- Home

- »

- Distribution & Utilities

- »

-

India Microgrid Market Size & Share, Industry Report, 2030GVR Report cover

![India Microgrid Market Size, Share & Trends Report]()

India Microgrid Market (2024 - 2030) Size, Share & Trends Analysis Report By Power Source (CHP, Natural Gas, Solar PV, Diesel, Fuel Cell) By Connection Type (Remote, Grid Connected, Hybrid), By End-use, And Segment Forecasts

- Report ID: GVR-4-68040-287-7

- Number of Report Pages: 70

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Energy & Power

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

India Microgrid Market Size & Trends

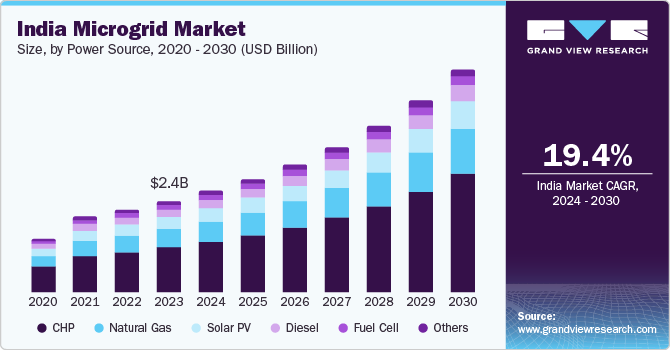

The India microgrid market size was estimated at USD 2.38 billion in 2023 and is projected to grow at a CAGR of 19.4% from 2024 to 2030. The market growth is driven by various factors, such as government initiatives promoting renewable energy adoption in rural areas, increasing demand for renewable energy sources like solar and wind power, the need for grid resilience to maintain power supply during outages, and a growing focus on energy management and sustainability. In March 2023, the National Thermal Power Corporation Renewable Energy Ltd., a conglomerate aiming to support power development in the country, collaborated with the Indian Army to establish a green hydrogen-based microgrid power plant in the forward areas along the Northern borders of eastern Ladakh, as part of the 'National Green Hydrogen Mission,' marking a significant step towards sustainable energy initiatives.

The growing population and rapid urbanization in India have led to a significant increase in energy demand. Microgrids offer a decentralized solution to meet this rising demand, especially in remote or off-grid areas where traditional grid infrastructure is lacking. Microgrids are crucial in improving energy access in rural and underserved areas of India. Microgrids help bridge the energy access gap and support economic development by providing reliable electricity to communities not connected to the main grid. The Indian government has set ambitious renewable energy targets to reduce carbon emissions and combat climate change. For instance, in September 2023, Dr. Jitendra Singh, Minister of State for Coal and Mines, announced a plan to achieve a coal production target of 1 billion tons by 2030. This goal is part of the government's efforts to enhance coal production and reduce its dependence on imports.

The industry benefits from the rising deployment of microgrids for rural electrification, increasing demand for clean energy solutions, and initiatives, such as the Ministry of New and Renewable Energy's program, to install mini-grids and microgrids. These drivers collectively contribute to the expansion and advancement of the market, reflecting a shift towards sustainable energy solutions and enhanced energy access across various sectors. Microgrids enhance grid resilience by providing backup power during grid outages or natural disasters. In a country prone to frequent power disruptions, microgrids offer a reliable source of electricity, ensuring the continuity of essential services, another significant factor driving the market.

Market Concentration & Characteristics

The industry stage growth is high and the pace of its growth is accelerating. The market is characterized by a high degree of innovation due to continuous technological advancements and increasing demand for more efficient and cost-effective microgrids. For instance, the deployment of solar-storage remote microgrids by the SELCO Foundation in Karnataka in 2020 showcased the integration of solar energy and storage solutions to provide reliable energy access in rural areas.

The level of mergers & acquisitions (M&A) activity in the industry is moderate due to fragmentation and favorable regulations, initiatives, and collaboration with government organizations. For instance, in 2021, Common Service Centers (CSCs), the Indian government's e-governance services, revealed a partnership with Tata Power to deploy solar-powered microgrids and water pumps in rural regions. Tata Power intends to establish 10,000 microgrids to assist rural consumers via Common Service Centres (CSCs). This collaboration aims to enhance the government's ongoing efforts to deliver clean and sustainable energy to households and businesses in rural areas.

The impact of regulations in the industry is moderate, owing to the government's increasing focus on renewable energy and initiatives to promote clean energy solutions. Regulations promoting renewable energy integration, providing incentives for microgrid deployment, and facilitating grid interconnection have significantly influenced the growth and development of the market.

The level of service substitutes in the industry is moderate owing to the energy solutions, benefits, and functions offered by these alternatives. Non-wire alternatives (NWAs) are gaining prominence as strategic considerations for energy stakeholders, utilizing distributed energy resources and microgrids to defer or avoid costly infrastructure upgrades.

Power Source Insights

The Combined Heat & Power (CHP) segment accounted for the largest revenue share of around 43% in 2023 owing to several factors, such as its high efficiency, cost savings, reliability, and resilience, making it a preferred choice for industries seeking uninterrupted power supply and improved energy utilization. In addition, CHP systems offer environmental benefits by reducing emissions and aligning with India’s sustainability goals. The growing demand for CHP, fueled by rising energy costs, energy security needs, and government support for clean energy solutions, further solidifies its position in India's energy sector.

Furthermore, CHP is expected to grow at the fastest CAGR of 21.1% during the forecast period due to increasing demand for decentralized power. The rising demand for cogeneration in the industrial sector and stringent government regulations on carbon emissions support market growth. In addition, government initiatives promoting biogas and non-bagasse cogeneration systems through incentives and tariff subsidies are expected to further boost market growth.

The Western and Southern regions of India are the primary demand generators for CHP systems due to the presence of key industries and supportive government initiatives, such as the Green Energy Corridor. The gas & steam turbine technology holds the largest share of the market and is anticipated to retain its dominance in the coming years. The country's transition towards sustainable and efficient energy solutions to meet the increasing energy demand and address environmental concerns supports market growth.

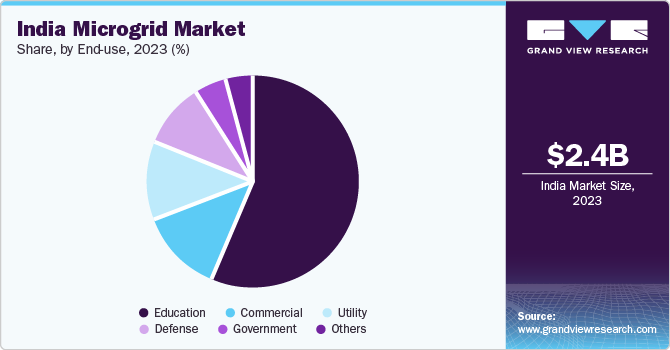

End-use Insights

The education segment accounted for the largest revenue share in 2023 due to the rising government investments in education infrastructure to provide school education in rural areas, the extensive power supply requirements for lighting, and electronic equipment in educational institutions, and an increasing focus on improving education access and quality. For instance, in the fiscal year 2023-24, the Indian government earmarked approximately USD 14 billion for education expenditure at the national level. This allocation encompassed both school and higher education, with a notable rise in funding for school education by 16.5% and higher education by 8% compared to the preceding year.

The emphasis on improving educational infrastructure, especially in rural regions, underscores the government's dedication to fostering a technology-driven and knowledge-based economy while enhancing public finances and fortifying the financial sector. The government segment is expected to grow at the fastest CAGR from 2024 to 2030 due to the government's initiatives and investments in microgrid development, increasing demand for reliable & uninterrupted power supply in government facilities, focus on rural electrification projects, and rising government-led efforts for decarbonization.

Connection Type Insights

The grid-connected segment accounted for the largest revenue share in 2023 owing to several factors, such as their ability to provide enhanced and consistent energy supply, especially in remote areas, offering benefits like system stability and reliability during network disruptions. The advantages of grid connectivity, coupled with government support, incentives promoting sustainable solutions, and technological advancements, such as smart controls and intelligent algorithms, drive the demand for grid-connected microgrids, solidifying their dominance in revenue within the market. The remote connection type is expected to register the fastest CAGR from 2024 to 2030.

This is due to the COVID-19 impact accelerating remote work practices, government support for digital infrastructure, demand for remote work facilitated by technological advancements, and the need for global connectivity. A rise in remote connections in India is driven by the shift toward flexible work arrangements, advancements in digital tools, and the necessity for seamless communication and collaboration among remote workers, positioning remote connection types as a rapidly expanding segment in India’s connectivity landscape. For instance, the Indian government has launched initiatives, such as the Solar Rooftop Scheme, and programs, such as SAUBHAGYA and DDUGJY, to accelerate the adoption of microgrids for rural electrification. These efforts aim to enhance energy access in remote areas and drive the demand for microgrid solutions.

Key India Microgrid Company Insights

Some of the key companies operating in the India microgrid market include Exelon Corporation, Hitachi Ltd, and Siemens India Pvt Ltd.

-

Exelon Corporation is a prominent player in the market, known for its energy generation and distribution expertise. The company's involvement in microgrid projects aligns with its commitment to sustainable energy solutions. Exelon's initiatives focus on enhancing energy access, reducing carbon footprint, and promoting renewable energy sources like solar and wind power. Through collaborations and investments, Exelon aims to drive innovation in the microgrid sector, supporting economic growth, job creation, and environmental sustainability in India

-

Hitachi Ltd. is another key player shaping the market with its advanced technologies and solutions. Hitachi's presence in the microgrid industry underscores its focus on energy efficiency, reliability, and grid modernization. The company's contributions to microgrid projects in India emphasize the integration of smart technologies, battery storage, and solar photovoltaic systems for optimized energy management. Hitachi's innovative approach to microgrids aims to address energy challenges, enhance grid resilience, and promote sustainable development in the Indian energy sector

Key India Microgrid Companies:

- Eaton Corporation Plc

- Exelon Corporation

- General Electric Company

- Gram Power India Pvt Ltd

- Greenpeace Foundation

- Hitachi Ltd.

- Mera Gao Micro Grid Power Pvt. Ltd.

- Schneider Electric SE

- Siemens India Private Limited

- Toshiba India Pvt. Ltd.

Recent Developments

-

In April 2023, Uneecops Technologies Ltd. established the first Green Hydrogen Microgrid Project in Leh, India. The work includes overseeing the engineering, procurement, and construction (EPC) of a 25kw green hydrogen-powered fuel cell microgrid at the guest house located at the Power Station in Alchi, Leh

-

In April 2022, IElectrix launched its Shakti microgrid in New Delhi with an aim to improve the resilience and quality of the electricity supply in the city using solar energy. The launch of the Shakti microgrid by IElectrix represents a significant step towards promoting sustainable energy solutions and addressing the challenges associated with traditional electricity grids

-

In August 2022, TP Renewable Microgrid (TPRMG), a subsidiary of Tata Power and SIDBI, partnered to launch a program aiming to establish 1,000 green energy enterprises nationwide. This initiative aligns with the Government of India’s vision of Atmanirbhar Bharat by promoting sustainable entrepreneurship models and empowering rural entrepreneurs

India Microgrid Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 8.01 billion

Growth rate

CAGR of 19.4% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, volume in MW, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, volume forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Power source, connection type, end-use

Key companies profiled

Eaton Corp. Plc, Exelon Corp.; General Electric Company; Gram Power India Pvt. Ltd.; Greenpeace Foundation; Hitachi Ltd.; Regain Paradise; Schneider Electric SE; Siemens India Pvt. Ltd.; Toshiba India Pvt. Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

India Microgrid Market Report Segmentation

This report forecasts revenue and volume growth at country level and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the India microgrid market report based on the power source, connection type, and end-use:

-

Power Source Outlook (Volume, MW; Revenue, USD Million, 2018 - 2030)

-

CHP

-

Natural Gas

-

Solar PV

-

Diesel

-

Fuel Cell

-

Others

-

-

Connection Type Outlook (Volume, MW; Revenue, USD Million, 2018 - 2030)

-

Remote

-

Grid Connected

-

Hybrid

-

-

End-use Outlook (Volume, MW; Revenue, USD Million, 2018 - 2030)

-

Government

-

Education

-

Commercial

-

Utility

-

Defense

-

Others

-

Frequently Asked Questions About This Report

b. The India microgrid market size was valued at USD 2.38 billion in 2023.

b. The India microgrid market is projected to grow at a compound annual growth rate (CAGR) of 19.4% from 2024 to 2030 to reach USD 8.01 billion by 2030

b. The Combined Heat & Power (CHP) segment accounted for the largest revenue share of around 43% in 2023 owing to several factors, such as its high efficiency, cost savings, reliability, and resilience, making it a preferred choice for industries seeking uninterrupted power supply and improved energy utilization.

b. Some of the key companies operating in the India microgrid market include Exelon Corporation, Hitachi Ltd, and Siemens India Pvt Ltd, among others.

b. The India microgrid market is driven by various factors, such as government initiatives promoting renewable energy adoption in rural areas, the increasing demand for renewable energy sources such as solar and wind power, the need for grid resilience to maintain power supply during outages, and a growing focus on energy management and sustainability.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.