- Home

- »

- Automotive & Transportation

- »

-

Industrial & Commercial Floor Scrubbers Market Report, 2030GVR Report cover

![Industrial And Commercial Floor Scrubbers Market Size, Share & Trends Report]()

Industrial And Commercial Floor Scrubbers Market Size, Share & Trends Analysis Report By Type (Walk-behind Scrubbers, Ride-on Scrubbers, Robotic Scrubbers), By End-use (Retail, Healthcare, Transportation & Logistics), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68039-121-1

- Number of Report Pages: 114

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

Market Size & Trends

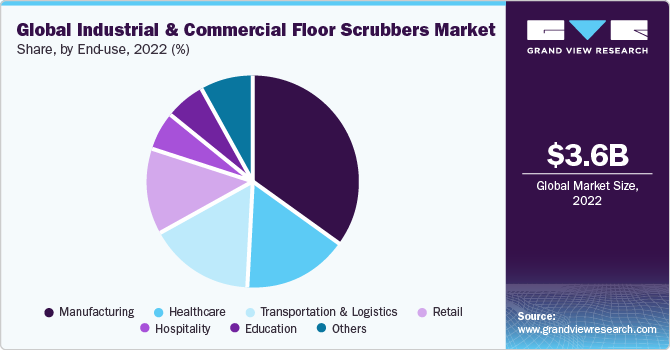

The global industrial and commercial floor scrubbers market size was valued at USD 3.61 billion in 2022 and is anticipated to grow at a compound annual growth rate (CAGR) of 9.5% from 2023 to 2030.Industrial and commercial floor scrubbers are cleaning machines that are used to effectively and efficiently clean floors. These machines are a replacement for traditional mops and buckets. The market is driven by various benefits offered by scrubbers over traditional cleaning methods, including high cleaning efficiency, ease of operability, and quicker dry time. The outbreak of the COVID-19 virus led the governments of various countries to impose strict cleaning measures during the preliminary stages of the pandemic. In turn, this encouraged various organizations to switch from their traditional cleaning methods to utilizing machines for cleaning purposes. Manufacturers faced multiple challenges during the initial stages of the pandemic due to the disruptions in the supply chain.

As floor scrubbing machines fall under the essential goods category, various market players were able to generate revenue amid the challenging situation. Technological advancements are likely to pave the way for market growth over the next seven years. Market players are focusing on manufacturing technologically advanced products to enhance their product portfolio and meet end-user requirements. Integrating floor scrubbers with various software platforms for ease of operability is one major ongoing trend in the market. For instance, Avidbots Corp. is utilizing software platforms to enhance safety during autonomous cleaning and increase battery life by shutting down the scrubber after 10 minutes of inactivity.

Stringent certification norms for floor scrubbers are expected to affect market growth over the forecast period adversely. Manufacturers need to procure certification related to battery charge and fuel by a Nationally Recognized Testing Laboratory (NRTL). However, rapid industrialization in developing countries, such as Brazil, is expected to open new avenues for the market. The automotive manufacturing sector in Brazil gained momentum in 2017, and the trend is expected to continue progressing over the upcoming years.

Growing tourism is another factor driving product demand in the hospitality sector. Everyday hospitality organizations deal with accommodations, food services, and even entertainment, leading to a high number of daily footfalls. Facilities in this sector have a wide variety of surfaces that require regular scrubbing. Moreover, increasing environmental sustainability issues have forced market players to invest significantly in their research & development activities to manufacture eco-friendly scrubbers that use less water, thereby augmenting the market growth.

Type Insights

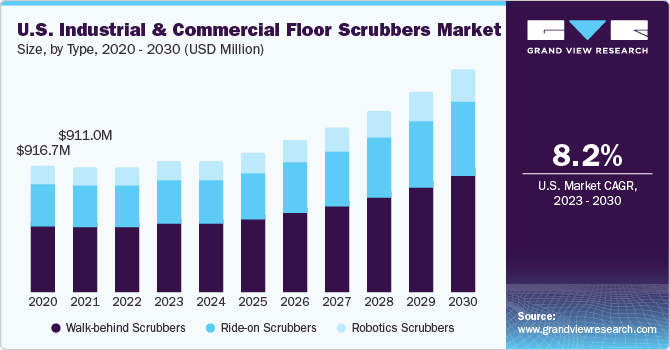

The walk-behind scrubbers segment accounted for the largest revenue share of 53.8% in 2022. Walk-behind scrubbers are easy to carry and prove beneficial for commercial places that lack an elevator. These products reduce the total cleaning cost, which is the major reason fueling the segment's growth.

The robotics scrubber segment is expected to expand at the fastest CAGR of 11.0% during the forecast period. This growth is attributed to the growing demand for autonomous cleaning equipment due to the outbreak of the COVID-19 pandemic. Various industrial and commercial facilities need more workforce owing to workplace regulations. Moreover, the rising need for regular cleaning has led to a surge in demand for robotic scrubbers.

End-use Insights

The manufacturing segment accounted for the largest revenue share of 35.1% in 2022. This is attributed to the various advantages offered by floor scrubbers over manual cleaning. Scrubbers are more efficient, they reduce the cleaning time of manufacturing facilities, and increase employees' productivity as they can manage other tasks. Industrial scrubbers offer better cleaning and are built to last in harsh environments.

The healthcare segment is estimated to register the fastest CAGR of 10.9% over the forecast period. This growth is attributed to rising hygiene awareness, coupled with increasing demand for contact-free cleaning. The number of daily visitors in healthcare facilities is high, which brings a challenge to get rid of the floor bacteria and keep it dirt-free. Moreover, regulatory bodies have set cleaning standards for healthcare organizations to maintain hygiene in their respective facilities.

Regional Insights

North America dominated the industrial and commercial floor scrubbers market and accounted for the largest revenue share of 30.0% in 2022. It is attributed to the growing demand in the retail sector and is anticipated to propel the market growth from 2023 to 2030. Also, the presence of major market players, such as Tennant Company, Diversey, Inc., and Nilfisk Group, is fueling the regional market growth.

Asia Pacific is expected to expand at the fastest CAGR of 11.5% during the forecast period. It is attributed to rapid industrialization in developing countries, such as China and India. China is considered to be the manufacturing hub, and India's manufacturing sector is on the rise due to the "Make in India" initiative. According to the India Brand Equity Foundation (IBEF), the manufacturing sector in India is expected to reach USD 1 trillion by 2025, with various companies, such as Vivo Mobile Communication Co., Ltd. and Morris Garages, investing significantly in manufacturing their products in India. It is expected that the number of manufacturing facilities will increase, leading to a rise in the demand for floor scrubbers.

Key Companies & Market Share Insights

Market players are focusing on inorganic growth strategies, such as acquisitions & mergers, and collaborations, to augment their market share. For instance, in April 2022, Kärcher brought a commercial robotic scrubber to its lineup of autonomous products. The KIRA B 100 R is powered by Brain Corporation, the most dependable and widely used software platform for autonomous mobile robots (AMRs) working in indoor public settings. Kärcher Intelligent Robotic Applications is known as KIRA.

Key Industrial And Commercial Floor Scrubbers Companies:

- Tennant Company

- Amano Corporation

- Diversey, Inc

- DULEVO INTERNATIONAL S.P.A.

- Hako GmbH

- Nilfisk Group

- Numatic International

- Powr-Flite, A Tacony Company

Recent Developments

-

In April 2023, Tennant Company announced two new additions to its ride-on sweeper portfolio: the S680 and S880 sweepers. Simple to operate and incredibly maneuverable, the S680 and S880 are small, battery-powered ride-on sweepers intended for light- to medium-duty situations where they are used to clear big apertures and confined spaces. Compared to earlier Tennant ride-on sweeper models, both offer excellent productivity while taking up less area.

-

In August 2022, ONYX Systems, LLC, an innovator of technology powering a cleaner future, introduced the latest addition to the battery-powered floor care range, the DX15 15" Floor Scrubber. This device is light, portable, compact, and ideal for modest retail or commercial applications. These cleaning devices are dependable, have best-in-class productivity, and can clean quickly.

-

In February 2022, Sam's Club, a division of Walmart Inc., announced a partnership with Brain Corp. and Tennant Company to add inventory scan functionality to their fleet of robotic scrubbers. With the deployment of inventory scan the company is able to acquire crucial inventory data without requiring much time.

-

In September 2020, Nilfisk announced the release of a new high-performance robotic scrubber called the Liberty SC60. The SC60 is the first Nilfisk device to run on BrainOS, an AI software platform for designing and operating commercially viable autonomous mobile robots (AMRs) at scale. The SC60 is perfect for big indoor locations, including retail, airports, malls, warehouses, light industrial, and more, since it has the largest scrub deck in the autonomous ride-on category.

Industrial And Commercial Floor Scrubbers Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 3.71 billion

Revenue forecast in 2030

USD 7.03 billion

Growth rate

CAGR of 9.5% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

December 2023

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; China; Japan; India; Australia; South Korea; Brazil; Mexico; Saudi Arabia; South Africa; UAE

Key companies profiled

Tennant Company.; Amano Corporation.; Diversey, Inc; DULEVO INTERNATIONAL S.P.A.; Hako GmbH; Nilfisk Group; Numatic International; Powr-Flite, A Tacony Company

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Industrial And Commercial Floor Scrubbers Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global industrial and commercial floor scrubbers market report based on type, end-use, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Walk-behind scrubbers

-

Ride-on scrubbers

-

Robotics scrubbers

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Retail

-

Hospitality

-

Healthcare

-

Manufacturing

-

Transportation & Logistics

-

Education

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global industrial and commercial floor scrubbers market size was estimated at USD 3.61 billion in 2022 and is expected to reach USD 3.71 billion in 2023.

b. The global industrial and commercial floor scrubbers market is expected to grow at a compound annual growth rate of 9.5% from 2023 to 2030 to reach USD 7.03 billion by 2030.

b. North America dominated the industrial and commercial floor scrubbers market with a share of 30.0% in 2022. This is attributable to the growing demand for floor scrubbers in the retail sector.

b. Some key players operating in the industrial and commercial floor scrubbers market include Amano Corporation; Diversey, Inc.; Dulevo S.p.A.; Hako GmbH; Nilfisk Group; Numatic International; Polivac International Pty Ltd.; Powr-Flite; Tennant Company; and TRUVOX.

b. Key factors that are driving the industrial & commercial floor scrubbers market growth include ease of operation and advantages over manual cleaning, growing hygiene concerns at commercial places, rising demand for technologically advanced floor scrubbers.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."