Industrial Asset Management Market Size, Share & Trends Analysis Report By Component (Hardware, Software, Services), By Asset Type, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-370-5

- Number of Report Pages: 120

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

Industrial Asset Management Market Trends

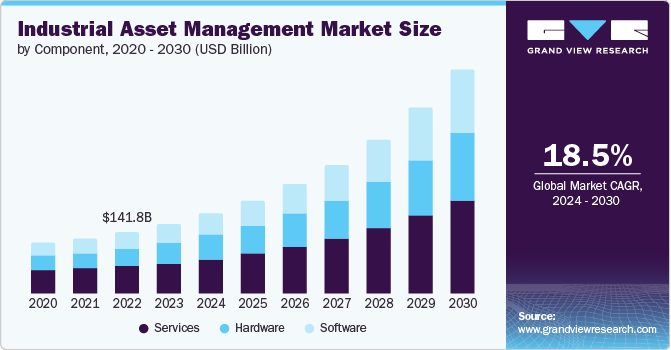

The global industrial asset management market size was estimated at USD 158.81 billion in 2023 and is expected to grow at a CAGR of 18.5% from 2024 to 2030. The industrial asset management (IAM) market is experiencing robust growth, driven by several factors, including the increasing adoption of digitalization and Industry 4.0 principles in various industries. As industries seek to improve operational efficiency and reduce costs, the integration of advanced technologies, such as the Internet of Things (IoT), artificial intelligence (AI), and machine learning (ML), into asset management systems is becoming essential. These technologies enable predictive maintenance, real-time monitoring, and data-driven decision-making, which enhance asset performance and longevity.

Advancements in cloud computing and mobile solutions are also crucial to the growth of the IAM market. Cloud-based IAM solutions offer scalability, flexibility, and cost-effectiveness, making them accessible to small and medium-sized enterprises (SMEs) and large corporations. Accessing asset data and management tools remotely via mobile devices further enhances operational agility and responsiveness, which are critical in today's fast-paced industrial environment. Integrating cloud-based IAM systems with other enterprise systems, such as enterprise resource planning (ERP) and customer relationship management (CRM), further enhances operational efficiency by providing a holistic view of organizational data.

The expansion of the industrial sector in emerging economies contributes to market growth. Countries in Asia Pacific, Latin America, and Middle East are witnessing rapid industrialization and infrastructure development, leading to increased investment in asset-intensive industries, such as manufacturing, energy, and utilities. This surge in industrial activities necessitates implementing robust asset management systems to efficiently manage the growing number of assets. The Global Industry Statistics Yearbook, produced by the United Nations Industrial Development Organization in December 2023, highlights a 2.3% improvement in various industrial domains, including manufacturing, mining, electricity, water provision, waste management, and additional utilities. Notably, manufacturing was the primary engine of this growth, witnessing a 3.2% rise. In addition, the aggregate mining and utilities sectors, which play a pivotal role in the economies of low-income nations, also saw significant contributions.

Governments and regulatory bodies worldwide are implementing stricter environmental regulations and standards, compelling companies to ensure their operations and assets are compliant. This shift has increased demand for IAM systems that can track and report compliance metrics, reduce emissions, and optimize resource utilization, thus aligning with broader environmental, social, and governance (ESG) goals. Companies are increasingly focusing on sustainable practices, and sophisticated asset management solutions play a crucial role in achieving these objectives by enabling efficient monitoring and management of resources.

Market Concentration & Characteristics

The degree of innovation in the market is remarkably high, driven by rapid technological advancements and the evolving needs of industries. One of the most significant areas of innovation is integrating the Industrial IoT (IIoT) and IoT into asset management systems. IoT-enabled devices and sensors provide real-time data on asset performance, conditions, and usage patterns. AI and ML are also significant innovations in the market. In addition, the development of digital twins, virtual replicas of physical assets, is a critical innovation in the market. Digital twins allow companies to simulate and analyze asset performance in a virtual environment, providing insights into potential issues and optimization opportunities without affecting real-world operations. This technology is valuable for complex and high-value assets, where testing and modifications can be costly and risky.

The market is experiencing notable M&A activities, reflecting the industry's dynamic nature and the strategic importance of asset management solutions in modern industrial operations. This surge in M&A activities is primarily driven by the need for companies to expand their technological capabilities, enhance their product portfolios, and increase their market presence. For instance, in January 2024, IFS, a Swedish cloud enterprise software company, agreed to acquire Falkonry, Inc., a U.S.-based Industrial AI software company. Falkonry provides automated, high-speed data analysis to the manufacturing and defense industries using self-learning AI to identify and analyze abnormal behavior and root causes of failures. This strategy involves comprehensively deploying AI to deliver end-to-end intelligent insights in asset management across various technological domains to enhance people and asset productivity.

Safety and health regulations are significant drivers of the market growth. Regulatory bodies set stringent guidelines to ensure the safety of workers and the public, particularly in industries, such as manufacturing, energy, and utilities, where hazardous materials and processes are commonplace. Compliance with these regulations requires robust asset management practices to ensure that equipment and infrastructure are regularly inspected, maintained, and operated safely. Advanced IAM solutions provide the tools to manage these tasks effectively, reducing the risk of accidents and ensuring regulatory compliance. Moreover, regulatory requirements for data security and privacy, such as the General Data Protection Regulation (GDPR) in Europe, influence the IAM market. Companies must ensure that the data collected and processed by their asset management systems is secure and complies with privacy laws. This has led to the development and adoption of IAM solutions with robust security features, including encryption, access controls, and data anonymization.

Industrial Asset Management (IAM) products and services offer numerous advantages to businesses, primarily by enhancing operational efficiency and reducing costs. By implementing sophisticated IAM solutions, companies can achieve real-time monitoring and predictive maintenance of their assets, significantly reducing unplanned downtime and maintenance costs. These systems leverage technologies, such as IoT, AI, and ML, to analyze asset performance data and predict potential failures before they occur. This proactive approach extends the lifespan of assets and optimizes their utilization, ensuring that businesses can maximize their return on investment.

Component Insights

The services segment accounted for the largest market share of 44.7% in 2023 in the industrial asset management market.As industries adopt more advanced technologies, such as IoT, AI, and predictive analytics, there is a growing demand for services that can help integrate these technologies into existing asset management frameworks. Companies are seeking external service providers to assist with the installation, configuration, and ongoing management of these sophisticated systems, ensuring they are effectively utilized to enhance operational efficiency and asset performance.

The software segment is expected to register a CAGR of 19.6% from 2024 to 2030. The shift towards cloud-based IAM solutions is a significant growth driver of the software segment. Cloud computing offers numerous advantages, including lower upfront costs, scalability, and remote accessibility. Cloud-based software allows companies to access their asset data and management tools from anywhere, facilitating greater flexibility and responsiveness. For instance, in October 2023, Gecko Robotics, a U.S.-based software platform that integrates data from robotic and hardware systems introduced an AI-powered platform for asset management, aiming to streamline the inspection of assets. This platform merges the use of drones and robotics with data analysis software for inspections. It enables seamless integration with various robotic and drone systems, effectively shifting the burden of asset maintenance. The platform collects data through these automated tools, which navigate the perimeters and surfaces of extensive assets.

Hardware Insights

The Global Positioning System (GPS) segment accounted for the largest share in 2023 due to several key factors that cater specifically to the needs of tracking and managing assets in industrial settings. The increasing demand for real-time location tracking and asset monitoring capabilities across diverse industries, such as logistics, transportation, construction, and manufacturing, drives the growth. GPS hardware enables companies to accurately track the location and movement of assets, including vehicles, equipment, and inventory indoors and outdoors.

The real-time location system (RTLS) segment is expected to register a CAGR of 23.1% from 2024 to 2030. The increasing integration of Internet of Things (IoT) devices and sensors in industrial environments has bolstered the adoption of RTLS. These devices can communicate location data wirelessly, often using technologies like RFID (Radio Frequency Identification) or Bluetooth Low Energy (BLE). Such IoT-enabled RTLS solutions track asset locations and gather data on usage patterns, environmental conditions, and operational efficiencies.

Software Insights

The location & movement tracking sub-segment accounted for the largest share in 2023. As industries become more complex and geographically circulated, there is a growing need to accurately track the location and movement of assets in real time. Location tracking software addresses this need by providing visibility into the whereabouts of assets, enabling companies to streamline operations, reduce search times, and optimize asset utilization. This capability is crucial for manufacturing, logistics, and utilities, where efficiently managing and monitoring assets across large facilities or remote locations is essential for maintaining productivity and minimizing downtime.

The repair & maintenance sub-segment is expected to register a CAGR of 23.1% from 2024 to 2030. Many industries are dealing with aging infrastructure and equipment, which are more prone to breakdowns and inefficiencies. Repair and maintenance software is crucial in managing these older assets by providing detailed insights into their condition and maintenance needs. This software helps organizations prioritize maintenance tasks, allocate resources effectively, and plan for replacements or upgrades, ensuring that aging equipment continues to operate reliably and efficiently.

For instance, in October 2023, Hitachi Energy, a Swiss technology company, announced the launch of asset performance management (APM) software, named Lumada APM. This advancement in Hitachi Energy's Lumada APM suite aims to strengthen sustainability, safety, and operational excellence initiatives by providing organizations that are heavy on assets with a comprehensive overview of their asset and asset systems' health. This strategic insight is designed to optimize asset utilization, decrease unexpected downtime, allocate maintenance budgets more effectively, prolong the lifespan of assets, and lower overall ownership costs.

Services Insights

The operational asset management segment accounted for the largest market share of 44.7% in 2023 as regulatory compliance and sustainability initiatives continue to influence the growth of operational asset management services. Regulatory requirements mandate industries to adhere to stringent environmental, safety, and operational standards, necessitating comprehensive asset management practices and documentation. Operational asset management services assist companies in ensuring compliance through regular audits, performance assessments, and reporting capabilities that track and demonstrate adherence to regulatory requirements.

The strategic asset management segment is expected to grow significantly from 2024 to 2030 owing to globalization and the expansion of industrial operations. As companies expand their operations globally, the complexity of managing assets across multiple locations increases. Strategic asset management services provide a centralized and standardized approach to asset management, facilitating consistent and efficient operations across different regions. This global approach ensures that best practices are implemented universally, improving overall asset performance and management. For instance, in September 2023, Infrastructure Data Solutions (IDS), headquartered in Canada, an asset solution developer, announced a partnership with Benesch, an engineering and asset management consultancy in the U.S. The partnership aims to investigate opportunities to offer cutting-edge asset management solutions, aiding their clientele in adopting advanced analytical tools and strategies for asset lifecycle planning.

Asset Type Insights

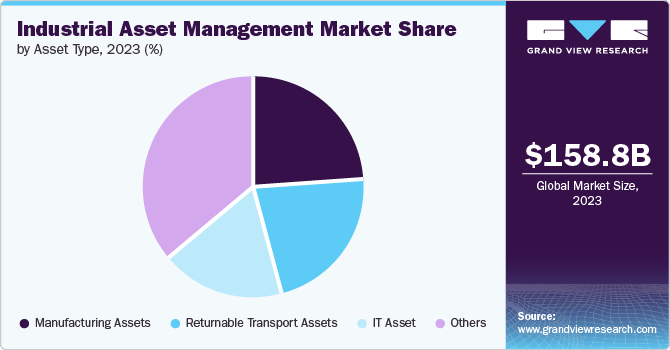

The manufacturing assets segment accounted for the largest market share of 24.3% in 2023 owing to the increased adoption of automation and smart manufacturing technologies. As manufacturers aim to improve productivity and efficiency, they invest heavily in advanced machinery and equipment integrated with IoT sensors, AI, and machine learning capabilities. These technologies enable real-time monitoring and predictive maintenance of manufacturing assets, reducing downtime and enhancing operational efficiency. The need to effectively manage and optimize these high-value assets propels the demand for sophisticated IAM solutions tailored to the manufacturing sector. For instance, in November 2023, ABB introduced the ABB Ability SmartMaster, a digital platform for managing asset performance in instrumentation. The platform collects and analyzes diagnostic data from field devices to enhance operational efficiency in various industries. It allows fleet instrumentation management and enables early detection of potential issues to prevent unplanned downtime. SmartMaster also provides extended possibilities for device optimization and maintenance.

The returnable transport assets segment is expected to register a CAGR of 19.1% from 2024 to 2030. The need for cost reduction and efficiency in logistics operations drives the adoption of returnable transport assets (RTAs). Companies can achieve significant cost savings over time by utilizing reusable transport assets. The initial investment in RTAs is offset by the reduction in recurring expenses associated with single-use packaging materials and the efficiencies gained through improved asset management.

Regional Insights

The industrial asset management market in North America dominated the global industry in 2023 and is expected to grow significantly at a CAGR of 14.6% from 2024 to 2030. This growth is owing to the region's strong emphasis on infrastructure development and modernization across various sectors, including manufacturing, energy, utilities, and transportation. As industries in North America continue to invest in upgrading their aging infrastructure and adopting advanced technologies, the demand for sophisticated IAM solutions has surged. These solutions are essential for managing and optimizing the performance of industrial assets, ensuring operational efficiency, and meeting stringent regulatory requirements.

U.S. Industrial Asset Management Market Trends

The U.S. industrial asset management market is expected to grow at a CAGR of 13.0% from 2024 to 2030. The U.S. government has implemented regulations and initiatives that encourage adopting IAM practices, particularly in industries like healthcare and energy. This regulatory environment is further driving the market growth.

Asia Pacific Industrial Asset Management Market Trends

The industrial asset management market in Asia Pacific is projected to register a CAGR of 21.8% from 2024 to 2030. Many countries, such as China, India, and Southeast Asian nations, are undergoing rapid industrialization and infrastructure development. This has led to a surge in the construction of new manufacturing facilities, logistics hubs, and transportation networks, driving the demand for effective asset management solutions to optimize the performance and lifespan of these critical industrial assets.

The China industrial asset management market is projected to register a CAGR of 19.8% from 2024 to 2030. The Chinese government has implemented various initiatives and regulations to promote the adoption of IAM solutions. For instance, in April 2024, the government of China issued a notice detailing the Implementation Plan for the Advancement of Equipment Renewal in the Industrial Field. This detailed action plan targets vital concerns about technological advancement and economic progression. It demonstrates China’s active approach toward boosting its manufacturing sector’s competitiveness and sustainability. The plan elevates the importance of modernizing industrial machinery to a key policy focus.

The industrial asset management market in India is estimated to grow significantly at a CAGR of 25.1% from 2024 to 2030. The rapid growth of e-commerce in India has fueled demand for modern, efficient logistics and warehousing assets. Asset managers play a crucial role in developing and managing these specialized industrial properties to cater to the needs of e-commerce giants and third-party logistics providers.

The Japan industrial asset management market is likely to record a CAGR of 23.3% from 2024 to 2030, driven by the country's capability as a leading manufacturer and innovator in robotics and advanced manufacturing technologies. Japan's industrial sector, including automotive, electronics, machinery, and robotics, relies heavily on sophisticated machinery and equipment that require efficient management and maintenance. IAM solutions are crucial in helping Japanese manufacturers optimize asset performance, reduce downtime, and enhance operational efficiency. For instance, according to the International Trade Administration, in 2021, Japan had 631 robots working in the manufacturing sector for every 10,000 humans.

Europe Industrial Asset Management Market Trends

The industrial asset management market in Europe is expected to grow at a CAGR of 19.9% from 2024 to 2030. The pharmaceutical industry in Europe is increasingly adopting IAM solutions to streamline operations, ensure regulatory compliance, and optimize asset performance. The growing emphasis on quality control and process efficiency in the pharmaceutical industry fuels the demand for IAM solutions in the region.

The UK industrial asset management market is likely to grow significantly at a CAGR of 21.1% from 2024 to 2030. The UK government's focus on promoting the adoption of Industry 4.0 technologies, such as the Made Smarter initiative, is expected to drive market growth. These initiatives help manufacturers leverage digital technologies to improve productivity, efficiency, and competitiveness, which is expected to increase the demand for industrial asset management solutions.

The industrial asset management market in Germany is growing significantly at a CAGR of 20.0% from 2024 to 2030. Sectors, such as energy, power, and pharmaceuticals, are increasingly adopting industrial asset management solutions in Germany. The energy and power segment, in particular, is experiencing high demand due to the need to upgrade aging infrastructure, control inventories, and prioritize work orders.

The France industrial asset management market is growing significantly at a CAGR of 22.9% from 2024 to 2030. There is a growing emphasis on digital transformation and Industry 4.0 initiatives in France, which are driving the adoption of advanced technologies, such as IoT, AI, and big data analytics, in industrial operations. IAM systems integrate these technologies to provide predictive maintenance capabilities, enhance asset performance monitoring, and support data-driven decision-making, thereby improving overall operational efficiency and competitiveness in domestic and international markets.

Middle East & Africa Industrial Asset Management Market Trends

The industrial asset management market in MEA is growing significantly at a CAGR of 16.0% from 2024 to 2030. Many countries in the region are undergoing rapid industrialization and infrastructure development to diversify their economies away from a heavy reliance on the oil & gas sector. It has increased investment in manufacturing, logistics, transportation, and other industrial sectors, driving the demand for effective asset management solutions.

Key Industrial Asset Management Company Insights

Some of the key players operating in the market include ABB, Honeywell International Inc., and IBM, among others.

-

ABB, a global technology company, is a significant player in the IAM market. Their ABB Ability platform offers a comprehensive suite of solutions to help organizations optimize the performance and efficiency of their industrial assets. One of the key offerings in ABB's industrial asset management portfolio is the ABB Ability Energy and Asset Manager. This solution combines hardware sensors and analytics software to provide real-time insights into energy consumption and the performance of multiple systems within a facility. The ABB Ability Asset Manager is designed to be user-friendly and accessible via computer, smartphone, or tablet, allowing companies to manage their systems flexibly

-

Honeywell International Inc. offers a range of solutions to help organizations optimize the performance and reliability of their critical assets. As a global leader in industrial automation and control systems, Honeywell provides a comprehensive suite of asset management tools and services that leverage advanced technologies, such as the IoT, data analytics, and AI. The company’s IAM offerings include Honeywell Forge platform, which provides a centralized system for monitoring, managing, and optimizing assets across multiple sites and industries. In addition, Honeywell offers a range of hardware products and services for industrial asset management. These include sensors, controllers, and other devices for monitoring and controlling industrial processes, as well as services, such as asset performance consulting, maintenance & repair, and training & support

Asset Panda, GoCodes and Accruent are some of the emerging market participants in the industrial asset management market.

-

Asset Panda is a provider of cloud-based asset management solutions, offering a powerful and flexible platform designed to help businesses across various industries, including the industrial sector, manage and track their assets effectively. Asset Panda's software provides full transparency into the state of assets, including their real-time status, depreciated value, repair history, warranty information, and more

-

GoCodes is a provider of IAM solutions, offering a comprehensive suite of tools to help businesses track, manage, and optimize their critical assets. GoCodes' flagship product is its cloud-based asset tracking software, which enables users to manage their equipment, inventory, and tools from a centralized platform. GoCodes also provides a range of hardware solutions, including patented QR code tags, rugged metal tags, and Bluetooth tracking devices

Key Industrial Asset Management Companies:

The following are the leading companies in the industrial asset management market. These companies collectively hold the largest market share and dictate industry trends.

- ABB

- Accruent

- Asset Panda

- AssetWorks, Inc.

- GE Vernova

- GoCodes

- Hexagon AB

- Hitachi Energy Ltd.

- Honeywell International Inc.

- IBM

- Oracle

- Rockwell Automation

- SAP SE

- Schneider Electric

- Siemens

Recent Developments

-

In June 2024, Hexagon announced the acquisition of Voyansi, a U.S.-based company specializing in services and solutions for Building Information Modeling (BIM) and Virtual Design and Construction (VDC) aimed at the architecture, engineering, construction, and operations (AECO) sector. This includes expertise in creating BIM workflow software and providing reality capture services. This move is part of Hexagon's Geosystems division's initiative to advance the digital transformation of the construction sector

-

In February 2024, ABB entered into a definitive agreement to acquire SEAM Group, a U.S.-based management and consultation services provider for energized assets across various industrial and commercial sectors. This strategic move is expected to enhance ABB's Electrification Service portfolio by integrating extensive know-how in predictive, preventive, and corrective maintenance, electrical safety, renewable energy solutions, and asset management consultancy. The acquisition is a critical step in ABB's strategy to establish a presence in the electrification services sector, expanding its services and market reach in the U.S.

-

In February 2023, Accruent introduced MC Kinetic, an offline computerized maintenance management system (CMMS) application designed to enhance the maintenance connection CMMS. It empowers maintenance teams to carry out work orders offline, and offers geo-location mapping, comprehensive work order management, and simplified inventory and parts management. These features aim to streamline workflow and improve operational efficiency for maintenance teams, even in remote settings

Industrial Asset Management Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 182.98 billion |

|

Market value forecast in 2030 |

USD 506.06 billion |

|

Growth rate |

CAGR of 18.5% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018- 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Market Value in USD billion and CAGR from 2024 to 2030 |

|

Report coverage |

Market value forecast, company share, competitive landscape, growth factors, and trends |

|

Segments covered |

Component, asset type, and region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; Australia; Brazil; Saudi Arabia; UAE; South Africa |

|

Key companies profiled |

ABB; Accruent; Asset Panda; AssetWorks, Inc.; GE Vernova; GoCodes; Hexagon AB; Hitachi Energy Ltd.; Honeywell International Inc.; IBM; Oracle; Rockwell Automation; SAP SE; Schneider Electric; Siemens |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Industrial Asset Management Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the industrial asset management market report based on component, asset type, and region:

-

Component Outlook (Revenue, USD Billion, 2018 - 2030)

-

Hardware

-

Real-Time Location System (RTLS)

-

Barcode

-

Mobile Computer

-

Labels

-

Global Positioning System (GPS)

-

Others

-

-

Software

-

Location & Movement Tracking

-

Check In/Check Out

-

Repair & Maintenance

-

Others

-

-

Services

-

Strategic Asset Management

-

Operational Asset Management

-

Tactical Asset Management

-

-

-

Asset Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Returnable Transport Assets

-

Manufacturing Assets

-

IT Asset

-

Others

-

-

Regional Outlook (Market Value, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa (MEA)

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global industrial asset management market size was estimated at USD 158.81 billion in 2023 and is expected to reach USD 182.98 billion in 2024.

b. The global industrial asset management market is expected to grow at a compound annual growth rate of 18.5% from 2024 to 2030 to reach USD 506.06 billion by 2030.

b. Services segment dominated the industrial asset management market with a share of 44.7% in 2023. As industries adopt more advanced technologies such as IoT, AI, and predictive analytics, there is a growing demand for services that can help integrate these technologies into existing asset management frameworks.

b. Some key players operating in the industrial asset management market include ABB, Accruent, Hexagon AB, Honeywell International Inc., SAP SE, Oracle, Siemens, Rockwell Automation, and others

b. The increasing adoption of digitalization and Industry 4.0 principles in various industries is driving growth of the market.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."