- Home

- »

- Biotechnology

- »

-

India Single-use Bioprocessing Probes And Sensors Market, Report, 2030GVR Report cover

![India Single-use Bioprocessing Probes And Sensors Market Size, Share & Trends Report]()

India Single-use Bioprocessing Probes And Sensors Market Size, Share & Trends Analysis Report By Type (pH Sensors, Oxygen Sensors), By Workflow (Upstream, Downstream), By End-use, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-345-0

- Number of Report Pages: 90

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Market Size & Trends

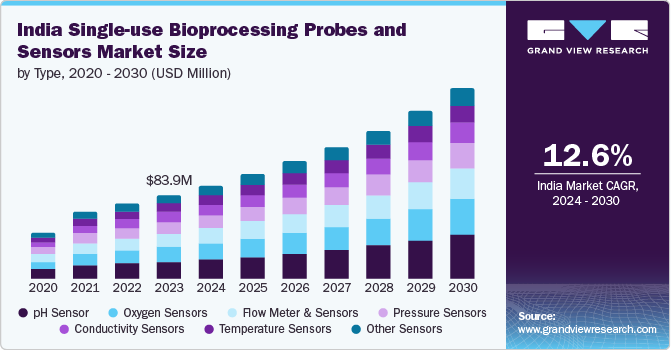

The India single-use bioprocessing probes and sensors market size was valued at USD 83.9 million in 2023 and is expected to grow at a CAGR of 12.61% from 2024 to 2030. The growth of the market can be attributed to the rising demand for biopharmaceuticals and the increasing popularity of disposable systems in preclinical trials. Furthermore, the commercial benefits of the products, such as cost-effectiveness and reduced contamination risk, are driving the demand for single-use bioprocessing probes and sensors. The growing demand for personalized medicines and the need for faster and more efficient drug development processes are further fueling the adoption of single-use bioprocessing technologies in India.

The implementation of single-use technology (SUT) in biomanufacturing processes offers several advantages that resonate throughout the Indian biopharmaceutical industry. Single-use systems significantly reduce the risk of cross-contamination, ensuring product purity and integrity, which is crucial for the growing domestic biosimilars and biologics market. By eliminating the need for cleaning and sterilization between batches, these systems enhance operational efficiency, leading to shorter turnaround times and increased productivity - a key benefit for Indian manufacturers aiming to scale up and meet the rising domestic and global demand for biopharmaceuticals.

The commercial advantages of single-use sensors are particularly relevant for the Indian market, where companies are increasingly focused on optimizing their processes and staying competitive. These benefits, including streamlined operations, reduced costs, enhanced flexibility, and improved regulatory compliance and product quality, make single-use sensors an attractive option for Indian biomanufacturers. The adoption of disposable bioreactors and associated single-use sensors and probes can help Indian companies lower their capital expenditure and achieve faster turnaround times, which are critical in the fast-paced domestic market.

The rising demand for improved bioprocess monitoring devices is another major factor expected to drive the market growth for single-use bioprocessing probes and sensors in India. Regulatory bodies like the Central Drugs Standard Control Organization (CDSCO) require stringent quality control and assurance in bioprocessing, and enhanced monitoring ensures compliance with Good Manufacturing Practices (GMP) and other regulatory standards. Initiatives such as the Indian government's focus on promoting the domestic manufacturing of pharmaceutical and biotechnology products are further encouraging the adoption of advanced monitoring tools like single-use sensors to ensure product quality and process efficiency in the country.

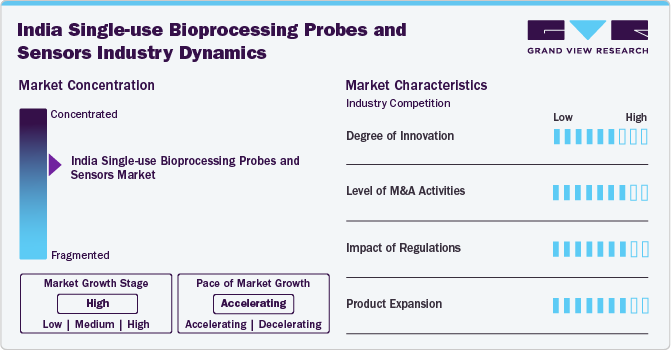

Market Characteristics & Concentration

The degree of innovation in the India single-use bioprocessing probes and sensors industry is high. Companies are constantly innovating and creating sophisticated products to cater to the changing demands of the biopharmaceutical sector. For instance, in March 2019, Pall Corporation (Danaher), a leading player in the market, launched a new line of single-use pH and dissolved oxygen sensors with improved accuracy and response time. These sensors enable better monitoring and control of critical process parameters during biopharmaceutical manufacturing, helping customers optimize their production processes.

In the India market, collaboration activities are a high level of engagement within the industry. Such partnerships enhance the transfer of technology, accelerate research and development activities, and foster the commercialization process. In July 2021, Sartorius, a major player in the market, acquired Cellexus, a company specializing in single-use bioreactors. This acquisition allowed Sartorius to expand its portfolio of single-use solutions for cell culture applications and strengthen its position in the growing Indian biopharmaceutical market.

The impact of regulations on the India single-use bioprocessing probes and sensors industry is high. These products are subject to stringent quality and safety standards by the Central Drugs Standard Control Organization (CDSCO). For example, the CDSCO recently introduced guidelines for validating single-use bioprocessing equipment, requiring manufacturers to demonstrate the reliability and performance of their products. This has led companies to invest significant research, development, and compliance resources to ensure their products meet regulatory requirements.

The India single-use bioprocessing probes and sensors industry currently exhibits a high level of product expansion. The threat of product substitutes in the India market is low. Single-use bioprocessing solutions offer unique benefits that are difficult to replicate by traditional reusable systems. For instance, Merck KGaA developed a range of single-use sensors that provide real-time monitoring of critical parameters like pH and dissolved oxygen, helping biopharmaceutical companies improve their process control and efficiency.

Type Insights

Based on type, pH sensors held the largest revenue share of 20.24% in 2023 and are expected to grow at the fastest CAGR over the forecast period. The single-use pH sensor segment is driven by the widespread adoption and increasing penetration of these sensors in the country. The high usage rate of pH sensors, essential for measuring the acidity and alkalinity of water and solutions, has been a key factor behind the segment's success. Moreover, the development of advanced pH sensors with integrated temperature monitoring capabilities fuels the demand among Indian biopharmaceutical manufacturers. These technological advancements enable companies to enhance their process control and optimization, making them more attractive to leading pharmaceutical firms in the country.

The oxygen sensors segment is expected to register a significant CAGR over the forecast period. The growth rate is driven by the growing demand of the biopharmaceutical industry for efficient and accurate oxygen monitoring during the production of biologics, such as monoclonal antibodies and vaccines. Single-use oxygen sensors offer significant advantages, such as reduced contamination risks, lower costs by eliminating the need for cleaning and sterilization, and seamless integration into disposable bioprocessing systems. These benefits have been crucial in driving the adoption of single-use oxygen sensors among Indian biopharmaceutical manufacturers as they seek to enhance their production efficiency and meet the growing demand for biologics in the domestic and global markets.

Workflow Insights

Based on workflow, the market is segmented into upstream and downstream segments. The upstream segment dominated the market with a market share of 73.49% in 2023 and is anticipated to grow at the fastest CAGR over the forecast period. The upstream segment is driven by the increasing adoption of these technologies among leading pharmaceutical firms such as Thermo Fisher Scientific, Inc. The effective control and monitoring of critical process parameters, such as dissolved oxygen, temperature, and pH, through specialized single-use sensors, is crucial in driving the adoption of these technologies in the upstream segment, as companies enhance their manufacturing efficiency and focus on the rising demand for biologics and biosimilars in the country.

The downstream segment is expected to grow at a significant CAGR over the forecast period. The downstream segment is experiencing growth, fueled by the demand for flexible and scalable bioprocessing capabilities. Downstream processing is critical for separating, isolating, and purifying products from cell cultures and necessitates adjustable production volumes to align with market needs. The popularity of single-use bioprocessing probes and sensors in this domain is on the rise due to their versatility and the variety of sizes available, simplifying production scalability. This versatility is crucial in encouraging Indian biopharmaceutical firms to integrate these technologies into their operations, aiming to streamline their downstream processes and satisfy the increasing domestic and international demand for biologics and biosimilars.

End-use Insights

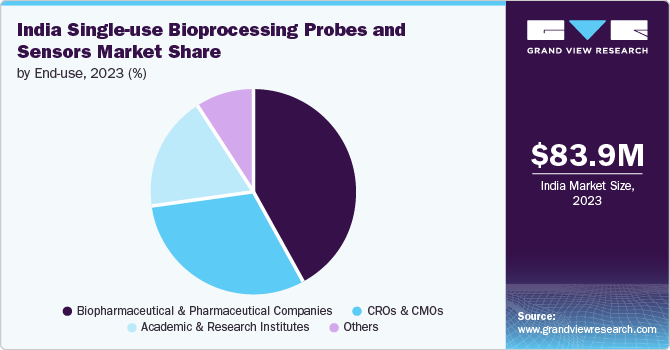

Based on end use, the market is segmented into biopharmaceutical & pharmaceutical companies, CROs & CMOs, academic & research institutes and other end use. The biopharmaceutical & pharmaceutical companies dominated the segment with a market share of 41.69% in 2023. Indian giants such as Sartorius AG invest in advanced single-use systems to enhance their manufacturing capabilities and meet the rising global demand for biopharmaceuticals. The consistent introduction of new and innovative single-use bioprocessing products by domestic and international players fuels the adoption of these technologies in the Indian market. For instance, Biocon, a major Indian biopharmaceutical company, has implemented single-use bioprocessing solutions across its manufacturing facilities to improve efficiency and reduce cost.

The CROs & CMOs segment is expected to grow at the fastest CAGR over the forecast period. Indian CROs such as Syngene International invested in these technologies to enhance capabilities, improve efficiency, and maintain compliance, making it an attractive partner for outsourcing. The government's initiatives to promote India as a global biopharma hub have further accelerated the adoption of single-use bioprocessing solutions among CMOs and CROs in the country.

Key India Single-use Bioprocessing Probes And Sensors Company Insights

The market players operating in the India single-use bioprocessing probes and sensors industry are adopting product approval to increase the reach of their products in the market and improve the availability of their products in diverse geographical areas, along with expansion as a strategy to enhance production/research activities. In addition, several market players are acquiring smaller players to strengthen their market position. This strategy enables companies to increase their capabilities, expand their product portfolios, and improve their competencies.

Key India Single-use Bioprocessing Probes And Sensors Companies:

- Thermo Fisher Scientific

- Sartorius AG

- PreSens Precision Sensing GmbH

- Hamilton Company

- Mettler-Toledo India Private Limited

- PARKER HANNIFIN CORP

- Danaher

- Saint-Gobain

Recent Developments

-

In March 2024, Syngene announced the expansion of its biologics manufacturing facility in Bangalore, India. The upgraded facility is expected to be operational in the second half of 2024, will include two production suites with five 2,000-liter single-use bioreactors each. This expansion triples Syngene’s biomanufacturing capacity and integrates various biologics capabilities, including high-speed vial filling lines and advanced purification systems.

-

In November 2023, Aragen announced that the company will be investing USD 30 million in a new biologics manufacturing facility in Bangalore, which is scheduled to begin operations in 2024. This facility will focus on the development and manufacture of monoclonal antibodies, therapeutic proteins, and fusion proteins. It is designed to provide integrated solutions across various stages of the biologic’s development lifecycle.

-

In October 2023, Hamilton Company introduced VisiFerm SU, a single-use redesign of trusted dissolved oxygen sensors.

-

In December 2022, the 8th edition of the International Bioprocessing India Conference [SA2] offered a dedicated platform for discussing and presenting advanced scientific advancements in the bioprocessing sector. The conference extensively covered key bioprocessing industry interest areas, including upstream & downstream processing for recombinant protein therapeutics, biomanufacturing, scale-up strategies, and comprehensive analytical & biophysical characterization, all focused on key industrial domains.

India Single-use Bioprocessing Probes And Sensors Market Report Scope

Report Attribute

Details

Revenue Forecast in 2030

USD 191.04 million

Growth rate

CAGR of 12.61% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, workflow, End-use

Key companies profiled

Thermo Fisher Scientific; Sartorius AG; PreSens; Precision Sensing GmbH; Hamilton Company; Mettler-Toledo India Private Limited; PARKER HANNIFIN CORP; Danaher; Saint-Gobain

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

India Single-use Bioprocessing Probes And Sensors Market Report Segmentation

This report forecasts revenue growth in India and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the India single-use bioprocessing probes and sensors market report based on type, workflow, and end-use:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

pH Sensor

-

Oxygen Sensors

-

Pressure Sensors

-

Temperature Sensors

-

Conductivity Sensors

-

Flow Meter & Sensors

-

Other Sensors

-

-

Workflow Outlook (Revenue, USD Million, 2018 - 2030)

-

Upstream

-

pH Sensor

-

Oxygen Sensors

-

Pressure Sensors

-

Temperature Sensors

-

Conductivity Sensors

-

Flow Meter & Sensors

-

Other Sensors

-

-

Downstream

-

pH Sensor

-

Pressure Sensors

-

Temperature Sensors

-

Conductivity Sensors

-

Flow Meter & Sensors

-

Other Sensors

-

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Biopharmaceutical & Pharmaceutical Companies

-

CROs & CMOs

-

Academic & Research Institutes

-

Others

-

Frequently Asked Questions About This Report

b. The India single-use bioprocessing probes and sensors market size was estimated at USD 83.9 million in 2023 and is expected to reach USD 93.7 billion in 2024.

b. The India single-use bioprocessing probes and sensors market is expected to grow at a compound annual growth rate of 12.61% from 2024 to 2030 to reach USD 191.04 billion by 2030.

b. On the basis of type, pH sensors held the largest revenue share in 2023 and is expected to grow at the highest CAGR over the forecast period. The single-use pH sensor segment is driven by the widespread adoption and increasing penetration of these sensors in the country.

b. The key players operating in the market include Thermo Fisher Scientific; Sartorius AG; PreSens; Precision Sensing GmbH; Hamilton Company; Mettler-Toledo India Private Limited; PARKER HANNIFIN CORP; Danaher; and Saint-Gobain.

b. The growth of the market can be attributed to the rising demand for biopharmaceuticals, the increasing popularity of disposable systems in preclinical trials and the commercial benefits of the products such as cost-effectiveness and reduced contamination risk.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."