Indoor Positioning And Navigation Market Size, Share, & Trends Analysis Report By Component (Software, Hardware, Service), By Technology, By Application, By End-use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-384-4

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

Market Size & Trends

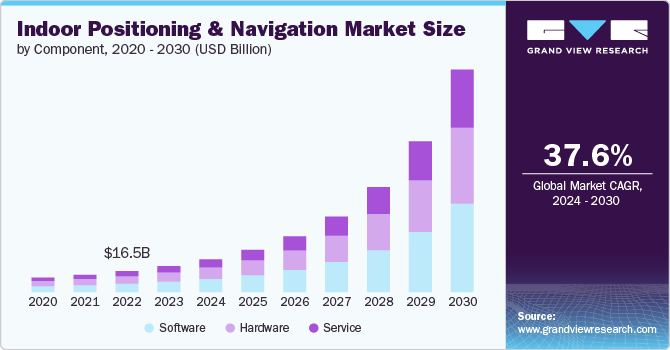

The global indoor positioning and navigation market size was estimated at USD 20.38 billion in 2023 and is anticipated to grow at a CAGR of 37.6% from 2024 to 2030. The increasing adoption of smartphones and smart devices equipped with advanced sensors has augmented the demand for precise indoor navigation solutions in various environments such as malls, airports, and hospitals. Moreover, the growing need for enhanced customer experience and operational efficiency in retail and commercial spaces is propelling the market as businesses seek to leverage indoor positioning technologies to offer personalized services, streamline operations, and gain insights into customer behavior.

The development of more accurate and reliable indoor positioning technologies, such as Simultaneous Localization and Mapping (SLAM), Bluetooth Low Energy (BLE) beacons, Wi-Fi, and Ultra-Wideband (UWB), is driving the market growth. SLAM enables devices to map an unknown environment while keeping track of their location. This technology is crucial for indoor navigation, where GPS signals are often weak or unavailable. The ability of SLAM to provide accurate and real-time positioning in complex indoor environments makes it highly valuable for applications such as robotics, augmented reality (AR), and autonomous vehicles. Businesses and industries are increasingly adopting SLAM to enhance navigation capabilities, improve efficiency, and enable new functionalities in their operations.

The market is experiencing rapid growth driven by the increasing adoption of IoT-enabled devices and the widespread use of smartphones. These devices can utilize location data to offer enhanced services, such as personalized advertisements, efficient navigation within complex buildings, and improved asset tracking. The integration of IoT technology allows for more accurate and real-time location tracking, which is essential for various applications in sectors like retail, healthcare, and logistics. In addition, the proliferation of smartphones equipped with advanced sensors has significantly increased the demand for indoor positioning and navigation solutions. Businesses are leveraging this technology to enhance customer experiences, streamline operations, and gain valuable insights into consumer behavior.

Component Insights

The software segment accounted for the largest market share of 40.25% in 2023 due to the rising trend of smart buildings and smart cities. As urban environments become more connected and complex, there is a growing need for robust indoor navigation systems that can seamlessly integrate with other smart technologies. Software solutions that support seamless integration with IoT devices, cloud services, and AI-driven analytics are becoming essential, driving further growth and innovation within the market.

The service segment is anticipated to grow at the fastest CAGR over the forecast period.The demand for customized solutions tailored to specific industry needs drives growth in the service segment. Retail, healthcare, hospitality, and logistics industries require personalized indoor navigation solutions that integrate seamlessly with existing infrastructure and operational workflows. Service providers offer consulting services to assess client needs, design bespoke solutions, and provide ongoing support to optimize performance and user experience.

Technology Insights

The Bluetooth low energy (BLE) segment accounted for the largest market share of 35.24% in 2023. BLE's compatibility with smartphones and other consumer devices facilitates seamless integration into existing infrastructure. This ease of integration enables businesses to implement cost-effective indoor positioning solutions without requiring extensive hardware upgrades. Therefore, BLE technology is increasingly favored for applications such as indoor wayfinding in large venues like shopping malls, airports, and museums, where precise location tracking and navigation services are crucial for enhancing user experiences.

Theultra-wideband technologysegment is anticipated to grow significantly over the forecast period due toaccurate location tracking capabilities. Its ability to provide precise location data within centimeter-level accuracy makes it ideal for applications where pinpoint location information is crucial, such as asset tracking in warehouses or guiding surgical instruments in healthcare settings.

Application Insights

The asset & personnel tracking segment accounted for the largest market share of 34.65% in 2023. Advancements in IoT technology and the proliferation of connected devices have significantly contributed to expanding asset and personnel tracking solutions. IoT-enabled sensors and tags provide accurate location data, allowing organizations to monitor the movement and status of assets and personnel seamlessly. This level of visibility is crucial for improving inventory management, reducing loss or theft, and ensuring compliance with regulatory requirements.

The location-based analytics segment is anticipated to grow at the fastest CAGR over the forecast period.Retailers increasingly adopt indoor positioning and navigation solutions to leverage location-based analytics for venue-based marketing strategies. This allows them to better understand customer behavior, preferences, and intent, enabling more personalized experiences and targeted promotions.

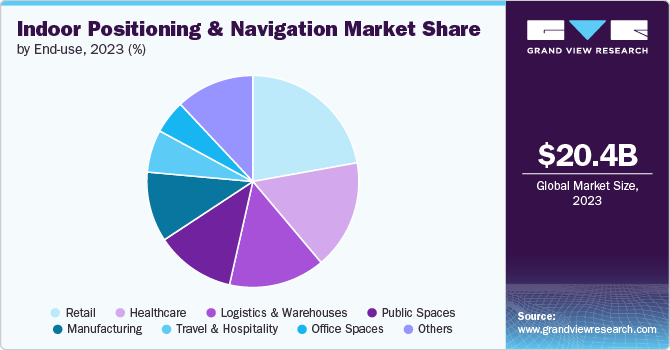

End-use Insights

The retail segment accounted for the largest market share of 22.15% in 2023. The rise of omnichannel retailing pushes businesses to integrate online and offline experiences. Indoor positioning systems enable retailers to offer seamless navigation and targeted marketing within physical stores, creating a cohesive shopping experience. As retailers increasingly adopt these technologies to stay competitive, the demand for indoor positioning and navigation solutions continues to grow, further fueling the market's expansion.

The healthcare segment is anticipated to grow at the fastest CAGR over the forecast period due to the increasing need for efficient asset management and patient tracking. Hospitals and healthcare facilities are adopting these solutions to improve operational efficiency, reduce wait times, and enhance patient experiences. By leveraging indoor positioning technologies, healthcare providers can ensure that medical equipment is easily located, staff can navigate complex facilities quickly, and patients receive timely assistance.

Regional Insights

North America held 35.95% of the indoor positioning and navigation market in 2023.The growing trend of smart buildings and the Internet of Things (IoT) significantly contributes to the market growth in the region. Smart buildings with indoor positioning and navigation systems offer enhanced security, energy management, and facility management. IoT devices connected within these buildings generate vast amounts of data, leading to smarter, more efficient operations when integrated with indoor positioning systems. This integration is particularly beneficial in large commercial spaces, industrial facilities, and complex healthcare environments where efficient navigation and asset tracking are critical.

U.S. Indoor Positioning And Navigation Market Trends

The indoor positioning and navigation market in the U.S. is expected to grow significantly from 2024 to 2030.The proliferation of smartphones and smart devices, which inherently possess the necessary sensors and connectivity features for indoor positioning, has fueled the demand for IPIN systems. As consumers and businesses rely more on mobile technology for navigation and location-based services, the demand for IPIN systems has surged. These systems facilitate various applications, from guiding shoppers within large retail spaces to aiding emergency responders in navigating complex buildings, highlighting their growing importance.

Europe Indoor Positioning And Navigation Market Trends

The indoor positioning and navigation market in Europe is growing significantly at a CAGR of 36.0% from 2024 to 2030. Businesses in Europe are increasingly focusing on enhancing customer experience and personalization through IPIN systems. Retailers use these technologies to deliver location-based services, such as targeted advertisements and promotions, enhancing customer engagement and satisfaction. Personalized navigation aids and tailored recommendations based on a user’s indoor location and behavior are becoming key differentiators for businesses aiming to improve their customer service and loyalty.

Asia Pacific Indoor Positioning And Navigation Market Trends

The indoor positioning and navigation market in Asia Pacific is growing at the highest CAGR of 39.8% from 2024 to 2030 due to rapid urbanization and the corresponding development of smart cities across the region. Governments and private entities are investing heavily in infrastructure that supports smart technologies, including indoor positioning and navigation systems, to enhance urban living standards. These technologies are crucial for managing large public spaces such as airports, shopping malls, and hospitals, where efficient navigation can significantly improve user experience and operational efficiency.

Key Indoor Positioning And Navigation Company Insights

Key players operating in the market includeApple Inc., Cisco Systems, Google (Alphabet Inc.), HERE Technologies, Honeywell International Inc., IndoorAtlas, Microsoft, NavVis, Siemens AG, Ubisense, and Zebra Technologies. The companies focus on various strategic initiatives, including new product development, partnerships & collaborations, and agreements to gain a competitive advantage over their rivals. The following are some instances of such initiatives.

-

In February 2024, Mapxus partnered with Kawasaki Heavy Industries (KHI) to deliver advanced indoor mapping and positioning services at Narita International Airport, integrating the iPNT-K service into the airport's official website. This collaboration aims to enhance passenger navigation by providing real-time, location-based information without requiring additional smartphone applications. Leveraging Mapxus' hardware-free indoor mapping technology, the web-based digital map seamlessly operates within the website, offering a more convenient navigation experience for passengers.

-

In February 2024, Mappedin, a provider of indoor mapping services, launched Mappedin Plus, a subscription service designed to give mapmakers access to user-friendly tools and enhanced features for creating detailed 3D indoor maps quickly. Mappedin Plus caters to mapmakers and teams in small to medium-sized organizations, allowing them to produce rich indoor maps with ease. Both Mappedin Free and Plus subscriptions offer tools for creating visually appealing 3D maps and navigation aids, helping guide visitors and customers while promoting safer and more efficient environments.

Key Indoor Positioning And Navigation Companies:

The following are the leading companies in the indoor positioning and navigation market. These companies collectively hold the largest market share and dictate industry trends.

- Apple Inc.

- Cisco Systems

- Ekahau

- Google (Alphabet Inc.)

- HERE Technologies

- Honeywell International Inc.

- IndoorAtlas

- Mappi

- Microsoft

- NavVis

- Point Inside

- Samsung Electronics

- Siemens AG

- Ubisense

- Zebra Technologies

Indoor Positioning And Navigation Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 25.68 billion |

|

Revenue forecast in 2030 |

USD 174.02 billion |

|

Growth rate |

CAGR of 37.6% from 2024 to 2030 |

|

Actual data |

2018 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company share, competitive landscape, growth factors, and trends |

|

Segments covered |

Component, technology, application, end-use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Saudi Arabia; South Africa |

|

Key companies profiled |

Apple Inc.; Cisco Systems; Ekahau; Google (Alphabet Inc.); HERE Technologies; Honeywell International Inc.; IndoorAtlas; Mappi; Microsoft; NavVis; Point Inside; Samsung Electronics; Siemens AG; Ubisense; Zebra Technologies |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Indoor Positioning And Navigation Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global indoor positioning and navigation market report based on component, technology, application, end-use, and region:

-

Component Outlook (Revenue, USD Billion, 2018 - 2030)

-

Software

-

Hardware

-

Service

-

-

Technology Outlook (Revenue, USD Billion, 2018 - 2030)

-

Ultra-Wideband Technology

-

Bluetooth Low Energy

-

Wi-Fi

-

Others

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Asset & Personnel Tracking

-

Location-Based Analytics

-

Navigation & Maps

-

Others

-

-

End-use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Healthcare

-

Retail

-

Manufacturing

-

Travel & Hospitality

-

Office Spaces

-

Public Spaces

-

Logistics & Warehouses

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

U.A.E

-

Kingdom of Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global indoor positioning and indoor navigation market size was estimated at USD 20.38 billion in 2023 and is expected to reach USD 25.68 billion in 2024.

b. The global indoor positioning and indoor navigation market is expected to grow at a compound annual growth rate of 37.6% from 2024 to 2030 to reach USD 174.02 billion by 2030.

b. The software segment accounted for the largest market share of 40.3% in 2023 in indoor positioning and indoor navigation market due to the rising trend of smart buildings and smart cities. As urban environments become more connected and complex, there is a growing need for robust indoor navigation systems that can seamlessly integrate with other smart technologies.

b. Some key players operating in the indoor positioning and indoor navigation market include Apple Inc., Cisco Systems, Ekahau, Google (Alphabet Inc.), HERE Technologies, Honeywell International Inc., IndoorAtlas, Mappi, Microsoft, NavVis, Point Inside, Samsung Electronics, Siemens AG, Ubisense, and Zebra Technologies

b. The increasing adoption of smartphones and smart devices equipped with advanced sensors has augmented the demand for precise indoor navigation solutions in various environments such as malls, airports, and hospitals. Moreover, the growing need for enhanced customer experience and operational efficiency in retail and commercial spaces is propelling the market as businesses seek to leverage indoor positioning technologies to offer personalized services, streamline operations, and gain insights into customer behavior.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."