- Home

- »

- Sensors & Controls

- »

-

Industrial Automation And Control Systems Market Report, 2030GVR Report cover

![Industrial Automation And Control Systems Market Size, Share & Trends Report]()

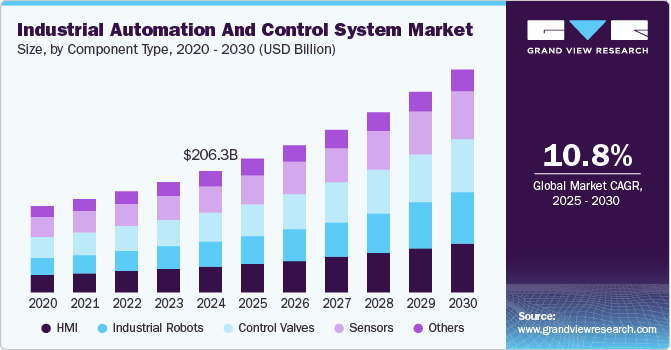

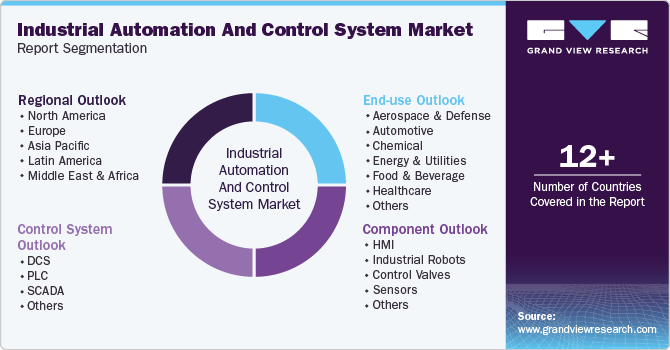

Industrial Automation And Control Systems Market Size, Share & Trends Analysis Report By Component (Industrial Robots, Control Valves), By Control System (DCS, PLC, SCADA), By End-use, By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68038-130-6

- Number of Report Pages: 130

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Semiconductors & Electronics

Market Size & Trends

The global industrial automation and control systems market size was estimated at USD 206.33 billion in 2024 and is anticipated to witness a CAGR of 10.8% from 2025 to 2030. The market is growing rapidly, driven by the rising demand for efficiency, precision, and safety across manufacturing industries. As businesses seek ways to minimize human error and boost productivity, the adoption of automation solutions like robotics, artificial intelligence, and IoT-based control systems has increased. Additionally, the push toward digital transformation and Industry 4.0 integration has made real-time monitoring, predictive maintenance, and optimized workflow management crucial for companies looking to stay competitive. Rising labor costs and the shortage of skilled workers are also incentivizing companies to invest in automation, contributing to the expansion of this market.

Government initiatives worldwide are playing a pivotal role in promoting the growth of the market. Various countries have launched policies and funding programs aimed at encouraging industries to adopt advanced automation technologies to boost economic growth and support sustainable practices. For example, the “Make in India” initiative promotes industrial modernization to enhance manufacturing efficiency and competitiveness, while Europe’s “Green Deal” provides incentives for automation that aids in reducing carbon footprints. These government efforts often include tax breaks, subsidies, and research grants that enable companies to invest in automation technologies, thereby propelling market growth

The market is poised for significant growth opportunities, largely due to emerging technologies and evolving industry needs. The integration of artificial intelligence (AI) and machine learning in automation systems is providing new avenues for advanced analytics, predictive maintenance, and decision-making capabilities, which appeal to industries seeking operational efficiency. Additionally, as sectors like pharmaceuticals, automotive, and consumer goods embrace automation to meet changing consumer demands, the demand for customized, scalable solutions is rising. Expansion into emerging markets, where automation adoption is still in the early stages, offers significant growth potential as companies look to modernize production facilities and enhance global competitiveness.

Manufacturers are increasingly prioritizing growth in the market by investing in advanced production technologies and expanding their automation portfolios. Leading companies are collaborating with software and technology providers to integrate AI, cloud computing, and IoT into their automation systems, thereby creating more value-added solutions. They are also focusing on training and after-sales support services, which help clients maximize the potential of automation systems. By emphasizing energy-efficient, flexible, and safe production environments, manufacturers are addressing key industry needs and are better positioned to attract clients, aiming to optimize and future-proof their operation

Technological innovation is a cornerstone of the market, with advancements like edge computing, 5G connectivity, and digital twin technology reshaping the landscape. These innovations allow for faster data processing, real-time monitoring, and enhanced precision, making automated systems more reliable and scalable. Robotics and AI-powered automation have also advanced significantly, enabling more complex, adaptive control systems that can operate autonomously and handle dynamic production needs. Innovations in cybersecurity have become essential as well, protecting interconnected systems against potential threats. This continuous technological evolution not only drives growth in the market but also meets the demands of industries focused on quality, efficiency, and flexibility

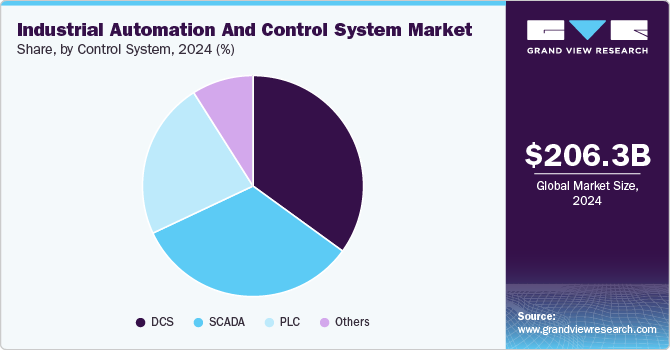

Control System Insights

The Distributed Control System (DCS) segment holds a substantial share in the market due to its ability to manage complex processes across large-scale industries, including oil and gas, chemical, and power generation. DCS solutions offer centralized control with decentralized decision-making, making them essential for industries requiring high reliability, consistent performance, and reduced downtime.

Supervisory Control and Data Acquisition (SCADA) systems are experiencing significant growth within the market as industries seek real-time monitoring and data collection capabilities. SCADA’s ability to manage and monitor equipment remotely makes it an essential tool for sectors like utilities, water treatment, and energy, where real-time data can enhance decision-making and improve operational efficiency.

Component Insights

The connected segment, which includes devices and systems integrated with IoT and smart technology, holds a significant share in the market due to its role in enabling seamless, data-driven operations. The high connectivity of devices allows for enhanced monitoring, real-time data exchange, and remote operation, which are critical for sectors like manufacturing, logistics, and energy. This segment’s growth is further fueled by the need for efficient data management, improved production flexibility, and enhanced safety standards. By providing a framework for seamless communication between devices, connected technologies support predictive maintenance, reduce downtime, and optimize production flows, making them indispensable in modern industrial environments.

The connected segment within the market is undergoing rapid growth, driven by advancements in IoT, AI, and cloud-based technologies. As industries transition towards smart factories and embrace Industry 4.0, connected devices and systems are essential for enabling interoperability and real-time analytics. This segment’s growth is further fueled by the need for efficient data management, improved production flexibility, and enhanced safety standards.

End Use Insights

The manufacturing segment commands a high share in the market, primarily due to the sector’s strong focus on efficiency, precision, and productivity. Automation solutions are integral to manufacturing operations, allowing for streamlined production, reducing human error, and enhanced safety. As competition intensifies, manufacturers are increasingly investing in automation technologies, such as robotics, DCS, and SCADA systems, to maintain quality standards while reducing costs.

The healthcare segment is experiencing notable growth in the industrial automation and control systems market, driven by the need for enhanced operational efficiency, safety, and accuracy in critical healthcare processes. Automation technologies enable healthcare providers to streamline workflows, improve asset tracking, and enhance patient monitoring. The adoption of automated solutions, such as robotics for surgical procedures and automated inventory management, has increased in hospitals and laboratories.

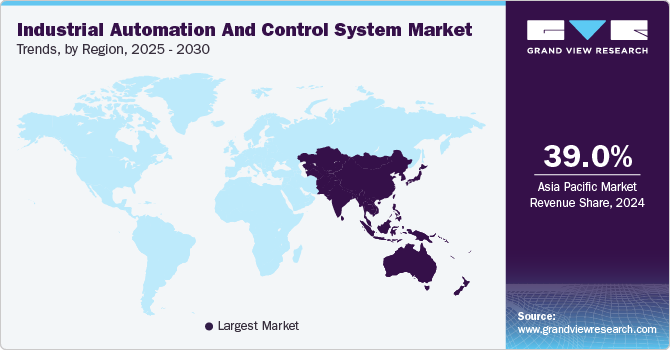

Regional Insights

The industrial automation and control systems market in North America holds a witness’s significant growth globally, driven by the region's strong focus on advanced manufacturing and high technology adoption rates. Key industries, such as automotive, aerospace, and electronics, continuously seek innovative solutions to improve production efficiency and minimize operational costs, fueling demand for automation systems. Furthermore, a well-established infrastructure and robust economic policies that favor digital transformation support widespread adoption. Government incentives and investments in emerging technologies, like robotics and AI, also propel the market, making North America a leader in industrial automation and control solutions.

U.S. Industrial Automation And Control Systems Market Trends

The U.S. industrial automation and control systems market has emerged as a dominant player, driven by the increasing demand for automation across sectors like manufacturing, healthcare, and logistics. With a highly developed industrial base, the U.S. prioritizes technological innovation to maintain competitiveness, pushing companies to adopt smart manufacturing practices and invest in automation.

Asia Pacific Industrial Automation And Control Systems Market Trends

The Asia Pacific industrial automation and control systems market was valued at largest revenue share of over 39% in 2024 and is expected to continue the dominance during 2025 to 2030. The demand for higher productivity, cost efficiency, and quality control has driven industries to adopt automation solutions at a rapid pace. Increasing foreign investments in manufacturing sectors and a growing emphasis on Industry 4.0 adoption in the region have further fueled this trend. The presence of large-scale manufacturing facilities for electronics, automotive, and heavy industries, coupled with government incentives to modernize production, contributes to Asia-Pacific’s significant market share.

The industrial automation and control systems market in China is a key player, driven by its large manufacturing base and focus on increasing production efficiency. As China transitions from labor-intensive manufacturing to more technology-driven production, the demand for automation has surged. The Chinese government’s “Made in China 2025” initiative aims to upgrade the nation’s manufacturing capabilities, with automation as a central focus, especially in automotive, electronics, and heavy industries.

India’s industrial automation and control systems market is on the rise, propelled by rapid industrial expansion and government initiatives like “Make in India,” which promotes domestic manufacturing. The Indian government’s push to attract foreign investment has led to a surge in demand for automation technologies in sectors like automotive, textiles, and pharmaceuticals. As labor costs increase and industries seek higher productivity, more companies are adopting automation solutions. Additionally, with the growth of smart city initiatives and infrastructure projects, automation and control technologies are becoming essential, contributing to significant market growth in India as it modernizes its industrial base.

Europe Industrial Automation And Control Systems Market Trends

Europe’s industrial automation and control systems market is experiencing steady growth due to its commitment to sustainability and energy efficiency in manufacturing. The European Union’s stringent regulations on reducing carbon emissions have prompted industries to adopt automation technologies that optimize energy usage and minimize waste.

Key Industrial Automation And Control Systems Company Insights

The competitive landscape highlights the industry dynamics reshaping the global market. Incumbent companies and new entrants anticipate organic and inorganic growth strategies, such as product launches, mergers & acquisitions, technological advancements, and geographical expansion, to remain pronounced in the forecast period.

Key players operating in the industrial automation and control systems market and their company profiles are:

-

Rockwell Automation, Inc. is headquartered in the U.S. The company provides products, solutions, and services within the industrial automation domain. The company’s critical operating segments include architecture & software and control products & solutions. The U.S. is the company’s highest revenue-generating region. Other key countries where the company holds a strong presence include Brazil, Germany, UK, Italy, Mexico, Canada, and China.

-

Siemens is headquartered in Germany. The company operates in industrial engineering, electrification, automation, and digitization verticals. The company is involved in manufacturing energy-efficient systems for medical diagnosis, power generation, and transmission and provides industrial infrastructure solutions worldwide.

Key Industrial Automation And Control Systems Companies:

The following are the leading companies in the industrial automation and control systems market. These companies collectively hold the largest market share and dictate industry trends.

- ABB Ltd.

- Emerson Electric Co.

- Honeywell International, Inc.

- Kawasaki Heavy Industries, Ltd.

- Mitsubishi Electric Corporation

- OMRON Corporation

- Rockwell Automation, Inc.

- Schneider Electric

- Siemens AG

- Yokogawa Electric Corporation

View a comprehensive list of companies in the Industrial Automation And Control Systems Market

Recent Developments

-

On July 23, 2024, Nozomi Networks Inc., a leader in OT and IoT security, introduced Arc Embedded—the first security sensor for OT and IoT that can be embedded directly within Mitsubishi Electric programmable logic controllers (PLCs). This advancement provides security and operations teams with unprecedented process-level visibility into industrial automation equipment and field assets, enabling them to detect and counteract process-level threats and unauthorized activity. This solution enhances operational resilience, reduces cyber risk, and improves compliance without impacting existing resources or disrupting critical networks.

-

In February 2023, ABB introduced an updated version of its ABB Ability™ Symphony® Plus distributed control system (DCS) to drive digital transformation in the power generation and water industries. DCS offers a secure OPC UA connection to Edge and Cloud environments, supporting digital advancement while maintaining core control and automation functions.

-

In March 2022, Mitsubishi Electric Corporation opened a collaborative engineering center in China where factory and industry automation solutions and applications will be developed from April.

Industrial Automation And Control Systems Market Report Scope

Report Attribute

Details

Market size in 2025

USD 226.76 billion

Revenue forecast in 2030

USD 378.57 billion

Growth rate

CAGR of 10.8% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025- 2030

Quantitative units

Revenue in USD billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, control system, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Brazil; South Korea; Australia; UAE; Saudi Arabia; South Africa

Key companies profiled

ABB Ltd.; Emerson Electric Co.; Honeywell International, Inc.; Kawasaki Heavy Industries, Ltd.; Mitsubishi Electric Corporation; OMRON Corporation; Rockwell Automation, Inc.; Schneider Electric; Siemens AG; Yokogawa Electric Corporation

Customization scope

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Industrial Automation And Control Systems Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and analyzes the latest market trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global industrial automation and control systems market report based on component, control systems, end use, and region:

-

Component Outlook (Revenue, USD Billion; 2018 - 2030)

-

HMI

-

Industrial Robots

-

Control Valves

-

Sensors

-

Others

-

-

Control System Outlook (Revenue, USD Billion, 2018 - 2030)

-

DCS

-

PLC

-

SCADA

-

Others

-

-

End Use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Aerospace & Defense

-

Automotive

-

Chemical

-

Energy & Utilities

-

Food & Beverage

-

Healthcare

-

Manufacturing

-

Mining & Metal

-

Oil & Gas

-

Transportation

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

South Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global industrial automation & control systems market size was estimated at USD 206.33 billion in 2024 and is expected to reach 226.76 billion in 2025.

b. The global industrial automation & control systems market is expected to grow at a compound annual growth rate of 10.8% from 2025 to 2030 to reach USD 378.57 billion by 2030.

b. Asia Pacific dominated the industrial automation & control systems market with a share of over 39% in 2024. This is attributable to the increasing demand for better solutions to manage industrial plants in countries such as China, India, and South Korea; as well as the presence of the key market players and emerging companies in the region.

b. Some key players operating in the industrial automation & control systems market include ABB; Emerson Electric Co.; Honeywell International Inc.; Kawasaki Heavy Industries, Ltd.; Mitsubishi Electric Corporation; OMRON Corporation; Rockwell Automation, Inc.; Schneider Electric; Siemens; and Yokogawa Electric Corporation.

b. Key factors that are driving the industrial automation & control systems market growth include the rising demand for mass/bulk production in the manufacturing sector and increasing adoption of industrial robots for automation of production.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."