India Heat Treating Market Size, Share & Trends Analysis Report By Material (Steel, Cast Iron), By Process, By Equipment (Electrically Heated Furnace, Fuel-Fired Furnace), By Application, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-2-68038-065-1

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

India Heat Treating Market Size & Trends

The India heat treating market size was valued at USD 4.70 billion in 2023 and is projected to grow at a CAGR of 5.4% from 2024 to 2030. This growth is attributed to the importance of heat treatment in improving the performance, efficiency, and longevity of crucial components in these industries. The country's expanding infrastructure projects and building activities drive demand for heat-treated materials. The necessity for lightweight, fuel-efficient cars and the growing acceptance of cutting-edge technologies drive growth in India's heat-treating industry.

Furthermore, sectors of the economy keep looking for new and improved methods for heating and cooling metal. This is also a result of the many benefits of heat treatment, case hardening, tempering steel, vacuum heat treatment, precipitation hardening, and other processes that provide solid metals with the proper mechanical and physical properties.

Heat treatment, on the other hand, is a technological process done in furnaces and involves mechanical, phase, and thermal phenomena designed and adapted to produce strong, long-lasting, and highly tolerant materials. Furthermore, by heating and cooling ferrous alloys and nonferrous alloys made of aluminum, copper, nickel, magnesium, or titanium, heat treatment is also used to change, reinforce, and alter structures. The automobile industry in India is seeing significant growth and expansion due to solid urbanization and infrastructural projects. The need for machinery and equipment is expected to increase due to the industry's rapid expansion and development.

Material Insights

Steel dominated the market and accounted for a revenue share of 81.0% in 2023. The market in the region is anticipated to be strengthened by the increasing demand for the construction, aerospace, and automotive sectors in India; it can be attributed to the aptness of heat treatment for the execution of different phase transformations involved in plain carbon steel and low-alloy steel. Moreover, the use of hardened steel in various end-use sectors because of its superior machinability and qualitative nature for heavy-duty applications boosts industry growth.

Cast iron is expected to grow at a CAGR of 4.9% over the forecast years owing to its high compressive strength, wear resistance, and good machinability, which make it ideal for manufacturing automotive components, utensils, and marine engineering, among other things.

Process Insights

Case hardening led the market with the largest revenue share of 27.9% in 2023. Its objectives are to harden the surface and subsurface selectively to obtain a challenging and wear-resistant surface and rigid impact-resistant core. It can be used for all plain carbon steel and alloy metals. Meanwhile, the preference for implementing the processes of case carburizing, case nitriding, case carbo-nitriding, or normalizing results in market growth.

Annealing is expected to grow at a CAGR of 5.8% over the forecast period owing to the rapid expansion of India's automotive and aerospace industries, which is a significant driver, as annealing is essential for enhancing the ductility, machinability, and stress relief of critical components in these sectors. The country's growing construction and infrastructure projects also increase demand for annealed materials. Furthermore, the increasing adoption of advanced technologies and the need for lightweight, fuel-efficient vehicles are propelling the annealing market forward in India.

Equipment Insights

The electrically heated furnace led the market with the largest revenue share of 45.6% in 2023. It is seen that furnaces heated by electric elements normally toughen, anneal, and stress-relieve gears with precise temperature control, making it well-suited for applications where keeping a specific temperature is necessary. The heating elements process now operates at higher temperatures, lasts longer, and allows automobile manufacturers to minimize thermal processing expenditure. In addition, the electric furnace is an exceptionally engineered type of equipment. It is tightly designed or built, has enhanced insulation, and is energy efficient.

Fuel-fired furnaces are expected to grow at a CAGR of 5.0% over the forecast period. These furnaces are popular for industries because of their low maintenance requirements and running expenses. This expansion is also aided by the rising demand for metals and alloys, especially in the building and automotive industries. Fuel-fired furnace usage is also driven by increased investments in infrastructure development and the demand for effective heating solutions in various industrial applications.

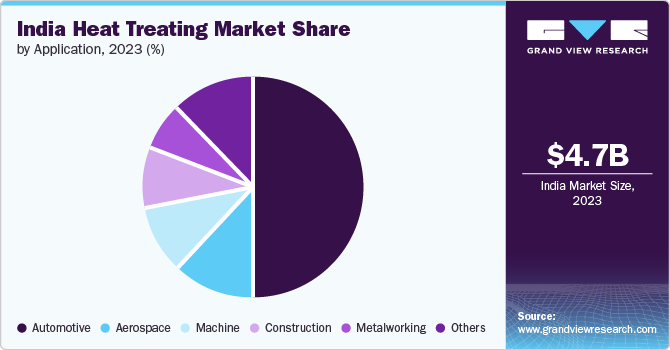

Application Insights

The automotive application segment dominated the market with a share of 50.5% in 2023. The industry's goal of improving the sector's better utilization of components and the need for high-strength steel has witnessed profitable growth due to the demands for high-quality, lightweight automobiles with enhanced fuel efficiency. The demand for heat treatment has increased due to the fast expansion of the Indian automobile industry. In addition, a wide range of automotive components, including the engine, body structure, transmission, suspension, and brake systems, employ heat-treated components.

Aerospace is expected to experience significant growth at a CAGR of 6.3% over the projected years. The aerospace industry's considerable growth drives the heat-treating market in India. It involves heat treatment processes of annealing, degassing, brazing, nitriding, normalizing, and stress relief. Aerospace heat treating includes titanium, aluminum, high-alloy metals, and other high-strength, lightweight materials. The aerospace industry will also benefit from modern infrastructure and improved geographical connectivity.

Key India Heat Treating Company Insights

Some of the key companies in the India heat treating market include Unitherm Engineers Limited, vHPM INDIA Pvt. Ltd., HighTemp Furnaces Limited, Modern Metals India Pvt. Ltd., SECO/WARWICK, INC.ALLE, Wesman Engineering Company Pvt. Ltd., THERELEK, and Deck India Engineering Pvt. Ltd., which are focusing on development and gaining a competitive edge in the industry.

-

Unitherm Engineers Ltd. provides commercial atmospheric heat services and addresses the requirements of automotive and non-automotive components. Its services include a range of carburizing, hardening, normalizing, carbo-nitriding, and gas-nitriding heat-treating procedures.

-

Deck India Engineering Pvt. Ltd. offers various industries a wide range of heat-treating services, such as liquid nitriding, case carburizing, induction hardening, etc. They also provide thermal heat flattening treatment and ovality correction services.

Key India Heat Treating Companies:

- Unitherm Engineers Limited

- vHPM INDIA Pvt. Ltd.

- HighTemp Furnaces Limited

- Modern Metals India Pvt. Ltd.

- SECO/WARWICK, INC.ALLE

- Wesman Engineering Company Pvt. Ltd.

- THERELEK

- Deck India Engineering Pvt. Ltd.

- Sourabh Heat Treatments

- TRIAD ENGINEERS

View a comprehensive list of companies in the India Heat Treating Market

Recent Developments

-

In April 2024, SECO/WARWICK started producing its CAB line in India. Narain Cooling Technologies, an Indian manufacturer of heat exchangers, benefits from this approach. Furnace execution allowed Narain Cooling Technologies to stay in compliance with strict energy consumption guidelines while maintaining maximum production efficiency.

India Heat Treating Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 4.95 billion |

|

Revenue forecast in 2030 |

USD 6.79 billion |

|

Growth Rate |

CAGR of 5.4% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Material, process, equipment, application, region |

|

Country scope |

India |

|

Key companies profiled |

Unitherm Engineers Limited; vHPM INDIA Pvt. Ltd.; HighTemp Furnaces Limited; Modern Metals India Pvt. Ltd.; SECO/WARWICK, INC.ALLE; Wesman Engineering Company Pvt. Ltd.; THERELEK; Deck India Engineering Pvt. Ltd.; Sourabh Heat Treatments; TRIAD ENGINEERS |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

India Heat Treating Market Report Segmentation

This report forecasts revenue growth at regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the India heat treating market report based on material, process, equipment, application, and region.

-

Material Outlook (Revenue, USD Million, 2018 - 2030)

-

Steel

-

Cast Iron

-

Others

-

-

Process Outlook (Revenue, USD Million, 2018 - 2030)

-

Case Hardening

-

Hardening & Tempering

-

Annealing

-

Normalizing

-

Others

-

-

Equipment Outlook (Revenue, USD Million, 2018 - 2030)

-

Electrically Heated Furnace

-

Fuel-fired Furnace

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Automotive

-

Machine

-

Construction

-

Aerospace

-

Metalworking

-

Others

-

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."