- Home

- »

- Communication Services

- »

-

Industrial Communication Market Size & Share Report, 2030GVR Report cover

![Industrial Communication Market Size, Share & Trends Report]()

Industrial Communication Market (2024 - 2030) Size, Share & Trends Analysis Report By Offering (Components, Software), By Communication Protocol (Fieldbus, Wireless), By Vertical, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-483-2

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Industrial Communication Market Summary

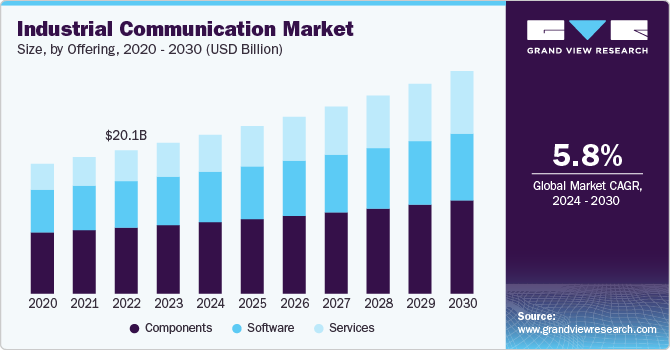

The global industrial communication market size was estimated at USD 21.15 billion in 2023 and is projected to reach USD 31.21 billion by 2030, growing at a CAGR of 5.8% from 2024 to 2030. The growing integration of the Industrial Internet of Things (IIoT) is one of the most significant trends driving the market.

Key Market Trends & Insights

- The industrial communication market in Asia Pacific dominated the global market, accounting for 35.67% in 2023.

- Based on offering, the components segment led the market, accounting for 45.5% of the global revenue in 2023.

- By communication protocol, the industrial ethernet segment accounted for the largest market revenue share in 2023.

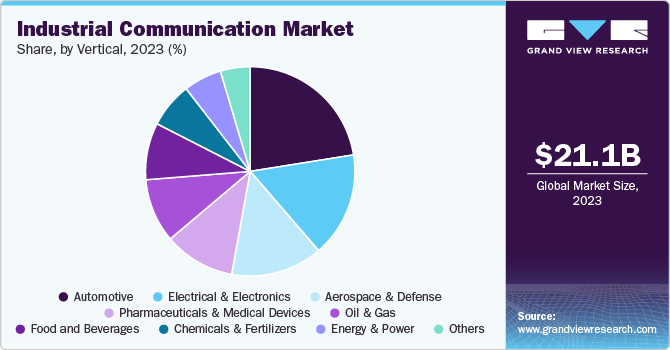

- By vertical, the automotive segment accounted for the largest market revenue share in 2023.

Market Size & Forecast

- 2023 Market Size: USD 21.15 Billion

- 2030 Projected Market Size: USD 31.21 Billion

- CAGR (2024-2030): 5.8%

- Asia Pacific: Largest market in 2023

IIoT enables seamless connectivity among machines, sensors, and control systems, facilitating real-time data analysis and decision-making. By leveraging IIoT, manufacturers can monitor equipment performance, reduce downtime through predictive maintenance, and enhance overall operational efficiency. The increasing use of smart sensors, combined with cloud computing and big data analytics, further accelerates the adoption of automation solutions across various industries, from manufacturing to energy and power.

Another major trend shaping the industrial communication industry is the shift toward Industry 4.0. This next-generation industrial revolution focuses on creating smart factories where machines communicate autonomously, and operations are highly optimized. Industry 4.0 technologies, including robotics, artificial intelligence (AI), and machine learning, are transforming industries' operations. Companies increasingly invest in automation to streamline production processes, reduce human error, and increase flexibility in responding to market demands. The rising adoption of AI-powered robots for complex tasks drives the push toward more automated and intelligent manufacturing systems.

Cybersecurity is another crucial driver in the industrial communication market, as the increasing connectivity of devices and systems exposes industries to cyber threats. As a result, there is a growing focus on integrating advanced security protocols to protect sensitive data and ensure uninterrupted industrial operations. Companies increasingly invest in secure communication frameworks and implement technologies such as blockchain and encryption to safeguard critical infrastructure against malicious attacks and vulnerabilities.

The industrial communication market also benefits from advancements in edge computing and cloud integration. Edge computing reduces the latency involved in data processing by bringing computation closer to the source, allowing for faster decision-making and real-time analytics in industrial settings. This trend is complemented by integrating cloud-based solutions, which provide scalable storage and processing capabilities and facilitate remote access to critical data. Together, edge and cloud technologies enable more flexible and efficient industrial operations, further driving the adoption of advanced communication networks.

A key trend shaping the industrial communication market is the shift toward wireless technologies, including 5G networks. While wired communication has traditionally dominated the sector due to its reliability, wireless technologies are gaining traction, offering flexibility in system architecture, lower installation costs, and enhanced scalability. The rollout of 5G networks is particularly significant, as it enables ultra-reliable, low-latency communication (URLLC) necessary for critical industrial applications such as remote monitoring, autonomous systems, and real-time process control.

Offering Insights

Based on offering, the components segment led the market, accounting for 45.5% of the global revenue in 2023. The rising demand for advanced hardware such as sensors, switches, gateways, and controllers drives significant growth as industries increasingly automate their operations. These components are the backbone of industrial communication systems, enabling real-time data exchange between machines and systems. More reliable and high-performance hardware is critical as industries adopt technologies such as IIoT and smart manufacturing. Additionally, advancements in edge computing and wireless communication technologies are pushing manufacturers to upgrade their existing systems with modern components that offer improved speed, connectivity, and durability, ensuring uninterrupted operations in harsh industrial environments.

The services segment is expected to register significant growth from 2024 to 2030. The services segment within the industrial communication market is driven by the increasing need for specialized support in managing complex communication networks. As industries embrace advanced technologies such as IoT, automation, and cloud integration, the demand for consulting, system integration, and maintenance services has grown. Companies require expert guidance to implement these technologies effectively, ensuring optimal performance and minimal downtime. Furthermore, the rise of predictive maintenance, powered by AI and machine learning, has led to a growing reliance on managed services that monitor and analyze network performance in real-time.

Communication Protocol Insights

The industrial ethernet segment accounted for the largest market revenue share in 2023. The shift toward high-speed, reliable, and scalable communication networks is a key driver of the segment's growth. Industrial Ethernet protocols, such as EtherNet/IP and PROFINET, are becoming increasingly popular due to their ability to handle large amounts of data with low latency, making them ideal for real-time industrial applications. As industries adopt smart manufacturing and IIoT technologies, the need for robust and flexible communication systems to support complex automation environments is rising. Industrial Ethernet’s capability to integrate with legacy systems and modern cloud-based platforms further enhances its adoption, particularly in industries such as automotive, energy, and electronics, where precision and efficiency are paramount.

The fieldbus segment is expected to grow significantly from 2024 to 2030. Fieldbus is important, especially in industries with established infrastructure and specific operational requirements. While Fieldbus technologies are considered legacy systems, they remain widely used in industries such as oil & gas, chemicals, and power generation due to their reliability in harsh environments and ability to function in hazardous conditions. Despite the growing popularity of Industrial Ethernet, Fieldbus protocols such as PROFIBUS and Modbus still offer cost-effective and stable communication solutions for specific applications where high-speed data transmission is not a priority.

Vertical Insights

The automotive segment accounted for the largest market revenue share in 2023. The automotive sector is experiencing significant growth in the industrial communication market, driven by the increasing complexity of manufacturing processes and the rise of connected and autonomous vehicles. Automotive manufacturers are adopting advanced communication technologies to streamline production lines, enhance automation, and ensure seamless coordination between machines, robots, and control systems. Real-time data exchange and high-speed communication within manufacturing environments have become crucial with the push toward electric and autonomous vehicles. Technologies such as Ethernet, Time-Sensitive Networking (TSN), and wireless communication protocols enable efficient, low-latency communication for precise control and monitoring in smart factories.

The pharmaceuticals & medical devices segment is expected to grow significantly from 2024 to 2030. As these industries adopt automation and digital technologies to enhance quality control, ensure traceability, and meet stringent regulatory standards, reliable communication systems have become essential. Real-time data exchange between machines, monitoring systems, and management platforms allows for improved process oversight and faster decision-making, ensuring that production complies with regulatory requirements. Additionally, the rise of smart manufacturing in these sectors, particularly with IoT for monitoring equipment and environmental conditions, drives the need for high-speed, secure communication networks.

Regional Insights

North America industrial communication market is poised for significant growth from 2024 to 2030. The industrial communication market is driven by the growing adoption of smart manufacturing technologies and the shift toward Industry 4.0. Manufacturers in the automotive, aerospace and pharmaceutical sectors increasingly invest in automation to enhance productivity and reduce labor costs. Integrating advanced technologies such as artificial intelligence, machine learning, and IIoT further fuels regional growth as companies seek to optimize operations and improve real-time decision-making. Additionally, the focus on reshoring manufacturing and increasing demand for energy-efficient systems are key factors contributing to the market’s expansion.

U.S. Industrial Communication Market Trends

The industrial communication market in U.S.is anticipated to grow significantly from 2024 to 2030. High-tech industries, including electronics, automotive, and healthcare, implement cutting-edge communication technologies to support smart manufacturing. Companies are increasingly turning to digitalization and robotics to boost competitiveness and innovation.

Europe Industrial Communication Market Trends

The industrial communication market in Europeis poised for significant growth from 2024 to 2030. Countries such as Germany, France, and the Netherlands are embracing industrial automation to reduce energy consumption, lower carbon emissions, and enhance production efficiency. The region's emphasis on green technologies and eco-friendly manufacturing processes aligns with Europe’s broader goals of environmental sustainability. As European industries increasingly adopt smart manufacturing technologies, advanced industrial communication systems are pivotal in ensuring seamless, efficient, and environmentally responsible production processes.

Asia Pacific Industrial Communication Market Trends

The industrial communication market in Asia Pacificdominated the global market, accounting for 35.67% of the overall market share in 2023. Rapid industrialization and urbanization drive the demand for communication, particularly in countries such as China, Japan, and South Korea. These countries increasingly adopt automation solutions to enhance productivity and maintain a competitive edge in global markets, particularly electronics, automotive, and textiles. Rising labor costs and the need to reduce operational inefficiencies push manufacturers toward advanced communication technologies that enable seamless data exchange and control in automated systems. Moreover, government initiatives promoting smart manufacturing and the presence of leading technology providers are expected to further propel the regional industrial communication market.

Key Industrial Communication Company Insights

Key players operating in the industrial communication market include Cisco Systems, Inc., Siemens, Rockwell Automation, Inc., OMRON Corporation, Moxa Inc., Huawei Technologies Co., Ltd., SICK AG, Schneider Electric, ABB, and Belden Inc. Prominent companies are capturing significant market share by offering a diverse range of solutions that cater to evolving industry needs, such as high-speed data transfer, real-time control, and secure communication protocols. As industries continue to transition toward digitalization and smart manufacturing, these companies are expected to maintain their leadership by innovating in areas such as edge computing, 5G integration, and cybersecurity for industrial networks.

Many companies in the market are actively implementing strategic initiatives to expand their presence across different regions. For instance, in June 2023, Fiberroad Technology Co., Ltd. launched the Auto Pro series of industrial Ethernet switches designed to enhance automation in industrial management systems. The series integrated key features such as Auto Broadcast Suppression, Auto QoS Priority, and Auto Power Switching, offering intelligent, professional-grade performance for various industrial applications. The Auto Pro series was tailored for demanding environments, ensuring stability, high performance, and energy efficiency through innovations such as Auto Energy Management and dual power switching. It was versatile, supporting applications in industrial automation, road traffic management, and data center monitoring.

Key Industrial Communication Companies:

The following are the leading companies in the industrial communication market. These companies collectively hold the largest market share and dictate industry trends.

- Cisco Systems, Inc.

- Siemens

- Rockwell Automation, Inc.

- OMRON Corporation

- Moxa Inc.

- Huawei Technologies Co., Ltd.

- SICK AG

- Schneider Electric

- ABB

- Belden Inc.

Industrial Communication Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 22.28 billion

Revenue forecast in 2030

USD 31.21 billion

Growth rate

CAGR of 5.8% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments covered

Offering, communication protocol, vertical, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; India; Japan; South Korea; Australia; Brazil; Kingdom of Saudi Arabia (KSA); UAE; South Africa

Key companies profiled

Cisco Systems, Inc.; Siemens; Rockwell Automation, Inc.; OMRON Corporation; Moxa Inc.; Huawei Technologies Co., Ltd.; SICK AG; Schneider Electric; ABB; Belden Inc.

Customization scope

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Industrial Communication Market Report Segmentation

The report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global industrial communication market report based on offering, communication protocol, vertical, and region:

-

Offering Outlook (Revenue, USD Billion, 2018 - 2030)

-

Components

-

Switches

-

Gateways

-

Routers & WAP

-

Controllers & Connectors

-

Power Supply Devices

-

Others

-

-

Software

-

Services

-

-

Communication Protocol Outlook (Revenue, USD Billion, 2018 - 2030)

-

Fieldbus

-

Industrial Ethernet

-

Wireless

-

-

Vertical Outlook (Revenue, USD Billion, 2018 - 2030)

-

Automotive

-

Aerospace and Defense

-

Food and Beverages

-

Electrical and Electronics

-

Pharmaceuticals & Medical Devices

-

Oil & Gas

-

Chemicals & Fertilizers

-

Energy & Power

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa (MEA)

-

UAE

-

Kingdom of Saudi Arabia (KSA)

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global industrial communication market size was estimated at USD 21.15 billion in 2023 and is expected to reach USD 22.28 billion in 2024.

b. The global industrial communication market is expected to grow at a compound annual growth rate of 5.8% from 2024 to 2030 to reach USD 31.21 billion by 2030.

b. Asia Pacific dominated the industrial communication market with a share of 35.67% in 2023. Rapid industrialization and urbanization are driving the demand for communication, particularly in countries such as China, Japan, and South Korea.

b. Some key players operating in the industrial communication market include Cisco Systems, Inc., Siemens, Rockwell Automation, Inc., OMRON Corporation, Moxa Inc., Huawei Technologies Co., Ltd., SICK AG, Schneider Electric, ABB, and Belden Inc.

b. Key factors that are driving the market growth include the rise of Industry 4.0 and smart manufacturing, and the expansion of IoT in industrial applications.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.