Industrial Agitators Market Size, Share & Trends Analysis By Product (Top Entry, Side Entry, Portable), By Application (Chemical, Water & Wastewater Treatment, Oil, Gas & Petrochemicals), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: 978-1-68038-878-7

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

Industrial Agitators Market Size & Trends

The global industrial agitators market was estimated at a value of USD 2.67 billion in 2023 and is expected to grow at a CAGR of 4.5% from 2024 to 2030, owing to efficient wastewater treatment. As the global population grows and the scarcity of clean water intensifies simultaneously, there is a heightened focus on efficient wastewater treatment. This has driven considerable demand for agitators as they help optimize treatment processes, ensuring a safe water supply for communities.

Moreover, industrial agitators play a crucial role in promoting reactions via heat transfer, enhancing mixing materials, and ensuring uniform distribution of chemicals in industries including pharmaceutical, chemical, cosmetic, and mineral sectors. These are utilized as energy-efficient mixing equipment that helps optimize mixing processes, ensuring homogenous mixing, flow maximization, rapid blending, and waste reduction.

Another primary market driver is the heavy reliance on industrial agitators for consistent, efficient production quality in food, beverage, healthcare, and more industries. In addition, consistent mixing processes that are done in less time and at a higher speed enhance product quality. Agitators facilitate homogeneity, stability, and uniform distribution of active ingredients.

Furthermore, major market players and industrial giants are investing substantially in research and development activities. These efforts contribute to the technological advancement of industrial agitators. For instance, introducing custom-made agitators has significantly improved production processes across various industries, driving the global demand for these essential components.

Product Insights

The top-entry products held the dominant share of the market with 45.7% in 2023, owing to the increased demand from chemical industries. Top-entry agitators are strategically positioned at the top of tanks and vessels. These are designed to allow efficient mixing, ensuring uniform distribution of reactants, temperature control, and homogenization, translating to optimized production processes. Top-entry agitators are extensively utilized in chemical manufacturing as precise ratios and compositions are critical for desired outcomes.

Portable industrial agitators is expected to emerge as the fastest-growing product segment over the forecast period. These compact agitators, with smooth surfaces and reduced crevices adhering to regulatory requirements, are found to be of extensive use in laboratories and research centers to minimize contamination risks. In addition, portable agitators incorporate IoT sensors for real-time data collection and monitor parameters, including seed, temperature, and viscosity. Automation in these agitators enables remote control and adjustments, optimizing the mixing process with fine-tuned settings.

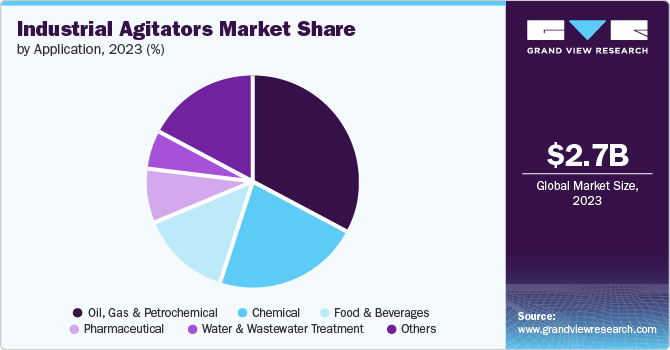

Application Insights

Based on application, the oil, gas & petrochemicals segment secured the dominant share of 33.3% in 2023 owing to the rising petrochemical manufacturing intricacies. Top-entry, side-entry, and bottom-entry agitators made with strategic positions ensure consistent composition and enhance product quality, minimizing waste. In addition, customized agitators with IoT integration allow precise control over mixing parameters such as energy consumption, waste reduction, and optimal efficiency.

The food and beverage industry is anticipated to witness the fastest CAGR over the forecast period. As consumers increasingly prioritize sustainable choices, the demand for organic, plant-based, and clean-label products surges. This has significantly augmented the growth of industrial agitators that help in blending natural ingredients while maintaining product integrity. Agitators facilitate experimentation and customized mixing processes, allowing manufacturers to create diverse food and beverage offerings including functional beverages and artisanal snacks. Manufacturers extensively use these agitators to ensure consistent flavor, texture, and quality across a wide range of items. Additionally, escalating raw material costs impact the food and beverage industry, resulting in companies creatively upcycling excess or waste materials to produce valuable food ingredients. Upcycling mitigates costs while promoting environmental responsibility.

Regional Insights

The North America industrial agitators market was primarily propelled by industries including pharmaceuticals, chemicals, and cosmetics, which expanded the market's production capacity. Agitators gained prominence owing to the rising need for energy efficiency, rapid mixing for consistent product quality, and flow optimization. In addition, environmental awareness led to increased adoption of agitators as these systems reduce ecological waste, aligning with sustainability goals.

Asia Pacific Industrial Agitators Market Trends

The industrial agitators market in Asia Pacific secured the dominant share with 36.4% in 2023. This growth is attributable to the widespread product adoption and the rising demand for technologically advanced solutions. Robust economies, including China, India, and Japan, contribute to this trend. Additionally, the shift from conventional utilization to efficient and timely order fulfillment capabilities is expected to boost the market in the region further.

China Industrial Agitators Market Trends

The industrial agitators market in China dominated Asia Pacific with a 48.3% share in 2023. The market was significantly increased due to the country's growing chemical, pharmaceutical, food, and cosmetic industries which heavily rely on customized agitators. These agitators are capable of blending viscous materials, adapting to non-standard flow behavior, and ensuring uniformity in products. In addition, companies such as Shenyang Precision Work Huazhiyi Machinery Co., Ltd, and HEBEI XINHUAFA PETROLEUM MACHINERY CO., LTD. have pioneered unique agitator forms, including magnetic Agitators which are used in magnetic fields for stirring and minimizing contamination risks.

Europe Industrial Agitators Market Trends

The industrial agitators market in Europe was driven by the regional companies' emphasis on energy-saving technologies. Agitators designed for low power consumption played a critical role in ensuring uniform blends, consistent product quality, and optimized processes in the chemical, pharmaceutical, and food & beverages sectors. Moreover, customized agitators tailored to specific applications have gained momentum by addressing industry-specific needs, enhancing overall efficiency.

Key Industrial Agitators Company Insights

The market is characterized by keen competition that is driving market participants to create efficient and innovative products to meet industry-specific demands. Key players are also investing in various R&D activities and developing strategic partnerships to continue with their dominant footprint.

-

Xylem Inc. is an American water technology provider that operates across various sectors including residential, commercial, public utility, agricultural, and industrial settings. The company mainly focuses on water infrastructure and wastewater treatment.

-

Chemineer is a globally recognized brand for innovation in designing and manufacturing fluid agitation systems. The company offers top-quality services and provides fluid-handling solutions to meet operational needs and specifications.

Key Industrial Agitators Companies:

The following are the leading companies in the industrial agitators market. These companies collectively hold the largest market share and dictate industry trends.

- Sulzer Ltd.

- Xylem Inc.

- SPX Corporation

- Ekato Group

- Philadelphia Mixing Solutions, Ltd. Tacmina Corporation

- Chemineer Inc.

- JBW Systems Inc.

- Mixer Systems Inc.

- Silverson Machines Inc.

- FluidMix

- Premix Technologies

- Inoxmim

Recent Developments

-

In May 2024, Xylem announced the launch of Reuse Brew, a Bavarian beer to address the rising water scarcity. This beer, crafted from top-quality treated wastewater, represents a major leap forward in water recycling technology, providing a sustainable solution to the rising challenges posed by climate change.

-

In December 2022, Silverson Machines introduced three fresh Laboratory Scale mixers including an upgraded version of the Silverson Flashmix Powder/Liquid mixer with cutting-edge design and mixing technology.

Industrial Agitators Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 2.78 billion |

|

Revenue forecast in 2030 |

USD 3.63 billion |

|

Growth Rate |

CAGR of 4.5% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, application, region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, MEA |

|

Country scope |

U.S., Canada, Mexico, Germany, UK, France, Italy, Spain, China, Japan, India, South Korea, Brazil, Argentina, Saudi Arabia, UAE |

|

Key companies profiled |

Sulzer Ltd.; Xylem Inc.; SPX Corporation; Ekato Group; Philadelphia Mixing Solutions, Ltd. Tacmina Corporation; Chemineer Inc.; JBW Systems Inc.; Mixer Systems Inc.; Silverson Machines Inc.; FluidMix; Premix Technologies; Inoxmim |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Industrial Agitators Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global industrial Agitators market report based on product, application, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Top Entry

-

Side Entry

-

Bottom Entry

-

Portable

-

Static

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Chemical

-

Water And Wastewater Treatment

-

Oil, Gas And Petrochemical

-

Food And Beverages

-

Pharmaceutical

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

UAE

-

Saudi Arabia

-

-

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."