- Home

- »

- Conventional Energy

- »

-

India Process Piping Market Size And Share Report, 2030GVR Report cover

![India Process Piping Market Size, Share & Trends Report]()

India Process Piping Market (And Segment Forecasts 2023 - 2030) Size, Share & Trends Analysis Report By Product (Steam Process Piping, Wastewater Piping, Crude Oil Piping, Acid Piping, Refrigerant Piping), By End-use

- Report ID: GVR-4-68040-093-2

- Number of Report Pages: 67

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Energy & Power

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

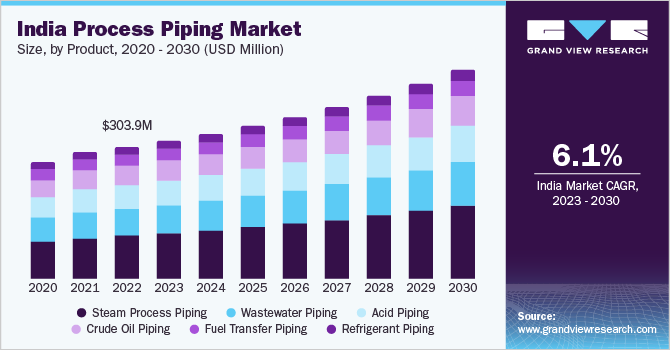

The India process piping market size was valued at USD 303.99 million in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 6.1% from 2023 to 2030. The growth in production and oil & gas exploration activities is one the major factors driving the process piping market’s growth. Discoveries in oil & gas fields require process piping systems to transport extracted hydrocarbon from wells to the processing facilities. In addition, the development of upstream infrastructure, which includes offshore facilities, onshore production facilities, and drilling platforms, necessitates the requirement of a process piping system that enables the transportation of oil, gas, and chemicals to the processing and storage facilities.

As the demand for natural gas is increasing, gas processing facilities and liquefied natural gas plants are being developed in India. The unconventional resources require extensive process piping systems for the transportation and extraction of hydrocarbons from shale formations to processing and distribution facilities. Process piping systems are one the crucial components of these projects, which facilitate the transportation of gases, liquefaction, and storage of liquefied natural gas.

The growth of the chemical industry has a direct impact on the process piping industry. As per the Ministry of Chemicals & Fertilizers, as of 2022, the Indian chemical industry was valued at USD 220 million and is expected to reach USD 300 million by 2025 and USD 1 trillion by 2040.

In the chemical industry, process piping is utilized for the transportation of fluids such as raw materials, intermediaries, and finished chemicals. Process piping plays a vital role in ensuring efficient and reliable transportation of fluids throughout chemical manufacturing processes in the chemical industry, although it requires careful consideration of corrosion resistance, process integration, and compliance with regulations and industry standards.

Product Insights

The steam process piping segment accounted for the largest market share of 32.68% in 2022. Steam process piping is mainly used in power generation facilities like renewable energy projects and thermal energy power plants, which utilize steam for electricity production. Increasing demand for energy in the country has fueled the investment in power generation infrastructure to increase energy generation capacity. For instance, in May 2023, the Central Electricity Authority (CEA) of India announced investments of USD 319 million for the construction of thermal power plants between 2022 and 2027.

The wastewater piping segment accounted for a significant revenue share in 2022. India ranks second in terms of the population in the world. The growing population and rapid urbanization with the development of residential and commercial buildings prosper the demand for wastewater piping for accommodation and transportation of wastewater, which is expected to fuel the demand for wastewater process piping systems in the coming years.

Crude oil and acid piping segments are also expected to increase steadily over the forecast period as the demand for the energy and chemical industry is growing in the country. The chemical manufacturing sector in India is rapidly expanding as a result of factors such as increased domestic demand, government manufacturing initiatives, and increased exports.

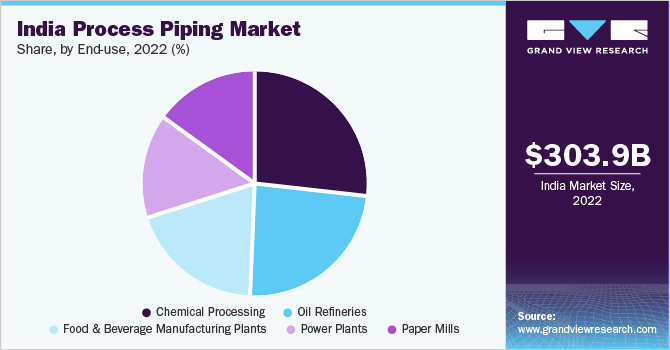

End-use Insights

Based on end-use, the India process piping market is further divided into oil refineries, food and beverage manufacturing, paper mills, power plants, and chemical processing. The chemical processing segment led with 26.69% of the market share in 2022. The Indian chemical industry is subject to safety and environmental regulations. The American Society of Mechanical Engineers (ASME) and the Occupational Safety and Health Administration (OSHA) have established relevant codes and standards for process piping systems. Compliance with these regulations ensures both the safe operation of chemical plants and the protection of the environment. Growing awareness about safety and environmental regulations for process piping in India is expected to drive the demand for process piping in the chemicals industry in the coming years.

The oil refineries segment accounted for the second-largest market share in 2022. India is one of the fastest-growing economies in the world, with rapidly rising energy demand due to the country's growing population, urbanization, and industrialization. As a result, increased refining capacity is required to meet the rising demand for petroleum products like petrol, diesel, and petrochemicals. Growing demand for oil & gas and stringent regulations for piping in oil refineries is expected to fuel the adoption of process piping in oil refineries over the forecast period.

The food and beverage segment is expected to grow at a significant CAGR owing growing demand for process piping in manufacturing industries. Food and beverage products are protected by process piping systems during transportation and processing; they are designed to reduce flavor transfer, and product contamination, and maintain the desired temperature and pressure conditions. Government agencies such as the Food Safety and Standards Authority of India (FSSAI) regulate the food and beverages industry in India. These regulations address food safety, quality, labeling, and hygiene issues, as well as process piping system requirements.

Key Companies & Market Share Insights

Key participants in the industry are focusing on technological advancements and innovation to minimize the cost of process piping in the country. In addition, industry players are practicing several strategic initiatives to expand their foothold in the renewable energy market over the coming years. For instance,in September 2022, Venus Pipes and Tubes announced a capacity expansion to develop a larger tube mill to manufacture stainless steel welded pipes, at an investment worth USD 6.48 million. Some prominent players in the India process piping market include:

-

Chemical Process Piping Pvt. Ltd.

-

Power Process Piping, Inc.

-

Marshall Industrial Technologies

-

Carolina Process Piping, Inc.

-

Process Piping Materials LLC

-

Lesico Process Piping

-

JBT

-

Thermopack Boiler Services

-

Hyperbaric Technologies Pvt. Ltd.

-

Gautam Tube Corporation

India Process Piping Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 481.03 million

Growth rate

CAGR of 6.1%from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million, and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, end-use

Country scope

India

Key companies profiled

Chemical Process Piping Pvt. Ltd.; Power Process Piping, Inc.; Marshall Industrial Technologies; Carolina Process Piping, Inc.; Process Piping Materials LLC; Lesico Process Piping; JBT; Thermopack Boiler Services; Hyperbaric Technologies Pvt. Ltd.; Gautam Tube Corporation

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global India Process Piping Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. Forthis study, Grand View Research has segmented the India process piping market report based on product and end-use:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Steam Process Piping

-

Wastewater Piping

-

Crude Oil Piping

-

Acid Piping

-

Refrigerant Piping

-

Fuel Transfer Piping

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Oil Refineries

-

Food and Beverage Manufacturing Plants

-

Paper Mills

-

Power Plants

-

Chemical Processing

-

Frequently Asked Questions About This Report

b. The India process piping market size was estimated at USD 303.99 billion in 2022 and is expected to reach USD 317.86 Million in 2023.

b. The India process piping market is expected to grow at a compound annual growth rate of 6.1% from 2023 to 2030 to reach USD 481.03 billion by 2030.

b. The steam process piping segment dominated the India process piping market with a share of 32.68% in 2022. This is attributable to the growth of industries like chemicals, food processing, power generation, oil & gas, and textiles.

b. Some key players operating in the IIndia process piping market include Chemical Process Piping Pvt. Ltd, Gautam Tube Corporation, Process Piping Materials LLC.

b. Key factors that are driving the India process piping market growth included growing chemical and FMCG industry.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.