- Home

- »

- Advanced Interior Materials

- »

-

India Geosynthetics Market Size, Industry Report, 2030GVR Report cover

![India Geosynthetics Market Size, Share & Trends Report]()

India Geosynthetics Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Geotextile, Geomembrane, Geogrid, Geonet, Geocells), And Segment Forecasts

- Report ID: GVR-4-68040-306-9

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2017 - 2022

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

India Geosynthetics Market Size & Trends

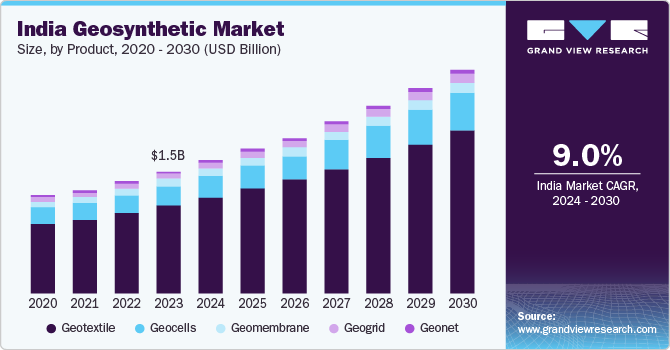

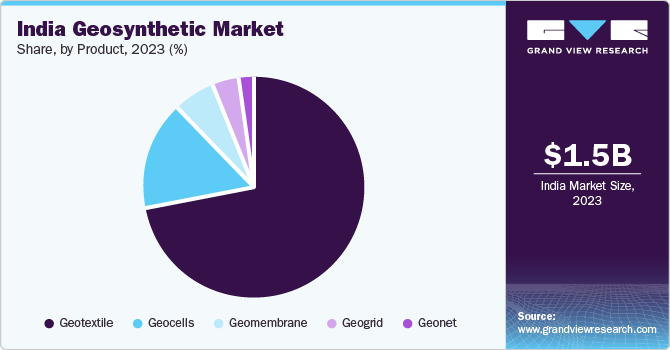

The India geosynthetics market size was estimated at USD 1.50 billion in 2023 and is projected to expand at a CAGR of 9.0% from 2024 to 2030. Growing demand from the construction industry in India is driving market growth. The country’s government is formulating initiatives to develop the nation’s infrastructure and foster economic growth. Ambitious targets for the transport sector have been set, such as developing a 2-lakh km national highway network by 2025. The total budget for ministries affiliated with infrastructure increased from approximately USD 44.5 billion to USD 60.1 billion in 2024. This push for infrastructure expansion in the nation is expected to foster market growth due to the value obtained by geosynthetics in construction procedures.

Furthermore, India's metals and mining industry is estimated to undergo a notable transformation over the upcoming years due to reforms such as Smart Cities, the Make in India campaign, and rural electrification. Moreover, the Union Cabinet approved the Production-Linked Incentive (PLI) Scheme in Specialty Steel to improve the country's manufacturing capabilities in 2021. It is expected to raise the demand for geosynthetics as the mining industry uses them to improve efficiency and safety by managing waste rock and tailings, stabilizing embankments and slopes, and preventing sedimentation and erosion.

Market Concentration & Characteristics

The India geosynthetics industry is fragmented and in a moderate growth stage; however, market growth is accelerating. The industry is transforming gradually with the arrival of new technologies and products, which has subsequently fueled industry growth through demand from different end-users.

The industry is moderately impacted by regulations mainly affiliated with the construction industry revolving around safety and sustainability. There are other regulatory policies associated with the different end-use industries. For instance, in April 2023, the Ministry of Textiles announced the launch of the first phase of two quality control orders for 31 goods, 19 of which are geotextiles. These orders signify the first technical regulation in the country for the technical textile industry and lead to a set of conformity assessment requirements for geotextiles.

Product Insights

Geotextiles dominated the market with the highest revenue share of 71.8% in 2023 and is estimated to grow at the fastest CAGR over the forecast period. Increasing focus on transportation infrastructure and water resource management fuels demand for geotextiles in India. The Indian government's ambitious initiatives, such as the Bharatmala Project for road development and the Namami Gange Program for river rejuvenation and conservation, require innovative solutions to address soil stabilization, drainage, and erosion control challenges. Geotextiles offer cost-effective and durable solutions for these applications, enabling efficient construction and maintenance of transportation networks and water infrastructure projects. As India continues to invest in expanding and modernizing its infrastructure, the demand for geotextiles is expected to grow, driving market expansion in the country.

Geocells is estimated to grow at a significant CAGR over the forecast period. The construction of resilient infrastructure to withstand natural disasters such as floods, earthquakes, and landslides is driving demand for geocells in India. Geocells play a crucial role in disaster mitigation and management by providing erosion control, slope stabilization, and flood protection solutions that help prevent soil erosion, slope failure, and infrastructure damage during extreme weather events. As India faces increasing risks from climate change and extreme weather events, there is a growing recognition of the importance of integrating geosynthetics into disaster-resilient infrastructure designs. This awareness drives the adoption of geocells in India's infrastructure projects, contributing to market growth in the country.

Key India Geosynthetics Company Insights

Some of the key players operating within the market include STRATA, TECHFABINDIA.

-

STRATA is a company catering to sectors such as railways, highways, energy, mining & landfills, land development, water infrastructure, ports, and container yards. The company is a major player in the market and has participated in over 60% of the national highway expansions. The firm offers tailor-made geosynthetic solutions to its clients along with its existing product portfolio.

-

TECHFABINDIA manufactures geosynthetics for retaining structures, pavement and ground improvement solutions, hydraulics, railway applications, and geohazard mitigation. The company has completed over 1,000 projects worldwide and caters to several sectors, such as transportation, real estate and construction, waste management, and mining.

Key India Geosynthetics Companies:

- STRATA

- TECHFABINDIA

- Terram Geosynthetics Pvt. Ltd.

- ENVIROGEO Group

- OCEAN GLOBAL

- Indonet Group

- AB Geosynthetics

- Tensar International Corporation

- Sachi Geosynthetics Pvt. Ltd.

- FlexiTuff Ventures International Ltd.

- Solmax

Recent Developments

-

In June 2023, Hella Infra Market Private Limited, a company involved in construction materials, acquired a majority stake in STRATA. The acquisition enables Hella Infra to develop India’s largest multi-product construction material portfolio and, eventually, globally. This acquisition aids Hella Infra Market Private Limited in strengthening its capabilities in geosynthetics and related engineering solutions.

-

In February 2023, Concrete Canvas Ltd. and TECHFABINDIA announced their new partnership contract for the marketing, sales, and distribution rights of the former’s geosynthetic product range, CCX, made for the agriculture sector. With this partnership, Concrete Canvas Ltd. aims to expand its business reach and tap into India’s large agricultural market.

-

In May 2022, TECHFABINDIA announced the establishment of its new geosynthetic-soil interaction testing facility in Rakholi, India. The facility enables the company to assess the interaction of geogrids and geotextiles in a broad range of soil and other fills. The company made this move to further build its goodwill in the market by enhancing product quality.

India Geosynthetics Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 2.73 billion

Growth rate

CAGR of 9.0% from 2024 to 2030

Base year for estimation

2023

Historical data

2017 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, volume in million square meters, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, competitive landscape, company ranking, trends, and growth factors

Segments covered

Product

Key companies profiled

STRATA; TECHFABINDIA.; Terram Geosynthetics Pvt. Ltd.; ENVIROGEO Group; OCEAN GLOBAL; Indonet Group.; AB Geosynthetics; Tensar International Corporation; Sachi Geosynthetics Pvt. Ltd.; FlexiTuff Ventures International Ltd.; Solmax

Customization scope

Free customization of report (equivalent to up to 8 analysts working days) with purchase. Alteration or addition to country, regional & segment scope.

Purchase and pricing options

Avail customized purchase options to meet your exact research needs. Explore purchase options

India Geosynthetics Market Report Segmentation

This report forecasts revenue growth at a country level and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the India geosynthetics market report based on product.

-

Product Outlook (Volume, Million Square Meters; Revenue, USD Million, 2017 - 2030)

-

Geotextile

-

By Raw Material

-

Natural

-

Jute

-

Others

-

-

Synthetic

-

Polypropylene

-

Polyester

-

Polyethylene

-

-

-

By Product

-

Woven

-

Slit Tape Wovens

-

High Strength Wovens

-

-

Non-woven

-

Light weight

-

Medium Weight

-

Heavy Weight

-

Paving Fabrics

-

-

Knitted

-

-

By Application

-

Erosion Control

-

Reinforcement

-

Drainage Systems

-

Lining Systems

-

Asphalt Overlays

-

Separation & Stabilization

-

Silt Fences

-

-

-

Geomembrane

-

By Raw Material

-

HDPE

-

LDPE

-

Ethylene Propylene Diene Monomer (EPDM)

-

Polyvinyl Chloride (PVC)

-

Others

-

-

By Application

-

Waste Management

-

Water Management

-

Mining

-

Lining systems

-

Others

-

-

By Technology

-

Extrusion

-

Calendering

-

Others

-

-

-

Geogrid

-

By Raw Material

-

HDPE

-

Polypropylene

-

Polyester

-

-

By Application

-

Road Construction

-

Railroad

-

Soil Reinforcement

-

Others

-

-

By Product

-

Uniaxial

-

Biaxial

-

Multi-axial

-

-

-

Geonet

-

By Raw Material

-

MDPE

-

HDPE

-

Others

-

-

By Application

-

Road Construction

-

Drainage

-

Railroad

-

Others

-

-

-

Geocells

-

By Raw Material

-

HDPE

-

Polypropylene (PP)

-

Others

-

-

By Application

-

Earth Reinforcement

-

Load Support

-

Tree Root Protection

-

Slope Protection

-

Others

-

-

-

Frequently Asked Questions About This Report

b. The India geosynthetics market size was estimated at USD 1.50 billion in 2023 and is expected to reach USD 1.63 billion in 2024

b. The India geosynthetics market is expected to grow at a compound annual growth rate of 9.0% from 2023 to 2030 to reach USD 2.73 billion by 2030

b. Geotextiles segment dominated the market with the highest revenue share of 71.8% in 2023 and is estimated to grow at the fastest CAGR over the forecast period. Increasing focus on transportation infrastructure and water resource management is fueling demand for geotextiles in India.

b. Some key players operating in the India geosynthetics market include STRATA, TECHFABINDIA, Terram Geosynthetics Pvt. Ltd., ENVIROGEO Group, OCEAN GLOBAL, Indonet Group., AB Geosynthetics, Tensar International Corporation, Sachi Geosynthetics Pvt. Ltd., FlexiTuff Ventures International Ltd., and Solmax.

b. Factors such as increasing investments in infrastructure projects by both government and private sectors and the growing need for sustainable solutions to address soil erosion, groundwater contamination, and urban drainage issues are driving the India geosynthetics market growth

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.