- Home

- »

- Disinfectants & Preservatives

- »

-

Indoor Air Purification Market Size, Industry Report, 2030GVR Report cover

![Indoor Air Purification Market Size, Share & Trends Report]()

Indoor Air Purification Market (2025 - 2030) Size, Share & Trends Analysis Report By Product, By Technology, By Application (Commercial, Industrial, Residential), By Region, And Segment Forecasts

- Report ID: GVR-1-68038-000-2

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Indoor Air Purification Market Size & Trends

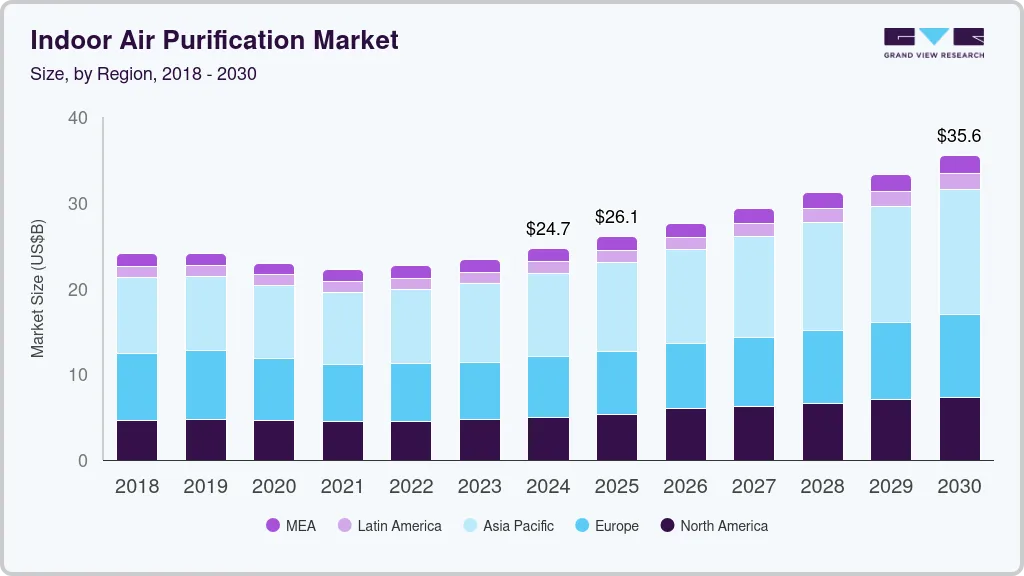

The global indoor air purification market size was valued at USD 24,700.4 million in 2024 and is projected to grow at a CAGR of 6.4% from 2025 to 2030. The increasing air pollution in urban areas worldwide has led to a rise in the demand for these devices. The detrimental health implications of poor indoor air quality, including respiratory issues, allergies, and chronic diseases, have compelled consumers to prioritize air purification. Customers recognize the importance of building healthy living and working spaces to improve overall quality of life. Furthermore, the Air Quality Index (AQI) continuously increases due to rapid urbanization and industrialization, affecting human health and raising the demand for indoor air purifiers.

Government regulations mandating better indoor air quality standards in residential and commercial spaces have further accelerated market expansion. Stringent compliance standards have forced building owners and occupants to purchase air purification systems. Moreover, the increasing disposable incomes and the expanding middle class in numerous nations have enabled customers to invest in advanced air purification technologies.

Advancements in air purification technologies have played a pivotal role in driving market growth. The development of innovative filtration systems, energy-efficient designs, and smart features has enhanced the appeal of air purifiers. Integrating air purifiers with other smart home devices has expanded functionality and broadened the consumer base. Additionally, the COVID-19 pandemic has highlighted the importance of indoor air quality and the role of air purifiers in mitigating the spread of airborne diseases, providing significant growth to the market.

Product Insights

Dust collectors & vacuums dominated the market and accounted for a revenue share of 36.0% in 2023. The high usage of the product in the industrial and residential sectors boosts demand. It efficiently removes dust particles and pollutants, contributing to healthier indoor environments. Consumers are taking health seriously and becoming more aware of wellness. Efficient dust removal systems are necessary to change lifestyles due to urbanization, increased construction activities, and rising pollution levels. In addition, dust collectors and vacuums are cheaper than other air purifiers. It is easy to use, requires low maintenance costs, and the installation process is not complex.

The fume & smoke collectors segment is expected to register a significant CAGR during the forecast period. The growing strictness of environmental rules aimed at reducing air pollution and protecting public health. Businesses in various industries are investing in high-tech fume and smoke collection systems to meet emission standards and avoid penalties. Additionally, the increasing awareness of the detrimental health impacts of being exposed to fumes and smoke is prompting workplaces to ensure the safety and health of employees. Furthermore, the increasing industrialization, urbanization, and the rising emphasis on indoor air quality are generating a strong demand for effective fume and smoke collection systems. In addition, advances in filtration and purification technologies enable developing more effective and energy-efficient products, thereby driving segment growth.

Technology Insights

High-efficiency particulate arrestance (HEPA) technology accounted for the largest revenue share in 2023. The technology's demonstrated effectiveness in trapping a wide range of airborne particles such as allergens, dust mites, pollen, and pet dander has significantly contributed to the dominance. Increasing consumer awareness regarding indoor air quality problems and related health risks has driven the demand for air purifiers with HEPA filters. Furthermore, strict government regulations on indoor air pollution standards have made it necessary to use advanced filtration technologies such as HEPA, especially in commercial and institutional setups. The versatility of HEPA filters, compatible with various air purifier designs and suitable for diverse environments, has further solidified position for individuals and companies.

The electrostatic precipitator (ESP) segment is projected to grow at the fastest CAGR over the forecast period. The demand for electrostatic precipitator (ESP) air purifiers is rising across residential, commercial, and industrial sectors. ESP technology’s versatility makes it adaptable to diverse environments, requiring efficient airborne contaminant removal for healthier spaces. ESPs excel at filtering out tiny particles. Moreover, high separation efficiency, low maintenance, ability to withstand high temperatures, and reduced operational costs drive high demand for electrostatic precipitator-based air purifiers in the coming years.

Application Insights

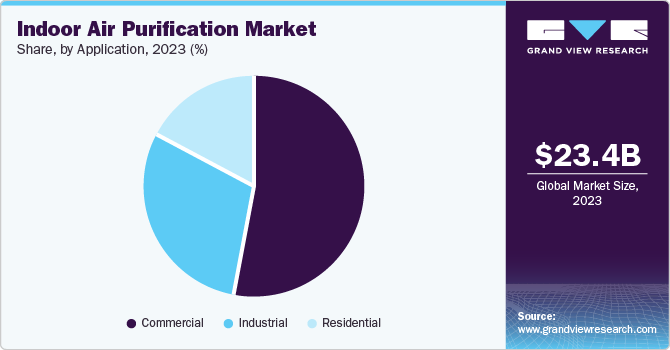

The commercial segment dominated the market in 2023. Commercial establishments, such as offices, retail stores, and hospitality venues, have increasingly recognized the significance of offering clean, healthy indoor air for employees, customers, and guests. The presence of contaminants such as dust particles, allergens, and other airborne pollutants within these spaces has necessitated the installation of indoor air purifiers to reduce health risks and improve overall air quality. Air purifiers create a more conducive and efficient work atmosphere in office environments, where workers spend a considerable portion of their day. These devices can lower the chance of respiratory problems and allergies by eliminating pollutants and allergens, ultimately enhancing the health and productivity of employees.

The industrial segment is expected to witness a significant CAGR over the forecast period. Hazardous contaminants, such as chemical fumes, particulate matter, and volatile organic compounds (VOCs), are present in industrial environments, requiring advanced air purification systems to protect worker health and safety. Furthermore, the increasing focus on productivity and the well-being of employees has resulted in higher investments in managing indoor air quality. Moreover, stringent government regulations mandating improved indoor air quality in industrial settings propel the demand for effective air purification solutions.

Regional Insights

Asia Pacific indoor air purification market dominated the market in 2023. The region's thriving economy, rapid urbanization, and industrialization have increased air pollution levels. This has increased consumer consciousness regarding the harmful impacts of low indoor air quality on health, driving demand for air purifiers. Strict regulations implemented by the government to enhance indoor air quality have also helped drive market expansion. Moreover, the rising number of respiratory illnesses and allergies in the region and the growing geriatric population have increased the need for air purifiers to promote better indoor air quality.

China Indoor Air Purification Market Trends

China indoor air purification market dominated the Asia Pacific with a revenue share of 39.7% in 2023 due to the country's severe air pollution problem, particularly in urban areas. This has increased public awareness of the harmful impacts of low air quality on health, leading to a notable increase in the need for air purifiers to reduce indoor pollution exposure. Furthermore, the rising middle class in China, with high purchasing power, has increased the purchase of high-end air purifiers.

Europe Indoor Air Purification Market Trends

Europe indoor air purification market was identified as a lucrative region in 2023. The increasing levels of air pollution in the region have raised public concern about the health risks linked to low indoor air quality. The growing focus on health and well-being and higher disposable incomes have driven the need for air purification solutions. The ever-increasing emphasis on energy efficiency and sustainability has led to implementing advanced air purification technologies in European homes and businesses.

The UK indoor air purification market is expected to grow rapidly in the coming years. Stringent government regulations to enhance indoor air quality in residential and commercial settings foster a favorable market environment. The growing demand for energy-efficient and environmentally friendly products is also fueling the popularity of advanced air purifiers in the UK market.

North America Indoor Air Purification Market Trends

North America indoor air purification market is expected to grow with the fastest CAGR over the forecast period. The rising consumer awareness about the importance of indoor air quality and its impact on overall well-being has fueled the market. The region's robust economy and rising disposable income have enabled consumers to invest in advanced air purification technologies for homes and workplaces. Furthermore, stringent government regulations promoting indoor air quality standards and the growing focus on energy efficiency and sustainability have also contributed to market growth.

The U.S. indoor air purification market held a substantial market share in 2023 owing to the rising prevalence of allergies, asthma, and respiratory issues among people, which has led to a higher need for air purification solutions. Additionally, the increasing concerns regarding indoor air quality and its impact on overall health and well-being have led consumers to purchase air purifiers. Additionally, advancements in air purification technologies and extensive marketing and consumer awareness campaigns have contributed to market growth.

Key Indoor Air Purification Company Insights

Some key companies in the indoor air purification market include FLSmidth, Hamon, Camfil, Thermax Limited, Kelin Environmental Protection Technology Co., Ltd., KC Cottrell India, and others. Major companies in the market are strategically expanding their customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions and partnerships with other major companies.

-

Thermax Limited, an international sales and service network, focuses on providing sustainable energy and environmental solutions. It deals in a wide range of verticals, including boilers and heaters, solar power, air pollution control systems, and water and waste solutions.

-

FLSmidth is a technology and service supplier that provides industries with engineering and equipment solutions. It offers a wide range of products, such as pressure filters, automated scrubbers, and compression crushers, and services like education, testing, research, and operational services. FLSmidth aims for carbon-neutral operations by 2030.

Key Indoor Air Purification Companies:

The following are the leading companies in the indoor air purification market. These companies collectively hold the largest market share and dictate industry trends.

- FLSmidth

- Hamon

- Camfil

- Thermax Limited

- Kelin Environmental Protection Technology Co., Ltd.

- KC cottrell India.

- Nederman Holding AB

- Sumitomo Heavy Industries, Ltd.

- Donaldson Company, Inc.

- Babcock & Wilcox Enterprises, Inc.

- SHARP CORPORATION

- Honeywell International Inc.

- DAIKIN INDUSTRIES, Ltd.

- Halton Group

- Trane

Recent Developments

-

In April 2024, Abatement Technologies launched its new ATL Filtration brand, which focuses on advanced filtration solutions for various applications. With this new product line, the company aims to enhance indoor air quality and support health and safety standards. The brand was introduced to address growing concerns about air pollution and its impact on public health.

-

In February 2024, Airthings launched the Renew Wave Enhance, an advanced air quality monitor designed for smart homes. This device features enhanced sensors for tracking indoor air quality, including carbon dioxide levels, volatile organic compounds, and humidity. It aims to provide users with real-time data to improve their home environment.

Indoor Air Purification Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 26,096.0 million

Revenue forecast in 2030

USD 35,551.8 million

Growth Rate

CAGR of 6.4% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, technology, application

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, Italy, Spain, China, Japan, India, South Korea, Australia, Brazil, Argentina, UAE, South Africa and Saudi Arabia

Key companies profiled

FLSmidth; Hamon; Camfil; Thermax Limited.; Kelin Environmental Protection Technology Co., Ltd.; KC cottrell India.; Nederman Holding AB.; Sumitomo Heavy Industries, Ltd.; Donaldson Company, Inc.; Babcock &Wilcox Enterprises, Inc.; SHARP CORPORATION; Honeywell International Inc.; DAIKIN INDUSTRIES, Ltd.; Halton Group; Trane

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Indoor Air Purification Market Report Segmentation

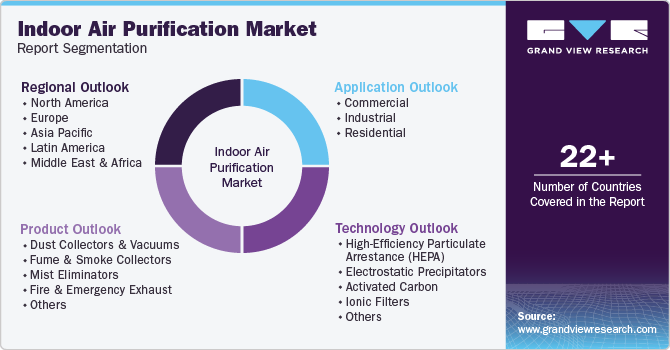

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global indoor air purification market report based on product, technology, application, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Dust Collectors & Vacuums

-

Fume & Smoke Collectors

-

Mist Eliminators

-

Fire & Emergency Exhaust

-

Others

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

High-Efficiency Particulate Arrestance (Hepa)

-

Electrostatic Precipitators

-

Activated Carbon

-

Ionic Filters

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018- 2030)

-

Commercial

-

Industrial

-

Residential

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.