Industrial Access Control Market Size, Share & Trends Analysis Report By Component (Hardware, Services), By End Use (Manufacturing, Warehouse & Logistics), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-468-1

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2017 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

Market Size & Trends

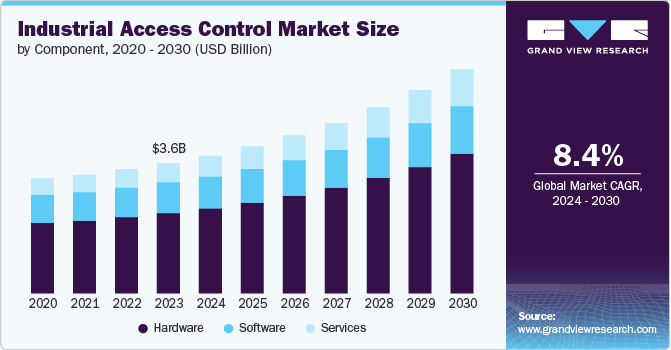

The global industrial access control market size was estimated at USD 3.59 billion in 2023 and is expected to grow at a CAGR of 8.4% from 2024 to 2030. Ensuring the safety of employees and the protection of valuable assets is a top priority for industrial organizations. Access control systems play a crucial role in mitigating safety risks and preventing unauthorized access. The market is driven by increasing security concerns, advancements in technology, and growing demand for remote access management. As industrial environments face growing threats from theft, vandalism, and cyberattacks, there is a heightened demand for advanced access control systems to protect physical and digital assets.

Innovations in biometric authentication, IoT, and AI are enhancing the capabilities of industrial access control systems. These technological advancements enable more secure, efficient, and flexible access management solutions. Moreover, the integration of access control systems with other smart building technologies, such as building management systems (BMS) and energy management systems (EMS), is driving market growth. This integration offers enhanced security, efficiency, and operational control. The increasing automation of industrial processes requires advanced access control systems to manage and monitor access to automated equipment, control rooms, and sensitive areas.

Stricter regulations and standards for industrial security and safety are driving the adoption of access control systems. Compliance with standards such as the International Organization for Standardization (ISO), Occupational Safety and Health Administration (OSHA), and data protection regulations necessitates robust access control measures. Moreover, the need for remote monitoring and management of access control systems, driven by the rise in remote work and distributed operations, is fueling the adoption of cloud-based and networked access control solutions.

Component Insights

The hardware segment led the market and accounted for over 61.0% share of the global revenue in 2023. Various factors such as advancement in technologies, growing security concerns, and expansion of industrial infrastructure are primarily contributing to the segment’s growth. The incorporation of Internet of Things (IoT) technologies and smart features in access control hardware enhances functionality and attracts investments. Innovations in fingerprint, facial recognition, and iris scanning technologies improve security and reliability. Stricter regulations and standards for physical security necessitate upgraded access control hardware to meet compliance requirements.

The services segment is anticipated to exhibit a significant CAGR from 2024 to 2030. Growing concerns over physical security and the need to protect valuable assets in industrial environments drive demand for comprehensive access control services. Thus, organizations seek expert services to ensure robust and effective security measures. Moreover, modern access control systems are increasingly complex, integrating various technologies such as biometrics, RFID, and IoT. This complexity necessitates professional services for installation, configuration, and maintenance to ensure optimal functionality.

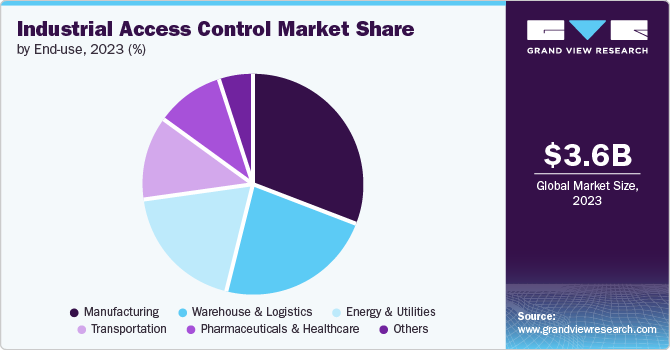

End Use Insights

The manufacturing segment accounted for the largest revenue share in 2023. Manufacturing facilities such as house valuable machinery, equipment, and intellectual property require robust security measures to prevent theft and unauthorized access. Moreover, the rise of smart manufacturing and Industry 4.0 initiatives drives the need for advanced access control systems that integrate with smart technologies and digital infrastructure. Furthermore, modern access control solutions offer scalability and flexibility to adapt to changes in manufacturing processes, facility expansion, and evolving security needs.

The warehouse & logistics segment is anticipated to exhibit the highest CAGR from 2024 to 2030. The rapid expansion of e-commerce has increased the need for larger and more secure warehouses and distribution centers. As leading companies such as Amazon and Alibaba continue to expand, the demand for advanced access control systems to efficiently manage entry points, secure inventory, and monitor personnel movement is on the rise. These solutions are essential to maintaining operational security and efficiency in large-scale logistics environments. Furthermore, the rise of automation and smart technologies in warehouses requires advanced access control solutions that integrate with automated systems, robotics, and IoT devices. These systems ensure that only authorized personnel can access specific areas, safeguarding valuable assets and sensitive operations.

Regional Insights

North America industrial access control market dominated with a revenue share of over 38.0% in 2023. North America has been at the forefront of security technology advancements, including the development and adoption of biometrics, IoT-based access control solutions, and AI-driven security systems. Local companies and startups are playing a key role in implementing and expanding these technologies, contributing to the growth of the industrial access control market in the region.

U.S. Industrial Access Control Market Trends

The U.S. industrial access control market is anticipated to exhibit a significant CAGR from 2024 to 2030. The shift towards contactless access control systems, such as facial recognition and mobile-based access gained significant momentum in the country. The emphasis on reducing physical interaction in industrial settings has driven long-term changes in security infrastructure, with companies in the country adopting advanced, touchless solutions at a higher rate.

Europe Industrial Access Control Market Trends

The industrial access control market in the Europe region is expected to witness significant growth over the forecast period. The European Union's push towards Industry 4.0 and smart manufacturing is fueling demand for advanced access control systems. The integration of automation and digital technologies in manufacturing and industrial processes requires secure access control to protect these systems and ensure safe operations.

Asia Pacific Industrial Access Control Market Trends

The Asia Pacific industrial access control market is anticipated to register the highest CAGR from 2024 to 2030. The Asia-Pacific region is experiencing fast-paced industrialization and urbanization. This rapid development drives the need for advanced access control systems to secure new industrial facilities, warehouses, and infrastructure projects. Moreover, the development of smart cities and smart infrastructure in the Asia-Pacific region involves integrating advanced technologies, including access control systems, to enhance security and operational efficiency. These initiatives boost the adoption of modern access control solutions.

Key Industrial Access Control Company Insights

Key companies include Qualcomm Technologies, Inc., Intel Corporation, and NVIDIA Corporation. Companies active in the industrial access control market are focusing aggressively on expanding their customer base and gaining a competitive edge over their rivals. Hence, they pursue various strategic initiatives, including partnerships, mergers & acquisitions, collaborations, and new product/ technology development.

For instance, in April 2024, Zoo Hardware introduced an access control range tailored for commercial buildings, public facilities, and residential spaces. The range includes over 40 products, such as key switches, entry and exit devices, keypads, magnetic locks, and emergency door releases providing customers with a complete access control system that ensures safe and secure management of building access.

Key Industrial Access Control Companies:

The following are the leading companies in the industrial access control market. These companies collectively hold the largest market share and dictate industry trends.

- Allegion

- ASSA ABLOY

- Bosch Sicherheitssysteme GmbH

- dormakaba Group

- Hirsch, Inc.

- Honeywell International Inc.

- Johnson Controls Inc.

- Schneider Electric

- Siemens

- Thales

Recent Developments

-

In July 2024, Dahua Technology Co., Ltd., a video-centric AIoT service and solution provider, introduced DSS Professional V8.5, the latest enhancement to its industry-specific security management software. The software is designed to streamline security operations. This version introduces enhanced interactive AR monitoring, user interface, enhanced integration, and advanced access management, all tailored to meet the evolving needs of various industries.

-

In June 2024, Honeywell International Inc. acquired Carrier Global Corporation’s global access solutions segment for USD 4.95 billion. Carrier Global Corporation plans to use the net proceeds from the sales to reduce debt, aiming to achieve approximately 2x net leverage by the end of 2024.

-

In April 2024, Siemens launched Siemens Xcelerator, a new Siemens software automatically identifies vulnerable production assets. The software automatically links identified vulnerabilities of cybersecurity to the production assets of industries. This helps industrial automation and operator professionals, even those without specialized cybersecurity knowledge, detect risks within their OT assets on the shop floor and receive a prioritized threat analysis.

Industrial Access Control Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 3.80 billion |

|

Revenue forecast in 2030 |

USD 6.17 billion |

|

Growth rate |

CAGR of 8.4% from 2024 to 2030 |

|

Actual data |

2017 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD billion/million and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Component, end use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; Germany; UK; France; China; India; Japan; Australia; South Korea; Brazil; UAE; South Africa; KSA |

|

Key companies profiled

|

Allegion; ASSA ABLOY; Bosch Sicherheitssysteme GmbH; dormakaba Group; Hirsch, Inc.; Honeywell International Inc.; Johnson Controls Inc.; Schneider Electric; Siemens; Thales |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Industrial Access Control Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global industrial access control market report based on the component, end use, and region:

-

Component Outlook (Revenue, USD Million, 2017 - 2030)

-

Hardware

-

Software

-

Services

-

-

End Use Outlook (Revenue, USD Million, 2017 - 2030)

-

Manufacturing

-

Energy & Utilities

-

Warehouse & Logistics

-

Transportation

-

Pharmaceuticals & Healthcare

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

MEA

-

UAE

-

South Africa

-

KSA

-

-

Frequently Asked Questions About This Report

b. The global industrial access control market size was estimated at USD 3.59 billion in 2023 and is expected to reach USD 3.80 billion in 2024.

b. The global industrial access control market is expected to grow at a compound annual growth rate of 8.4% from 2024 to 2030 to reach USD 6.17 billion by 2030.

b. North America dominated the industrial access control market with a share of 38.8% in 2023. North America has been at the forefront of security technology advancements, including the development and adoption of biometrics, IoT-based access control solutions, and AI-driven security systems. Local companies and startups are playing a key role in implementing and expanding these technologies, contributing to the growth of the industrial access control market in the region.

b. Some key players operating in the industrial access control market include Allegion; ASSA ABLOY; Bosch Sicherheitssysteme GmbH; dormakaba Group; Hirsch, Inc.; Honeywell International Inc.; Johnson Controls Inc.; Schneider Electric; Siemens; and Thales.

b. The industrial access control market is driven by increasing security concerns, advancements in technology, and growing demand for remote access management. As industrial environments face growing threats from theft, vandalism, and cyberattacks, there is a heightened demand for advanced access control systems to protect physical and digital assets.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."