- Home

- »

- Nutraceuticals & Functional Foods

- »

-

India Gummy Market Size & Share, Industry Report, 2030GVR Report cover

![India Gummy Market Size, Share & Trends Report]()

India Gummy Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Vitamins, Dietary Fibres, Melatonin), By Ingredient (Gelatine, Plant-based Gelatine Substitute), By End-use, By Distribution Channel, And Segment Forecasts

- Report ID: GVR-4-68040-242-9

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

India Gummy Market Size & Trends

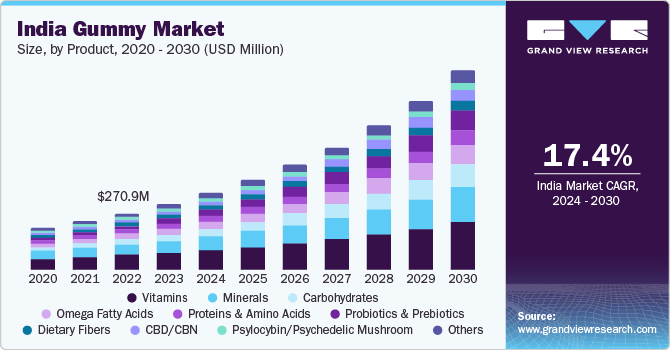

The India gummy market size was estimated at USD 316.2 million in 2023 and is expected to grow at a CAGR of 17.4% from 2024 to 2030. The growing consumption of gummies by consumers as part of their preventive healthcare practices to fill nutrient gaps is expected to drive market growth during the forecast period. Gummy supplement brands are launching products catering to different demographic groups to enhance their consumer base in the country. Furthermore, increasing awareness regarding wellness since the outbreak of COVID-19 in the country has boosted the demand for gummy-based supplements. In addition, high disposable income and increase in spending capacity is anticipated to boost market growth.

The Indian market accounted for a share of 3.25% of the global gummy market in 2023. Gummies infused with minerals such as zinc and calcium are essential for optimal growth and development of the body and, therefore, are expected to witness increasing consumer demand. Omega fatty acids aid in maintaining heart health, and therefore, gummies fortified with omega-3 fatty acids are expected to gain traction as a preventive measure against cardiovascular diseases. Proteins such as collagen provide skincare benefits and are expected to gain traction from beauty product consumers.

The prevalence of diseases resulting from nutritional deficiencies in India is expected to fuel the demand for gummy supplements. Malnourishment leads to poor growth and development of the body and results in weak immunity and proneness to diseases such as anemia and digestive disorders in humans. According to the 2022 Global Hunger Index (GHI) report for India, the prevalence of undernourishment stands at 16.3%. Furthermore, the Indian government's primary initiative to combat malnutrition, "Poshan Abhiyaan", remains a focal point of substantial funding and attention. It is anticipated that efforts under this program will lead to gradual improvements in undernourishment indicators over time. Gummy supplements can be consumed to fill the nutritional gap of a regular diet in the country.

Rising consumer preference for healthy products in India is anticipated to augment the demand for gummies infused with vitamins and proteins. In addition, gummies formulated from collagen and hyaluronic acid are expected to gain popularity among the female population of the country as they are beneficial for skin and hair.

India has an aging population, with a significant proportion reaching retirement age. This demographic shift has fueled interest in supplements as a means of promoting healthy aging and maintaining quality of life in later years. The influence of traditional Ayurveda medicine, which emphasizes the importance of preventive health and natural remedies, has also contributed to the popularity of supplements in India.

India is home to a variety of spices, tree species, and medicinal herbs, thereby boosting the botanical supplements market. Moreover, India has a large population, especially in remote and inaccessible rural areas, mostly dependent on naturally available bio-sources and herbal remedies to treat common ailments and as general protective & preventive medications.

Market Concentration & Characteristics

The India gummy industry is characterized by high degree of innovation, with businesses continuously focusing on differentiating themselves through unique experiences and offerings. Leading market players are channeling their efforts toward effective promotion and marketing activities to expand the consumer base. Similarly, gummy manufacturers are focusing on the development of new technologies and utilizing advanced methods to manufacture cost-effective products. Manufacturers are focusing on understanding consumer patterns to serve the changing demands of the millennial population. Players are making efforts in product development that can allow consumers to cherish the taste and texture of gummies without compromising health conditions.

Market players are entering partnerships, agreements, joint ventures, and mergers & acquisitions with supplement manufacturers, retail brands, and distributors to strengthen their market shares and expand their geographical reach. For instance, in April 2023, TopGum announced the acquisition of R&D specialist PharmItBe to leverage PharmItBe’s comprehensive research laboratories and advance the production of gummies. Moreover, in October 2022, Bloomios, Inc., a leading private label and white label manufacturer and wholesaler of hemp-derived cosmetics, nutraceuticals, and pet products, announced the acquisition of Infusionz, a leading gummy manufacturer.

End-user concentration is a significant factor in the Indian gummy industry. Consumers are looking for ingredients with minimum side effects and high efficiency. Factors such as the growing geriatric population and rising interest in preventive healthcare have surged the demand for dietary supplements, spurring industry growth.

Product Insights

The vitamin gummy market accounted for a share of 24.7% in 2023. the popularity of vitamin gummies is on the rise as they are similar to gummy candies, which makes them an appealing choice for consumers who prefer a pleasant taste experience when taking their supplements. Several manufacturers are broadening their product range by providing gummy vitamins in different colors, shapes, and innovative flavors. In addition, the rising health awareness among consumers positively contributes to the demand for vitamin gummies.

The growing prevalence of sleep deprivation and insomnia is driving the demand for melatonin gummies in the country, with the demand anticipated to grow at a CAGR of 19.4% from 2024 to 2030. Sleep disorders have become a concern owing to stressful and hectic lifestyles. As more consumers struggle to achieve quality sleep, they seek effective methods to improve overall well-being and sleep patterns.

The CBD/CBN-based gummy market is projected to grow at a CAGR of 23.2% from 2024 to 2030. The growth of this segment can be attributed to the increasing incidence of anxiety, depression, insomnia, etc. among working professionals in the country.

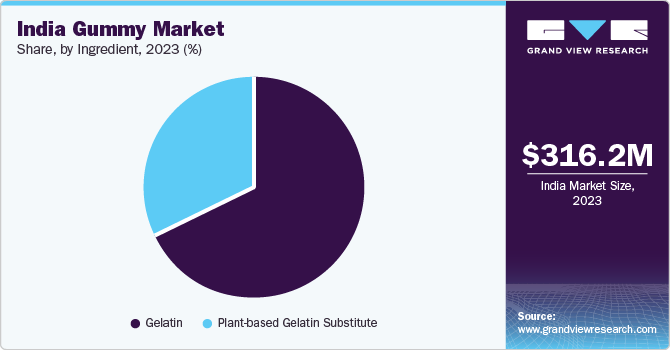

Ingredient Insights

Gelatin-based gummies accounted for a share of 68.0% in 2023. Gelatin-based gummies are the most common supplement provided by manufacturers. Factors such as ideal texture, cost-effectiveness, and compatibility with other ingredients drive the demand for gelatin-based gummies.Several manufacturers are launching innovative products in the market to respond to the rising demand for gelatin-based gummies. In March 2023, Gelita AG, a key player in the collagen industry, announced Confixx, a fast-setting gelatin that helps produce starch-free gummies. The innovation will enable gummy manufacturers to offer gelatin gummies free of starch.

The demand for gummies made from plant-based gelatin substitutes is expected to grow at a CAGR of 19.0% from 2024 to 2030. Consumers’ rising awareness of clean-label products and the increasing vegan populace have generated the demand for plant-based gelatin substitutes for utilization in gummies. Plant-based gummies are free of animal-derived ingredients, making them ideal for consumers following a vegan lifestyle.

End-use Insights

Adult gummies accounted for a share of 77.6% in 2023. A major factor driving the demand for gummies among adults is the enjoyable taste and texture of these supplements. The wide availability of gummies in different flavors makes them more appealing than traditional supplements such as pills or capsules.

The demand for gummies by pregnant women is expected to grow at a CAGR of 22.5% from 2024 to 2030.Gummies can be easily formulated with active ingredients and minerals, such as folic acid, zinc, calcium, and vitamin D, which help women maintain their health during pregnancy. Apart from this, the availability of a wide range of prenatal gummies online makes it easier for pregnant women to choose the right kind based on their requirements. For instance, Amazon.com offers a wide variety of prenatal gummies from brands such as OLLY, Vitafusion, Pink Stork, and Lunakai.

Distribution Channel Insights

Offline sales of gummies accounted for a share of 80.3% in 2023. Offline channels such as hypermarkets/supermarkets offer an extensive range of products and dedicate a special shelf for gummy supplements from various brands. This, in turn, encourages several consumers to make impulse purchases and try different kinds of supplements. Established offline retailers often build strong relationships with consumers over time, fostering brand loyalty and trust. Consumers prefer to purchase health and wellness products from familiar and reputable outlets, contributing to sustained sales.

The online sales of gummies in India are expected to grow at a CAGR of 20.4% from 2024 to 2030. The growing demand for gummy supplements through e-commerce or online channels can be attributed to the wide availability of multiple gummy supplement brands. These channels allow market players to display their products and gain global traction from consumers, which might not be impossible in other offline channels. Moreover, these channels frequently implement dynamic pricing strategies and discounts to drive sales. These factors are considered highly favorable among consumers, encouraging them to purchase gummy supplements.

Key India Gummy Company Insights

The India gummy market is characterized by the presence of established brands as well as small & medium enterprises. The players are focused on new product development and expansion of technological capabilities to gain competitive advantages in the market.

Key India gummy Companies:

- Church & Dwight Co., Inc.

- Nature’s Bounty

- Nestle SA

- Garden of Life

- Procaps Group, S.A.

- Hero nutritionals

- Amway

- Vitakem nutraceutical

- Better Nutritionals

- Rainbow Light

Recent Developments

-

In June 2023, Nature's Bounty launched Sleep3 Gummies that incorporate L-theanine, time-release melatonin, and quick-release melatonin, all conveniently packaged in a gummy format. This innovative product is designed to prepare the body for a restful night's sleep and encourages sustained sleep for adults with occasional sleeplessness.

India Gummy Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 369.8 million

Revenue forecast in 2030

USD 968.7 million

Growth rate

CAGR of 17.4% from 2024 to 2030

Actuals

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, ingredient, end-use, distribution channel

Country scope

India

Key companies profiled

Church & Dwight Co., Inc.; Nature’s Bounty; Nestle SA; Garden of Life; Procaps Group, S.A.; Hero nutritionals; Amway; Vitakem nutraceutical; Better Nutritionals; Rainbow Light

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

India Gummy Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the India gummy market report based on product, ingredient, end-use, and distribution channel:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Vitamins

-

Minerals

-

Carbohydrates

-

Omega Fatty Acids

-

Proteins & Amino Acids

-

Probiotics & Prebiotics

-

Dietary Fibers

-

CBD/CBN

-

Psylocybin/Psychedelic Mushroom

-

Melotonin

-

Others

-

-

Ingredient Outlook (Revenue, USD Million, 2018 - 2030)

-

Gelatin

-

Plant-based Gelatin Substitute

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Adult

-

Men

-

Women

-

Pregnant Women

-

Geriatric

-

-

Kids

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Offline

-

Hypermarkets/Supermarkets

-

Pharmacies

-

Specialty Stores

-

Practitioner

-

Others

-

-

Online

-

Frequently Asked Questions About This Report

b. The India gummy market size was estimated at USD 316.2 million in 2023 and is expected to reach USD 369.8 million in 2024.

b. The India gummy market is expected to grow at a compound annual growth rate of 17.4% from 2024 to 2030 to reach USD 968.7 million by 2030.

b. Vitamins dominated the Indian gummy market with a share of 24.7% in 2023. This is attributable to the growing trend of consumers incorporating multivitamins and other vitamin supplements into their daily diets, along with the increasing popularity of gummies among consumers due to the pleasant taste and different flavors on offer.

b. Some key players operating in the India gummy market include Church & Dwight Co., Inc.; Nature’s Bounty; Nestle SA; Garden of Life; Procaps Group, S.A.; Hero nutritionals; Amway; Vitakem nutraceutical; Better Nutritionals; and Rainbow Light

b. Key factors that are driving the market growth include the growing consumption of gummies by consumers as part of their preventive healthcare practices to fill nutrient gaps.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.