand, the microbial limits testing segment is estimated to witness the fastest growth rate of 12.70% during the forecast period. The rising prevalence of chronic & infectious diseases, together with the growing demand for packaged food & beverage products, increases the demand for microbiological limit testing services to ensure product safety. This is expected to drive the expansion of the overall market during the forecast period.

End-use Insights

The pharmaceutical & biotechnology end-use segment dominated the global industry in 2022 and accounted for the largest share of 29.93% of the overall revenue. In the pharmaceutical and biotechnology industries, quality must be maintained during the manufacturing process. These requirements are upheld by a variety of means, one of which is the environmental monitoring procedure, which determines the quality & sterility of the controlled manufacturing environment.

On the other hand, the food & beverage end-use segment is estimated to witness the fastest growth rate of 11.54% during the forecast period. The rise in cases of food-borne illnesses, growing consumer awareness about food safety, the implementation of strict food safety standards, and rising customer demand for convenience & packaged food products are all driving the market expansion. For instance, according to the CDC estimates, each year in the U.S., 48 million people become ill, 128,000 receive medical treatment, and 3,000 die as a result of foodborne infections.

Regional Insights

North America accounted for the largest share of 44.01% of the overall revenue in 2022. The presence of major companies from industries including pharma and biotechnology, as well as food and drinks, is the primary indicator of the largest market share. In addition, present competitors are undertaking initiatives to develop industrial testing capabilities in a variety of applications. Perfectus Biomed Group, a CRO established in the U.S. and the UK, was bought by NAMSA in October 2022. This acquisition intends to improve customized microbiological services while also establishing a global footprint through 20 lab locations in the U.S., Europe, and Asia.

The Asia Pacific regional market is expected to experience the fastest growth rate of 10.62% from 2023 to 2030 due to improved healthcare infrastructure, improving economic factors, an increase in government efforts to raise awareness, as well as favorable regulatory policies that will boost the rate of adoption for industrial microbiology testing services. Furthermore, the region's increased need for high-quality healthcare has a favorable impact on industry growth.

Key Companies & Market Share Insights

The continuous demand for industrial microbiology testing services by multiple applications has created numerous market opportunities for major players to capitalize on. For instance, in June 2023, The Colorado Department of Public Health & Environment (CDPHE) approved Eurofins Microbiology Laboratories, Inc. of Lafayette, Colorado to execute microbial hemp testing to ensure compliance for industrial hemp & hemp-derived products. Some of the prominent players in the global industrial microbiology testing services market include:

-

Charles River Laboratories

-

Intertek Group Plc

-

Spectro Analytical Labs Pvt. Ltd.

-

Pacelabs

-

Biotech Testing Services

-

Merck KGaA

-

TÜV SÜD

-

Precise Analytics Lab

-

Eurofins Scientific

-

Biocare Research (India) Pvt. Ltd.

-

STERIS

Industrial Microbiology Testing Services Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 3.58 billion

Revenue Forecast in 2030

USD 6.17 billion

Growth rate

CAGR of 9.4% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report Coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments Covered

Test type, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Thailand; Brazil; Mexico, Argentina; South Africa; Saudi Arabia, UAE; Kuwait

Key companies profiled

Charles River Laboratories; Intertek Group Plc; Spectro Analytical Labs Pvt. Ltd.; Pacelabs; Biotech Testing Services; Merck KGaA; TÜV SÜD; Precise Analytics Lab; Eurofins Scientific; Biocare Research (India) Pvt. Ltd.; STERIS

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Industrial Microbiology Testing Services Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View research has segmented the industrial microbiology testing services market report based on test type, end-use, and region:

-

Test Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Sterility Testing

-

Microbial Limits Testing

-

Bio-burden Testing

-

Water Testing

-

Air Monitoring Tests

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Food & Beverages

-

Pharmaceutical & Biotechnology

-

Agricultural

-

Environmental

-

Cosmetic and Personal Care

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global industrial microbiology testing services market size was estimated at USD 3.00 billion in 2022 and is expected to reach USD 3.28 billion in 2023.

b. The global industrial microbiology testing services market is expected to grow at a compound annual growth rate of 9.43% from 2023 to 2030 to reach USD 6.17 billion by 2030.

b. On the basis of test type, the sterility testing segment accounted for the largest share in 2022. The large share is attributed to the increase in demand for sterilized products among various industry sectors.

b. A few of the key market players include Charles River Laboratories, Intertek Group plc, Spectro Analytical Labs Pvt. Limited, Pacelabs, Biotech Testing Services, Merck KGaA, TÜV SÜD, Precise Analytics Lab, Eurofins Scientific, Biocare Research (India) Pvt. Ltd., STERIS.

b. The rapid spread of infectious diseases across the globe, including the novel coronavirus disease and its emerging variants, increasing utilization of advanced industrial microbiology techniques for pharmaceutical and food & beverage manufacturing, and rising public concerns about the efficacy and safety of pharmaceutical and food & beverage products are the main drivers of the global industrial microbiology testing services market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.