- Home

- »

- Medical Devices

- »

-

India In Vitro Fertilization Market Size, Industry Report, 2030GVR Report cover

![India In Vitro Fertilization Market Size, Share & Trends Report]()

India In Vitro Fertilization Market Size, Share & Trends Analysis Report By Instrument (Equipment, Culture Media), By Procedure Type (Fresh Nondonor), By Providers, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-308-2

- Number of Report Pages: 70

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

India In Vitro Fertilization Market Trends

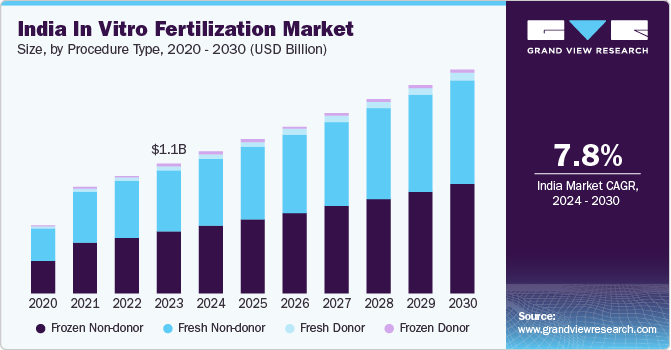

The India In vitro fertilization market size was estimated at USD 1.06 billion in 2023 and is projected to grow at a CAGR of 7.8% from 2024 to 2030. The technological advancements in assisted reproductive technology, the emergence of fertility tourism, rising government initiatives, rising awareness about fertility treatments, the growing acceptance of IVF as a viable option for couples trying to conceive, and the increasing prevalence of infertility cases are some of the key factors driving the market growth. According to the National Family Health Survey 2019-21 (NFHS-5), The Total Fertility Rate (TFR), the average number of children per woman, has declined from 2.2 to 2.0 nationally between 4th round and 5th round of NFHS ( 2015-16 & 2019-21). They are Meghalaya (2.91), Bihar (2.98), Jharkhand (2.26), Uttar Pradesh (2.35), and Manipur (2.17) are the only states above the replacement level of fertility.

The advancements in medical technology and techniques related to IVF have significantly improved success rates and reduced the overall cost of treatment. Innovations such as preimplantation genetic testing, time-lapse imaging, and embryo freezing have made IVF more accessible and effective for patients in India. Additionally, the Indian IVF market is also being driven by technological advancements in Assisted Reproductive Technology (ART). ART is a medical technology used to treat infertility, and it includes the procedure of In vitro fertilization (IVF). Therefore, due to the increasing demand for ART treatments, the Indian IVF market is expected to grow in the upcoming years.

The emergence of fertility tourism is a key factor driving the growth of the Indian IVF market. The combination of cost-effectiveness, advanced medical infrastructure, favorable regulatory environment, and cultural acceptance has positioned India as a leading destination for individuals seeking high-quality and affordable IVF treatments through fertility tourism. For instance, Fertility Tourism by Chennai Fertility Center is dedicated primarily to childless couples from abroad seeking to explore options for successful fertility treatment.

The Indian government has taken steps to promote fertility treatments and make them more affordable for its citizens. Initiatives such as financial assistance programs, regulatory reforms, and awareness campaigns have played a crucial role in driving the growth of the IVF market in India. For instance, in August 2023, the government of Goa launched the Intrauterine Insemination /In Vitro Fertilization and Assisted Reproductive Technology Centre at the Goa Medical College and Hospital (GMC). The center will provide infertility treatment free of cost.

With changing societal norms and an increasing acceptance of alternative family-building methods, there is a growing demand for fertility treatments such as IVF in India. Couples are now more open to seeking medical assistance for conception, which has fueled the growth of the IVF market in the country. Greater awareness about infertility issues, advancements in fertility treatments, and educational campaigns have encouraged more individuals to seek help for their reproductive health concerns. This increased awareness has also led to a higher number of patients opting for IVF treatments in India. For instance, November 2023, Nova IVF introduced "Fertility Tales," a podcast project with the aim of raising awareness about fertility treatment through engaging narratives. The podcast interviews industry stakeholders and shares real patient stories about firsthand experiences with IVF treatment.

Market Concentration & Characteristics

The industry growth stage is medium, and the pace of the industry growth is accelerating and characterized by a high degree of innovation. The Indian IVF market has seen a rapid integration of cutting-edge technologies to enhance success rates and improve patient experience. Innovations such as time-lapse imaging systems, preimplantation genetic testing, and advanced cryopreservation techniques have revolutionized the field of assisted reproduction.

The India IVF market is also characterized by a medium level of merger and acquisition (M&A) activity by the market players. This is due to several factors, including the desire to leverage each other’s strengths, share resources, access new markets, and diversify service offerings. Such strategic partnerships can lead to synergies that drive growth and innovation in the India IVF market. For instance, in October 2023, The Competition Commission of India (CCI) approved Zonnebaars to acquire a controlling stake in Indira IVF and for Spaceway Wellness to merge with Indira IVF.

The India IVF market is also subject to increasing regulatory scrutiny. The Indian IVF market is subject to a high degree of regulatory scrutiny. The regulatory bodies closely monitor the market to ensure all procedures and practices comply with legal and ethical standards. The Indian Council of Medical Research (ICMR) and the National Accreditation Board for Hospitals & Healthcare Providers (NABH) are the two main bodies overseeing ART clinics in India. The Assisted Reproductive Technology (Regulation) Bill 2020 was presented in the Lok Sabha of India in September 2021 and was approved on December 1, 2021. The Bill aims to prevent the exploitation of economically disadvantaged women who may be lured to provide their gametes or surrogacy services for money and to regulate and supervise ART clinics and banks.

There are a limited number of direct product substitutes for IVF due to its unique nature. However, there are alternative fertility treatments and procedures that individuals may consider based on their specific circumstances and preferences. These include Intrauterine Insemination (IUI), ovulation induction, lifestyle changes, and natural remedies.

End-user concentration is a significant factor in the Indian IVF market. The concentration of end users in the Indian IVF market is high in urban areas and among middle to high-income demographics. This is due to the rise in the prevalence of infertility issues and increased awareness, accessibility, and affordability of fertility treatments in these regions. However, IVF clinics are opening in Tier 2 and Tier 3 cities to cater to a broader market.

Instrument Insights

Culture media dominated the market and accounted for a share of around 40% in 2023. This can be attributed to factors such as a rise in R&D activities to improve culture media and availability of funding. For instance, in June 2023, Gold Standard Diagnostics introduced BACGro Culture Media to detect pathogenic microorganisms in the food, environmental, and pharmaceutical industries. BACGro product line offers dehydrated and liquid media product that meet global standards and reference methods.

The disposable devices segment is expected to register the fastest CAGR during the forecast period. This segment's growth is due to industry players introducing disposable devices, such as slides, needles, and chambers, to meet sterility and regulatory requirements. Such developments are expected to increase the adoption of disposable IVF devices. Disposable slides for sperm counting, an imaging-based tracking system to isolate the best motile sperm, and disposable microchips are some of the innovations witnessed by the market in recent years. For instance, in May 2022, DPU IVF and Endoscopy Center introduced the Time-Lapse Imaging Embryoscope, an advanced technology for IVF treatment in Pune. The Time Lapse Imaging system improves live birth rates and reduces early pregnancy loss rates significantly.

Procedure Type Insights

Frozen nondonor accounted for the largest market revenue share in 2023. The factors contributing to high share are its cost-effectiveness when compared to fresh embryo transfers or donor eggs, rising success of IVF, and the availability of genetic testing. Advances in genetic testing have made it possible to screen embryos for genetic disorders before they are implanted. This has led to an increase in the number of couples choosing to use frozen embryos for genetic testing purposes, as it allows them to select the healthiest embryo for implantation. In December 2023, Progenesis, a renowned genetic testing brand, expanded its operations to India by launching its first genetic laboratory in New Delhi.

The fresh donor segment is expected to register the fastest CAGR during the forecast period. The rising demand for donor eggs and sperm due to increasing infertility rates is a significant factor fueling the growth of the fresh donor segment in the India in vitro fertilization market. Moreover, India has a large pool of potential egg donors due to its vast population and socio-cultural factors. This availability enables clinics to offer a wide range of options to couples seeking donors, including fresh donors. Additionally, many clinics offer anonymous donations, which further increases the pool of potential donors. For instance, in June 2023, LifeCell International Pvt. Ltd. launched self-collection testing and preservation kits for sexual, reproductive, women's, and baby health services. The kits, namely OvaScore, SpermScore, and InferGenes, make sample collection private, convenient, and possible from home.

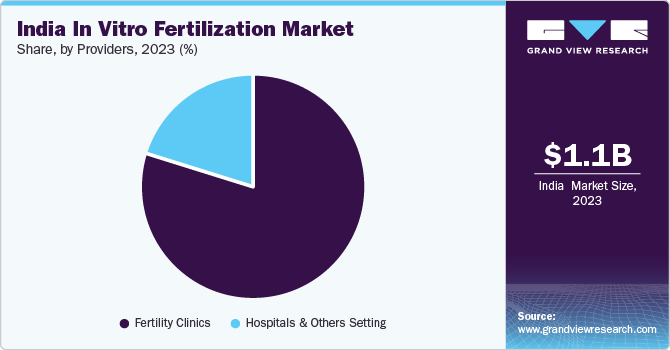

Provider Insights

The fertility clinics segment dominated the market in 2023 and is anticipated to grow at the fastest CAGR during the forecast period. An increase in demand for ART treatments, the rise in the number of ART centers and fertility clinics, has led to the growth of the fertility clinics segment.

Moreover, the availability of specialists, cost-effectiveness, and minimal chances of Hospital-Acquired Infections (HAIs) are expected to drive this growth. For instance, in January 2024, CK Birla Healthcare Pvt. Ltd. introduced a new a new fertility clinic in Meerut, Uttar Pradesh.

Key India In Vitro Fertilization Company Insights

Some of the key players operating in the market include Nova IVF, Indira IVF Hospital Private Limited, CK Birla Healthcare Pvt. Ltd., Max Healthcare, Bloom Fertility Centre, Manipal Health Enterprises Pvt Ltd, and others.

-

Nova IVF is a network of fertility clinics that provides assisted reproductive services to individuals and couples seeking to conceive through treatments such as in vitro fertilization (IVF), egg freezing, and other fertility procedures.

-

Indira IVF Hospital Private Limited is a healthcare company specializing in infertility treatments and assisted reproductive technologies. The hospital offers a wide range of services, including IVF, IUI, surrogacy, fertility preservation, and diagnostic tests.

-

Max Healthcare is a healthcare provider in India, offering a wide range of medical services, including infertility treatments, along with comprehensive range of infertility treatments, including In Vitro Fertilization (IVF) services. Its services include IVF (In Vitro Fertilization), ICSI (Intracytoplasmic Sperm Injection), IUI (Intrauterine Insemination), Donor Egg IVF, Surrogacy, and Cryopreservation.

-

Bloom Fertility Centre is a healthcare facility that specializes in assisted reproductive technology (ART) services. The centre is equipped with the latest equipment and imported culture media, and has skilled staff & provides. It offers services such as ovarian stimulation, egg retrieval, embryo transfer, and others.

Key India In Vitro Fertilization Companies:

- CK Birla Healthcare Pvt. Ltd.

- Nova IVF

- Indira IVF Hospital Private Limited.

- Apollo Fertility (Apollo Specialty Hospitals Pvt. Ltd.)

- Max Healthcare

- MANIPAL HEALTH ENTERPRISES PVT LTD

- Bloom Fertility Centre

- BACC Healthcare Private Limited

- Cloudnine Hospitals

- Morpheus IVF

- Babies and Us Fertility and IVF Centre (Ind) Pvt Ltd

Recent Developments

-

In February 2024, the Sabine Hospital, an IVF hospital based in Kerala, announced that it is all set to install its new and advanced machine to identify genetic diseases while the fetus is still in the womb. This machine, known as the Next Generation Sequencer (NGS), to detect genetic diseases in the developing fetus.

-

In December 2023, Little Angel IVF launched in vitro fertilization treatments such as personalized fertility consultation, comprehensive diagnostic services, advanced IVF treatments, and intracytoplasmic sperm injection (ICSI) for Non-Resident Indian patients.

-

In June 2023, Nova IVF acquired WINGS IVF, a regional IVF chain based in Ahmedabad. This acquisition expands Nova IVF Fertility's reach to 68 centers in 44 cities.

-

In March 2023, Santaan launched a new fertility clinic and research institute in the state of Odisha, India.

-

In March 2023, Indira IVF opened its 116th IVF center in Pune, Maharashtra. The new center is an addition to the existing center in Pune.

India In Vitro Fertilization Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 1.82 billion

Growth rate

CAGR of 7.8% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Instrument, procedure type, providers

Key companies profiled

CK Birla Healthcare Pvt. Ltd.; Nova IVF; Indira IVF Hospital Private Limited.; Apollo Fertility (Apollo Specialty Hospitals Pvt. Ltd.); Max Healthcare; Manipal Health Enterprises Pvt Ltd; Bloom Fertility Centre ; BACC Healthcare Private Limited; Cloudnine Hospitals; Morpheus IVF; Babies and Us Fertility and IVF Centre (Ind) Pvt Ltd

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

India In Vitro Fertilization Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the India In vitro fertilization market report based on instrument, procedure type, and providers.

-

Instrument Outlook (Revenue, USD Million, 2018 - 2030)

-

Disposable Devices

-

Culture Media

-

Cryopreservation Media

-

Embryo Culture Media

-

Ovum Processing Media

-

Sperm Processing Media

-

-

Equipment

-

Sperm Analyzer Systems

-

Imaging Systems

-

Ovum Aspiration Pumps

-

Micromanipulator Systems

-

Incubators

-

Gas Analyzers

-

Laser Systems

-

Cryosystems

-

Sperm Separation Devices

-

IVF Cabinets

-

Anti-vibration Tables

-

Witness Systems

-

Other

-

-

-

Procedure Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Fresh Donor

-

Frozen Donor

-

Fresh Non-donor

-

Frozen Non-donor

-

-

Providers Outlook (Revenue, USD Million, 2018 - 2030)

-

Fertility Clinics

-

Hospitals & Others Setting

-

Frequently Asked Questions About This Report

b. The India in vitro fertilization market size was valued at USD 1.06 billion in 2023.

b. The India in vitro fertilization market is projected to grow at a compound annual growth rate (CAGR) of 7.8% from 2024 to 2030 to reach USD 1.82 million by 2030.

b. Culture media dominated the market and accounted for a share of around 40% in 2023. This can be attributed to factors such as a rise in R&D activities to improve culture media and availability of funding.

b. Some of the key players operating in the in vitro fertilization market include Nova IVF, Indira IVF Hospital Private Limited, and CK Birla Healthcare Pvt. Ltd., Max Healthcare, Bloom Fertility Centre, and MANIPAL HEALTH ENTERPRISES PVT LTD.

b. The key driving factors driving the India in-vitro fertilization (IVF) services market growth include the technological advancements in assisted reproductive technology, the emergence of fertility tourism, rising government initiatives, rising awareness about fertility treatments, the growing acceptance of IVF as a viable option for couples trying to conceive, and the increasing prevalence of infertility cases.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."