India Diabetic Foot Ulcer Treatment Market Size, Share & Trends Analysis Report By Treatment (Wound Care Dressings, Biologics, Therapy Devices, Antibiotic Medications) By Ulcer Type (Neuropathic, Ischemic, Neuro-ischemic), By End-use, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-306-5

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Market Size & Trends

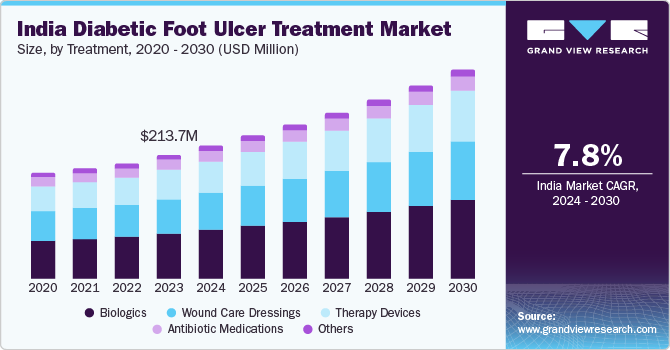

The India diabetic foot ulcer treatment market size was valued at USD 213.7 million in 2023 and is anticipated to expand at a CAGR of 7.82% from 2024 to 2030. The rise in diabetes prevalence, an aging population, technological advancements in wound care, increased awareness and screenings for diabetic foot ulcers, a shift towards home care settings, and growing healthcare expenditure. These factors contribute to the growing demand for effective treatments for diabetic foot ulcers in India.

The rising prevalence of diabetes significantly drives the diabetic foot ulcer treatment market in India. For instance, According to the Lancet Global Health journal; "The Global Burden of Disease Study 1990-2016" diabetes prevalence among all ages in India increased by 64.3%, with the age-standardized prevalence rising to 29.3% from 1990 to 2016. This trend is projected to continue, with diabetes prevalence rising from 7.1% in 2009 to 8.9% in 2019, and expected to increase further to 10.4% by 2045. The burden of diabetes is anticipated to grow, with 25.2 million adults estimated to have impaired glucose tolerance (IGT) in 2019, increasing to 35.7 million by 2045. India ranks second globally in the diabetes epidemic, with 77 million people with diabetes, including 12.1 million aged over 65 years, projected to increase to 27.5 million by 2045. Nearly 57% of adults with diabetes are undiagnosed, indicating a significant need for diabetic foot ulcer treatment.

Several diabetes care device manufacturers are setting up new manufacturing facilities in India due to the favorable regulatory environment and high population. Several companies are entering into partnerships and collaborations to gain a competitive advantage. For instance, in October 2022, Healthium Medtech, a Bengaluru-based company, launched several wound dressing products under its wound care portfolio. These dressings are intended to cure venous leg ulcers and diabetic foot ulcers. Thus, such factors are expected to increase the competition in the India diabetic foot ulcer treatment market.

Moreover, the Ministry of Health and Family Welfare and WHO Country Office for India, as well as other partners, launched a mobile health initiative known as mDiabetes. This health initiative is focused on increasing awareness about early diagnosis and treatment of diabetes. Similarly, WHO and IDF are working together to prevent & control diabetes and ensure good quality of life for people worldwide. For instance, the WHO Diabetes Program is aimed at preventing type 2 diabetes, reducing complications, and improving the quality of life for people with diabetes. Several NGOs and governments are creating norms and standards, raising awareness about diabetes prevention, and promoting surveillance to strengthen the prevention & control of diabetes. Therefore, a growing number of awareness programs is expected to aid in the diagnosis of diabetes, thus boosting market growth in India.

Market Concentration & Characteristics

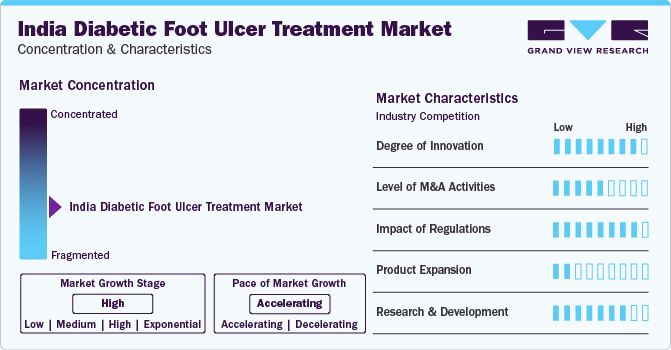

The diabetic foot ulcer treatment industry is growing at accelerating pace owing to the escalating demand for treatment and the growing adoption of technologically advanced devices that can be used during these procedures.

The degree of innovation is high due to the rising adoption of novel biologics and wound care devices for treatment. Technological advancements, such as the development of advanced wound dressings and negative pressure wound therapy systems, are driving the market growth. These innovations aim to improve patient outcomes and reduce the risk of complications associated with diabetic foot ulcers.

Several industry participants are undergoing mergers and acquisitions to bolster their presence in the industry. Some companies operating in the India market and implementing this strategy include ConvaTec, Inc., Acelity L.P. Inc., 3M Healthcare, Coloplast A/S, Smith & Nephew Plc. , B. Braun Melsungen AG, and Medline Industries, Inc. This strategy helps companies provide novel offerings across the country.

The Central Drugs Standard Control Organization (CDSCO) regulates all medical devices in India, as per Medical Device (Amendment) Rules, 2020. Medical devices in India are governed under The Drugs and Cosmetics Act, of 1940, whereas The Medical Device Rules, 2017 (MDR) are meant for quality requirements, which need to be followed by manufacturers, importers, or marketers. The classification of medical devices in India along with regulation, approval, and registration is done through the Drug Controller General of India (DCGI), which is controlled by CDSCO.

Product substitutes in this market include patented technology for the treatment of diabetic foot ulcers (DFU), by Alkem Laboratories Ltd. This technology aims to avoid amputations for many diabetic patients by managing DFUs effectively. The technology is designed to treat deep, non-healing chronic wounds, offering a promising alternative to existing treatments.

The market expansion is supported by ongoing clinical trials and advancements in research, with a focus on developing specific dressings for different types of foot ulcers.

Treatment Insights

The biologics segment accounted for the largest revenue share of 36.41% in 2023. Biologics are useful in the efficient management of chronic wounds & burn injuries with benefits like restoring tissue integrity, reducing repeated visits to doctors' offices for dressing changes, assurance of improved clinical patient outcomes noninvasively, and minimal scarring effects. The biologics that are mainly used in wound management are growth factors and engineered skin substitutes.

The therapy devices segment is expected to grow with the highest CAGR from 2024 to 2030. Wound therapy devices majorly include Negative Pressure Wound Therapy (NPWT), oxygen & hyperbaric oxygen equipment, electric stimulation devices, pressure relief devices, and others. The introduction of new product lines related to wound therapy devices by major market players is also expected to surge the demand for such devices.

Ulcer Type Insights

The neuro-ischemic ulcers segment accounted for the largest revenue share of 53.4% in 2023. Individuals with PAD, which impairs blood flow to the affected area, along with neuropathy (nerve damage), are at higher risk of developing neuroischemic ulcers, a type of chronic wound. In individuals with diabetes, these ulcers frequently occur on the lower extremities, particularly the feet. The treatment of neuroischemic ulcers involves a multidisciplinary approach, with the help of medical specialists such as podiatrists, wound care experts, vascular surgeons, and diabetologists. The primary therapeutic objectives revolve around promoting wound healing, controlling infection, enhancing blood flow, and addressing underlying issues that contributed to the development of the ulcer.

The neuropathic ulcers segment is expected to grow with the highest CAGR from 2024 to 2030. According to an NCBI published report in June 2021, between 5.0% and 7.5% of individuals with diabetes and peripheral neuropathy develop foot ulcers annually. These ulcers are a consequence of peripheral neuropathy, which affects the sensory, motor, and autonomic nerves. Sensory neuropathy increases the vulnerability of patients to thermal, chemical, and physical injuries. In addition, a substantial majority of diabetic foot ulcers are caused by a lack of sensation.

End-use Insights

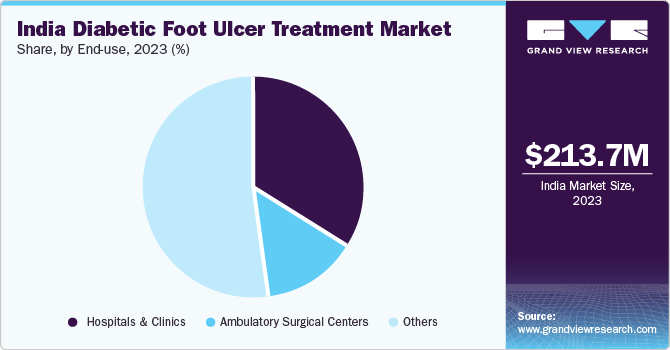

The other segment accounted for the largest market share of 51.48% in 2023. The segment dominance is driven by the introduction of single-use NPWT systems for the treatment and care of diabetic foot ulcers in homecare settings. These devices are lightweight, portable, canister-free, and are easy to use. In addition, the cost-effectiveness of such therapy for treating wounds encourages patients to adopt homecare settings instead of hospital stays. Furthermore, rising research & development related to such therapies by leading players to promote home healthcare is also anticipated to contribute to the segment growth from 2024 to 2030. For instance, Smith & Nephew manufactures portable NPWT devices like PICO and RENASYS GO, which are widely used at home.

The hospitals & clinics segment accounted for the second largest segment in 2023. Surgical wound care dressings and Negative Pressure Wound Therapy (NPWT) are primarily designed for use in hospitals and are not feasible for home care. NPWT often requires an extended hospital stay and constant monitoring. The increasing cases of diabetic foot ulcers and venous leg ulcers are the major factors driving the segment growth, as NPWT is majorly used to treat such conditions.

Key India Diabetic Foot Ulcer Treatment Company Insights

The competition in India diabetic foot ulcer treatment market is anticipated to be driven by the rising developments of advanced and novel products. In addition, the major and emerging participants operating in the market are adopting various strategies such as partnerships and mergers & acquisitions. Furthermore, the easy availability of products from major companies is expected to propel market competition in the coming years.

Key India Diabetic Foot Ulcer Treatment Companies:

- ConvaTec, Inc.

- Acelity L.P. Inc.

- 3M Healthcare

- Coloplast A/S

- Smith & Nephew Plc.

- B. Braun Melsungen AG

- Medline Industries, Inc.

- Medtronic Plc.

- Organogenesis, Inc.

- Molnlycke Health Care AB

- BSN Medical GMBH

Recent Developments

-

In March 2023, Pune-based Mylab Discovery Solutions partnered with UK firm DnaNudge to develop a diabetic foot ulcer detection kit. This kit, one of the world's first point-of-decision molecular technology solutions, can identify bacteria involved in infections and provide antimicrobial resistance results in under an hour, aiding in personalized treatment and reducing the risk of antimicrobial resistance.

-

In January 2022, Alkem Laboratories Ltd. announced the launch of a patented technology for treating Diabetic Foot Ulcers (DFUs) in India, utilizing 4D Bioprinting technology. This innovative solution aims to address the significant challenge of DFUs, which are a common and devastating complication of diabetes, leading to amputations in many cases.

-

In November 2022, PolyNovo Limited announced the launch of its first product in India. This would help the company compete with global players and increase its market share.

India Diabetic Foot Ulcer Treatment Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 229.9 million |

|

Revenue forecast in 2030 |

USD 361.2 million |

|

Growth rate |

CAGR of 7.82% from 2024 to 2030 |

|

Actual data |

2018 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Treatment, ulcer type, end-use |

|

Country scope |

India |

|

Key companies profiled |

ConvaTec, Inc.; Acelity L.P. Inc.; 3M Healthcare; Coloplast A/S; Smith & Nephew Plc.; B. Braun Melsungen AG; Medline Industries, Inc.; Medtronic Plc.; Organogenesis, Inc.; Molnlycke Health Care AB; BSN Medical GMBH |

|

Customization scope |

Free report customization (equivalent to up to 8 analysts' working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail of customized purchase options to meet your exact research needs. Explore purchase options |

India Diabetic Foot Ulcer Treatment Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the India diabetic foot ulcer treatment market report on the basis of treatment, ulcer type, and end-use.

-

Treatment Outlook (Revenue, USD Million, 2018 - 2030)

-

Wound Care Dressings

-

Alginate Dressings

-

Hydrofiber Dressings

-

Foam Dressings

-

Film Dressing

-

Hydrocolloid Dressings

-

Surgical Dressings

-

Hydrogel Dressings

-

Biologics

-

Growth Factors

-

Skin Grafts

-

Therapy Devices

-

Negative Pressure Wound Therapy

-

Ultrasound Therapy

-

Antibiotic Medications

-

Others

-

-

Ulcer Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Neuropathic Ulcers

-

Ischemic Ulcers

-

Neuro-ischemic Ulcers

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals & clinics

-

Ambulatory surgical center

-

Others

-

Frequently Asked Questions About This Report

b. The India diabetic foot ulcer treatment market size was estimated at USD 213.7 million in 2023 and is expected to reach USD 229.9 million in 2024.

b. The India diabetic foot ulcer treatment market is expected to grow at a compound annual growth rate of 7.82% from 2024 to 2030 to reach USD 361.2 million by 2030.

b. Biologics segment dominated the India diabetic foot ulcer treatment market with a share of 36.41% in 2023. These biologics help reduce hyperglycemia, increase oxygenation & circulation, and repair lost tissues. As a result, they are increasingly being used to treat DFU and are considered to be ideal for managing wounds at different stages.

b. Some key players operating in the India diabetic foot ulcer treatment market include ConvaTec, Inc., Acelity L.P. Inc., 3M Healthcare, Coloplast A/S, Smith & Nephew Plc., B. Braun Melsungen AG, Medline Industries, Inc., Medtronic Plc., Organogenesis, Inc., Molnlycke Health Care AB, BSN Medical GMBH

b. The rise in diabetes prevalence, an aging population, technological advancements in wound care, increased awareness and screenings for diabetic foot ulcers, a shift towards homecare settings, and growing healthcare expenditure. These factors contribute to the growing demand for effective treatments for diabetic foot ulcers in India.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."