- Home

- »

- Advanced Interior Materials

- »

-

Industrial Fasteners Market Size, Industry Report, 2033GVR Report cover

![Industrial Fasteners Market Size, Share & Trends Report]()

Industrial Fasteners Market (2026 - 2033) Size, Share & Trends Analysis Report By Raw Material (Metal, Plastic), By Product (Externally Threaded, Internally Threaded, Non-threaded), By Application (Aerospace), By Distribution Channel (Direct, Indirect), By Type (Bolts, Screws, Nuts, Washers, Rivets) By Region, And Segment Forecasts

- Report ID: 978-1-68038-351-5

- Number of Report Pages: 68

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Industrial Fasteners Market Summary

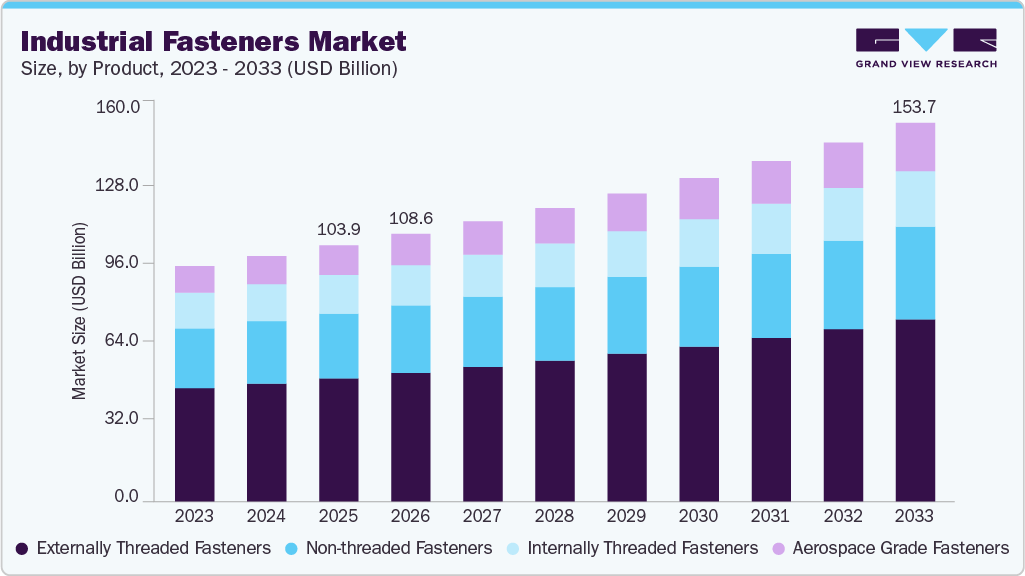

The global industrial fasteners market size was estimated at USD 103.92 billion in 2025 and is projected to reach USD 153.71 billion by 2033, growing at a CAGR of 5.1% from 2026 to 2033. The market is expected to be driven by the growing population, high investments in the construction sector, and rising demand for industrial fasteners in the automotive and aerospace sectors.

Key Market Trends & Insights

- Asia Pacific dominated the industrial fasteners market with the largest revenue share of 45.1% in 2024.

- By raw material, the plastics segment is expected to grow at the fastest CAGR of 5.8% over the forecast period.

- By product, the aerospace grade fasteners segment is expected to grow at the fastest CAGR of 6.4% over the forecast period.

- By application, the aerospace segment is expected to grow at the fastest CAGR of 6.4% over the forecast period.

- By distribution channel, the indirect segment is expected to grow at the fastest CAGR of 5.5% over the forecast period.

- By type, the rivets segment is expected to grow at the fastest CAGR of 6.1% over the forecast period.

Market Size & Forecast

- 2025 Market Size: USD 103.92 Billion

- 2033 Projected Market Size: USD 153.71 Billion

- CAGR (2026-2033): 5.1%

- Asia Pacific: Largest in 2025

Infrastructure development is one of the key parameters to consider when tracking the regional market development. The construction industry notably impacts the demand for industrial fasteners as they are extensively used in buildings, bridges, walls, and roofs. Unlike other industries, fasteners used in construction are standardized and subject to stringent quality checks. Government intervention through a regulatory framework pressurizes manufacturers to offer standardized products with superior performance characteristics. The U.S. is one of the largest fastener-importing countries in the world and is likely to witness a similar trend over the forecast period on account of high product demand in automation, aerospace, and other industrial applications. Moreover, owing to the growing demand for lightweight vehicles and aircraft, companies are shifting from standard to customized products, which in turn is positively increasing the U.S. fastener market size across these industries.

The market for industrial fasteners is characterized by intensive technological developments to produce advanced, lightweight products that find usage in automotive and other industrial applications. With the enhancement in technology, the rising demand for hybrid fasteners, which incorporate a combination of injection-molded plastic components with metal elements, is expected to drive the demand.

Increasing metal prices and the decelerating growth of these fasteners, owing to their replacement by plastic fasteners, automotive tapes, and adhesives, are expected to be key barriers for metal fastener manufacturers over the forecast period. Plastic fastener manufacturers are expected to gain an advantage owing to the rising demand for lightweight components from automotive manufacturers.

Companies engaged in the manufacturing of fasteners require significant capital investment owing to the high production volumes and stringent specifications concerning testing and labeling. Industrial fasteners, including bolts, screws, nuts, studs, and rivets, are manufactured and distributed by various participants. Companies invest significantly in R&D activities, thus resulting in dynamic market conditions.

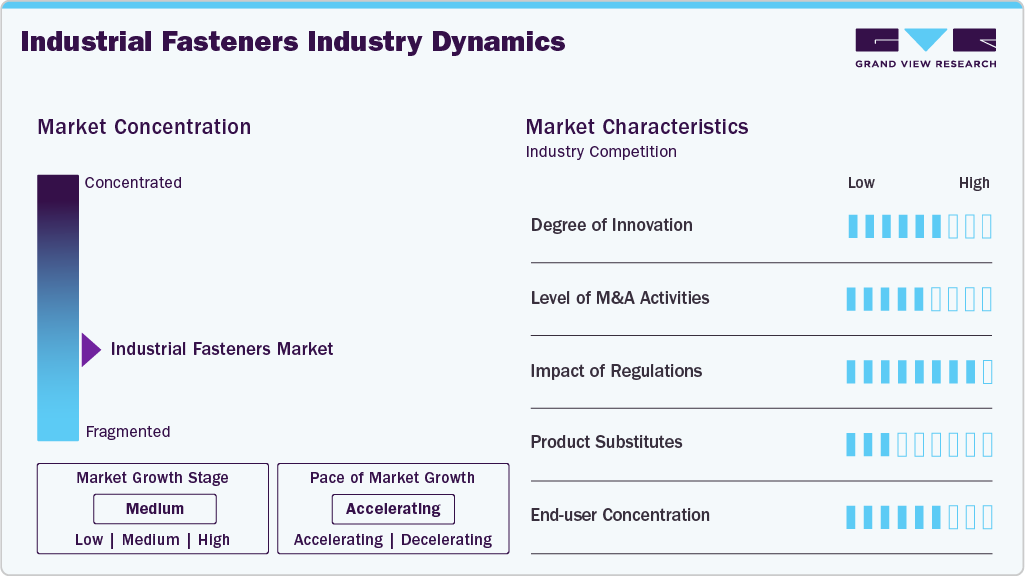

Market Concentration & Characteristics

The market growth stage is medium, and the pace of the market growth is accelerating. The industrial fasteners market is fragmented and highly competitive in nature, with various large and small-scale manufacturers in China, Taiwan, Thailand, and Japan. Significant development of commercial construction, coupled with the rising demand for green building materials in the region, has triggered market growth, improving the competition in the market.

A major challenge faced by the competitors is the fluctuation of raw material prices; hence, a high degree of backward and forward integration is likely to be observed among the major players in the market. This will further intensify the market rivalry and competition, making it difficult for emerging players to sustain in the market.

The fasteners market is characterized by intensive technological developments to produce advanced lightweight products that are found in automotive and other industrial applications. Key fastener companies in the market are majorly focusing on sourcing high-quality raw materials and simpler designs & structures that are easier to assemble.

The manufacturing of fasteners primarily includes casting, forming, machining, and thread production processes. The fasteners offered by the major manufacturers comply with the global standards, including the American Society for Testing and Materials (ASTM), American Society of Mechanical Engineers (ASME), British Standards (BS), Deutsches Institut für Normung (DIN), and Japanese Industrial Standards (JIS).

The major manufacturers in the market are observed to have long-term contracts with players from the automotive, aerospace, and electronics industries. The major fastener manufacturers offer specialty fasteners, which are custom-manufactured based on the specifications given by the end users to cater to their specific requirements. As a result, the product pricing and profit margins of these industry players are found to vary across the industry.

Raw Material Insights

Metal fasteners accounted for the largest market share of 91.0% in 2025. It includes various materials such as stainless steel, bronze, cast iron, superalloys, and titanium. The high mechanical strength is expected to be a key factor driving their growth over the forecast period.

The plastic fasteners segment is projected to grow at the fastest CAGR of 5.8% over the forecast period. The product is gaining importance in the automotive industry due to its low cost, lightweight properties, and superior chemical & corrosion resistance. These are manufactured using various raw materials, including polycarbonate, polyurethane (PUR), polyvinylchloride (PVC), polyacrylamide (PA), polystyrene (PS), polyethylene (PE), and nylon.

Products Insights

Externally threaded fasteners accounted for the largest revenue share of 48.1% in 2025. Bolts and screws are the most widely utilized type of externally threaded fasteners. Bolts hold a dominant share in the market due to their wide variety and broad application scope.

Non-threaded fasteners accounted for the second largest revenue share in 2025 and are expected to grow at a significant rate over the forecast period. The rising demand for non-threaded fasteners in the construction industry, particularly for applications such as subflooring, decking, and roofing, is expected to have a positive impact on growth over the projected period.

Aerospace grade fasteners are expected to expand at the fastest CAGR from 2026 to 2033. This fastener varies significantly as compared to ordinary commercial-grade fasteners in terms of quality, performance, raw material, price, and other technical specifications. The most commonly used aerospace nuts include fiber inserts and castle nuts.

Internally threaded fasteners accounted for a significant share of the market. Stainless steel is the most common material used for manufacturing internally threaded industrial fasteners. Brass, alloy steel, and aluminum are the other materials used to manufacture these industrial fasteners. Innovations in the design of internally threaded fasteners, which provide better performance, high impact, and vibration resistance, are expected to positively impact growth.

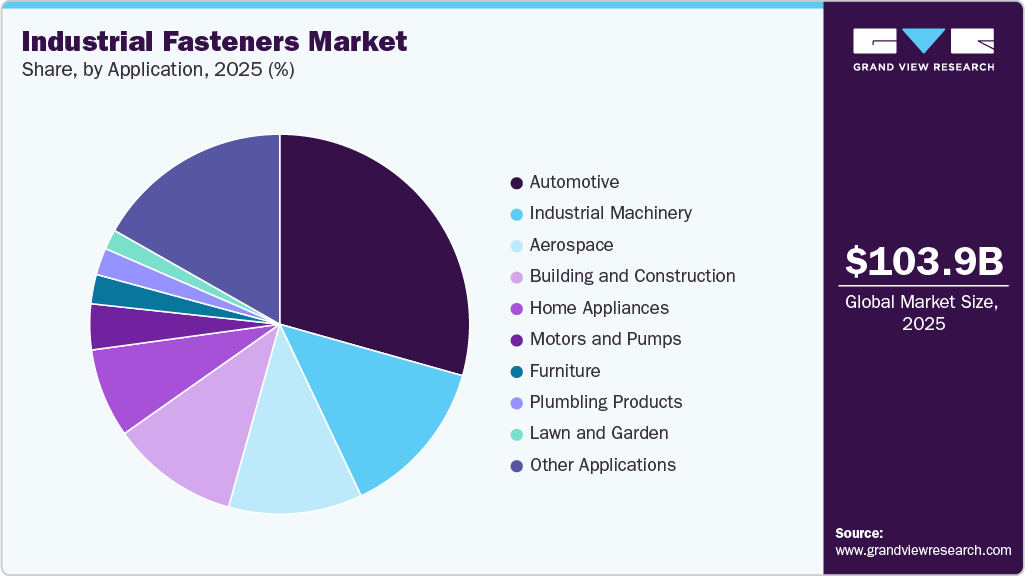

Application Insights

The automotive segment accounted for the largest revenue share in 2025. High production volumes of automotive vehicles across the Asia Pacific have been a key factor driving industry growth over the past few years. Moreover, fasteners are a crucial component of the automotive industry, available in numerous varieties, sizes, and shapes. The common fasteners used in the automotive industry include nuts, bolts, screws, rivets, studs, bits, anchors, and panel fasteners. Metal fasteners have traditionally dominated the fastener industry, and this trend is likely to continue over the projected period.

Increasing investments in commercial constructions, such as hotels, hospitals, and educational institutions, in the region are projected to have a positive impact on the building & construction industry's growth during the projected period. In addition, the rapid growth of heavy machine-driven industries, including textiles, food & beverage, and chemicals, is expected to propel the demand for industrial machinery, thus driving the demand for industrial fasteners over the coming years.

Distribution Channel Insights

Direct distribution channel dominated the market, accounting for the revenue share of 59.9% in 2025. Direct distribution involves manufacturers supplying fasteners directly to end-users, such as OEMs in automotive, aerospace, and heavy machinery industries. This channel offers cost efficiency, enhanced supply chain control, and customized options. Large industrial clients prefer direct procurement to ensure quality consistency, bulk pricing advantages, and guaranteed availability of critical fasteners for production lines and maintenance operations.

Type Insights

Bolts held the largest market share of 31.3% in 2025 due to their widespread use in structural applications, heavy machinery, and the transportation industry. They provide high-strength fastening solutions that can withstand heavy loads and vibrations, making them essential in construction and infrastructure projects. Furthermore, with advancements in material technology, corrosion-resistant and high-tensile-strength bolts are seeing increased demand, particularly in offshore and aerospace applications.

Regional Insights

The industrial fasteners industry in the Asia Pacific accounted for the largest revenue market share with 45.1% in 2025. Economic growth in the Asia Pacific has increased the need for improved public infrastructure such as roads, harbors, airports, and rail transportation networks. Furthermore, a substantial increase in mergers & acquisitions, integration activities, and site relocations has boosted industrial development in the region. This has resulted in increased construction of industrial and infrastructure activities in emerging nations such as India, Vietnam, Thailand, and Malaysia, which is expected to drive the demand for the industrial fasteners in the region.

The India industrial fasteners industry is projected to grow at a CAGR of 8.7% over the forecast period of 2026 to 2033. The country has a strong framework to provide all the necessary resources for the aerospace industry, such as R&D capabilities, engineering services, manufacturing expertise, and information technology, which is likely to fuel the growth of the aerospace industry in the country, which, in turn, is likely to drive the demand for aerospace fasteners over the projected period.

The industrial fasteners industry in China accounted for the largest revenue share of 47.3% in the region in 2025, due to the presence of favorable government policies that promote investments in the construction sector. Furthermore, factors such as population growth, rapid urbanization, and rising disposable incomes also play an important role in developing the country’s construction sector. Thus, with a rise in construction activities in the country, the industry is expected to witness growth over the forecast period.

North America Industrial Fasteners Market Trends

The industrial fasteners industry in North America comprises major fastener manufacturers, as well as distributors and suppliers, catering to both local and international consumers. Direct distribution offers advantages, including a better supply chain and a more seamless consumer experience. As a result, the distribution of plastic fasteners for building and construction activities is expected to register growth over the forecast period.

U.S. Industrial Fasteners Market Trends

The industrial fasteners industry in the U.S. is highly competitive in nature on account of the presence of several well-established players in the market. The country experiences high investments by foreign players owing to the presence of an educated and skilled workforce, diverse offerings, extensive distribution systems, and strong government support for the industry, which in turn, increases the demand for industrial fasteners in the U.S.

Europe Industrial Fasteners Market Trends

The industrial fasteners market in Europe has gained ground from the automotive industry. There is a presence of several major automotive manufacturers,, including Mercedes-Benz, Fiat, Renault, MW, Ferrari, Volkswagen, and Ford, in Europe. These major players are increasingly investing and focusing on the production of lightweight and strong vehicles. As a result, the demand for automotive fasteners in Europe is expected to grow at a faster pace.

The Germany industrial fasteners industry accounted for a revenue of USD 6.56 billion in 2025. The country is known for its electronics, machinery, and automotive industries. The automotive industry has been the largest consumer of fasteners in the country and this trend is expected to continue over the projected period.

The industrial fasteners market in Spain is driven by major industries including energy, tourism, agriculture, and manufacturing. The growth of these industries, in turn, is likely to boost commercial construction, including offices, warehouses, manufacturing facilities, hotels & restaurants, shopping malls, and supermarkets, thereby driving the demand for industrial fasteners in Spain.

The France industrial fasteners industry accounted for the revenue of a share of 11.5% in Europe in 2025, driven by long-standing favorable demographic and sociological factors, including a high birth rate and high divorce rate. An increased number of households owing to the rise in the divorce rate, increased life expectancy, and population growth driven by high birth rate & net migration are factors expected to boost residential construction, thereby bolstering the product demand.

Central & South America Industrial Fasteners Market Trends

The industrial fasteners industry in Central & South America is expected to grow a CAGR of 4.2% over the forecast period. The manufacturing process of industrial machinery practiced in Argentina is expected to grow for poultry equipment, paper industry machinery manufacturers, equipment of the textile industry, plastic and rubber manufacturers, thus increasing the use of industrial fasteners.

Middle East & Africa Industrial Fasteners Market Trends

The industrial fasteners industry in the Middle East & Africa is expected to reach USD 3.16 billion by the end of 2033. Besides, the industrial machinery manufacturing segment is expected to witness growth over the forecast period owing to an increase in oil production and rising investments from production companies. Industrial machinery is widely utilized in the production of oil in the Gulf Cooperation Council, thereby supporting the product growth.

Key Industrial Fasteners Company Insights

Some of the key players operating in the market include Illinois Tool Works, Inc., Arconic Fastening Systems and Rings, Hilti Corporation, LISI Group - Link Solutions for Industry, and Nifco Inc., among others.

-

Arconic Fastening Systems and Rings is a fastener manufacturing company, which was formerly a part of Alcoa, Inc., a U.S.-based company established in 1888, and was separated in November 2006. Arconic Fastening Systems and Rings had a presence in 20 countries, including China, Brazil, Canada, Japan, and Russia. The key brand names associated with the company are Camloc, Delron, Huck, Kaynar, K-Fast, Linread, Mairoll, Marson, Mecaero, Microdot, and North Bridge.

-

Hilti Corporation offers rotary hammer drills, diamond cutting & grinding systems, expansion & sleeve anchors, electric screwdrivers, and support brackets for piping & ductwork. The company manufactures fasteners under its anchor systems. It has a presence in over 120 countries, with its manufacturing units located in Liechtenstein, Austria, Germany, China, Hungary, Mexico, and the U.S.

Acument Global Technologies, Inc., ATF, Inc., Birmingham Fastener and Supply, Inc., SESCO Industries, Inc. are some of the emerging market participants in the market.

-

Acument Global Technologies offers fastening and assembly solutions and has a presence in over 35 countries, with 10 manufacturing facilities and several distribution facilities strategically positioned across three continents, including North America, Europe and Asia Pacific. Its product portfolio comprises three segments: engineered fastening systems, externally threaded fastening systems, and internally threaded fastening systems.

-

ATF, Inc. operates through its eight offices and nine manufacturing units located in Europe, North America, and Asia. The company’s product portfolio includes cold-formed specials, anchors, formed & rolled parts, thread-forming fasteners for metals, thread-forming fasteners for plastics, engineered fasteners for light-weighting applications, and mechanisms & assemblies’ fasteners.

Key Industrial Fasteners Companies:

The following are the leading companies in the industrial fasteners market. These companies collectively hold the largest market share and dictate industry trends.

- Illinois Tool Works, Inc.

- Arconic Fastening Systems and Rings

- Hilti Corporation

- LISI Group - Link Solutions for Industry

- Nifco Inc

- MW Industries, Inc.

- Birmingham Fastener and Supply, Inc.

- SESCO Industries, Inc.,

- Elgin Fastener Group LLC

- Slidematic

- Dokka Fasteners A S

- Manufacturing Associates, Inc.

- Eastwood Manufacturing

- Acument Global Technologies, Inc.

- ATF, Inc.

Recent Developments

-

In June 2023, B&F Fastener Supply announced the acquisition of Northern States Supply to gain market share in the U.S. industrial fasteners market. In addition, the acquisition is also expected to help the company provide high-quality products and services to various end uses such as automotive, construction, and industrial machinery.

-

In June 2023, CAMCAR announced the acquisition of Ttapdrive AS, the creator of the ttap brand. The company frequently invests in R&D activities to improve product performance, an easy assembling process, and innovate new fastener products.

Industrial Fasteners Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 108.60 billion

Revenue forecast in 2033

USD 153.71 billion

Growth rate

CAGR of 5.1% from 2026 to 2033

Base year for estimation

2025

Historical data

2021 - 2024

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Raw material, product, application, distribution channel, type, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; France; Spain; China; India; Japan; Malaysia; Indonesia; South Korea; Thailand; Brazil; Saudi Arabia

Key companies profiled

Illinois Tool Works, Inc.; Arconic Fastening Systems and Rings; Hilti Corporation; LISI Group - Link Solutions for Industry; Nifco Inc; MW Industries, Inc.; Birmingham Fastener and Supply, Inc.; SESCO Industries, Inc.; Elgin Fastener Group LLC; Slidematic; Dokka Fasteners A S; Manufacturing Associates, Inc.; Eastwood Manufacturing; Acument Global Technologies, Inc.; ATF, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Industrial Fasteners Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global industrial fasteners market report based on raw material, product, application, distribution channel, type, and region.

-

Raw Material Outlook (Revenue, USD Million, 2021 - 2033)

-

Metal fasteners

-

Plastic Fasteners

-

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Externally Threaded Fasteners

-

Internally Threaded Fasteners

-

Non-threaded Threaded Fasteners

-

Aerospace Grade Fasteners

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Automotive

-

Aerospace

-

Building & Construction

-

Industrial Machinery

-

Home appliances

-

Lawns and gardens

- Motors and pumps

-

Furniture

-

Plumbing products

-

Other Applications

-

-

Distribution Channel Outlook (Revenue, USD Million, 2021 - 2033)

-

Direct

-

Indirect

-

-

Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Bolts

-

Screws

-

Nuts

-

Washers

-

Rivets

-

Other Types

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

Spain

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Malaysia

-

Indonesia

-

Thailand

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global industrial fasteners market size was estimated at USD 103.92 billion in 2025 and is expected to reach USD 108.60 billion in 2026.

b. The industrial fasteners market is expected to grow at a compound annual growth rate of 5.1% from 2026 to 2033 to reach USD 153.71 billion by 2033.

b. Asia Pacific dominated the industrial fasteners market with a share of 45.1% in 2025 owing to high production volumes of automotive vehicles across key economies in the region.

b. Some of the key players operating in the industrial fasteners market are Illinois Tool Works, Inc., Arconic Fastening Systems and Rings, Hilti Corporation, LISI Group—Link Solutions for Industry, Nifco Inc., MW Industries, Inc., Birmingham Fastener and Supply, Inc., SESCO Industries, Inc., Elgin Fastener Group LLC, and Slidematic.

b. The key factors driving the industrial fasteners market include the rapidly developing automotive and aerospace defense sectors in developing countries.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.