Indonesia Halal Hair Care Market Size, Share & Trends Analysis Report By Product (Shampoo, Hair Color, Conditioners, Hair Oil) By Distribution Channel (Online, Supermarkets & Hypermarkets), And Segment Forecasts, 2024 - 2030

- Report ID: GVR-1-68038-443-7

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

Indonesia Halal Hair Care Market Trends

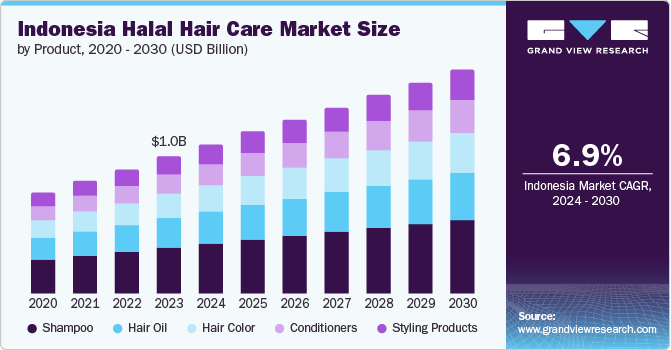

The Indonesia halal hair care market size was valued at USD 1.02 billion in 2023 and is projected to grow at a CAGR of 6.9% from 2024 to 2030. This growth is attributed to a vast number of the Islamic middle-class population of the country, who are willing to purchase branded and high-quality products, and personal grooming has increased in the country. In addition, the vast Muslim population, which comprises the bulk of the nation's population, is becoming more conscious of and discerning about halal-certified goods, further fueling the market’s growth.

The market's growth has also been aided by the increased emphasis on personal hygiene and grooming and the accessibility of a large selection of halal hair care products that meet various customer needs. It is anticipated that the growing consumer base and the persistent focus on halal certification are expected to propel the market expansion over the forecast years. Previously, these products were mostly preferred by Muslims, but nowadays, it can be seen that non-Muslims also use these products. The rising awareness among males and females about the benefits of vegan, organic, and natural products is that of using chemical products for personal care. The advantage of natural and organic products is that they give effective results for hair-related problems such as baldness, dandruff, and increasing hair fall in the younger generation, which propels the market growth.

Furthermore, these products are generally based on verified Halal science and are certified by the authorities. In addition, the large hijab-wearing female population in Indonesia drives the market expansion; simultaneously, the advantages of using halal hair care products, such as good fragrance, freshness, increasing hair volume, and hair growth, play a vital role in market growth.

Product Insights

Shampoo dominated the market with the largest revenue share of 33.4% in 2023. Females widely use halal anti-dandruff shampoo for the treatment of specific complications, itchy scalp, issues such as dandruff, hair-fall, and limp, dull, lifeless hair, are aimed using particular and branded shampoos having natural and herbal ingredients. These products are often marketed by highlighting them as the best alternative for problems resulting in soft, shiny, silky, and glossy hair, which attracts the country's youths.

Conditioners are expected to grow at a CAGR of 7.2% over the projected years. They offer benefits to overcome hair issues by enhancing texture, volume, smoothness, and nourishment. Women in the country increasingly utilize herbal, organic, natural, and chemical-free products because of religious ethics and strict government rules and laws, which are likely to expand the market growth in the upcoming years.

Distribution Channel Insights

Hypermarkets & supermarkets led the market and accounted for the largest revenue share of 40.6% in 2023. It is now easier for customers to obtain halal-certified hair care products due to their increased exposure and availability at these sizable retail establishments. Price-conscious customers have also been drawn to hypermarkets and supermarkets due to their competitive pricing and promotional offers. The growing market share of these distribution channels for halal haircare goods in Indonesia is also a result of consumers' growing demand for one-stop shopping centers, particularly among the country's growing middle-class population.

Online distribution channels have experienced growth with a CAGR of 10.6% in projected years. The surge online has had a significant impact on how plates are distributed. Online channels now allow consumers to quickly browse through various products from the comfort of their homes. These platforms cater to a broad audience, granting access to brands, including those not stocked in local stores. Shopping online for plates is characterized by its simplicity in comparing products, availability of customer reviews, and often competitive pricing. Online retailers can range from specialized food e-commerce sites to general online marketplaces hosting multiple sellers.

A large female population of hijab-wearing has led to a surge in demand for personal care products that provide benefits. In addition, the initiatives by the government for developing and improving growth opportunities for local companies and investments in newer technologies for catering to hair problems and offering the best solutions. The halal haircare market is expected to grow compared to other personal care segments. Furthermore, the growth in the number of working women and the awareness and importance of using natural and organic products in the country has boosted spending power, which has attracted significant investments in the Asia Pacific, particularly in Indonesia.

Key Indonesia Halal Hair Care Company Insights

Some of the key companies in the Indonesia halal hair care market include Unilever, L'Oréal Paris, Wardah, Sariayu Cosmetics, Procter & Gamble, CLARA INTERNATIONAL BEAUTY GROUP, Iba., PHB Ethical Beauty Ltd., PT Paragon Technology and Innovation in the market are focusing on development & to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives.

-

Unilever manufactures, distributes, and sells fast-moving consumer goods, with a portfolio of products ranging from food to beauty and personal care products, beverages, pharmaceuticals, soaps, home care products, vitamins, minerals, and supplements. It has a strong presence in over 190 countries worldwide.

-

L'Oréal Paris is a leading brand in the cosmetics and personal care segment, offering luxury beauty products that are accessible to everyone. This category includes makeup, skincare, haircare and hair color, and grooming products for men.

Key Indonesia Halal Hair Care Companies:

- Unilever

- L'Oréal Paris

- Wardah

- Sariayu Cosmetics

- Procter & Gamble

- CLARA INTERNATIONAL BEAUTY GROUP

- Iba Halal

- PHB Ethical Beauty Ltd.

- PT Paragon Technology and Innovation

Recent Developments

-

In July 2024, Unilever and Southeast Asian ventures invested USD 4 million in Esqa, an Indonesian skincare start-up, and over USD 2 million in the personal care brand Luna Daily.

-

In March 2023, Paragon Technology and Innovation collaborated with Garuda Indonesia Airlines to improve the experience of Umrah and Hajj pilgrims. Further, the company introduced a skincare for Umrah & Hajj Packages intended for travelers.

Indonesia Halal Hair Care Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 1.11 billion |

|

Revenue forecast in 2030 |

USD 1.66 billion |

|

Growth Rate |

CAGR of 6.9% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, distribution channel |

|

Country scope |

Indonesia |

|

Key companies profiled |

Unilever; L'Oréal Paris; Wardah, Sariayu Cosmetics; Procter & Gamble; CLARA INTERNATIONAL BEAUTY GROUP; Iba Halal; PHB Ethical Beauty Ltd.; PT Paragon Technology and Innovation |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Indonesia Halal Hair Care Market Report Segmentation

This report forecasts revenue growth at the country level and analyzes the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Indonesia halal hair care market report based on product, and distribution channel:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Shampoo

-

Hair Color

-

Conditioners

-

Hair Oil

-

Styling Products

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Online

-

Hypermarkets & Supermarkets

-

Convenience Stores

-

Others

-

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."