- Home

- »

- Power Generation & Storage

- »

-

India Lithium-ion Battery Market Size, Industry Report, 2030GVR Report cover

![India Lithium-ion Battery Market Size, Share & Trends Report]()

India Lithium-ion Battery Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Lithium Cobalt Oxide, Lithium Iron Phosphate), By Component, By Capacity, By Voltage, By Battery Type, By Application, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-290-6

- Number of Report Pages: 210

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Energy & Power

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

India Lithium-ion Battery Market Trends

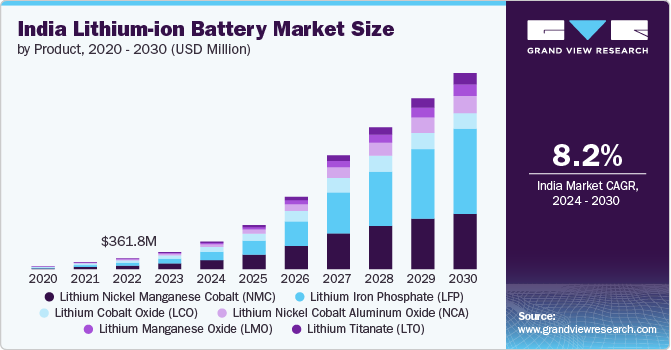

The India lithium-ion battery market size was estimated at USD 573.07 million in 2023 and expected to expand at a CAGR of 38.7% from 2024 to 2030. The growth of the market in the country can be attributed to the increasing adoption of electric vehicles (EVs) and the ongoing integration of renewable wind and solar energy sources into power grids that create significant demand for energy storage solutions. Moreover, supportive government policies also contribute to the growth of the market in India.

As the world shifts towards sustainable transportation options to reduce carbon emissions and combat climate change, the demand for lithium-ion batteries used in these vehicles is rising. According to the Ministry of Road Transport & Highways (MoRTH), 1,531,926 units of battery-operated vehicles (BOV) were sold in India in 2023, an increase of 49.2% from 2022. Lithium-ion batteries are widely used rechargeable energy storage solutions in contemporary society, valued for their compactness, lightweight construction, and extended lifespan.

Drivers, Opportunities & Restraints

The growing concern pertaining to global warming and climate change is driving the growth of electric vehicles (EVs) in India. The Government of India is incentivizing the adoption of EVs by launching initiatives such as the National Electric Mobility Mission Plan (NEMMP) 2020 and Faster Adoption and Manufacturing of Hybrid and Electric Vehicles (FAME) Scheme. Companies including Tata Motors Limited, Mahindra Electric Mobility Limited, Ather Energy Private Limited, Ola Electric Mobility Private Limited, Hero Electric Vehicles Pvt. Ltd., Bajaj Auto Limited, TVS Motor Company Limited, and others are introducing innovative EVs owing to the increased demand and regulatory support.

Furthermore, the rising prices of petrol and diesel in India are driving the adoption of EVs as a cheaper and more sustainable transportation alternative. With petroleum reserves dwindling and geopolitical tensions causing frequent spikes in oil prices, consumers and businesses are increasingly turning to electricity to power their vehicles. This shift not only helps reduce dependence on imported oil but also offers a more stable and predictable energy cost, making electric transportation an attractive option in the current economic climate. As a result, the electric vehicle market in India is experiencing significant growth, supported by economic factors and environmental considerations.

Growing need for energy storage solutions is one of the major opportunities in the India lithium-ion battery market. With India’s increasing focus on renewable energy sources like solar and wind, efficient energy storage systems are in need to manage the intermittent nature of these energy sources. Lithium-ion batteries, with their high energy density and efficiency, are ideal for storing energy and ensuring a stable power supply. This demand is expected to drive investments in battery storage projects across the country.

Product Insights & Trends

Based on product, the market is further categorized as lithium cobalt oxide (LCO), lithium iron phosphate (LiFePO4), lithium nickel cobalt aluminum oxide (NCA), lithium manganese oxide (LMO), lithium titanate (LTO), lithium nickel manganese cobalt (NMC). The NMC segment led the market with a share of 33.59% in 2023. The rising need for decarbonization and the transition to clean energy sources are driving the demand for NMC lithium-ion batteries. As countries worldwide set targets to reduce greenhouse gas (GHG) emissions and promote sustainable energy practices, the need for energy storage solutions, such as NMC batteries, to support renewable energy integration into the grid is increasing. NMC batteries play a crucial role in storing excess energy generated from wind or solar power during peak demand periods or when renewable sources are not actively producing energy.

The LiFePO4 segment is anticipated to grow at the fastest CAGR over the forecast period owing to the increasing demand for reliable and safe energy storage solutions in applications where safety and longevity are paramount. LFP batteries offer excellent safety and have a long life span. The rising demand for these batteries in portable and stationary products as they require high load currents and endurance is expected to augment the growth of the market for them in India in the coming years. The extensive research and development activities for launching effective and high-quality LFP batteries in the market are among the initiatives undertaken by their manufacturers in the country.

Component Insights & Trends

Based on component, cathode segment held the market with the largest revenue share of 48.93% in 2023. The demand for cathodes in lithium-ion batteries in India is poised for significant growth, driven by the increasing adoption of electric vehicles (EVs) and the need for energy storage solutions. The lithium-ion batteries constitute a major cost component in EVs, accounting for 40%-50% of the total expense. As the Indian government targets a cumulative demand of 903 GWh for energy storage by 2030, the need for cathode materials, particularly nickel manganese cobalt (NMC) variants, is expected to rise steadily. Moreover, increasing domestic production of cathode in India is expected to contribute to market growth.

The cathode segment is expected to grow at the fastest CAGR over the forecast period. Growing anode production plants in India is expected to foster the market growth. For instance, In May 2024, Epsilon Advanced Materials announced plans to set up a cathode manufacturing plant in Telangana, Karnataka, and Tamil Nadu. The company plans to start commercial production by 2025.

Capacity Insights & Trends

Based on capacity, 3,001 to 10,000 mAH segment held the market with the largest revenue share of 34.17% in 2023. The demand for lithium-ion batteries with capacities ranging from 3,001 to 10,000 mAh is experiencing significant growth across various industries, including consumer electronics, automotive, appliances, and aerospace. These batteries are in high demand as they have the ability to power heavy loads and can often be assembled into modules for applications requiring substantial energy storage.

The 3,001 to 10,000 mAH segment is expected to grow at the fastest CAGR over the forecast period. As the world moves toward more connected and intelligent offerings, such as electric vehicles and AI-powered electronic devices, the demand for these mid-range capacity batteries is projected to increase in the coming years.

Voltage Insights & Trends

Based on voltage, medium (12 V to 36 V) segment held the market with the largest revenue share of 46.30% in 2023. The increasing adoption of electric vehicles (EVs) and the rising demand for energy storage solutions in India have led to the surged demand for lithium-ion batteries with medium voltage (12 V to 26 V) in the country. Government initiatives aimed at promoting electric mobility, such as the Faster Adoption and Manufacturing of Hybrid and Electric Vehicles (FAME) scheme, are significantly contributing to this demand by incentivizing the development and use of EVs.

The medium (12 V to 36 V) segment is expected to grow at the fastest CAGR over the forecast period. As India progresses toward its sustainability goals, the requirement for efficient and reliable medium-voltage (12 V to 26 V) batteries for use in various applications, including automotive and renewable energy storage, is becoming increasingly critical.

Battery Type Insights & Trends

Based on battery type, prismatic segment held the market with the largest revenue share of 40.81% in 2023. Prismatic lithium-ion batteries are gradually gaining traction in India due to their high energy density and scalability. The rigid structure of these batteries ensures their effective thermal management and enhanced safety. This, in turn, makes prismatic lithium-ion batteries suitable for large-scale energy storage systems and electric commercial vehicles.

The pouch segment is expected to grow at the fastest CAGR over the forecast period. The market for pouch lithium-ion batteries in India is growing due to the use of these batteries in EVs. Their flexibility in terms of shape and size makes pouch lithium-ion batteries suitable for use in electric passenger cars, commercial vehicles, and two-wheelers. Moreover, these batteries offer higher energy density than their cylindrical counterparts, thereby making pouch lithium-ion batteries attractive for applications demanding long driving ranges.

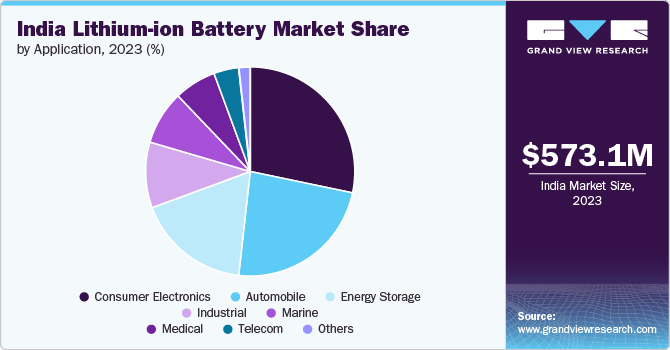

Application Insights & Trends

Based on application, consumer electronics segment held the market with the largest revenue share of 28.28% in 2023. The consumer electronics segment in the market is experiencing significant growth, driven by a combination of rising disposable income and rapid technological advancements. As more individuals across the country see an increase in their incomes, they have more money to spend on different types of consumer electronics. This includes everything from smartphones and laptops to tablets and wearable devices, all of which rely heavily on lithium-ion batteries for their power needs.

The automobile segment is expected to grow at the fastest CAGR over the forecast period. India is one of the largest and fastest-growing automobile markets in the world. The presence of companies, such as Maruti Suzuki India Limited, Tata Motors Limited, Kia Motors India Private Limited, Renault India Private Limited, ŠKODA AUTO Volkswagen India Pvt Ltd, BMW India Private Limited, Mercedes-Benz India Pvt Ltd, Hyundai Motor India Limited, Nissan Motor India Private Limited, Mahindra and Mahindra Limited, JSW MG Motor India Pvt Ltd, Toyota Kirloskar Motor Private Ltd., and Honda Motor India Private Limited, has created a competitive environment, which is fostering innovation and propelling the market.

Regional Insights & Trends

North India dominated the India market and accounted for largest revenue share of over 44.00% in 2023. The rising pollution levels in the region, especially in Delhi and Chandigarh, are urging local governments to incentivize alternative fuel sources, leading to an increased adoption of EVs in the region. This trend is expected to accelerate over the coming years, which will fuel the need for lithium-ion batteries. Luminous Power Technologies Pvt. Ltd., Okaya Power Private Limited, Samsung SDI India Private Limited, Loom Solar Pvt. Ltd., Su-Kam Power Systems Ltd., and Karacus Energy Pvt. Ltd. are the major companies operating in the region, promoting competition and innovation.

North India Lithium-ion Battery Market Trends

The northern region of India covers states, namely Haryana, Himachal Pradesh, Punjab, Uttarakhand, Uttar Pradesh, and Rajasthan, and union territories namely Chandigarh, Delhi, Jammu and Kashmir, and Ladakh. The lithium-ion battery segment is expected to grow in North India owing to the large amount of lithium reserves available in Rajasthan and Jammu & Kashmir.

South India Lithium-ion Battery Market Trends

The South India consists of five states-Andhra Pradesh, Telangana, Karnataka, Kerala, and Tamil Nadu. This region is a technological hub of the country; Bengaluru, a city in Karnataka, is also regarded as the Silicon Valley of India. The region heavily invests in research & development activities to introduce novel products, driving innovation in the market. The region houses some of the largest lithium-ion manufacturers, namely Amara Raja Energy & Mobility Limited, HBL Power Systems Limited, BYD India Private Limited, Log 9 Materials Scientific Pvt Ltd., and TVS Lucas.

East India Lithium-ion Battery Market Trends

The East India region includes the states of Bihar, Jharkhand, Odisha, and West Bengal and the union territory of the Andaman and Nicobar Islands. The increasing renewable energy projects in the region are expected to promote the market over the forecast period. East India is witnessing a surge in renewable energy projects, particularly in solar and wind energy. West Bengal and Odisha have also launched several initiatives to promote renewable energy generation.

West India Lithium-ion Battery Market Trends

The West India covers the states of Gujarat, Madhya Pradesh, Maharashtra, and Goa and the union territories of Dadra & Nagar Haveli and Daman & Diu. West India, particularly Maharashtra and Gujarat are the major industrial hubs and economic zones. Mumbai, Pune, and Ahmedabad have a high concentration of manufacturing industries, including automotive, pharmaceuticals, chemicals, and electronics. The rapid industrialization in these areas necessitates reliable and efficient power solutions, driving the demand for lithium-ion batteries for backup power systems and energy storage solutions.

Key India Lithium-ion Battery Company Insights

The market is experiencing significant growth, driven by a combination of technological advancements and increasing demand for renewable energy solutions. Companies are focusing on partnerships and collaborations to enhance their market positions and drive innovation.

Key India Lithium-ion Battery Companies:

- Amara Raja Energy & Mobility Limited

- Exide Industries Limited

- Tata Chemicals Limited

- Luminous Power Technologies Pvt. Ltd.

- Okaya Power Private Limited

- HBL Power Systems Limited

- Panasonic Life Solutions India Private Limited

- Samsung SDI India Private Limited

- Loom Solar Pvt. Ltd.

- BYD India Private Limited

Recent Developments

-

In March 2024, Panasonic Life Solutions India and Indian Oil Corporation Ltd. (IOCL) announced their plans to form a joint venture to produce cylindrical lithium-ion batteries in India. This partnership aims to leverage Panasonic's battery technology expertise and IOCL's industrial infrastructure to manufacture these batteries locally.

-

In April 2024, Hyundai Motor Company and Kia Corporation announced a partnership with Exide Industries to localize electric vehicle (EV) battery production in India. This collaboration aims to strengthen the supply chain for EV batteries in the country and reduce reliance on imports.

India Lithium-ion Battery Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 925.64 million

Revenue forecast in 2030

USD 6.60 billion

Growth rate

CAGR of 38.7% from 2024 to 2030

Historical data

2018 - 2022

Base Year

2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, Volume in Thousand Units, Capacity in MWh, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, Volume forecast, Capacity forecast, competitive landscape, growth factors and trends

Segments covered

Product, component, capacity, voltage, battery type, application, region

Regional scope

North India; South India; East India; West India

Country Scope

India

Key companies profiled

Amara Raja Energy & Mobility Limited; Exide Industries Limited; Tata Chemicals Limited; Luminous Power Technologies Pvt. Ltd.; Okaya Power Private Limited; HBL Power Systems Limited; Panasonic Life Solutions India Private Limited; Samsung SDI India Private Limited; Loom Solar Pvt. Ltd.; BYD India Private Limited; Reliance New Energy Limited; Log 9 Materials Scientific Pvt Ltd.; TVS Lucas; TDS Lithium-Ion Battery Gujarat Private Limited; WAAREE ESS Private Limited; Fusion Power Systems (Amptek India); Tata Power Company Limited; Servotech Power Systems Limited; Su-Kam Power Systems Ltd.; Battrixx (division of Kabra Extrusiontechnik (KET)); Karacus Energy Pvt. Ltd.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

India Lithium-ion Battery Market Report Segmentation

This report forecasts revenue growth at India levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the India lithium-ion battery market report based on product, component, capacity, voltage, battery type, application, and region:

-

Product Outlook (Revenue, USD Million; Volume, Thousand Units, 2018 - 2030)

-

Lithium Cobalt Oxide (LCO)

-

Lithium Iron Phosphate (LFP)

-

Lithium Nickel Cobalt Aluminum Oxide (NCA)

-

Lithium Manganese Oxide (LMO)

-

Lithium Titanate

-

Lithium Nickel Manganese Cobalt (NMC)

-

-

Component Outlook (Revenue, USD Million; Volume, Thousand Units, 2018 - 2030)

-

Cathode

-

Anode

-

Electrolyte

-

Separator

-

Current collector

-

Others

-

-

Capacity Outlook (Revenue, USD Million; Volume, Thousand Units, 2018 - 2030)

-

Below 3,000 mAH

-

3,001 to 10,000 mAH

-

10,001 to 60,000 mAH

-

Above 60,000 mAH

-

-

Voltage Outlook (Revenue, USD Million; Volume, Thousand Units, 2018 - 2030)

-

Low (Below 12 V)

-

Medium (12 V to 36 V)

-

High (Above 36 V)

-

-

Battery Type Outlook (Revenue, USD Million; Volume, Thousand Units, 2018 - 2030)

-

Cylindrical

-

Pouch

-

Prismatic

-

-

Application Outlook (Revenue, USD Million; Volume, Thousand Units, 2018 - 2030)

-

Consumer electronics

-

IoT Devices

-

Wearables

-

Cell Phones

-

Tablet and Personal computer

-

UPS

-

Others

-

-

Automobile

-

Passenger vehicles

-

Commercial vehicles

-

Electric vehicles

-

E-bikes

-

E-Scooters

-

Electric forklifts

-

Automated Guided Vehicles (AGVs)

-

E-Cars

-

Others

-

-

-

Energy Storage

-

Military & Defense

-

Communication devices

-

Armored vehicles

-

UAVs

-

Weapon systems

-

-

Marine

-

Medical

-

Industrial

-

Telecom

-

Others

-

-

Regional Outlook (Revenue, USD Million; Volume, Thousand Units, 2018 - 2030)

-

North India

-

South India

-

West India

-

East India

-

Frequently Asked Questions About This Report

b. The India lithium-ion battery market size was estimated at USD 1.43 billion in 2023 and is expected to reach USD 1.62 billion in 2024

b. The India lithium-ion battery market is expected to grow at a compound annual growth rate of 23.0% from 2024 to 2030 to reach USD 5.62 billion by 2030

b. The lithium nickel manganese cobalt (NMC) segment held the highest market share of 28.5% in 2023. The rising need for decarbonization and the transition to clean energy sources are driving the demand for NMC lithium-ion batteries.

b. Some key players operating in the India lithium-ion battery market include Servotech Power Systems; Amara Raja Energy & Mobility Limited.; EXIDE INDUSTRIES LTD.; CLN Energy Pvt Ltd.; WAAREE ESS; Su-kam; Battrixx; PPAP Technology Limited; Sainik Industries Pvt. Ltd.; Sanvaru Technology

b. Factors such as rising adoption of electric vehicles and hybrid electric vehicles and increasing investments in research & development is driving the market growth

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.