- Home

- »

- Medical Devices

- »

-

India Skin Boosters Market Size, Share, Trends, Report, 2030GVR Report cover

![India Skin Boosters Market Size, Share & Trends Report]()

India Skin Boosters Market (2024 - 2030) Size, Share & Trends Analysis Report By Type (Mesotherapy, Micro-needle), By Gender (Female, Male), By End-use (Dermatology Clinics, Medical Spas), And Segment Forecasts

- Report ID: GVR-4-68040-202-0

- Number of Report Pages: 70

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

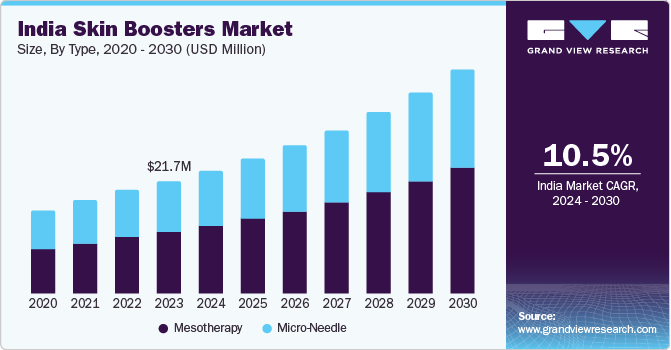

The India skin boosters market size was estimated at USD 21.66 million in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 10.5% from 2024 to 2030. The essential fact accelerating the skin boosters application in India is a relatively new concept in aesthetic treatments that has gained popularity in the country in recent years. Skin boosters are an injectable treatment that aims to improve skin texture, hydration, and elasticity by delivering hyaluronic acid (HA) deep into the skin.

The companies are investing significantly in research and development to create innovative skin boosters that surpass the efficacy and safety of existing treatments. This competitive landscape drives the industry to continuously innovate and improve the quality of skin boosters available to consumers. The major players in the skin boosters market are increasing the production capacity and developing new and advanced facilities to improve their market expansion and increase the customer base due to increasing demand. For instance, in April 2023, Merz Pharma announced plans to build a new manufacturing facility in Reinheim, located in the Odenwald region to expand the company's production capabilities and enhance its manufacturing processes.

The skin boosters in India are becoming increasingly popular due to their effectiveness in improving skin texture and hydration without causing any significant downtime or side effects such as bruising or swelling commonly associated with traditional fillers or other invasive treatments such as laser resurfacing or chemical peels.

Some of the market players involving Medytox, Inc., AbbVie Inc., Merz Pharma, Galderma, Teoxane, IBSA Farmaceutici Italia Srl, PharmaResearch Co., Ltd, and Sinclair Pharma are investing significantly in the research and development and increasing their production capacity. These companies are working to avail the non-invasive skincare procedures to the Indian population.

Market Concentration & Characteristics

The market growth stage is high, and the market growth is accelerating. The market is characterized by a high degree of innovation owing to the research and development driven by factors nanotechnology and stem cell therapy, advancement in mesotherapy and microneedling devices and more effective and less invasive treatments and procedures. Subsequently, increasing research and development is expected to contribute to the constant market growth.

The market players are involved in merger and acquisition (M&A) activities. This is due to several factors, including the desire to gain a new customer base, the need to consolidate in a rapidly growing market, and strengthening the skincare product portfolio and increasing market presence. For instance, in January 2022, Galderma successfully acquired ALASTIN Skincare Inc., that specialized in creating advanced skin care products for medical professionals designed with clinical testing to provide effective results for patients seeking aesthetic treatments for skin concerns involving ageing prevention, further strengthening the company's portfolio.

Regulation plays a crucial role in shaping the Indian skin boosters market, affecting product development, approval, and commercialization. The Indian regulatory authority, the Central Drugs Standard Control Organization (CDSCO), has implemented strict guidelines for the approval of skin boosters to ensure their safety, efficacy, and quality. These guidelines include clinical trials, pre-market approval, and post-market surveillance.

Moreover, the regulatory environment in India is expected to affect the pricing and availability of skin boosters. The high cost of regulatory compliance and approval is expected to result in higher prices for skin boosters, which is further expected to hamper the accessibility to a wider customer base. This is expected to create a gap in the market for affordable and accessible skin boosters.

End-user concentration is a significant factor in the Indian skin boosters market. There are end-users involving medical spas and dermatology clinics that are driving demand for the Indian skin boosters market. The concentration of demand in a few end-users creates opportunities for companies that focus on developing non-surgical cosmetic procedures over surgical ones.

Type Insights

Based on type, the mesotherapy segment led the market with a largest revenue share of 54.4% in 2023, owing to the growing demand for non-surgical cosmetic treatments and rising consumer spending on cosmetic treatments. With more people having higher disposable incomes due to factors such as economic growth, urbanization, and job creation, there has been a significant increase in consumer spending on a range of cosmetic products and services. These services that cater specifically to Indian skin concerns related to aging prevention and management are getting popular.

According to Trading Economics, December 2023 data, the total disposable personal income was approximately USD 3.28 trillion, with consumer spending of about USD 285.16 billion recorded in September 2023. This trend is expected to continue as the Indian middle class expands and as more individuals become aware of the long-term benefits and affordability of these cosmetic treatments, leading to further growth and innovation in the cosmetic industry in India over time.

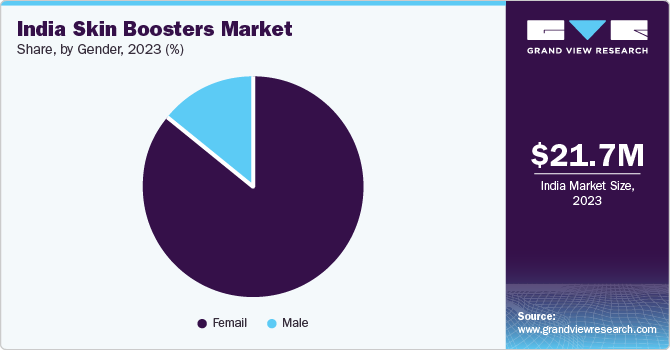

Gender Insights

Based on gender, the female segment accounted for the largest market revenue share of 85.4 in 2023. This is attributable to the growing aging population and increasing skin health awareness. The studies have shown that women with Indian skin tend to develop deeper wrinkles at a faster rate than individuals with other ethnic skin types, particularly in the age group of 30 to 50 years. This accelerated wrinkle formation becomes more pronounced after the age of 40 years. This highlights the unique skincare concerns of individuals with Indian skin and underscores the need for targeted skincare solutions to address these issues.

According to World Bank Data in 2022, the female population about 30 to 34 years of age was reported to be approximately 8% and is further expected to grow with time. This is expected to increase the market growth in the forecast period owing to the female population opting for anti-aging, non-surgical cosmetic, and skin care procedures.

End-use Insights

Based on end-use, the medical spa segment led the market with the largest revenue share of 64.5% in 2023, owing to the growing number of medical spas and the growing popularity of celebrity culture in India. The increasing number of skincare and beauty influencers on social media platforms involving YouTube, Instagram, and Facebook are aggressively promoting skincare and beauty products and non-invasive therapies. This is expected to increase the demand for skincare products and skin booster therapy by increasing customer flow to dermatology clinics and medical spas. Furthermore, the increasing number of subscribers and view count to these channels signifies the growing interests of the Indian population and awareness for beauty and skin care.

The dermatology clinics segment is anticipated to witness a substantial CAGR over the forecast period, due to increasing awareness about skin health. Increasing skin disorders are one of the drivers for the segment. According to International Journal of Research in Medical Sciences, acne is a prevalent skin condition that affects many individuals during different stages of their lives in India and globally. It is one of the most frequently encountered dermatological issues during consultations at dermatological clinics in India. Acne treatment options encompass topical medications administered externally on the skin surface, oral medications taken orally, and procedural therapies that involve specialized techniques. The dermatological clinics also offer procedural therapies to treat various skin conditions. These therapies involve specialized techniques such as chemical peels, laser therapy, and microneedling.The microneedling techniques involve using fine needles to puncture the skin, promoting collagen production, and reducing the appearance of scars and fine lines. These procedures are becoming increasingly popular in India due to their effectiveness in treating various skin concerns.

Key India Skin Boosters Company Insights

Some of the key players operating in the market include Merz Pharma, and Galderma.

-

Merz Pharma skincare division called Merz Aesthetics GmbH & Co KG focuses on developing and marketing aesthetic treatments for various skin concerns as wrinkles, fine lines, acne scars, and skin laxity. The division's portfolio includes injectable fillers and non-surgical treatments that lift and tighten the skin without surgery. Merz Aesthetics is committed to advancing the field of aesthetics through research and development of innovative treatments that deliver natural-looking results for patients in India and worldwide

-

Galderma is a Swiss multinational pharmaceutical company specializing in dermatology treatments for skin diseases and aesthetic concerns. The company's product portfolio includes prescription medications for acne, psoriasis, rosacea, vitiligo, actinic keratosis (pre-cancerous skin lesions), and skin cancer.The company is committed to advancing medical research and development through collaborations with academic institutions and industry partners to bring new treatments to patients worldwide

AbbVie Inc., Medytox India, IncSinclair Pharma, and Allergan India, are some of the other market participants in the global market.

-

Medytox India is a subsidiary of Medytox Inc., a South Korean company specializing in neurotoxins for aesthetic treatments. The company offers a range of skin boosters, including Medytox BTX-A

-

Sinclair Pharma is a UK-based company with a presence in India through its subsidiary, Sinclair Pharma India. The company offers a range of skin boosters under the brand name Juvederm

Key India Skin Boosters Companies:

The following are the leading companies in the India skin boosters market. These companies collectively hold the largest market share and dictate industry trends. Financials, strategy maps & products of these India skin boosters companies are analyzed to map the supply network.

- Medytox, Inc.

- AbbVie Inc.

- Merz Pharma

- Galderma

- Teoxane

- IBSA Farmaceutici Italia Srl

- PharmaResearch Co., Ltd

- Sinclair Pharma

- Allergan India

Recent Developments

-

In 2022, Sinclair Pharma, a UK-based company with a presence in India, announced its acquisition of Viora, a company specializing in energy-based devices for aesthetic and medical applications. This strategic move aims to strengthen Sinclair's portfolio and expand its operations by leveraging Viora's innovative technology and global marketing and distribution network

-

In 2021, Galderma acquired Alastin Skincare, a company specializing in specialty aesthetics. This move is part of Galderma's strategic plan to strengthen its integrated dermatology platform and expand its product offerings in the dermatology and aesthetics sectors. The acquisition of Alastin Skincare reflects Galderma's commitment to enhancing its position in these markets and meeting the evolving demands of patients seeking advanced skincare solutions

-

In 2021, Sinclair Pharma, a UK-based company with a presence in India, announced its acquisition of Cocoon Medical, a leading provider of energy-based devices (EBD) for aesthetic and medical applications. This strategic move aims to expand Sinclair's presence into the EBD market and further strengthen its position in the global aesthetics market by leveraging Cocoon Medical's innovative technology and global distribution network

India Skin Boosters Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 23.68 million

Revenue forecast in 2030

USD 43.02 million

Growth rate

CAGR of 10.5% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, gender, end-use

Country scope

India

Key companies profiled

Medytox, Inc.; AbbVie Inc.; Merz Pharma; Galderma; Teoxane; IBSA Farmaceutici Italia Srl; PharmaResearch Co., Ltd; Sinclair Pharma

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

India Skin Boosters Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the India skin boosters market report based on type, gender, and end-use.

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Mesotherapy

-

Micro-Needle

-

-

Gender Outlook (Revenue, USD Billion, 2018 - 2030)

-

Female

-

Male

-

-

End-use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Dermatology Clinics

-

Medical Spa

-

Frequently Asked Questions About This Report

b. The India skin boosters market size was estimated at USD 21.6 million in 2023 and is expected to reach USD 23.68 million in 2024.

b. The India skin boosters market is expected to grow at a compound annual growth rate (CAGR) of 10.5% from 2024 to 2030 to reach USD 43.02 million by 2030.

b. The female segment dominated the market with the largest market share of 85.9% in 2023. This high share is attributable to growing aging population and increasing skin health awareness among the female population.

b. Some of the key players operating in the India skin boosters market include Medytox, Inc., AbbVie Inc., Merz Pharma, Galderma, Teoxane, IBSA Farmaceutici Italia Srl, PharmaResearch Co., Ltd, Sinclair Pharma, Allergan India, among others.

b. Key factors driving the market growth include the increasing number of beauty clinics and spas, the rapidly aging population, rising disposable income, and the growing popularity of celebrity culture.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.