- Home

- »

- Organic Chemicals

- »

-

India Hot Melt Adhesives Market Size, Industry Report, 2030GVR Report cover

![India Hot Melt Adhesives Market Size, Share & Trends Report]()

India Hot Melt Adhesives Market Size, Share & Trends Analysis Report By Product (Ethylene-Vinyl Acetate (EVA), Polyurethane (PUR), Rubber, Polyolefin), By Application, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-301-3

- Number of Report Pages: 200

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

India Hot Melt Adhesives Market Trends

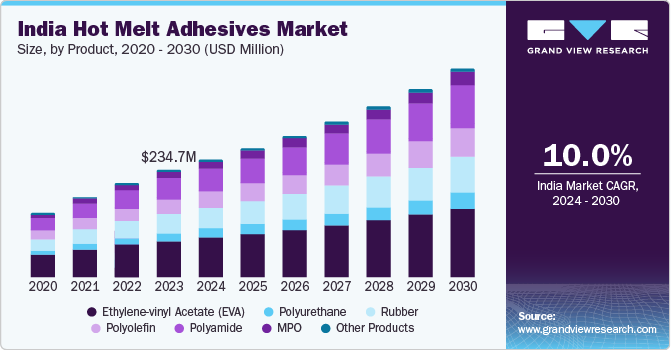

The India hot melt adhesives market size was estimated at USD 234.7 million in 2023 and is projected to grow at a CAGR of 10.0% from 2024 to 2030. Increasing usage of hot glue in the packaging industry for various applications, such as sealing boxes and cartons for food and general consumer packaging, propels the market growth. Hot melt adhesives (HMA)s offer adhesion to a wide variety of materials and surfaces, such as fabric, paper, ceramic, metal, cardboard, and plastics, which makes them suitable for DIY applications. Advancements in hot melt adhesive technology have rendered it a significant component across a broad spectrum of industries, including construction, where the product plays a pivotal role in assembly and structural integrity maintenance. HMAs are utilized in various capacities within the construction industry.

One notable application lies in the optimization of the production process. For instance, in the construction of precast concrete components, such as recesses for sockets, hot melt adhesives facilitate swift and effortless fixation onto pallets, allowing for easy removal upon completion of the concrete wall assembly. Furthermore, amid increasing emphasis on climate protection, the importance of insulation materials in both new construction and renovation projects is escalating. Thermally insulated buildings not only offer economic benefits but also enhance living comfort.

Given the diverse range of materials employed and varying production conditions on-site, leveraging our extensive experience in the construction industry and our comprehensive selection of product and application technologies proves advantageous. HMAs offer unique advantages specifically tailored to the needs of the textile industry. They deliver the requisite strength for textile bonding while exhibiting exceptional bonding capabilities across a wide array of materials. Furthermore, they boast excellent shelf life & storage capabilities and are more cost-effective than other adhesives.

Market Concentration & Characteristics

The India hot melt adhesives market is moderately consolidated, with major players like Dow, Henkel, H.B. Fuller, 3M, and Pidilite Industries dominating it. These companies are undertaking numerous strategies like new product launches and collaborations/partnerships to strengthen their position in the market. In April 2023, Avery Dennison Corporation, in partnership with Dow, launched their breakthrough hot melt label adhesive to enhance packaging recycling.

HMAs find application in various industries, such as packaging, automotive, electronics, and woodworking. Application-specific channels cater to the unique requirements of these industries. For example, in the packaging industry, the product may be supplied through packaging material suppliers or adhesive manufacturers who specialize in packaging solutions.

Similarly, in the automotive industry, HMAs may be distributed through specialized automotive adhesive suppliers who understand the specific needs and performance requirements of automotive applications. In conclusion, the sales channel analysis for the global hot melt adhesives market involves a combination of offline and online sales channels, industrial supply chains, OEM and B2B channels, and application-specific channels. These channels ensure the availability and accessibility of HMAs to customers across various industries. The diverse range of sales channels allows manufacturers and distributors to reach a wide customer base and cater to the specific needs of different end-users.

End-user concentration is a significant factor in the market. Since several application areas are increasingly utilizing these products in their product formulation, it often leads to larger volume purchases. This can lead to economies of scale for product suppliers, potentially resulting in cost efficiencies in production and distribution. High end-user concentration may lead to long-standing relationships between product suppliers and major players in the end-use industries. This stability can foster collaboration, mutual understanding, and consistent business partnerships.

Product Insights

The ethylene-vinyl acetate (EVA) segment dominated the market and accounted for a share of approximately 33.9% in 2023, EVA is a copolymer adhesive, deployed in various industries including packaging, assembly, paper, and automotive. Excellent adhesion, strong mechanical strength, paraffin solubility, and superior flexibility are the key features of this product propelling the segment growth. Ethylene component bonds with non-polar substrates like polyethylene, enhancing mechanical strength, block resistance, and paraffin solubility.

Conversely, vinyl acetate encourages adhesion to polar substrates, such as paper, promoting flexibility, adhesion, and superior performance at lower temperatures. Formulation intricacies dictate the adhesive's properties directly. Polyurethane or PUR hot melt, represents an adhesive dispensed from cartridges or slugs, contrasting with traditional stick or pellet hot melts. Its unique feature is solidifying through atmospheric moisture, forming an exceptionally strong bond resistant to re-melting.

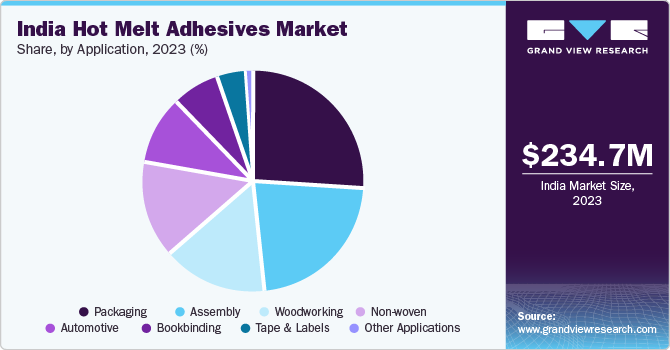

Application Insights

The packaging segment dominated the market and accounted for a share of approximately 24.5% in 2023. HMAs play a crucial role in the packaging industry as they are used for sealing cartons and cases and bonding paper goods and plastic containers. These products are also used in labeling applications. The packaging industry encompasses a diverse array of products and manufacturing methods, ranging from sealing cases and crafting various paper items to reinforcing pallets. Adhesives act as versatile solutions for use in these applications, thereby enhancing their efficacy and performance. Specifically, HMAs are ideally suited for packaging tasks owing to their simplicity and cost-effectiveness. They offer resilience against anticipated stress and have superior bonding capabilities with the materials commonly utilized in the packaging industry.

Hot melt adhesives play a crucial role in smartphone manufacturing and assembly processes. They are widely used due to their fast-setting time, strong bonding properties, and versatility. Hot melt adhesives are used to bond the display module to the smartphone's chassis or frame. This ensures a secure attachment while maintaining the slim profile of the device. In addition, these products are also applied to affix the battery to the smartphone's housing. This provides a strong and durable bond, securing the battery in place during everyday use.

Key India Hot Melt Adhesives Company Insights

Some of the key players operating in the market include Texyear Industrial Adhesives Private Limited., Bostik, Mario Industries Private Ltd., and 3M among others.

-

Texyear Industrial Adhesives Private Limited was formed after years of co-operation between Tex Year Industries Inc. and Industrial Adhesives Pvt. Ltd. and is a professional manufacturer and supplier of adhesives and related products. The company offers its products to more than 70 countries worldwide. The company offers HMAs under the brand name “Polymelt” for various end-use industries like woodworking, lamination, bookbinding, packaging, DIY, footwear, and automotive among others

-

3M is one of the leading manufacturing companies serving their wide range of products to end-use industries like automotive, electronics & electrical, transportation, consumer goods, energy, healthcare, and general manufacturing. The company operates through 4 business segments namely: Safety & Industrial, Healthcare, Transportation & Electronics, and Consumer. It has 6 brands namely: Command, Littmann, Nexcare, Post-it, Scotch-Brite, and Scotch. The company has 3 manufacturing sites in the country, along with 2 innovation centers. The company operates in multiple cities in India, including Mumbai, Pune, Gurugram, Kolkata, Hyderabad, and Chennai, among others

Paramelt B.V., Dycon Chemicals, Astra Chemtech Private Limited, and Yashbond Adhesive Company are some of the emerging market participants in the hot melt adhesives market.

-

Dycon Chemicals is a distinguished manufacturer, exporter, importer, and trader of various raw materials, especially for the plastics industry. The company operates through its single production facility in Mumbai. It also has 5000 square feet production facility and a warehousing complex. The company exports 20% of its products to major export destinations like Bangladesh, Bhutan, Indonesia, Sri Lanka, and Saudi Arabia

-

Yashbond Adhesive Company is an integrated manufacturer and supplier of hot melt adhesives, operating through its two manufacturing facilities in the country. The company offers products like tape & label, bookbinding, packaging, shoes & footwear, automotive, and industrial adhesives

Key India Hot Melt Adhesives Companies:

- Texyear Industrial Adhesives Private Limited

- Bostik

- Mario Industries Private Limited

- Om Mid-West Industries

- 3M

- Henkel Adhesives Technologies India Private Limited

- Pidilite Industries Ltd.

- Paramelt B.V.

- Dow

- H.B. Fuller India Adhesives Private Limited (a part of H.B. Fuller)

- MAAG

- Sika India (a part of Sika AG)

- Arkema

- Avery Dennison Corporation

- Yashbond Adhesive Company

- Nanpao Resins Chemical Group

- Dycon Chemicals

- Astra Chemtech Private Limited

- Super Bond Adhesive Pvt. Ltd.

Recent Developments

-

In February 2024, Henkel Adhesives Technologies India Private Limited announced its plans to invest in production capacity expansions by setting up a new facility in Udhamsingh Nagar, Uttarakhand with a capacity of producing 5,010.00 metric tons per annum

-

In July 2023, Henkel Adhesives Technologies India Private Limited showcased its sustainable and efficient product portfolio of athleisure and footwear solutions at the India International Footwear Fair (IIFF), which included its wide range of hot melt adhesives

-

In April 2023, Avery Dennison Corporation in partnership with Dow announced the launch of their breakthrough hot melt label adhesive to enhance the recycling of packaging products

India Hot Melt Adhesives Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 257.9 million

Revenue forecast in 2030

USD 457.3 million

Growth rate

CAGR of 10.0% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Volume in Kilotons, revenue in USD million, and CAGR from 2024 to 2030

Report coverage

Volume and revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application

Key companies profiled

Texyear Industrial Adhesives Pvt. Ltd.; Bostik, Mario Industries Pvt. Ltd.; OM; Midwest Industries; 3M; Henkel Adhesives; Technologies India Pvt. Ltd.; Pidilite, Industries Ltd.; Paramelt BV; Dow; H.B. Fuller India Adhesives Pvt. Ltd.; MAAG; Sika India; Arkema; Avery Dennison Corp.; Yashbond Adhesive Company; Nanpao Resins Chemical Group; Dycon Chemicals; Astra Chemtech Pvt. Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

India Hot Melt Adhesives Market Report Segmentation

This report forecasts volume and revenue growth at country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the India hot melt adhesives market report based on product and application:

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Ethylene-vinyl Acetate (EVA)

-

Polyurethane

-

Rubber

-

Polyolefin

-

Polyamide

-

MPO

-

Other Products

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Packaging

-

Assembly

-

Woodworking

-

Automotive

-

Non-wovens

-

Bookbinding

-

Tape & Labels

-

Other Applications

-

Frequently Asked Questions About This Report

b. The India hot melt adhesives market was estimated at USD 234.7 million and is expected to reach USD 257.9 million by 2024.

b. The India hot melt adhesives market is expected to grow at CAGR of 10.0% from 2024 to reach USD 457.3 million by 2030.

b. Packaging segment accounted for highest revenue share of 24.5% in 2023. The packaging industry encompasses a diverse array of products and manufacturing methods, ranging from sealing cases and crafting various paper items to reinforcing pallets. Adhesives act as versatile solutions for use in these applications, thereby enhancing their efficacy and performance.

b. Some of the key players operating in the market include Texyear Industrial Adhesives Private Limited., Bostik, MARIO INDUSTRIES PRIVATE LIMITED , and 3M among others.

b. Increasing usage of hot glue in the packaging industry for various applications, such as sealing of boxes and cartons for food and general consumer packaging, is propelling the market growth. HMAs offer adhesion to a wide variety of materials and surfaces, such as fabric, paper, ceramic, metal, cardboard, and plastics, which makes them suitable for DIY applications.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."