- Home

- »

- Advanced Interior Materials

- »

-

India Kaolin Market Size And Share, Industry Report, 2030GVR Report cover

![India Kaolin Market Size, Share & Trends Report]()

India Kaolin Market (2024 - 2030) Size, Share & Trends Analysis Report By Application (Paper, Ceramic, Paint & Coatings, Fiber Glass, Plastic, Rubber, Pharmaceuticals & Medical, Cosmetics, Others) And Segment Forecasts

- Report ID: GVR-4-68040-304-6

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

India Kaolin Market Size & Trends

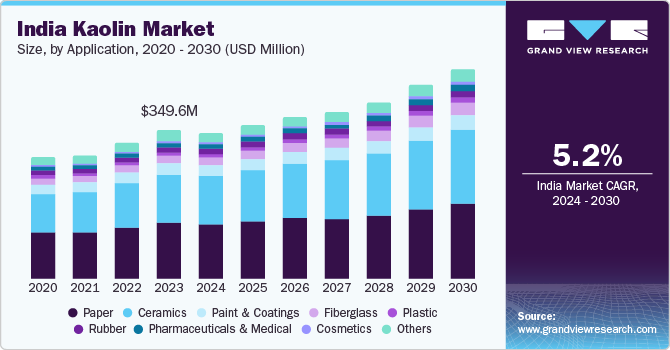

The India kaolin market size was estimated at USD 349.6 million in 2023 and is expected to grow at a CAGR of 5.2% from 2024 to 2030. The increasing construction and infrastructural developments, paper manufacturing, and growing paints and coating industries are driving growth for kaolin. Kaolin is a hydrated aluminum silicate crystalline formed by hydrothermal decomposition of granite rocks.

With the rapid urbanization and infrastructure projects, India's construction sector is witnessing increasing demand for tiles, ceramics, and sanitaryware. Kaolin is a vital raw material in these products, and its consumption is expected to rise proportionally. The Indian paper industry, particularly the packaging and printing segment, relies heavily on kaolin for its coating and filling properties. Kaolin ensures good printability, opacity, and color in the final paper product. Beyond ceramics and paper, kaolin is increasingly used in rubber and plastic products manufactured in India. Kaolin is a filler and reinforcing agent, enhancing their strength and other desired properties.

Kaolin improves rubber and plastic products' strength, durability, and performance. Increasing personal care and health awareness is boosting the cosmetics and pharmaceutical industries. Kaolin is used in these industries for its properties as a gentle exfoliant, detoxifying agent, and in drug formulations. This consumer-driven demand is likely to be a significant growth factor.

Market Concentration & Characteristics

India has significant kaolin deposits in states such as Rajasthan, Gujarat, West Bengal, and Odisha. The industry uses various techniques to process kaolin, including drying, crushing, grinding, and calcining. The choice of method depends on the desired properties of the final product, such as particle size, brightness, and purity. The industry is slightly fragmented, featuring domestic and international players. Competition is based on price, quality, processing technology, and distribution networks. The degree of innovation is high in the industry as manufacturers use new technologies for the mining of kaolin.

The impact of regulations is higher, as kaolin manufacturers must adhere to environmental regulations to reduce the environmental impact of kaolin mining. The end user concentration is higher, as kaolin is used in various industries, such as paper, ceramics, paints and coatings, fiberglass, plastic, rubber, pharmaceuticals and medicals, and cosmetics.

Application Insights

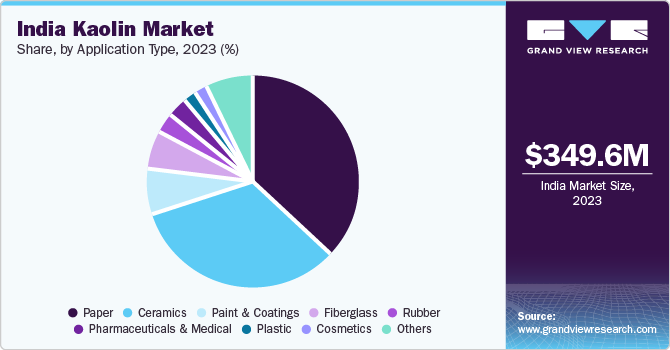

Based on application, the paper segment dominated with the largest market share of 37.3% in 2023 and is expected to grow at a significant CAGR over the forecast period. The increasing demand for high-quality printing paper, the growth of the packaging industry, and the rise in food and grocery delivery services are driving the segment growth.

Kaolin is used to make high-quality paperboard for packaging goods. Kaolin offers a gloss and smooth finish to paper and is used for manufacturing high-quality paper, which is used in various industries such as advertising, publications, and others. Additionally, with the growth of online food delivery and grocery services, the demand for kaolin has increased for packaging paper production.

Ceramics is expected to have the fastest-growing CAGR over the forecast period. The increasing demand from real estate and interior design firms is expected to drive the segment growth. With increasing urbanization, the demand for high-quality tiles, sanitary fittings, and ceramic artifacts has significantly increased. Kaolin is used for manufacturing sanitary fittings, high-grade tiles, and other architectural ceramics.

Key India Kaolin Company Insights

Some of the key players operating in the market include Zillion Sawa Minerals Pvt. Ltd., EICL, Gujarat Earth Minerals Pvt. Ltd., SRINATH ENTERPRISES,

-

Zillion Sawa Minerals Pvt. Ltd. is one of India's leading players in manufacturing kaolin. The company mines different types of kaolin, such as calcined kaolin, hydrous kaolin, meta kaolin, and levigated kaolin. It serves various industries, such as paint, rubber, ceramic, paper, and glass.

Key India Kaolin Companies:

- Zillion Sawa Minerals Pvt. Ltd.

- EICL

- Gujarat Earth Minerals Pvt. Ltd.

- SRINATH ENTERPRISES

- Jai Vardhman Khaniz Pvt. Ltd.

- Kaolin Techniques Private Limited.

- Karnataka Silicates.

- Shree Ram Kaolin.

- Ashapura China Clay Company

Recent Developments

-

In November 2023, Andromeda Metals signed a heads-up agreement with Opaque Ceramics India, a kaolin manufacturer. The company actively aims to pursue business opportunities in the Indian industrial minerals industry, including distributing kaolin and kaolin-zircon mixtures.

India Kaolin Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 491.5 million

Growth rate

CAGR of 5.2% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD Million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application

Country scope

India

Key companies profiled

Zillion Sawa Minerals Pvt. Ltd.; EICL; Gujarat Earth Minerals Pvt. Ltd.; SRINATH ENTERPRISES; Jai Vardhman Khaniz Pvt. Ltd.; Kaolin Techniques Private Limited.; Karnataka Silicates.; Shree Ram Kaolin.; Ashapura China Clay Company

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

India Kaolin Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the India Kaolinmarket research report based on the application:

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Paper

-

Ceramics

-

Paint & Coatings

-

Fiberglass

-

Plastic

-

Rubber

-

Pharmaceuticals & Medical

-

Cosmetics

-

Others

-

Frequently Asked Questions About This Report

b. The India kaolin market size was estimated at USD 349.6 million in 2023 and is expected to reach USD 345.1 million in 2024

b. The Indian kaolin market is expected to grow at a compound annual growth rate of 5.2% from 2024 to 2030 to reach USD 491.5 million by 2030

b. The paper segment dominated with the largest market share of 37.3% in 2023 and is expected to grow at a significant CAGR over the forecast period. The increasing demand for high quality printing paper, growth of packaging industry and rise in food and grocery delivery services are driving the segment growth.

b. Some key players operating in the India kaolin market Zillion Sawa Minerals Pvt. Ltd., EICL, Gujarat Earth Minerals Pvt. Ltd., SRINATH ENTERPRISES , Jai Vardhman Khaniz Pvt. Ltd., Kaolin Techniques Private Limited., Karnataka Silicates, Shree Ram Kaolin, Ashapura China Clay Company

b. The increasing construction and infrastructural developments, paper manufacturing and growing number of paints and coatings industries are the key factors driving kaolin market growth in the country

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.