- Home

- »

- Advanced Interior Materials

- »

-

India Lithium Market Size And Share, Industry Report, 2030GVR Report cover

![India Lithium Market Size, Share & Trends Report]()

India Lithium Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Carbonates, Hydroxide), By Application (Automotive, Consumer Electronics, Grid storage, Glass & Ceramics), And Segment Forecasts

- Report ID: GVR-4-68040-285-1

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

India Lithium Market Size & Trends

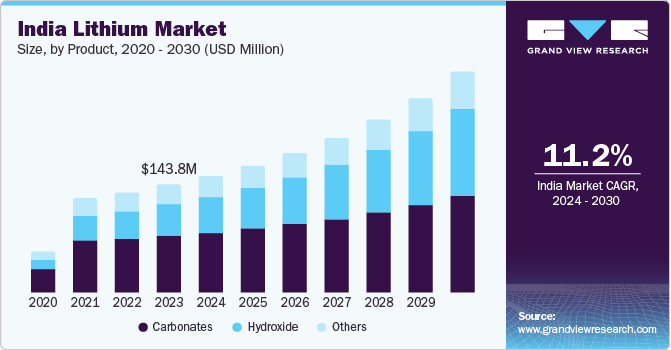

The India lithium market size was estimated at USD 143.8 million in 2023 and is expected to grow at a CAGR of 11.2% from 2024 to 2030. The shift towards vehicle electrification propels the demand for lithium-ion batteries, driving market growth. The automotive sector is poised for significant expansion, fuelled by strict emissions regulations pushing automakers towards electric vehicles (EVs) to curb carbon emissions. This transition to EV production is expected to boost the demand for lithium and associated products. Government initiatives and investments in the EV sector are anticipated to accelerate market growth further. The stringent regulations on internal combustion engine (ICE) vehicles are reshaping the automotive landscape, emphasizing the importance of EVs, and creating a favorable environment for market expansion.

In 2022, the Geological Survey of India (GSI) conducted five lithium extraction projects in Andhra Pradesh, Jammu & Kashmir, and Arunachal Pradesh, contributing to the country's lithium market growth. The COVID-19 pandemic negatively impacted India's lithium industry, particularly affecting the lithium-ion battery market. The outbreak led to disruptions in the supply chain, as India heavily relies on imports of batteries and essential materials, such as lithium and cobalt. This disruption resulted in a decline in factory operating rates and production capacities, impacting various sectors, such as automotive. However, as the world gradually recovered from the pandemic, India intensified its efforts to secure lithium resources and bolster domestic manufacturing capabilities.

Market Concentration & Characteristics

The India lithium industry is significantly fragmented, however, its growth stage is high, and the pace of the industry is accelerating. Manufacturers in the industry are heavily investing in R&D to enhance the utilization of lithium in rapidly growing sectors like EVs. These companies are dedicated to optimizing manufacturing processes and achieving high-purity lithium. Through significant R&D investments, manufacturers strive to innovate and create new products by enhancing their production techniques to meet the demands of evolving industries. Government associations promote the mining of lithium and other critical minerals. In February 2023, the Geological Survey of India discovered 5.9 million tonnes of lithium deposits in Jammu & Kashmir. These lithium reserves are anticipated to be a significant asset for the Indian government, generating revenue to address climate challenges, promote renewable energy, and improve energy security.

The industry is characterized by a high level of merger and acquisition (M&A) activity. The focus on mergers and acquisitions in the market underscores a proactive approach toward securing access to vital resources that drive sustainable growth across various sectors, including energy storage, electronics, and transportation. In April 2023, Amperex Technology Limited collaborated with AM Batteries to develop electrodes for lithium-ion batteries without using solvents. This collaborative initiative seeks to tackle significant industry challenges linked to the substantial carbon footprint, energy usage, and costly infrastructure requirements of the traditional solvent evaporation process in electrode fabrication.

The impact of regulations on the industry is high due to strict government policies. In March 2020, the Indian government launched schemes like the Production-Linked Incentive (PLI) Scheme for Advanced Chemistry Cell (ACC) Battery and the Battery Waste Management Rules, 2022, to drive the development of cutting-edge battery technologies, reduce import dependency, and ensure environmentally sound management of waste batteries.

Product Insights

The carbonate product segment accounted for the largest revenue share of 52.7% in 2023. The segment is anticipated to witness growth opportunities in the future as more industries and sectors adopt lithium-based technologies. This trend aligns with global developments where lithium-ion batteries are becoming increasingly prevalent across various applications due to their high energy density and long cycle life. With the government’s push towards electric mobility and renewable energy integration, the demand for lithium carbonate is projected to increase over the forecast period.

The hydroxide product segment is anticipated to grow significantly over the forecast period. Lithium hydroxide plays a crucial role in the battery application segment, especially in the production of cathode materials for lithium-ion batteries. With the increasing demand for EVs and renewable energy storage solutions, the consumption of lithium hydroxide is expected to grow significantly.

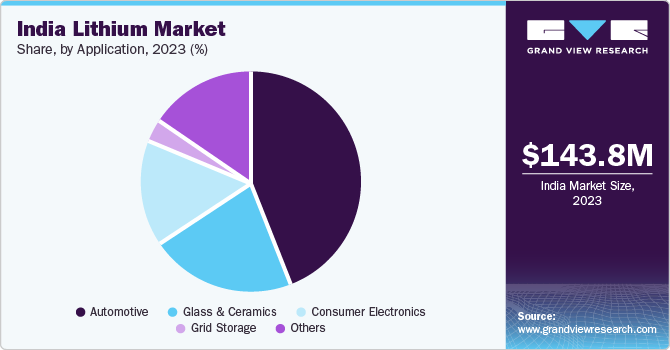

Application Insights

The automotive application segment accounted for the largest revenue share in 2023 due to rising EV demand and reduced upkeep expenses compared to conventional vehicles. According to India Briefing, around 440,000 EVs were sold in the country in 2023, fuelling the demand for lithium-ion batteries.

The consumer electronics segment is anticipated to register the fastest CAGR from 2024 to 2030. The increasing demand for consumer electronics, driven by rising disposable income and technological advancements, is driving the market growth. With the growing demand for electronic devices, such as smartphones, laptops, tablets, and other gadgets, the need for efficient and reliable power sources, such as lithium-ion batteries, has risen.

Key India Lithium Company Insights

Some of the key companies operating in the market are HBL Power Systems Limited, Li Energy Private Limited, Luminous Power Technologies Private Limited, and others.

-

HBL Power Systems Limited offers a range of lithium batteries and energy storage solutions, which include lithium iron phosphate (LiFePO4) batteries recognized for their durability and safety characteristics. The company designs and manufactures key components of EVs, such as drive motors, motor controllers, and battery modules, ensuring seamless integration and effective electrification solutions using Li-ion batteries

-

Li Energy Private Limited offers lithium-ion battery manufacturing services for EVs and renewable energy applications. The company aims to establish India’s first lithium-ion battery manufacturing gigafactory to contribute to a sustainable future in the EV and renewable energy sectors

Key India Lithium Companies:

- TDK Corporation

- Evolute

- Exide Industries Ltd.

- Future Hi-tech Batteries Limited

- HBL Power Systems Limited

- Li Energy

- Luminous Power Technologies Private Limited

- Okaya

- TDS

Recent Developments

-

In November 2022, TDK Corporation announced the acquisition of Amperex Technology Limited. The acquisition expanded TDK Corporation’s production of lithium-polymer batteries in India for the smartphone market by supplying these batteries to companies such as Samsung and Apple

-

In June 2022, Excide Industries Ltd. and Leclanché SA collaborated, started a joint venture, Nexcharge, and commenced operations at a lithium-ion battery facility in Gujarat. The plant, with a capacity of 1.5 GWh, could manufacture batteries for automotive and energy storage purposes

-

In February 2022, Luminous Power Technologies Private Limited launched the New Age Li-ON Series Integrated Inverter featuring a Lithium-ion Battery. Compared to traditional lead-acid battery-based inverters, the Li-ON series inverters provide reliable performance with minimal maintenance

India Lithium Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 294.1 million

Growth rate

CAGR of 11.2% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million, volume in kilotons, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, volume forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application

Key companies profiled

TDK Corp.; Evolute; Exide Industries Ltd.; Future Hi-tech Batteries Ltd.; HBL Power Systems Ltd.; Li Energy; Luminous Power Technologies Pvt. Ltd. Okaya; TDS

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

India Lithium Market Report Segmentation

This report forecasts revenue and volume growth at country level and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the India lithiummarket report based on product and application:

-

Product (Volume, Kilotons; Revenue USD Million, 2018 - 2030)

-

Carbonates

-

Hydroxide

-

Others

-

-

Application (Volume, Kilotons; Revenue USD Million, 2018 - 2030)

-

Automotive

-

Consumer Electronics

-

Grid Storage

-

Glass & Ceramics

-

Others

-

Frequently Asked Questions About This Report

b. The India lithium market size was estimated at USD 143.8 million in 2023 and is expected to reach USD 155.6 million in 2024

b. The India lithium market is expected to grow at a compound annual growth rate of 11.2% from 2024 to 2030 to reach USD 294.1 million by 2030

b. The carbonate segment in product accounted for the market share of 52.7% in 2023 driven by the increasing need for energy storage solutions and the shift towards electric vehicles to reduce carbon emissions

b. Some key players operating in the market include Amperex Technology Limited; Evolute; Exide Industries Ltd.; Future Hi-tech Batteries Limited; HBL Power Systems Limited; Li Energy; Luminous Power Technologies Private Limited; Okaya; TDS

b. Factors such as government initiatives and investments in the EV sector are anticipated to accelerate the market growth

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.