- Home

- »

- Water & Sludge Treatment

- »

-

India Membrane Bioreactor Market, Industry Report, 2030GVR Report cover

![India Membrane Bioreactor Market Size, Share & Trends Report]()

India Membrane Bioreactor Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Hollow Fiber, Flat Sheet), By Configuration (Submerged, Side Stream), By Application (Municipal, Industrial), And Segment Forecasts

- Report ID: GVR-3-68038-796-4

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

India Membrane Bioreactor Market Trends

The India membrane bioreactor market size was estimated at USD 188.6 million in 2024 and is anticipated to grow at a CAGR of 9.6% from 2025 to 2030. This growth is attributed to the increasing urbanization and industrialization leading to higher wastewater production, necessitating effective treatment solutions. In addition, stringent government regulations on wastewater discharge further compel industries to adopt MBR technology for compliance. Furthermore, rising awareness of water quality issues and the need for sustainable water management practices are boosting demand. The market is also supported by advancements in MBR technology, enhancing efficiency and reducing operational costs, which attract more installations across various sectors.

Membrane Bioreactor (MBR) technology integrates biological treatment processes with membrane filtration, utilizing semi-permeable membranes to separate microorganisms from treated water. This approach effectively combines ultrafiltration or microfiltration with suspended growth bioreactors, making it a popular choice for municipal and industrial wastewater treatment. MBRs eliminate the need for secondary clarifiers and tertiary filtration, significantly reducing the plant's footprint. In India, MBR technology is rising due to its cost-effectiveness, energy efficiency, and compact design, making it preferable over traditional activated sludge systems.

The Indian MBR market is propelled by rapid population growth, leading to a heightened demand for clean water. Increased private sector investments to upgrade existing wastewater treatment facilities with MBR systems further support market expansion. Environmental concerns regarding water scarcity and pollution have intensified the need for advanced treatment technologies.

Furthermore, ongoing infrastructure development projects have prompted the government to enforce stricter environmental regulations, promoting the use of MBR technology. This combination of factors positions MBRs as a vital solution for addressing India's pressing water management challenges while ensuring sustainable practices in wastewater treatment across various sectors.

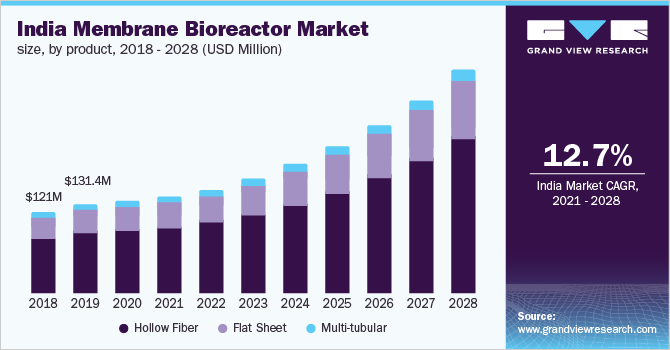

Product Insights

The hollow fiber dominated the market and accounted for the largest revenue share of 50.5% in 2024, owing to its operational efficiency and cost-effectiveness. Hollow fiber membranes offer lower operational and maintenance costs than other membrane types, making them an attractive option for wastewater treatment facilities. In addition, their compact design allows for higher packing density, enhancing productivity while minimizing treatment plants' footprint. Furthermore, the increasing demand for high-quality effluents in municipal and industrial applications further propels the adoption of hollow fiber technology, as it effectively meets stringent regulatory standards for wastewater discharge.

Flat sheet products are expected to grow at a CAGR of 10.2% over the forecast period, driven by their versatility and effectiveness in medium-scale applications. They are particularly favored in industries such as food and beverage, where high solid loading and good hydraulic flow are essential for efficient operation. In addition, the flat sheet configuration also facilitates easier maintenance and cleaning processes, which can lead to reduced downtime and operational costs. Furthermore, as urbanization accelerates and infrastructure projects expand, the demand for reliable wastewater treatment solutions using flat sheet technology is expected to rise, contributing to its growth in the market.

Configuration Insights

The submerged configuration held the dominant position in the market and accounted for the largest revenue share of 76.4% in 2024. This growth is attributed to its operational efficiency and lower energy consumption. This configuration allows membranes to be immersed in the biological treatment process, which enhances biodegradation and reduces fouling rates. As a result, submerged MBRs produce high-quality effluent while minimizing sludge production. Furthermore, the increasing demand for effective wastewater treatment solutions in urban areas, driven by rapid urbanization and stringent environmental regulations, further supports adopting submerged MBR technology across municipal and industrial applications.

The side stream configuration is expected to grow at a CAGR of 8.3% from 2025 to 2030, owing to its ability to handle high solid concentrations and improve overall system performance. In addition, this configuration allows for better control over membrane fouling and offers flexibility in operation, making it suitable for various industrial applications. Furthermore, the rising focus on sustainable water management practices and the need for advanced treatment technologies also contribute to the growing popularity of side stream configurations in the Indian market.

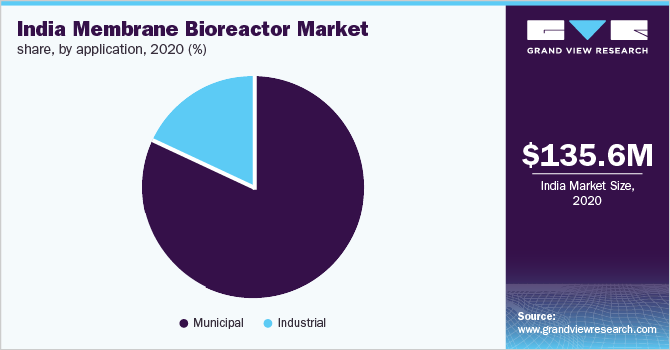

Application Insights

The municipal applications led the market and accounted for the largest revenue share of 61.8% in 2024, driven by increasing urbanization and population density. In addition, as cities expand, the volume of wastewater generated rises, necessitating advanced treatment solutions to ensure effective sanitation and environmental protection. Furthermore, stricter government regulations regarding wastewater discharge further compel municipalities to adopt MBR technology, which provides high-quality effluent suitable for reuse. Moreover, growing public awareness about sanitation and health issues drives investment in municipal water treatment facilities, enhancing the demand for MBR systems across urban areas.

The industrial applications segment is expected to grow at a CAGR of 11.3% over the forecast period, owing to rapid industrialization and the need for efficient wastewater management solutions. In addition, industries such as food and beverage, pharmaceuticals, and chemicals generate significant volumes of wastewater laden with pollutants, creating a pressing demand for effective treatment technologies. Furthermore, MBRs are favored for handling high solid concentrations and producing high-quality effluent that meets stringent regulatory standards. Moreover, government initiatives encouraging sustainable practices and investments in infrastructure development are driving industries to adopt MBR systems, thereby fostering growth in this segment.

Key India Membrane Bioreactor Company Insights

Some of the key companies in the market include General Electric Energy LLC, Kemira, Aquatech International Corp., and others. These companies adopt strategies, such as new product developments to improve efficiency and reduce costs, and strategic partnerships to leverage technological advancements and expand market reach. In addition, mergers and acquisitions consolidate resources, access new markets, and enhance innovation capabilities. Furthermore, companies focus on geographical expansion to tap into emerging markets, ensuring they meet the increasing demand for effective wastewater treatment solutions across municipal and industrial sectors.

-

Thermax India Ltd. manufactures modular MBR products that efficiently treat sewage and industrial effluents, ensuring high-quality water recovery. Operating primarily in the water and waste management segment, the company focuses on innovative solutions that contribute to environmental sustainability and resource conservation, catering to various residential, commercial, and industrial sectors.

-

UEM India Pvt. Ltd. manufactures MBR systems that integrate biological processes with membrane filtration for effective wastewater treatment. The company operates in municipal and industrial segments, providing tailored solutions that meet stringent effluent quality standards. Their focus on advanced technologies positions them as a key contributor to sustainable water management practices across diverse industries in India.

Key India Membrane Bioreactor Companies:

- General Electric Energy LLC

- Kemira

- Aquatech International Corp.

- Mitsubishi Chemical Corp.

- Danaher Corporation

- Veolia Environment S.A.

- Toray Industries

- UEM India Pvt. Ltd.

- Ion Exchange India Ltd.

- VA Tech Wabag Ltd

- Suez Environment S.A.

- Thermax India Ltd.

- Aquatech Systems Asia Pvt. Ltd.

- Kubota Corp.

Recent Developments

-

In November 2023, Thermax Water and Waste Solutions launched atoM, a compact modularized membrane bioreactor (MBR) designed for efficient sewage treatment. This innovative system integrates biological degradation with membrane filtration, effectively removing nitrogen and phosphorus to produce high-quality treated water suitable for recycling. The atoM package is fully automated, reduces installation area by 55%, and is ideal for various applications, including residential complexes and commercial establishments. This development aligns with sustainability goals, promoting the circular economy through water reuse.

India Membrane Bioreactor Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 205.4 million

Revenue forecast in 2030

USD 325.4 million

Growth rate

CAGR of 9.6% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Report updated

November 2024

Quantitative units

Revenue in USD Million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, configuration, application

Country scope

India

Key companies profiled

General Electric Energy LLC; Kemira; Aquatech International Corp.; Mitsubishi Chemical Corp.; Danaher Corporation; Veolia Environment S.A.; Toray Industries; UEM India Pvt. Ltd.; Ion Exchange India Ltd.; VA Tech Wabag Ltd; Suez Environment S.A.; Thermax India Ltd.; Aquatech Systems Asia Pvt. Ltd.; Kubota Corp.

Customization scope

Free report customization (equivalent to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

India Membrane Bioreactor Market Report Segmentation

This report forecasts revenue growth at the country level and analyzes the latest industry trends in each sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the global India membrane bioreactors market report based on product, configuration, and application.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Hollow Fiber

-

Flat Sheet

-

Multi-Tubular

-

-

Configuration Outlook (Revenue, USD Million, 2018 - 2030)

-

Submerged

-

Side Stream

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Municipal

-

Industrial

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.