- Home

- »

- Electronic & Electrical

- »

-

India Consumer Electronics Market Size, Share Report, 2030GVR Report cover

![India Consumer Electronics Market Size, Share & Trends Report]()

India Consumer Electronics Market (2023 - 2030) Size, Share & Trends Analysis Report By Product (Mobile Phones, Televisions, Refrigerators, Digital Cameras, Air Conditioners, Washing Machines), And Segment Forecasts

- Report ID: GVR-2-68038-143-6

- Number of Report Pages: 90

- Format: PDF

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

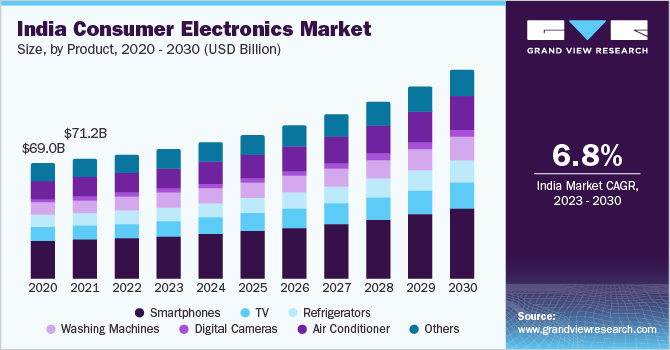

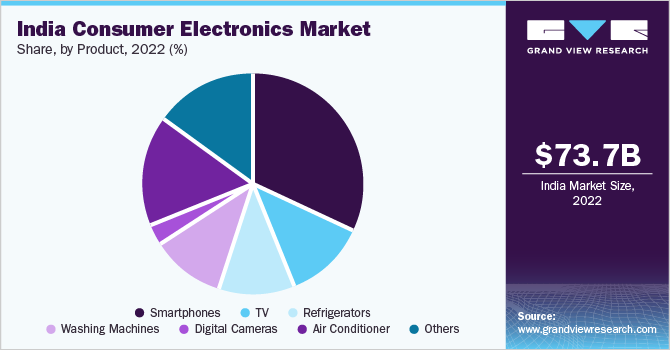

The India consumer electronics market size was valued at USD 73.73 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 6.8% from 2023 to 2030. India provides a worldwide opportunity for short to medium-term growth in consumer electronics spending. Minimal penetration rates, as against other upcoming markets, portray a better prospect to sell to first-time buying households, along with replacement devices to the middle class.

Due to the COVID-19 pandemic, the demand for consumer electronics has been significantly impacted. Manufacturing plant shutdown and supply chain disruptions resulted in substantial component shortages. Increased counterfeiting, shipping delays, customer behavior, and environmental concerns had a significant impact on the market growth. Due to the pandemic, manufacturers of consumer electronics have witnessed component shipment delays of at least five weeks from suppliers.

Growth in the Indian market for consumer electronics can be attributed to an increase in demand from households, changing lifestyles of individuals, easier access to credit, and rising disposable incomes. Intentional reduction by the Government in the import bill, coupled with government and corporate spending, is anticipated to complement the positive demand in this market. The India consumer electronics sector has attracted several strong investments in the form of merger & acquisition policies practiced by key participants of the global market and other FDI inflows.

As per the Make in India initiative, Electronic Development Fund Policy has been approved, with the intention of rationalizing a transposed duty structure. Additionally, the Modified Special Incentive Package Scheme (M-SIPS) has been introduced to provide a CAPEX subsidy of nearly 15 - 20%. Consumer electronics manufacturers are set to elevate investments in production, distribution, and R&D in the next few years. With the rising presence of organized retail, the market has witnessed the emergence of modern, durable retail chains, which include e-retailers such as E Zone, Reliance Digital, and Tata Croma.

High production in the Indian electronics market can be attributed to paced-up demand for advanced computers, mobile phones, TVs, and defense-related electronics. The situation in this market mandates manufacturers to keep themselves updated with the latest technology since it is eye-catching to typical consumers, and technological features play an apex role while selling to higher-income classes. The consumer electronics sector has acquired the largest share in the total production of electronic goods in India.

Under the Union Budget for the financial year 2017, the government exempted certain components, parts, and subparts for the production of set-top boxes for TV and internet and broadband modems. The introduction of artificial intelligence (AI) is set to project a bright future for consumers and industrial electronics in India.

India is likely to emerge as a potential future manufacturing hub for the region, provided the government shows adequate support and focus towards this sector. Specific factors anticipated to push manufacturing in India are inclusive of a reduction in borrowing costs, export incentives, reduction of customs duties on raw materials and components, and improvement in the ease of doing business.

Product Insights

The smartphone segment held the largest revenue share of over 30.0% in 2022. Increased disposable income, the development of telecom infrastructure, the appearance of budget-friendly smartphones, and a rising number of product launches are all contributing to the smartphone market's rise in India. In addition, the desire for high-speed data connectivity for integrated IoT (Internet of Things) applications like energy management and smart home devices is expected to drive 5G smartphone adoption.

The refrigerators segment is projected to grow from 2023 to 2030. Rapid urbanization, coupled with the increasing disposable income in the country, has contributed to a rise in demand for refrigerators. Due to the versatile and advanced refrigerators available in the market, Indian consumers are replacing their existing and old refrigerators with new ones. In addition to this scenario, refrigerator-selling retailers are adopting competitive strategies such as teaming up with financial institutes to provide easy financing options to sell their products. Such trends are expected to favor the market growth over the forecast period.

The Indian refrigeration industry is characterized by increasing supply, novel product launches, and regulatory support from the government. Companies adopt competitive pricing techniques to gain market share. The increasing penetration of refrigerators in rural areas is a key industry scenario.

Key Companies & Market Share Insights

The market includes both international and domestic participants. Key market players focus on strategies such as innovation and new product launches to enhance their portfolio offering in the market.

-

In January 2023, Samsung introduced its latest 2023 Side-by-Side Refrigerator Range, exclusively manufactured in India, and tailored with features designed specifically for the Indian market.

-

In June 2022, Samsung unveiled its 2022 lineup of refrigerators, featuring the popular Curd Maestro and Digi Touch Cool ranges, both thoughtfully designed with an "India-centric design."

-

In October 2021, Panasonic Corporation, a leading diversified technology business in India, announced the addition of 43 new refrigerator models and 24 new washing machine models to its home appliance lineup ahead of the festive season.

-

In January 2021, In India, Toshiba's Home Appliance Business opened its first unique store. The Toshiba Lifestyle Centre, which opened in Bangalore, is expected to provide first-hand experience with Toshiba's home appliance portfolio, which includes refrigerators, washing machines, dishwashers, water purifiers, and air purifiers.

-

In December 2021, the first-ever Bespoke French Door refrigerator, Bespoke kitchen package, Bespoke JetTM vacuum cleaner, and Bespoke Washer and Dryer were displayed at Samsung's CES 2022 booth.

Some prominent players in the India consumer electronics market include:

-

Samsung Electronics Co., Ltd.

-

LG Electronics, Inc.

-

Godrej Appliances

-

Sony Corporation

-

Mitsubishi Electric Corporation

-

Vijay Sales

-

Panasonic Corporation

-

Haier Consumer Electronics Group

-

Bajaj Electricals Ltd.

-

Hitachi Ltd.

-

Toshiba Corporation

-

Whirlpool Corporation

India Consumer Electronics Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 77.19 billion

Revenue forecast in 2030

USD 124.94 billion

Growth rate

CAGR of 6.8% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD Billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product

Key companies profiled

Samsung Electronics Co., Ltd., LG Electronics, Inc., Godrej Appliances, Sony Corporation, Mitsubishi Electric Corporation, Vijay Sales, Panasonic Corporation, Haier Consumer Electronics Group, Bajaj Electricals Ltd., Hitachi Ltd., Toshiba Corporation, Whirlpool Corporation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

India Consumer Electronics Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the latest trends and opportunities in each of the sub-segment from 2017 to 2030. For the purpose of this study, Grand View Research has segmented the India consumer electronics market on the basis of product.

-

Product Outlook (Revenue, USD Million; 2017 - 2030)

-

Smartphones

-

TV

-

Refrigerators

-

Washing Machines

-

Digital Cameras

-

Air Conditioner

-

Others

-

Frequently Asked Questions About This Report

b. The India consumer electronics market size was estimated at USD 73.73 billion in 2022 and is expected to reach USD 77.19 billion in 2022.

b. The India consumer electronics market is expected to grow at a compound annual growth rate of 6.8% from 2023 to 2030 to reach USD 124.94 billion by 2030.

b. Smartphones dominated the India consumer electronics market with a share of 30.0% in 2022. This is attributable to the increasing per capita income, burgeoning middle class, and increasing standard of living in the country.

b. Some key players operating in the India consumer electronics market include Videocon, Hitachi, Bharat Electronics, Panasonic, Hewlett Packard, Toshiba, Dell, among others.

b. Key factors that are driving the India consumer electronics market growth include demand from households, changing lifestyles of individuals, easier access to credit, and rising disposable incomes.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.