- Home

- »

- Specialty Polymers

- »

-

India Flame Retardants Market Size & Share Report, 2030GVR Report cover

![India Flame Retardants Market Size, Share & Trends Report]()

India Flame Retardants Market (2023 - 2030) Size, Share & Trends Analysis Report By Form, By Product (Halogenated, Non-halogenated), By End-use (Brominated, Chlorinated), And Segment Forecasts

- Report ID: GVR-4-68040-064-2

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Specialty & Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

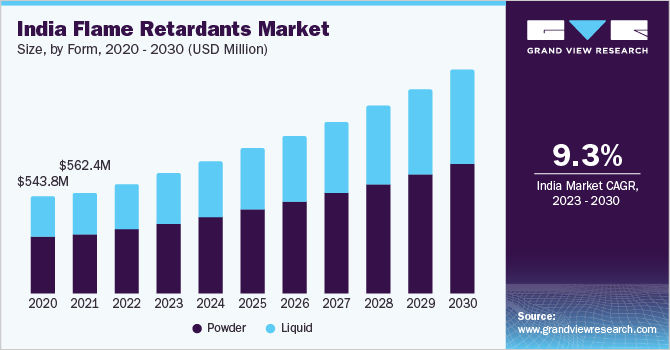

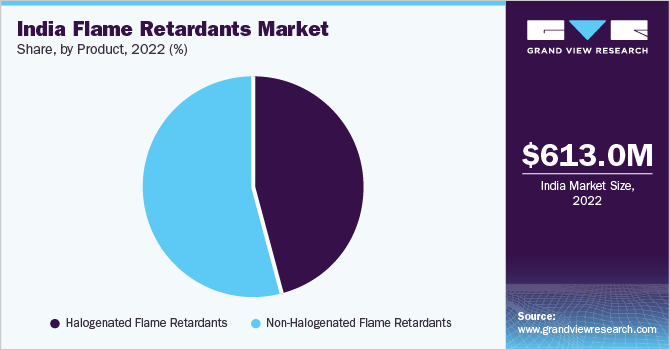

The India flame retardants market size was valued at USD 613.0 million in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 9.3% in terms of revenue from 2023 to 2030. The growth is attributed to surging investments in the construction, automotive, transportation, and electrical industries in the country. Asia Pacific is witnessing large-scale manufacturing, especially in countries such as India, China, Japan, and South Korea owing to increasing emphasis on the production and usage of eco-labeled flame retardants.

Additionally, the flourishing electrical & electronics industry and the increasing demand for electrical connectors, printed wiring boards, electronic enclosures, etc. in the region, are fueling the consumption of flame retardants used in this industry.

The demand for eco-friendly and sustainable products has surged in India post-pandemic. This has led to a rise in the consumption of eco-friendly or halogen-free flame retardants in the country. As such, various companies have launched eco-friendly products in the market to cater to their surging demand in the country.

For instance, Reliance Industries Ltd. uses Nofia technology to enhance the sustainability of its flame-retardant polyester brand, namely, Recron FS. The products produced by the company using this technology are certified with Green Screem, TCO, and ChemForward for meeting the technology and safety standards. The durability of the product can be enhanced by using additives that can chemically react with green ingredients/chemicals so that they remain an inherent part of substrates.

Fire can cause significant economic damage to a particular organization and result in the loss of lives. The product reduces the flame propagation tendency of inflammable materials such as paint thinners, benzene, propane, and fireworks. They are thus used in various industries such as plastics, textiles, etc. Governments of different countries in the Asia Pacific region have formulated stringent laws and regulations to curb fire risks.

Flame retardants are widely used in electrical & electronics equipment such as printed circuit boards, mobile phones, wires & cables, and computers & electrical sockets. The application of flame retardants to these products enables their manufacturers to meet stringent fire safety regulations. As such, companies operating in different end-use industries are adopting flame retardants-infused materials. Moreover, the rapid replacement of metals with plastics in the transportation industry is expected to create lucrative opportunities for the growth of the product market in India in the coming years.

Form Insights

The powder form dominated the market with the largest revenue share of more than 58% in 2022. This is attributed to the surging usage of powered flame retardants in latex paints, clear coatings, vinyl esters, oil-based paints, etc. is anticipated to fuel their demand in India in the coming years.

They are mainly used in wallpapers, curtains, bedspreads, wall cloth, carpets, and leather, as well as in home textile flocking applications. These retardants are suitable for the treatment of linen, wool, cotton, paper, polyester fibers, manmade fibers, etc. Various flame-retardant chemicals such as polypropylene and cellulosic are available in powdered form that is used for dry cleaning applications.

Flame retardants available in liquid form are widely used by manufacturers owing to their effectiveness to inhibit the ignition of raw and porous substrates. They are extensively used for the treatment of tents, bunting, and gazebos that are used in outdoor events. Liquid flame retardants when added to various materials and products prevent their burning and limit the spread of fire. The rising utilization of liquid flame retardants for the treatment of paper and natural fabrics in India is expected to positively impact the growth of the liquid segment over the forecast period.

End-use Insights

The electrical & electronics end-use segment dominated the market with the largest revenue share of more than 35% in 2022. This is attributed to the growing demand for electrical and electronic products in India have a high risk of fire damage owing to the flow of electric current in them for their functioning. Flame retardants are applied to vacuum cleaners, TV sets, smartphones, refrigerators, laptops, and printed wiring boards, among others to minimize the risk of fire breakout in them.

These retardants enhance the safety of electrical and electronic equipment and devices by regularly preventing overheating of their components, as well as by averting short circuits in them to avoid fire breakouts. The rising disposable income of individuals is fueling the growth of the electrical & electronics segment of the flame retardants market in India.

The construction industry was the second-largest segment and is predicted to grow at a CAGR of 9.4% over the forecast period. As the construction industry in India has transformed, various brominated Flame Retardants-infused products such as plastics, wall sheets, roofs, and insulation foams are increasingly being used in this industry for various applications, along with conventional products. Increasing government initiatives in India to provide affordable housing to the masses have fueled the growth of this industry. Thus, ongoing developments in the construction industry in the country are projected to contribute to the demand for products in India in the coming years.

Product Insights

The non-halogenated segment dominated the market with the largest revenue share of more than 54% in 2022. This is attributed to the increasing demand for environment-friendly products for use in various end-use applications. Moreover, restrictions imposed in India on the usage of halogenated products based on bromine and chlorine have also contributed to the rising demand for non-halogenated flame retardants in the country.

Aluminum hydroxide is the most widely utilized owing to its non-toxic nature and low cost. Aluminum hydroxide is commonly used in numerous molding compounds such as epoxy composites, polyester, polyurethane foams, latex-based formulations, wires, cables, wall coverings, silicone, and rubber.

Brominated belong to a wide group of organohalogens. These have emerged as the largest segment in the Flame Retardants market, owing to their low cost and high performance. They are bioaccumulative and persistent while having adverse effects on both humans and the environment.

Existing and emerging brominated flame retardants are still being used in highly industrialized nations, despite some being voluntarily withdrawn or banned by the manufacturers. The demand for brominated flame retardants is anticipated to rise over the forecast period on the account of extensive use of flame retardants in consumer goods.

Key Companies & Market Share Insights

The Indian market is dominated by domestic players, making it highly fragmented. Albemarle Corporation, Clariant, DSM, BASF SE, etc. are some key players operating in the Indian market. The market exhibits a high level of forward integration of companies across the value chain owing to reduce overall cost and subsequent increase in profit margins of the companies.

These players account for significant shares of the market in India owing to their widespread supply chains, along with their vast product portfolios. In comparison with the other market players, the top three companies in the market, including Albemarle Corporation, BASF SE, and Clariant, witness more penetration of their products in the construction, transportation, and electronics, industries. An extensive range of products offered by these companies to end-users has fueled surged their sales revenue. Some prominent players in the India flame retardants market include:

-

ACURO ORGANICS LIMITED

-

Albemarle Corporation

-

BASF SE

-

Clariant

-

DSM

-

DuPont

-

Huber Engineered Materials

-

ICL (Israel Chemicals Ltd)

-

Italmatch Chemicals S.p.A

-

LANXESS

-

Niknam Chemicals Private Limited

India Flame Retardants Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 1,247.2 million

Growth rate

CAGR of 9.3% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Volume in kilotons, revenue in USD million, and CAGR from 2023 to 2030

Report coverage

Revenue forecast, volume forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Form, product, end-use

Country scope

India

Key companies profiled

ACURO ORGANICS LIMITED; Albemarle Corporation; BASF SE; Clariant; DSM; DuPont; Huber Engineered Materials; ICL (Israel Chemicals Ltd); Italmatch Chemicals S.p.A; LANXESS; Niknam Chemicals Private Limited

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

India Flame Retardants Market Report Segmentation

This report forecasts volume and revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the India flame retardants market report based on form, product, and end-use:

-

Form Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Powder

-

Liquid

-

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Halogenated Flame Retardants

-

Brominated

-

Chlorinated Phosphates

-

Antimony Trioxide

-

Others

-

-

Non-Halogenated Flame Retardants

-

Aluminum Hydroxide

-

Magnesium Dihydroxide

-

Phosphorus Based

-

Others

-

-

-

End-use Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Construction

-

Transportation

-

Electrical & Electronics

-

Others

-

Frequently Asked Questions About This Report

b. The India flame retardant market size was estimated at USD 613 million in 2022 and is expected to reach USD 670.3 million in 2023.

b. The India flame retardant market is expected to grow at a compound annual growth rate of 9.3% from 2023 to 2030 to reach USD 1,247.2 million by 2030.

b. Non-halogenated dominated the India flame retardant market with a share of 54% in 2022. This is attributable to its non-toxic nature and low cost

b. Some key players operating in the India flame retardant market include Albemarle Corporation, Clariant, DSM, Niknam Chemicals Private Limited, Relic Chemicals, Sarex, and BASF SE among others.

b. Key factors that are driving the market growth include surging investments by international players in the construction, automotive, transportation, and electrical industries, and increasing demand for environment-friendly products

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.