- Home

- »

- Processed & Frozen Foods

- »

-

India Mushroom Market Size, Share, Industry Report, 2030GVR Report cover

![India Mushroom Market Size, Share & Trends Report]()

India Mushroom Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Button, Shiitake, Oyster), By Form, By Distribution Channel, By Application (Food, Pharmaceuticals, Cosmetics), And Segment Forecasts

- Report ID: GVR-4-68040-209-4

- Number of Report Pages: 75

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

India Mushroom Market Size & Trends

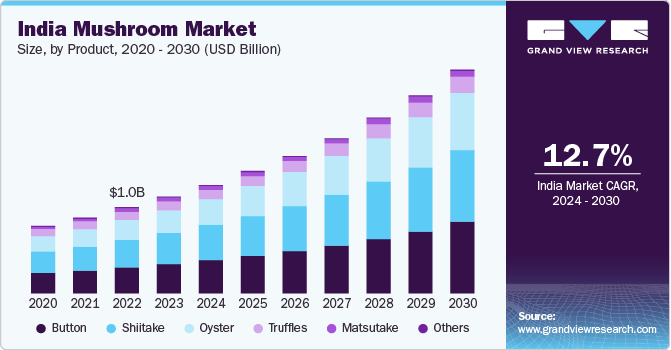

The India mushroom market size was estimated at USD 1.18 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 12.7% from 2024 to 2030. The growing vegan population's demand for a diet high in protein is anticipated to be a major driving force in the market over the course of the forecast period. Because of their high nutritional value, mushrooms are regarded as a superfood. Four essential nutrients, selenium, vitamin D, glutathione, and ergothioneine-are abundant in mushrooms. These nutrients aid in the reduction of oxidative stress and the prevention or mitigation of chronic illnesses such as dementia, cancer, and heart disease.

The India market accounted for a share of around 2% of the global mushroom market in 2023. India’s mushroom industry is mainly driven by rising consumer health consciousness and the increased demand for nutrient-rich, cholesterol-free food products. In addition, the growing popularity of veganism and the extensive use of mushrooms as a meat alternative due to their strong umami flavor are driving the country's market expansion. In addition, the growing use of mushrooms in dietary supplements is driving up demand for the product since they are high in fiber and digestive enzymes, which support immune system and gut health. Additionally, the growing demand for processed mushroom varieties, particularly in western nations, is giving India a lot of export prospects and improving the outlook for the regional industry.

In addition, the market is expanding due to ongoing developments in mushroom packaging technologies, such as the creation of materials that control humidity and keep water from condensing on mushrooms to increase their shelf life. An additional reason driving expansion is the growing use of mushrooms by the pharmaceutical sector to treat a variety of ailments, including hypertension and hypercholesterolemia. Moreover, throughout the course of the forecast period, the India mushroom market is anticipated to be driven by large investments in intelligent automation technologies for mushroom production in an effort to increase output and lower costs.

As of 2020, India ranked among the world's top producers of mushrooms, with an annual yield of 487 thousand tons, or 2% of the world total. The Indian mushroom industry is anticipated to be driven by farmers' growing preference for mushroom farming due to its higher profitability and greater export potential.

Since mushrooms are not classified as either plants or animals and are instead grown from spawns or spores, it is difficult to bring them under the regulatory framework. This is likely to present difficulties for the nation's mushroom farmers. Over the projection period, a rising consumer base and rising income levels in the nation are anticipated to fuel demand for unusual foods, including mushrooms.

Indian cuisine uses mushrooms in a variety of dishes as well as in pickles, vegetables, and medications. The Directorate of Mushroom Research projects that products including bread, cakes, drinks, papadum, and cookies enhanced with mushrooms will soon be available in India. This is because the organization has inked several agreements involving the transfer of technologies to four businesses, which will likely accelerate market expansion during the course of the forecast period.

Due to a notable increase in export potential, the global COVID-19 epidemic has presented growers with numerous opportunities. On the other hand, because to nationwide lockdowns that resulted in the closure of several eateries, cafés, and food outlets for extended periods of time, domestic consumption of fresh mushrooms decreased in 2020. In the next years, there will likely be a rise in the demand for supplements, herbs, and other items that improve immunity in addition to the growing popularity of vegan diets.

Market Concentration & Characteristics

The India mushroom market is moderately fragmented with the presence of a few large-sized and medium-sized players. Key players operating in this country increasingly emphasize sustainable production of mushrooms to attract an environmentally conscious customer base and improve brand position.

Leading agribusiness is anticipated to acquire small-sized and medium-sized mushroom companies in the coming years owing to the increasing attractiveness of mushroom market in light of growing health consciousness and rising vegan population across the world. Besides, the growing demand for meat substitutes is likely to advance the demand for mushrooms as food startup have developed chicken alternatives using Laetiporus mushroom also known as chicken of the woods. Such innovative product introductions are anticipated to open newer avenues to mushroom producers in the coming years.

Product Insights

Shiitake mushrooms dominated the market, having accounted for a revenue share of 32.4% in 2023. Shiitake mushrooms are extensively grown all over the world because of their many nutritional advantages and shorter spore incubation period. Moreover, the market is anticipated to be driven by their reduced costs, relative to their counterparts, throughout the forecast period. The shiitake product kind is well-liked across the world, mostly because of its savory rich taste and several health advantages. These mushrooms can be eaten raw or processed, such as dry shiitake mushrooms, which are more often used because of their umami flavor.

The demand for oyster mushrooms is projected to grow at a CAGR of 14.2% from 2024 to 2030. Oyster mushrooms are used in many different types of cooking, but because of their mildly savory flavor and delicate texture, they are especially popular in Asian cookery.

Additionally, benzaldehyde, an active ingredient in oysters, lowers the amount of bacteria in the body and functions as a natural antibacterial. Plant-based ingredients are being used by dietary supplement companies worldwide as a result of growing consumer interest in herbal products. In the upcoming years, this tendency is probably going to favor oyster mushroom growth.

Form Insights

Fresh mushrooms dominated the Indian industry, with a revenue share of over 90% in 2023. The demand for fresh mushrooms has significantly expanded over the past few years due to a rise in consumers who prioritize eating organic and unprocessed food to maximize the product's health advantages. Because fresh form has a short shelf life, it presents a challenge for manufacturers and distributors to distribute. However, growing technological developments, such the use of packaging with a controlled atmosphere, have lessened the difficulties related to mushrooms' short shelf life, supporting the segment's growth.

The demand for processed mushrooms in India is expected to grow at a CAGR of 13.1% from 2024 to 2030. Dried, frozen, canned, pickled, and powdered varieties are examples of processed varieties. To increase the shelf life of mushrooms, further processing such as canning, freezing, or drying is necessary. In an effort to capture the markets for convenience and processed food products, industrial companies are progressively producing packaged goods. Over the anticipated term, industry growth is anticipated to be supported by makers of food and cosmetics using more extracts and powder forms.

Distribution Channel Insights

Mushrooms are majorly distributed through supermarkets and hypermarkets in India, as of 2023, with this channel having accounted for a revenue share of over 38%. Supermarkets and hypermarkets are more common in industrialized regions. The dominance of this segment can be attributed to their abundance of this product in one location and the convenience of purchase. On the other hand, growing competition from internet retailers that sell mushrooms at a discount, together with shifting consumer preferences, has been impeding the expansion of supermarkets and hypermarkets.

The online sales of mushrooms are projected to grow at a CAGR of 13.3% from 2024 to 2030. Due to the convenience and financial advantages these channels provide, consumers all around the world are choosing to buy fresh produce online. Compared to supermarkets and hypermarkets, online retailers currently hold a lower percentage of the market. Because they purchase in greater quantities than convenience stores, grocery stores have access to a wider selection of processed goods at better prices.

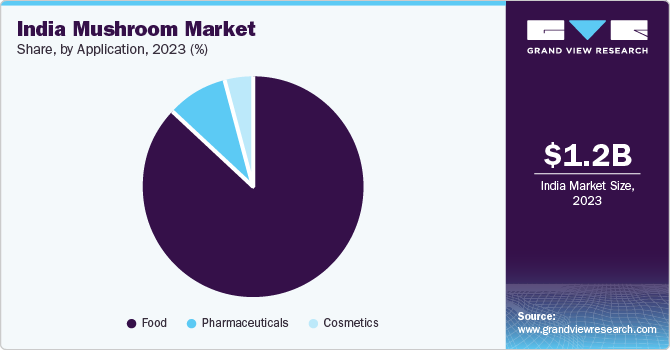

Application Insights

The usage of mushrooms in food applications accounted for a revenue share of around 87% in 2023. This application considers the utilization of fresh and processed forms by the household as well as food services. Mushrooms are low in fat and cholesterol, and they also have very little gluten and salt. Furthermore, mushrooms are a rich source of vitamins, minerals, proteins, and selenium, among other essential nutrients, and consequently, becoming quite well-liked among customers who are health-conscious and exercise lovers. Customers are choosing food items and drinks that are higher in nutrients and come from natural or clean sources.

The demand for mushrooms in cosmetic applications is expected to grow at a CAGR of 13.1% from 2024 to 2030. The cosmetics industry is seeing a boom in the use of mushrooms, as more and more brands are launching skincare products that feature mushrooms. Cosmetic firms are always looking for natural or clean sources for their products because of their lower toxicity and competitive effectiveness. Numerous important skin-beneficial substances, including vitamins, phenolics, polyphenolics, terpenoids, selenium, and polysaccharides, are abundant in mushrooms. These substances have good antioxidant, anti-aging, anti-wrinkle, skin-whitening, and moisturizing properties.

Key India Mushroom Company Insights

In developed regions, major firms are placing more and more emphasis on sustainable production in an effort to appeal to environmentally sensitive consumers and strengthen their brand. In the upcoming years, sustainability is probably going to become a crucial component of the market in corporate activities ranging from packaging to compost preparation and cultivation.

Key India Mushroom Companies:

- Fresh Lawn Mushroom Pvt. Ltd.

- Krishidev Fertilizers And Seeds Limited

- Chenab Impex Pvt. Ltd.

- Shobha International

- Shrim Industries Private Limited

- Pisum Food Services Private Limited

- Surabi

- Agrosophia

- Aroh Foundation

- Annavarshni Foods LLP

India Mushroom Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 1.33 billion

Revenue forecast in 2030

USD 2.72 billion

Growth rate

CAGR of 12.7% from 2024 to 2030

Actuals

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Volume in kilo tons, Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Volume and revenue forecasts, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, form, distribution channel, application

Country scope

India

Key companies profiled

Fresh Lawn Mushroom Pvt. Ltd.; Krishidev Fertilizers And Seeds Limited; Chenab Impex Pvt. Ltd.; Shobha International; Shrim Industries Private Limited; Pisum Food Services Private Limited; Surabi; Agrosophia; Aroh Foundation; Annavarshni Foods LLP

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

India Mushroom Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the India mushroom market report based on product, form, distribution channel, and application:

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Button

-

Shiitake

-

Oyster

-

Matsutake

-

Truffles

-

Others

-

-

Form Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Fresh

-

Processed

-

-

Distribution Channel Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Direct to Customer

-

Grocery Stores

-

Supermarkets & Hypermarkets

-

Convenience Stores

-

Online Stores

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Food

-

Pharmaceuticals

-

Cosmetics

-

Frequently Asked Questions About This Report

b. The India mushroom market size was estimated at USD 1.18 billion in 2023 and is expected to reach USD 1.33 billion in 2024.

b. The India mushroom market is expected to grow at a compound annual growth rate of 12.7% from 2024 to 2030 to reach USD 2.72 billion by 2030.

b. Shiitake mushrooms dominated the India market with a share of 32.4% in 2023. The growing demand for these mushrooms is attributable to abundant availability and the various health benefits.

b. Some key players operating in the India mushroom market include Fresh Lawn Mushroom Pvt. Ltd., Krishidev Fertilizers And Seeds Limited, Chenab Impex Pvt. Ltd., Shobha International, Shrim Industries Private Limited, Pisum Food Services Private Limited, Surabi, Agrosophia, Aroh Foundation, and Annavarshni Foods LLP.

b. Key factors that are driving the market growth include the growing usage of mushrooms as superfoods and the rising demand from the country's vegan population.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.