- Home

- »

- Renewable Chemicals

- »

-

Indonesia Palm Oil Market Size, Share, Industry Report 2030GVR Report cover

![Indonesia Palm Oil Market Size, Share & Trends Report]()

Indonesia Palm Oil Market Size, Share & Trends Analysis Report By Product (Crude Palm Oil, Fractionated Palm Oil), By Application (Food & Beverage, Pharmaceuticals), By Nature (Organic, Conventional), And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-298-5

- Number of Report Pages: 70

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Specialty & Chemicals

Indonesia Palm Oil Market Size & Trends

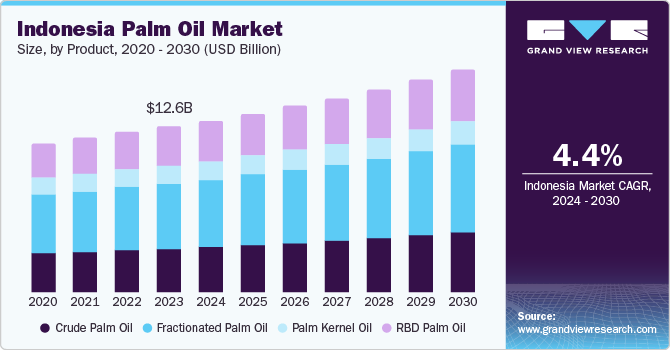

The Indonesia palm oil market size was estimated at USD 12.58 billion in 2023 and is projected to grow at a CAGR of 4.4% from 2024 to 2030. Increasing demand for palm oil in food, cosmetics, and biofuel industries is driving the market growth. According to the International Labour Organization, Indonesia's economy has significantly benefited from the growth of its palm oil industry, which has become a significant contributor. This sector is crucial for Indonesia's economic advancement, employment generation, and export earnings. With Indonesia being the world's largest palm oil producer, the industry has created job opportunities for over 17 million people.

The market in Indonesia is a significant contributor to the country's economy, as it provides agricultural output and export earnings. Production has recently increased due to the expanded plantations and technological advancements. Small-scale farmers operate around 40% of the country's total oil palm area, while large plantations owned by domestic and foreign companies make up the rest. For Instance, in 2022, the Indonesian Palm Oil Association (GAPKI) reported that the palm oil industry contributed a record-high of USD 39.07 billion to the country's economy.

The production of palm oil is steadily increasing due to the expansion of the population and laws supporting the use of oils in biofuels. The government is working to encourage sustainable production and collaborating with businesses to reduce environmental impact. For Instance, in February 2023, the government of Indonesia launched a high blend of palm oil biodiesel known as B35, which has 35% of palm oil content. The higher blend of palm oil-based biodiesel is expected to positively impact the environment and the economy. By increasing the use of renewable fuels, Indonesia can reduce its carbon footprint and contribute to global efforts to combat climate change.

Market Concentration & Characteristics

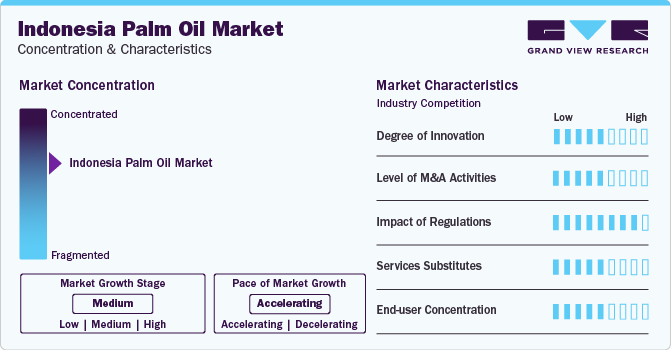

The industry growth rate is medium, and the pace of the industry growth is accelerating. The Indonesia palm oil industry is characterized by a moderate degree of innovation. For Instance, in 2022, PT Nusantara Green Energi (NGE) and researchers introduced a new palm oil processing process called the "dry-process" in Jambi, aiming to produce safer and healthier palm oil by maintaining its beneficial content.

The Indonesia palm oil industry is also characterized by a moderate level of Merger & Acquisition (M&A) activity by the leading players. For Instance, in 2020, Golden Agri-Resources Ltd. acquired Centrino Investment Limited, whose principal activity is oil palm cultivation and production in Indonesia.

The Indonesian palm oil industry is highly regulated, as the Indonesian Sustainable Palm Oil (ISPO) certification is mandatory for all palm oil producers in Indonesia. The government has implemented various regulations to manage and control the market to ensure domestic supply, sustainability, and compliance with international standards.

In February 2023, Indonesia imposed restrictions on palm oil exports to stabilize domestic prices and secure sufficient supply. These restrictions involved suspending a significant portion of export permits and limiting the amount of palm oil that can be exported out of the country. The Exporters are required to meet the "Domestic Market Obligation," allocating a specific amount of palm oil for domestic consumption before being granted permits for export.

Palm oil has unique properties, which makes it irreplaceable in many applications, and hence, the market is characterized by a medium level of service substitute. Indonesia palm oil market is characterized by a medium level of end-user concentration as palm oil is used in various industries such as food & beverage, personal care & cosmetics, and biofuel & energy.

Product Insights

The fractionated palm oil segment accounted for the largest revenue share 39.3% in 2023 and is expected to witness the fastest growth rate over the forecast period. Its dominance is attributed to its versatility, high demand across various industries, economic benefits, and increasing focus on sustainability. Fractionated oil finds applications in food processing, cosmetics, pharmaceuticals, and other sectors.

The demand for crude palm oil (CPO) and RBD palm oil is expected to increase significantly over the forecast period. CPO is widely used in the food and beverage industry due to its high productivity compared to other vegetable oils. On the other hand, RBD palm oil is a more refined version of CPO, making it suitable for various applications in the food industry. The rising preference for processed and packaged foods in Indonesia is fueling the demand for RBD oil as a preferred ingredient.

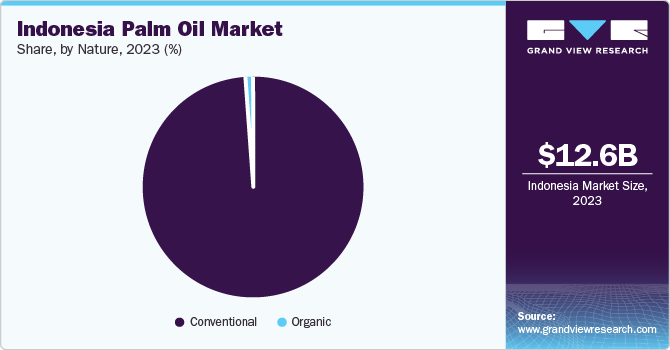

Nature Insights

Based on nature, the market is divided into conventional and organic segments, with the conventional segment leading in revenue share in 2023. Conventional palm oil is prevalent in Indonesia's industry due to its low production costs and higher yields than organic options, making it a preferred choice among many producers, especially smallholders. Conventional palm oil has an extended shelf life, acts as a natural preservative in food products, and maintains its integrity under high temperatures, making it ideal for cooking applications.

On the other hand, the organic segment is expected to grow rapidly over the forecast period. This growth is attributed to the sustainable and environmentally friendly practices used in producing organic palm oil without synthetic chemicals. Although organic products have a smaller market share compared to conventional ones, there is a rising global demand for them due to increasing consumer awareness about sustainability and environmental concerns.

Application Insights

The food and beverages segment led the market with the highest revenue share in 2023 driven by the widespread use of palm oil in cooking oils, margarine, snacks, baked goods, and processed foods. Indonesia’s demand for palm oil in the food and beverage industry remains strong due to its cost-effectiveness and versatility. Palm oil is widely used in the food industry due to its stability at high temperatures, making it ideal for frying.

The biofuel and energy segment is anticipated to grow at the fastest CAGR over the forecast period. This growth is driven by a global shift towards renewable energy sources and biofuels, with palm oil biodiesel emerging as a promising alternative to traditional fossil fuels. The increasing demand for biofuels presents a lucrative export opportunity for Indonesian palm oil producers, fueling the growth in this sector. The Indonesian government has taken proactive measures to reduce carbon emissions and encourage the use of biofuels in the aviation industry, further driving the market. For Instance, in October 2023, the first commercial flight in Indonesia has recently taken off using a fuel blend that includes palm oil.

Key Indonesia Palm Oil Company Insights

Some of the key players in the market include Wilmar International, Provident Agro, Golden Agri-Resources, Astra Agro Lestari, and Asian Agri.

-

Wilmar International is an agribusiness group that operates extensively in Indonesia, particularly in the palm oil sector. It has a strong foothold in Indonesia’s palm oil industry, with numerous plantations and processing facilities nationwide. The company’s operations in the country encompass various aspects of the palm oil supply chain, including cultivation, harvesting, processing, and distribution.

-

Golden Agri-Resources (GAR) is a plantation company with extensive palm oil plantations and operations across Indonesia, making it one of the largest palm oil producers in the country. GAR is committed to sustainable palm oil production practices and has been actively involved in initiatives to promote environmental conservation and social responsibility within the industry.

Key Indonesia Palm Oil Companies:

- Asian Agri

- Astra Agro Lestari

- First Resources Limited

- Golden Agri-Resources Ltd.

- M.P. Evans Group PLC.

- Musim Mas

- Provident agro

- PT Salim Ivomas Pratama Tbk

- PT SMART Tbk.

- Wilmar International

Recent Developments

-

On December 2023, First Resources, a major palm oil producer, acquired plantation assets in Indonesia. This acquisition marks a significant move in the company’s expansion strategy and further solidifies its position in the palm oil industry.

-

On September 2023, Unilever partnered with a government-owned Indonesian palm oil plantation, PT. Perkebunan Nusantara III (Persero), to accelerate sustainable palm oil production in Indonesia. This collaboration aims to improve transparency in the supply chain and make sustainable palm oil more mainstream.

-

On February 2023, Fastmarkets acquired Palm Analytics, a Singaporean company specializing in prices, data, and news on palm oils and its derivatives. This acquisition allows Fastmarkets to expand its coverage of the market and provide its customers with a more comprehensive suite of services.

Indonesia Palm Oil Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 16.93 billion

Growth rate

CAGR of 4.4 % from 2024-2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, nature

Country scope

Indonesia

Key companies profiled

Wilmar International; Provident Agro; Golden Agri-Resource; Astra Agro Lestari; Asian Agri; First Resources Limited; PT SMART Tbk; Musim Mas; PT Salim Ivomas Pratama Tbk; M.P. Evans Group PLC

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Indonesia Palm Oil Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Indonesia palm oil market report based on product, application, and nature:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Crude Palm Oil

-

Palm Kernel Oil

-

RBD Palm Oil

-

Fractionated Palm Oil

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Food & Beverage

-

Personal Care & Cosmetics

-

Biofuel & Energy

-

Pharmaceuticals

-

Others

-

-

Nature Outlook (Revenue, USD Million, 2018 - 2030)

-

Organic

-

Conventional

-

Frequently Asked Questions About This Report

b. The Indonesia palm oil market size was valued at USD 12.58 billion in 2023.

b. The Indonesia palm oil market is projected to grow at a compound annual growth rate (CAGR) of 4.4% from 2024 to 2030 to reach USD 16.93 billion by 2030.

b. The fractionated palm oil segment accounted for the largest revenue share 39.3% in 2023 and is expected to witness the fastest growth rate over the forecast period. Its dominance is attributed to its versatility, high demand across various industries, economic benefits, and increasing focus on sustainability.

b. Some of the key players in the market include Wilmar International, Provident Agro, Golden Agri-Resources, Astra Agro Lestari, and Asian Agri.

b. Increasing demand for palm oil in the food, cosmetics, and biofuel industries is driving the market growth. According to the International Labour Organization, Indonesia's economy has significantly benefited from the growth of its palm oil industry, which has become a significant contributor.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."