- Home

- »

- Clothing, Footwear & Accessories

- »

-

India Jewelry Market Size And Share, Industry Report, 2030GVR Report cover

![India Jewelry Market Size, Share & Trends Report]()

India Jewelry Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Necklace, Ring), By Material (Gold, Platinum, Diamond), By Distribution Channel, By End-user (Men, Women, Children), And Segment Forecasts

- Report ID: GVR-4-68040-227-7

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

India Jewelry Market Size & Trends

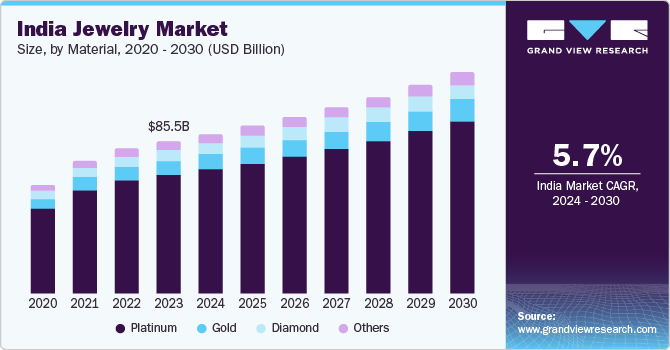

The India jewelry market size was estimated at USD 85.52 billion in 2023 and is expected to grow at a CAGR of 5.7% from 2024 to 2030. Jewelry serves as a crucial fashion item and enhances the overall appearance. When flaunting the latest fashion trends, customers select accessories that complement or spruce up their outfits. For instance, as streetwear trends have become more popular, both men and women are accessorizing with jewelry more frequently to express their sense of individuality.

India jewelry market accounted for the share of 24.21% of the global jewelry market in 2023. Consumers are increasingly investing in products that are high-quality, tangible, durable, and have profound value. The growth of the jewelry market is further supported by factors such as rising urbanization, novel and customized product releases, and technological improvements in product creation.

Bridal jewelry plays a significant role in driving the market. In countries like India, the high expenditure on wedding ceremonies and celebrations is expected to positively influence market growth. Gold is significant in Indian culture and is associated with festivals, customs, as well as religious beliefs. Weddings and festivals are the two main occasions for buying gold in India. According to CAIT Research & Trade Development Society, in November 2022, India witnessed 32 lakh weddings. Bridal jewelry controls 50-55% of the market for gold jewelry.

The demand for gold chains and necklaces is, however, not limited only to weddings and functions. Men and women wear rings, delicate gold chains, bracelets, and anklets as fashion accessories on a daily basis. These are also gifted on various occasions such as birthdays and anniversaries. This evolving consumption behavior is expected to positively impact market growth.

The continued notion of gold jewelry as an investment is the leading factor driving the market. Apart from this, jewelry is a crucial fashion accessory among women in the country and this has driven the market over the years. A large number of international luxury brands-such as London-based Missoma and Stellar 79-have entered the Indian market, which has only strengthened the fashion jewelry market in the country.

Market Concentration & Characteristics

The India jewelry industry is characterized by high degree of innovation, with businesses continuously focusing on differentiating themselves through unique experiences and offerings.Companies such as PCJeweller, P. N. Gadgil & Sons Ltd, and others are implementing innovative technologies such as virtual reality (VR) to attract customers who shop online. In July 2020, Jewelry retail subsidiary brand of Titan Company Limited 'Tanishq' announced the launch of multiple features such as virtual jewelry try-on, live assisted chat, and appointment booking powered by augmented reality across its 200 stores in India. Such competitive practices are expected to have a positive impact on the Indian jewelry industry.

Leading companies employ key strategies, including mergers, expansions, acquisitions, partnerships, and product development, to enhance brand visibility among consumers. Mergers & acquisitions are among viable expansion options for prospective jewelry manufacturers. For a potential manufacturer of platinum jewelry, it is more practical to merge with an established brand in that space as consumers typically buy platinum jewelry that comes with a certificate of purity or that which is marketed by a reputed platinum jewelry manufacturer. As platinum is rarer than gold, companies can offer discounts and loyalty cards to consumers to incentivize them, while also advertising the rarity of platinum.

End-user concentration is a significant factor in the India jewelry industry.India is a major jewelry market and has been so for a while, especially at a domestic level. In recent years, a large number of overseas luxury brands have entered the Indian jewelry market, which has the potential to change the buying behavior of Indian consumers. With the retail jewelry market gaining momentum in the country, many domestic players are consciously making efforts to offer high-end jewelry that is at par with foreign brands in terms of design, quality, and aesthetics.

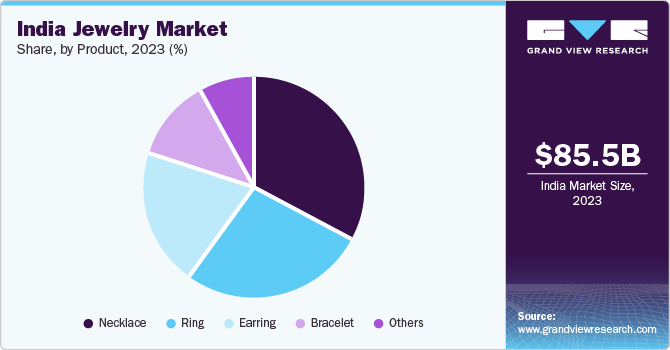

Product Insights

Necklace accounted for a revenue share of 32.97% in 2023. Necklaces are among the most widely used jewelry items around the world, particularly among women. Necklaces are available in a wide variety of styles and are often available with a matching set of earrings. In India, jewelers offer necklaces in traditional designs owing to the rising popularity of ethnic fashion jewelry within the country. While conventional and classic designs are targeted at older women, contemporary designs in a wide range of sizes and cuts are targeted at younger women who are more open to experimenting with the latest styles and trends. Some of the most prominent diamond necklace manufacturers worldwide are Swarovski, Monica Vinader, Van Cleef & Arpels, Buccellati, Damiani S.p.A., and Tiffany & Co.

The ring segment is expected to grow at a CAGR of 5.8% over the forecast period. The growing customer preference for personalized jewelry has been encouraging vendors in the ring market to provide a range of customization options. Rings can be customized based on material type, design, shape, and gemstone type. Tiffany & Co., for instance, offers several options to customers in terms of ring design and gemstone type through its website. The company also provides its customers with guides on metals and diamonds to brief them about cuts, colors, carats, and sizes, among others. Thus, the trend of personalized jewelry is expected to drive the growth of the rings segment over the forecast period.

Material Insights

The gold jewelry accounted for a revenue share of 77.72% in 2023, Gold continues to be the most widely used metal and material for jewelry items in India owing to its popularity and durability. It also has a high cultural, emotional, and financial value among people. Manufacturers are increasingly launching new variants such as blush gold and pink gold to attract more customers.

The diamond segment is expected to grow at a CAGR of 6.6% from 2024 to 2030. Increased spending on bridal jewelry by Indian customers is expected to boost segment’s growth. According to a 2020 customer sentiment survey by Bain,70%Indian believe diamonds are an essential part of a marriage engagement. Moreover, 75% to 80% of consumers said they plan to spend the same or more money on diamond jewelry than they did before the pandemic.

Distribution Channel Insights

The purchase of jewelry through offline stores accounted for a revenue share of over 85% in 2023. Presence of luxury stores in the region coupled with consumer preferences for purchasing jewelry in the stores is expected to boost segment’s growth. Luxury brands have their own stores where they offer a wide range of jewelry for customers to try. Jewelry stores conduct detailed consumer sentiment analyses to understand customer preferences for products and choices.

Sales of jewellery through online channels is expected to grow at a CAGR of over 8%. With major players focused on using their websites to announce new releases, sales, and other pertinent information, the jewelry market is also anticipated to experience substantial growth online.

End-use Insights

Women end users held a market share of over 55% in 2023. Increasing number of working women worldwide has significantly fueled the demand for luxury jewelry. According to data by the World Bank, in 2021, around 46% of the global working population comprised of women. In addition, rising per capita income and growing fashion consciousness in India is contributing to market growth. The availability of a wide range of designs suitable for every occasion has also increased the purchase as well as production of jewelry.

Men’s jewelry market is expected to grow at a CAGR of over 6%. The growing demand for jewelry among men is opening new avenues for manufacturers. Therefore, market players are increasingly focusing on expanding their product portfolios and customer base by introducing innovative designs for men. Asia Pacific could be a key market for men’s jewelry as the consumer group in this region is relatively more fashion-conscious. Over the past few years, the adoption of high-end jewelry has increased among male consumers. Rings, pendants, and bracelets are gaining popularity among this consumer group. Although rings are popular among men, the demand for necklaces and chains is likely to grow steadily in the coming years.

Key India Jewelry Company Insights

Some of the key players operating in the market include Tanishq, Kalyan Jewellers, Senco Gold, and Malabar Gold

-

Tanishq was founded in 1994, and its headquarters is in Bengaluru, Karnataka. It is India's first jewelry retail brand and is a division of Titan Company limited which is a part of Tata Group, and TIDCO (Tamil Nadu Industrial Development Corporation) joint venture started in 1984.

-

Kalyan Jewellers is a prominent player in India jewelry industry. The company offer authentic and high-quality diamonds, precious stones and other metals. It has 107 stores across India and 30 stores in the Middle East across Qatar, Oman, UAE, and Kuwait.

Reliance Jewels, Joyalukkas Jewellers, and Bhima Jewellers some of the other participants in the India jewelry market,

-

Reliance Jewels is a part of reliance. The company wide range of traditional and modern jewellery. They provide their customers with different styles and designs of jewelry such as Polki Kundan, temple, Filigree and contemporary diamonds jewelry and solitaire.

-

Joyalukkas is an Indian multinational jewelry group founded in 2001. The company is gaining popularity for its top-notch design and incomparable value.

Key India Jewelry Companies:

- Tanishq

- Kalyan Jewellers

- Senco Gold

- Malabar Gold

- Reliance Jewels

- Joyalukkas Jewellers

- Bhima Jewellers

- PC Jeweller

- BlueStone

- Sanjay Brothers

India Jewelry Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 89.65 billion

Revenue forecast in 2030

USD 124.70 billion

Growth rate

CAGR of 5.7% from 2024 to 2030

Actuals

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, material, distribution channel, end-user

Country scope

India

Key companies profiled

Tanishq; Kalyan Jewellers; Senco Gold; Malabar Gold; Reliance Jewels; Joyalukkas Jewellers; Bhima Jewellers; PC Jeweller; BlueStone; Sanjay Brothers

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

India Jewelry Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the India jewelry Market report based on product, material, distribution channel, and end-user:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Necklace

-

Ring

-

Earring

-

Bracelet

-

Others

-

-

Material Outlook (Revenue, USD Million, 2018 - 2030)

-

Platinum

-

Gold

-

Diamond

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Offline Retail Stores

-

Supermarkets & Hypermarkets

-

Jewelry stores

-

Others

-

-

Online Retail Stores

-

-

End-user Outlook (Revenue, USD Million, 2018 - 2030)

-

Men

-

Women

-

Children

-

Frequently Asked Questions About This Report

b. The India jewelry market size was estimated at USD 85.52 billion in 2023 and is expected to reach USD 89.65 billion in 2024.

b. The India jewelry market is expected to grow at a compounded growth rate of 5.7% from 2024 to 2030 to reach USD 124.70 billion by 2030.

b. Necklace accounted for a revenue share of 32.97% in 2023. Necklaces are among the most widely used jewelry items around the world, particularly among women. Necklaces are available in a wide variety of styles and are often available with a matching set of earrings. In India, jewelers offer necklaces in traditional designs owing to the rising popularity of ethnic fashion jewelry within the country.

b. Some key players operating in the India jewelry market include Tanishq; Kalyan Jewellers; Senco Gold; Malabar Gold; Reliance Jewels; Joyalukkas Jewellers; Bhima Jewellers; PC Jeweller; BlueStone; and Sanjay Brothers

b. Key factors that are driving the India jewelry market growth include flaunting of the latest fashion trends, customers select accessories that complement or spruce up their outfits. For instance, as streetwear trends have become more popular, both men and women are accessorizing with jewelry more frequently to express their sense of individuality

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.