Industrial Batteries Market Size, Share & Trends Analysis Report By Type (Lead-acid, Lithium-based), By Application (Motive Power, Grid-level Energy Storage), By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68038-657-8

- Number of Report Pages: 90

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Energy & Power

Industrial Batteries Market Size & Trends

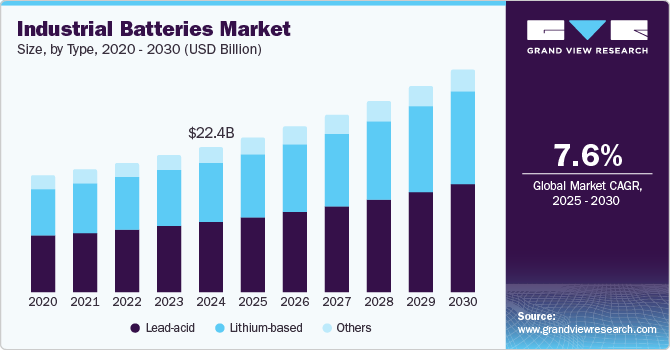

The global industrial batteries market size was valued at USD 22.44 billion in 2024 and is expected to grow at a CAGR of 7.6% from 2025 to 2030. This growth is attributed to the rising demand for backup power in industrial sectors, increasing adoption of renewable energy storage solutions, and growing applications in grid-level energy storage, telecommunications, and electric vehicles. In addition, government regulations promoting carbon emission reduction, the "Go Green" revolution, and the need for sustainable energy solutions are significantly contributing to market expansion. Furthermore, technological advancements, lithium-ion battery improvements, and increasing environmental consciousness are further propelling the growth of the industrial batteries market.

Industrial batteries are specialized energy storage devices engineered to provide robust, reliable power for heavy-duty industrial applications, designed to withstand rigorous operational conditions and deliver consistent performance across various sectors such as manufacturing, telecommunications, and renewable energy systems.

Technological innovations fundamentally transform the industrial battery landscape, driving substantial market evolution through strategic research and development investments. Manufacturers are intensely focused on developing next-generation battery technologies that address complex industry requirements, emphasizing improvements in energy efficiency, safety mechanisms, and charging capabilities. These advancements are compelling companies to reimagine battery design, creating more adaptable and versatile energy storage solutions that seamlessly integrate with emerging industrial ecosystems.

In addition, the global shift towards sustainable energy infrastructure is significantly accelerating industrial battery adoption, with renewable energy sectors emerging as critical growth catalysts. Battery storage systems are increasingly essential for managing intermittent renewable energy generation, enabling seamless power grid stabilization and ensuring consistent electricity supply during production fluctuations. These advanced storage solutions are bridging the gap between renewable energy production and consistent power delivery by capturing excess energy during peak generation periods.

Furthermore, rapid industrialization in developing economies creates unprecedented demand for sophisticated battery technologies. As countries modernize their industrial infrastructure, reliable, efficient power solutions become paramount. Emerging markets are witnessing substantial investments in automation, manufacturing, and power generation technologies, which inherently require robust energy storage systems.

Type Insights

The lead-acid battery segment dominated the market and accounted for the largest revenue share of 47.5% in 2024. This growth is attributed to cost-effectiveness, widespread automotive applications, and reliable backup power solutions. In addition, growing demand from transportation, UPS systems, telecommunications, and renewable energy storage sectors propels market expansion. Furthermore, the technology's established recycling processes, low manufacturing costs, and ability to provide efficient energy storage in critical infrastructure such as data centers contribute significantly to its continued market relevance and growth.

Lithium-based batteries are expected to grow at a CAGR of 8.1% over the forecast period, owing to experiencing rapid growth due to their superior energy density, longer lifecycle, and increasing adoption in electric vehicles and renewable energy storage. In addition, technological advancements enabling faster charging, reduced weight, and enhanced performance are key market drivers. Furthermore, the escalating demand for sustainable energy solutions, government incentives for clean transportation, and the ongoing digital transformation across industries further accelerate the lithium battery market expansion.

Application Insights

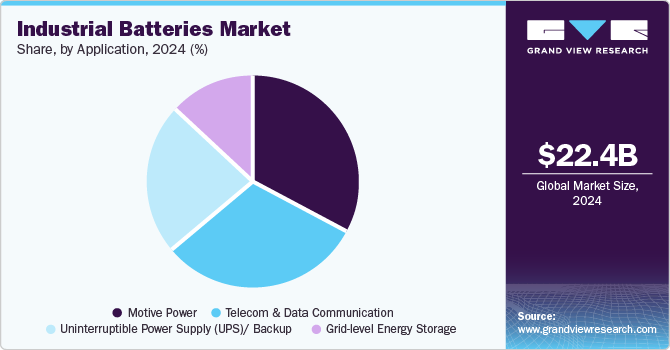

The motive power segment led the global industrial batteries industry with the largest revenue share of 32.7% in 2024, primarily driven by increasing electric vehicle adoption, automation trends, and corporate ESG goals. In addition, industrial truck battery market growth is fueled by productivity demands, maintenance-free battery technologies, and fast charging capabilities. Furthermore, internal combustion engine bans, rising electrification of industrial equipment, and the need for reliable power solutions in sectors such as material handling, mining, and transportation.

Grid-level energy storage is expected to grow at the fastest CAGR of 11.6% from 2025 to 2030, owing to the accelerating transition towards renewable energy sources. The increasing integration of intermittent renewable energy such as solar and wind necessitates advanced battery storage systems. In addition, government policies promoting clean energy, investments in grid modernization, and the need to stabilize electrical infrastructure are driving market growth. Furthermore, technological advancements in battery efficiency and declining storage costs further contribute to this segment's development.

Regional Insights

North America industrial batteries market is expected to grow substantially over the forecast period, owing to technological innovation, substantial investments in electric vehicle infrastructure, and increasing renewable energy adoption. In addition, the region's advanced research capabilities, significant venture capital investments, and supportive government policies are creating unprecedented market opportunities. Furthermore, increasing demand from data centers, telecommunications, and grid-level energy storage sectors and a strong focus on sustainable technologies are driving market growth and technological advancements.

U.S. Industrial Batteries Market Trends

The industrial batteries market in U.S. held the dominant position within the North American market, with the largest revenue share in 2024, driven by technological leadership, massive investments in clean energy technologies, and a robust electric vehicle ecosystem. In addition, Silicon Valley's innovation culture, substantial federal incentives for battery research, and growing demand from automotive, aerospace, and renewable energy sectors are propelling market expansion. Furthermore, advanced manufacturing capabilities, significant venture capital investments, and a comprehensive approach to energy transition are creating substantial opportunities for industrial battery manufacturers.

Asia Pacific Industrial Batteries Market Trends

The APAC industrial batteries market dominated the global market and accounted for the largest revenue share of 35.7% in 2024. This growth is attributed to the escalating demand from renewable energy sectors, electric vehicle adoption, and expanding data center infrastructure. In addition, technological advancements, declining lithium-ion battery prices, and government policies supporting clean energy transition are propelling market expansion. Furthermore, the region's strong manufacturing base, increasing investments in grid-level energy storage, and rapid industrialization in countries such as China, India, and Japan are creating substantial opportunities for industrial battery manufacturers.

The industrial batteries market in China led the Asia Pacific market and accounted for the largest revenue share in 2024, primarily driven by strategic government initiatives, massive investments in electric vehicle manufacturing, and ambitious renewable energy goals. In addition, the country's leadership in battery technology, substantial natural resources, and focus on grid-side energy storage are driving market growth. Furthermore, emerging sectors such as artificial intelligence, data centers, and telecommunications are creating unprecedented demand. Moreover, china's policy support for new energy vehicle research and manufacturing, coupled with its dominant position in global battery production, positions the market for significant technological and economic advancement.

Europe Industrial Batteries Market Trends

The industrial batteries market in the Europe is expected to grow at a CAGR of 8.3% over the forecast period, owing to stringent environmental regulations, aggressive decarbonization targets, and substantial investments in renewable energy infrastructure. In addition, the region's commitment to electric vehicle electrification, advanced manufacturing technologies, and sustainable energy transition are creating robust market opportunities. Furthermore, innovative battery research, government incentives for clean energy solutions, and growing demand from automotive, grid storage, and industrial sectors are driving technological advancements and market expansion.

The industrial batteries market in Germany dominated the European market and accounted for the largest revenue share in 2024, driven by precision engineering, robust automotive manufacturing, and cutting-edge technological innovations. In addition, the country's strong focus on industrial automation, renewable energy integration, and sustainable mobility solutions are creating significant market opportunities. Furthermore, advanced research institutions, strategic investments in battery technology, and a comprehensive approach to electrification across manufacturing and transportation sectors are driving substantial growth and technological breakthroughs.

Key Industrial Batteries Company Insights

Key players in the global industrial batteries industry include Enersys, Inc., Saft Groupe S.A., GS Yuasa Corp., and others. These players focus on strategic approaches, including product innovation, research and development investments, strategic partnerships, mergers and acquisitions, and geographical expansion to enhance battery performance, develop customized solutions, and strengthen market presence.

-

Exide Technologies produces batteries for automotive, industrial, inverter, and UPS applications across diverse sectors, including power generation, telecommunications, infrastructure, railways, mining, and defense. Their product range spans from small-capacity batteries to large industrial storage systems, serving critical applications in conventional and renewable energy sectors, with extensive global export capabilities.

-

Enersys specializes in manufacturing reserve power, motive power, and specialty battery technologies for the telecommunications, utilities, healthcare, aerospace, and defense industries. Their product portfolio includes advanced battery systems for critical backup power, material handling equipment, and specialized energy storage solutions for various technological platforms and industrial segments.

Key Industrial Batteries Companies:

The following are the leading companies in the industrial batteries market. These companies collectively hold the largest market share and dictate industry trends.

- Johnson Controls, Inc.

- Exide Technologies, Inc.

- Enersys, Inc.

- Saft Groupe S.A.

- GS Yuasa Corp.

- Northstar Battery Company LLC

- C&D Technologies, Inc.

- Robert Bosch GmbH

- East Penn Manufacturing Co.

- Smiths Interconnect

- Schneider Electric

View a comprehensive list of companies in the Industrial Batteries Market

Recent Developments

-

In June 2024, Smiths Interconnect unveiled its Hypertac Green Connect technology, which targets power loss in industrial batteries. This innovative solution provides up to 90% more energy transfer than existing market solutions, specifically designed for industrial battery applications such as electric transportation and static energy storage. The technology reduces contact resistance in industrial batteries, enabling efficient energy transfer and handling currents up to 500 amperes. Notably, the product is lead and beryllium-free, making it more environmentally friendly and safer for manufacturing industrial battery systems.

-

In April 2024, Schneider Electric introduced an advanced Battery Energy Storage System (BESS) designed for microgrid applications. This innovative solution for industrial batteries offers comprehensive energy management capabilities, enabling organizations to capture, store, and efficiently utilize energy from various sources. The system provides resilience, sustainability, and cost-saving features, supporting up to 2 MW of power. With integrated safety controls and flexible configuration, these industrial batteries can operate grid-connected and off-grid, addressing critical energy security challenges.

Industrial Batteries Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 23.92 billion |

|

Revenue forecast in 2030 |

USD 34.57 billion |

|

Growth rate |

CAGR of 7.6% from 2025 to 2030 |

|

Base year for estimation |

2024 |

|

Historical data |

2018 - 2023 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million/billion, and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Type, application, region |

|

Regional scope |

North America, Asia Pacific, Europe, Latin America, Middle East & Africa |

|

Country scope |

U.S., Canada, Mexico, China, India, Japan, South Korea, Thailand, Germany, France, UK, Italy, Brazil, Saudi Arabia |

|

Key companies profiled |

Johnson Controls, Inc.; Exide Technologies, Inc.; Enersys, Inc.; Saft Groupe S.A.; GS Yuasa Corp.; Northstar Battery Company LLC; C&D Technologies, Inc.; Robert Bosch GmbH; East Penn Manufacturing Co.; Smiths Interconnect; Schneider Electric. |

|

Customization scope |

Free report customization (equivalent to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Industrial Batteries Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and analyzes the latest industry trends in each sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the global industrial batteries market report based on type, application, and region.

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Lead-acid

-

Lithium-based

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Motive Power

-

Telecom & Data Communication

-

Uninterruptible Power Supply (UPS)/ Backup

-

Grid-level Energy Storage

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

Russia

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

-

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."