- Home

- »

- Communication Services

- »

-

India Online Grocery Market Size, Industry Report, 2030GVR Report cover

![India Online Grocery Market Size, Share & Trends Report]()

India Online Grocery Market Size, Share & Trends Analysis Report By Product (Fresh Produce, Breakfast & Dairy, Snacks & Beverages, Meat & Seafood, Staples & Cooking Essentials), By Payment Mode (Online, Offline), And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68039-316-6

- Number of Report Pages: 60

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

India Online Grocery Market Size & Trends

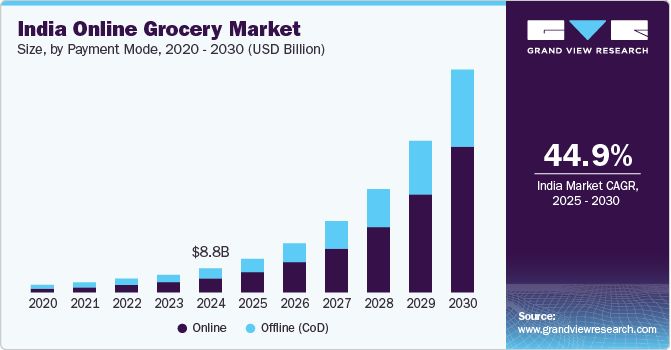

The India online grocery market size was valued at USD 8.82 billion in 2024 and is projected to grow at a CAGR of 44.9% from 2025 to 2030. The increasing inclination towards online grocery shopping, rising availability and accessibility to high-speed internet, the growing focus of the government on developing new infrastructure and enhancing existing capacities, and continuous improvements in service offerings by key companies in this market are driving the growth.

In recent years, online grocery shopping platforms have disrupted the Indian retail market significantly. The emergence of technology-driven mobile applications run by large retail organizations with efficient product and service portfolios in large cities such as Delhi, Mumbai, Bengaluru, Chennai, Hyderabad, Pune, and others has added to the growth opportunities for this market.

Changing consumer preferences, growing inclination towards choosing online grocery shopping alternatives over offline experiences in metro cities, attractive offers and reduced prices offered by the online platforms, intelligent process automation technology used by key companies to enhance customer experience and ensure greater engagement and widespread availability and accessibility of high-speed internet are also contributing to the growth of this market.

The launch of new service portfolio additions by prominent global brands in the country is expected to generate substantial growth for this market in approaching years. For instance, in May 2024, Uber, one of the key mobility solutions companies, introduced store pickup services in India. This newly launched offering allows customers to buy groceries up to five kilograms and order store pickup and delivery of the package via its platform.

Additional services offered by the online grocery shopping platforms in India, such as quick delivery, diligent package handling, enhanced shopping experiences, discounts offered through partnerships and collaborations with banks, and increased focus on customer retention, have attracted large groups of customers. Ease of use, ease of payment mode, hygiene, and safety, and remarkable service delivery are expected to assist this market in terms of growth during the forecast period.

Payment Mode Insights

Online payment modes segment dominated the India grocery market with a revenue share of 61.1% in 2024 owing to ease of use, rising adoption of digital payment mode platforms in India, government support for enhanced online payment mode gateway service delivery, convenience, promotional deals, and offers provided by the platforms and BFSI organizations, online money wallets offered by the shopping platforms and more. Collaborations between platforms and banks also add attractive alternatives to online payment mode services. For instance, in July 2023, Swiggy, a prominent delivery brand in Indian markets, and HDFC bank, a large private sector organization, collaborated to launch cobranded credit card services. This includes hosting by Mastercard, lucrative benefits for customers, and delivery of an unmatched customer-centric approach.

The offline (COD) payment modes segment is expected to experience a noteworthy CAGR of 42.0% from 2025 to 2030. The persistent popularity of the cash-on-delivery payment mode method in the Indian market, the security and confidentiality ensured by offline payment modes, online payment mode failures and the increasing occurrence of processing problems in online transactions, consumer behavior patterns, and convenience are some of the growth driving factors for this segment.

Product Insights

Based on products, the staples & cooking essentials segment dominated the Indian online grocery market with a revenue share in 2024. The continuous requirement for staples & cooking essentials such as flour, oils, spices, salt, sugar, rice, lentils, pulses, edible oils, and other products generates multiple orders through online platforms. Quick availability, assurances offered by brands for safety and quality, lucrative discounts, and changing customer preferences are key growth-driving factors for this market. New product launches in category, changing prices, and continuous needs are expected to fuel the demand in the next few years.

The breakfast and dairy segment is expected to experience a significant CAGR during the forecast period. Dairy industry brands offer a wide range of products, including milk of different types, curd, yogurt, and cheese in multiple packaging sizes, and offerings such as batter, bread, eggs, semolina, flattened rice, and other products, adding to the growth opportunities. Fast-track deliveries and the availability of multiple alternatives in one online store are expected to generate an upsurge in demand for this segment.

Regional Insights

South India dominated the Indian online grocery market with a revenue share of 34.3% in 2024. Presence of several key companies in the market in the South Indian region, such as Supermarket Grocery Supplies Pvt. Ltd. (BigBasket), Swiggy, Grofers India Pvt. Ltd., DUNZO, Fiora Online Limited (Star Quick), KiranaKart Technologies Private Limited (zepto), Blink Commerce Private Limited (blinkit) and others. In addition, the presence of specialized online grocery shopping platforms such as Simpli namdharis, a dedicated vegetarian grocery shopping platform, and others adds to the growth opportunities for this market. Increasing demand from cities such as Chennai, Bengaluru, Hyderabad, Kochi, and others is expected to fuel growth for this market in the approaching years.

East India is expected to experience the fastest CAGR from 2025 to 2030 owing to the increased ubiquity of smartphone technology and high-speed internet, the significant rise in disposable income levels, changes in lifestyles, government support for the development and enhancement of the online shopping industry supply chain, the presence of key online grocery platforms, the inclusion of automation technologies by major market participants, and more.

Key India Online Grocery Company Insights

Some of the key companies operating in the India online grocery market are BigBasket, DMart Ready, Flipkart Supermart, Blinkit (Blink Commerce Private Limited), Zepto (KiranaKart Technologies Private Limited), and others. To address unprecedented growth in demand and competition, key players in market are adopting strategies such as portfolio expansion, collaborations, service enhancements, faster delivery, adoption of modern technologies and more.

-

Blinkit (Blink Commerce Private Limited), one of the prominent companies in the industry, offers quick delivery service and online grocery shopping platform in multiple Indian cities such as Delhi, Kolkata, Lucknow, Pune, Hyderabad, Chennai, Chandigarh, Noida, Ahmedabad, Jaipur, Mumbai, Bengaluru and others. It offer products in categories such as vegetables & fruits, cold drink & juices, bakery & biscuits, beauty & cosmetics, personal care, ice cream & frozen desserts, cleaning essentials and more.

-

Zepto by KiranaKart Technologies Private Limited, online grocery platform with rapid growth in monthly active customers, provides multiple from various categories including fruits & vegetables, dairy, bread, & eggs, atta, rice, oils & dals, meat, fish & eggs, masala & dry-fruits, packaged food, tea, coffee & more, frozen food, sweet cravings, munchies, hair care, baby care, skincare, household essentials, and others.

Key India Online Grocery Companies:

- Amazon India Pvt. Ltd.

- BigBasket

- DMart Ready

- Flipkart Supermart

- Godrej Nature's Basket Ltd.

- Blink Commerce Private Limited (Blinkit)

- Nature's Basket

- Paytm E-Commerce Pvt. Ltd. (Paytm Mall)

- Reliance Retail Ltd. (Reliance Fresh)

- Spencer's Retail

- Star Quik (Fiora Online Limited)

- Swiggy (Instamart)

- UrDoorstep eRetail Pvt. Ltd.

- Zepto (KiranaKart Technologies Private Limited)

- Milkbasket

Recent Developments

-

In October 2024, BigBasket (Supermarket Grocery Supplies Pvt Ltd), one of the key players in the market, joined forces with Tanishq. The platform offered, fast delivery of gold and silver coins on occasion of Diwali festival.

-

In October 2024, Swiggy Instamart, a major market participant in online grocery shopping and delivery industry, added an extra feature in pilot phase to its platform for enhanced customer experience. The feature allows user to add their entire grocery list via three different input methods. This includes hassle free experience with alternatives including write it, say it, and scan it.

India Online Grocery Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 12.16 billion

Revenue forecast in 2030

USD 77.72 billion

Growth Rate

CAGR of 44.9% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Report updated

November 2024

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, payment mode, and region

Regional scope

South India, North India, East India, West India

Key companies profiled

Amazon India Pvt. Ltd.; BigBasket; DMart Ready; Flipkart Supermart; Godrej Nature's Basket Ltd.; Blink Commerce Private Limited (Blinkit); Nature's Basket; Paytm E-Commerce Pvt. Ltd. (Paytm Mall); Reliance Retail Ltd. (Reliance Fresh); Spencer's Retail; Star Quik (Fiora Online Limited); Swiggy (Instamart); UrDoorstep eRetail Pvt. Ltd.; Zepto (KiranaKart Technologies Private Limited); Milkbasket

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

India Online Grocery Market Report Segmentation

This report forecasts revenue growth at country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the India online grocery market report based on product, payment mode, and region.

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Fresh Produce

-

Breakfast & Dairy

-

Snacks & Beverages

-

Meat & Seafood

-

Staples & Cooking Essentials

-

Others

-

-

Payment Mode Outlook (Revenue, USD Billion, 2018 - 2030)

-

Online

-

Offline (CoD)

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

South

-

North

-

West

-

East

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."